Crypto Currency Adaption: Predicting Individual Tendency for Adaption of crypto currencies based on Hofstede’s 6 Cultural Dimensions

-

Introduction

In 1971, Richard Nixon announced that he was taking the United States, and therefore the world, off the gold standard and that the united states would stop selling gold to foreign official holders of dollars at a rate of $35 an ounce. Nixon promised that the dollar would retain its full value, a promise that was promptly broken. Today’s dollar has the same purchasing power as $0.16 had in 1971 or $1 from 1971 is worth $6.19 today when taking inflation and cost of living increases into consideration.

Today, most, if not all countries have a fiat currency. However, because fiat currencies are printed there tends to be a propensity to print what is needed, particularly during troubled times of great debt. After world war I, the Treaty of Versailles imposed a financial punishment upon Germany to pay enormous reparations which were ultimately unpayable. The German mark lost its value. In April 1919, 12 German marks were worth $1 US, in November 1921, it was 263 marks per $1 US and this continued from January 1923 with 17,000 marks equal to $1 US until December 1923 with 4.2 Trillion marks being worth $1 US.

Other countries that have seen their fiat currencies devalued include Argentina in 1932, Finland, Norway and Italy in 1992, Mexico in 1984, Russia in 1998 and the Thai Baht went from a stable 25 baht per $1 US to 56 baht per $1 US. In January 1998. The Turkish Lira was 9 Lira for 1 $1 US in 1966, 90 in 1980, 1,300 in 1988, 45,000 in 1995 and eventually 1,650,000 Turkish Lira for $1 US in 2001. Currently, Zimbabwe’s dollar is valued at 100,000,000,000,000 (100 trillion) to $1 US.

Venezuela’s bolivar (VEB) is currently valued around 100,000 bolivars per $1 US. Most of the population and the country’s consumers have lost faith in the central and commercial banks as well as the government. Venezuelans typically spend 20 minutes in lines at ATMs to get the government sanctioned maximum of 5,000 bolivars ($0.05 US) per day, which cannot purchase anything as local businesses, professionals and residents have rejected the bolivar as a currency in lieu of alternative forms of money. Crypto currency usage has taken over the role as the main currency, store of value and medium of exchange.

In Venezuela today, Bitcoin (BTC) is used to buy airline tickets, pay employees and purchase medication and thus Venezuela may become the first instance in which a crypto currency takes over a fiat currency as a country’s main currency and financial system.

In late February 2018, the Venezuelan government launched its own crypto currency named PETRO (PTR) allegedly in cooperation with the Russian government. With many aspects of the coin shrouded in mystery many initial coin offerings (ICO) rating sites state the project is missing critical information including its description of mechanism to its technology as well as its commodity backing giving it a low rating, scam status or not even bothering rating the coin, the consensus is to discourage investment in the coin (Laya, 2018) while some doubt the coin even exists (Wilmoth, 2018). In April 2018, the Venezuelan National Assembly stated that inflation was 454% in the first quarter with annual inflation over the last 12 months just short of 8,900 %. March’s monthly inflation was 67% down from 80% for February (Gupta, 2018). Though these numbers are immense they are down dramatically from 12 months earlier when the average monthly inflation rate was 750% per month. Even though President Nicolas Maduro has stated the PETRO ICO to has raised over $5 billion US with virtually no trading volume logged, VEB/BTC has seen a steady increase throughout 2018 with over $5 million US trading volume on the peer-to-peer (P2P) crypto currency trading platform LocalBitcoins alone despite the monumental downturn in bitcoin’s price and value in recent months (Wilmoth, 2018).

