Bitcoin looked into the abyss, the excitement around the tokensale BitTorrent and other key events of the week

The price of bitcoin

Last Sunday, the first cryptocurrency was trading at $ 3,600, but on Monday morning its rate went down sharply, dropping to $ 3,420 by Tuesday, to a new low since December 18 last year.

Later, several unsuccessful attempts at recovery were made, but the short-term penetration of the $ 3,500 mark on the night from Saturday to Sunday was the biggest success in this direction.

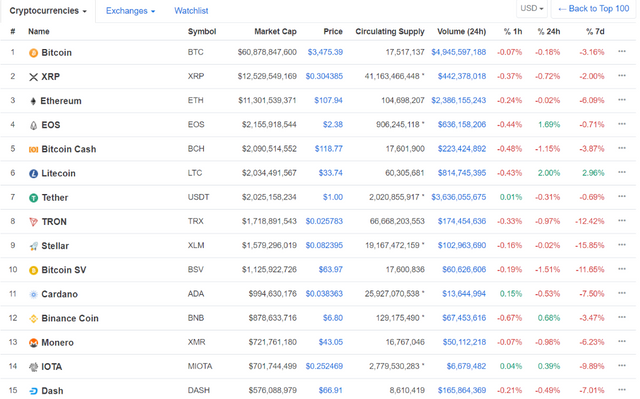

At the time of publication, Bitcoin is trading at around $ 3,475, thus losing more than 3% over 7 days. It is unlikely that investors will be pleased with the general picture of the last month:

Also in the red by the end of the week were almost all the other leading assets, although there are rare exceptions. Thus, Litecoin grew by almost 3%, the new stage of development of which this year should be the introduction of the technology of confidential transactions. Also, the Waves coin turned out to be in a slight plus, adding to the background of the launch of updated smart contracts in the Microsoft Azure cloud.

Crowdsale BitTorrent - $ 7.2 million in 18 seconds and technical problems

On Monday, January 28, on the ICO Binance Launchpad site, there was a crowded BitTorrent expected by many investors. The campaign, accompanied by increased agiotage and technical problems, ended in less than 18 minutes, and according to its results, 59.4 billion BTT tokens were sold (about $ 7.2 million).

BTT Crowdsale started at 15:00 UTC and was held in two parallel sessions: in one of them participants could buy tokens for the TRON (TRX) cryptocurrency, and in the second for BNB tokens.

At the same time, less than a thousand investors took part in the campaign - the platform did not cope with the large influx of visitors.

It will certainly be interesting to see how the fate of this token will turn out, but investors who have already managed to acquire it have not remained in the loser: the BTT trades started on February 1 with a course of four or more times the price of the tokensale. And at the end of the week, after a small drawdown, the token continued to grow - in the last 24 hours its price has risen by more than 35%.

Bitcoin-ETF - Cboe Re-Applied

The Chicago Stock Exchange (Cboe) re-applied to the US Securities and Exchange Commission with a proposal to make a change to the existing rules, which, if approved, will allow it to launch a Bitcoin-linked Exchange Investment Fund (ETF) on behalf of VanEck and SolidX.

The previous application was withdrawn earlier in January. As VanEck CEO Jan Van Eyck explained later, the suspension of the work of US government agencies due to the delay in adopting the country's budget at the end of December 2018 had a direct impact on the course of consideration of the application.

The countdown on the new application, however, has not yet gone - it will begin after the document is published in the US Federal Register. From this point on, the SEC, taking into account all the delays stipulated by law, may be allotted 240 days.

NEM Foundation is waiting for restructuring

According to information this week, the NEM Foundation, a community-sponsored nonprofit organization to promote the blockchain NEM, is planning a massive downsizing, which currently has 150 people.

The new leadership of the organization, represented by the new president, Alex Tinman, denies assumptions about bankruptcy, insisting that it is a restructuring of the NEM Foundation, but confirmed that it plans to send a request for allocation of 160 million XEM tokens (about $ 7.5 million) to the NEM public foundation.

The organization also intends to significantly reduce marketing costs, focusing instead on actual product development.

QuadrigaCX, Liqui, CoinPulse - exit scams or something else?

Cryptosis seriously affected the work of several exchanges. This week, the Canadian exchange QuadrigaCX went to 'technical work' amid bankruptcy rumors (she later announced that she could not access wallets with user funds for $ 190 million), another Bitcoin exchange, CoinPulse, announced maintenance ”due to liquidity problems, and the Ukrainian cryptoplatform Liqui - and completely about the cessation of activity due to similar problems.

“Unfortunately, we can no longer provide liquidity to the remaining users. We also see no economic sense in the provision of our services, ”said the representatives of the latter.

This is crazy