Although it appears that the adoption and usage of cryptocurrencies is broad and far reaching, this is not the case. A study in 2015 indicated that about 50% of US consumers had heard of Bitcoin or the other 700 virtual currencies then available at that time, by the end of 2015. Of those 50% of US consumers that had heard of virtual currencies only 1% of them or 2% of all US consumers have ever owned a virtual currency. Most of those that have owned virtual currency used it to pay a person or merchant in the past month. This adoption, usage and awareness correlates to a demographic that is a younger, non-white, lower-educated male with expectations that bitcoin will appreciate. This demographic has adopted a higher number of other payment instruments and usually is responsible for household shopping (Schuh & Shy, 2016). Globally, as of 2017 crypto currency adoption and penetration is merely 0.5 %, just a quarter of what it is in the US and can be compared to Internet usage in the year1994, one year after the Internet became commercialized (Paul, 2017). Not understanding realistic penetration and adaption rates as well as your demographics of early adopters can lead to wasting resources as well as marketing to wrong audiences. Expectations may be too lofty or not lofty enough and failure may occur for an ICO that should succeed due to scalability and marketing issues.

Given the relatively small penetration rate of early adopters of crypto currencies, the potential to have to strive for small amounts of users or to be inundated by a barrage of early adopters is great and so it is important understand the characteristics not only of the current adopters but of the adaptability of the population at large. This study focuses on the tendency of crypto currency adoption in regard to Hofstede’s cultural dimensions (Hofstede, 2011). Understanding the characteristics of adopters of crypto currency usage has not been studied a lot as of yet, however using Hofstede’s cultural dimensions to test hypotheses in regard to specific characteristics has been extensively practiced (Pelau & Pop, 2018; Tang & Koveos, 2008). Since identifying characteristic of adopters of crypto currencies allow developers to identify and market to specific segments of the population, the objective of this research is to identify if specific characteristics of cultural dimensions can predict the tendency to readily adopt crypto currencies or not from an individual as well as social perspective. Evidence from this research will benefit the marketer and developer of future crypto currencies.

-

Literature Review

-

Adopting Crypto Currency

-

However, adoption of crypto currencies are low with less than 3% of US consumers having ever owned a crypto currency let alone used one in a transaction although of those that own crypto currency the likelihood of them using it for a purchase or monetary transaction is great (Schuh & Shy, 2016). Globally, the number of users as a percent of the population that have adopted crypto currency as of 2017 stands less than 1% at 0.5%. There are many reasons for this, one is the ‘newness’ of crypto currency, crypto currency participation is still quite complex (Visser, 2018), governments do not like crypto currency as the cannot regulate, control or manipulate crypto currency, they cannot ‘print’ more coins and some governments have outlawed crypto currencies and use propaganda to stigmatize it Furthermore, traditional money markets and pundits claim crypto currencies to be scams and that their values will fall to zero (Wheatley, Sornette, Huber, Reppen, & Gantner, 2018), while others believe it to be a haven for criminal enterprise (Burks, 2017).

-

Factors affecting the Tendency to Purchase or Adopt Crypto Currencies

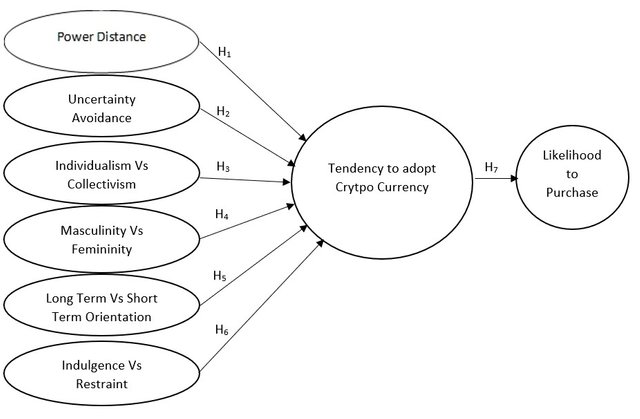

The six cultural dimensions are:

- Power Distance – accepted distributed inequality of power between members of a society or organization;

- Uncertainty Avoidance – the degree of stress a society undergoes regarding the prospects of future uncertainties;

- Individualism versus Collectivism – the level of integration of individuals into tribal primal groups;

- Masculinity versus Femininity – The level of which emotional roles are divided between males and females;

- Long Term versus Short Term Orientation – the orientation of a person’s focus to be on the future or the present and past;

- Indulgence versus Restraint – negatively correlated with long term versus short term orientation and focuses on an individual or society to allow hedonistic needs and desires to be fulfilled or the strict enforcement of social norms to curtail them.

Figure 1. A representation of Predictability of Crypto Currency Adoption

-

Power Distance

H1. The tendency for an individual to adopt the use of crypto currency or the likelihood that an individual purchase crypto currency is greater in societies that exhibit low power distance.

-

Uncertainty Avoidance

Societies with strong uncertainty avoidance and unsure of what the day will bring, and intolerant of deviant people and ideas, need structure and rules and believe that there can only be one truth. Societies with strong uncertainty avoidance then to avoid risk and prefer to stay at a job even if they do not like it. Life is uncertain (Hofstede, 2011).

Crypto currencies are unknown to most of the population and when investing in them one is advised to not invest anymore they can afford to lose. Prices fluctuate drastically, daily. It is not uncommon for a currency to lose 50% of its value in a day. One of the best characteristics is to HODL which means hold on for dear life and more specifically, don’t sell short because the price fluctuated a bit. Keeping calm and relaxed will lead you down a gold infused path:

H2. The tendency for an individual to adopt the use of crypto currencies or the likelihood that an individual purchase crypto currency is greater in societies that have a weak level of uncertainty avoidance than societies with strong uncertainty avoidance levels.

-

Individualism vs. Collectivism

Individualistic societies enjoy democracy, follow their gut feelings and people are responsible and accountable for themselves and their actions. Other people in society are recognized as individuals and speaking your mind is not only healthy but necessary.

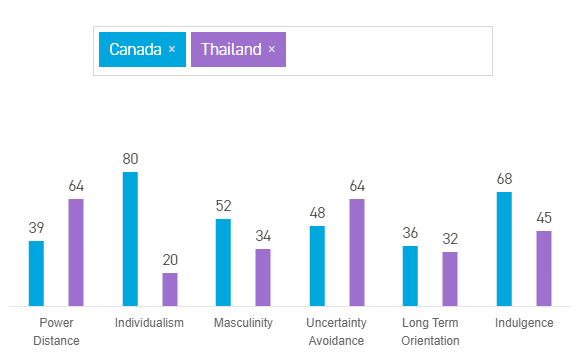

Countries that are high in individualism include the US, Canada and the UK. Countries low in individualism include Japan, Thailand and China.

Education in individualistic countries is focused on learning and becoming the best you can be is motivated from within yourself. Excellence in one’s self is good when recognized by others, however that is not a requirement at all:

H3. The tendency to adopt crypto currency and the likelihood to purchase crypto currency is greater in societies that have higher levels of individualism than societies that have low individualism or collectivism-based societies.

-

Masculinity vs. Femininity

Masculine cultures value money, purposefulness, tasks, performance and achievement whereas feminine cultures value charity, the environment and quality of life. Feminine cultures elect many women, boys and girls cry and men and women should be modest and caring. In masculine cultures work is most important, girls cry, and boys do not, boys should fight back but girls do not and there is a distinct role differentiation between the genders (Hofstede, 2011).

It could be argued that a feminine culture, wanting to help those that are in need might adopt to crypto currencies, however the modesty and lack of competitiveness and achievement, I feel would overtake any desire to participate in crypto currencies of any form until proven or forced:

H4. The tendency to adopt crypto currency or the likelihood to purchase crypto currencies is greater in societies that have a high degree of masculinity than in societies that are high in femininity.

-

Long Term vs. Short term Orientation

Short term-oriented societies exhibit slow economic growth like poor countries, feel luck is responsible for success, respect traditions, are rigid to change and look to the past for the best events in life. These societies consume and spend on social programs (Hofstede, 2011). Short term-oriented countries include the US, Canada and Australia:

H5. The tendency to adopt crypto currency or the likelihood to purchase crypto currency is greater in societies that are long-term oriented than societies that are short-term oriented.

-

Indulgence vs. Restraint

In restrained societies there are many police per 100,000 people, fewer happy people as people feel helpless. People are not active in sports and leisure is of low importance. Freedom of speech is not a primary concern and in countries with enough food, there are fewer obese people. In wealthy countries there are stricture sexual norms and in educated countries, there are lower birthrates.

Indulgent societies include Western Europe, and North and South America whereas restraint resides in the Muslim world, Eastern Europe and Asia (Hofstede, 2011):

H6. The tendency to adopt crypto currency or the likelihood to purchase crypto currency is greater in societies that are more indulgent in orientation than societies that are more restrained in orientation.

-

Likelihood to Purchase Crypto Currency

H7. The tendency to adopt crypto currency or the likelihood to purchase crypto currency is greater the in cultures that have an overall higher summated value of all six cultural dimensions combined.

References

Burks, C. (2017). Bitcoin: Breaking Bad or Breaking Barriers. North Carolina Journal of Law & Technology, 18, 244-282.

Goldberg, L. R. (1990). An alternative" description of personality": the big-five factor structure. Journal of personality and social psychology, 59(6), 1216.

Gupta, G. (2018, April 11, 2018). Venezuela inflation 454 percent in first quarter: National Assembly. Retrieved from https://www.reuters.com/article/us-venezuela-economy/venezuela-inflation-454-percent-in-first-quarter-national-assembly-idUSKBN1HI2MO

Hofstede, G. (2011). Dimensionalizing cultures: The Hofstede model in context. Online readings in psychology and culture, 2(1), 8.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Dimension data matrix. Electronic document, accessed, 10, 2010.

Laya, P. (2018, April 3, 2018). Crypto Rating Sites Are Already Calling Venezuela’s Petro a Scam. Retrieved from https://www.bloomberg.com/news/articles/2018-04-03/crypto-rating-sites-are-already-calling-venezuela-s-petro-a-scam

McCrae, R. R., & Costa Jr, P. T. (1999). A five-factor theory of personality. Handbook of personality: Theory and research, 2, 139-153.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system.

Paul, A. (2017). It's 1994 In Cryptocurrency. Retrieved from https://www.forbes.com/sites/apaul/2017/11/27/its-1994-in-cryptocurrency/#f778c6db28a3

Pelau, C., & Pop, N. A. (2018). Implications for the energy policy derived from the relation between the cultural dimensions of Hofstede's model and the consumption of renewable energies. Energy Policy, 118, 160-168.

Schuh, S., & Shy, O. (2016). US consumers’ adoption and use of Bitcoin and other virtual currencies. Paper presented at the DeNederlandsche bank, Conference entitled “Retail payments: mapping out the road ahead”. Google Scholar.

Tang, L., & Koveos, P. E. (2008). A framework to update Hofstede's cultural value indices: economic dynamics and institutional stability. Journal of International Business Studies, 39(6), 1045-1063.

Visser, J. (2018). What You Need to Think About Before Investing in Bitcoin and Other Cryptocurrencies.

Wheatley, S., Sornette, D., Huber, T., Reppen, M., & Gantner, R. N. (2018). Are Bitcoin Bubbles Predictable? Combining a Generalized Metcalfe's Law and the LPPLS Model.

Wilmoth, J. (2018). Venezuela’s Bolivar Sees 454% Inflation in Q1 as Maduro Hawks the Petro. Retrieved from https://www.ccn.com/venezuelas-bolivar-sees-454-inflation-in-q1-as-maduro-hawks-the-petro/

LIST OF FIGURES

| Figures

| Page | |

| 1.

| A representation of Predictability of Crypto Currency Adoption…

| 8 |

| 2.

| Hofstede’s Cultural Dimension Indexes Country comparisons …..

| see above |