BITCOIN (BTC) Update: The BIG Picture

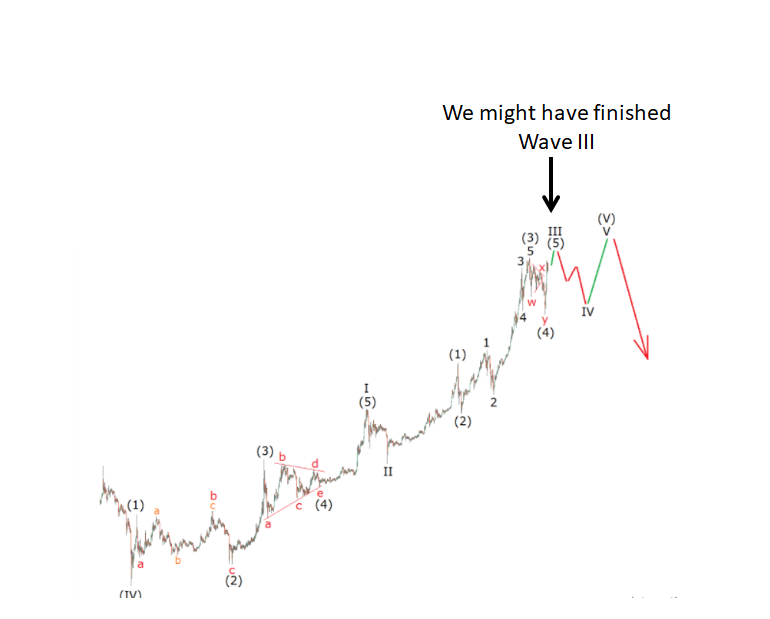

I'd like to relate the Big Picture outlook of my Elliott Wave counts. Especially for newer readers and followers. For a couple weeks now, I've shared the below chart and had been stating that the Wave III top is approaching.

We are now in a correction and per the below chart, Wave III has either completed or it will (I lean towards the first). Therefore, we are approaching and due the Wave IV correction.

My Wave IV target points are shown in below chart:

I believe the a to b (red) in this chart is the bounce we have perhaps seen over the past few days. That means BTC could take a dive but not until it first breaks below the topmost horizontal support line. This will confirm solidly that Wave IV is in progression and stops will be triggered en masse. Once the first horizontal black line support is breached, a very bearish looking Head & Shoulders can be discerened, as labeled with LS (Left Shoulder), Head (H) and Right Shoulder (RS).

The second dotted black horizontal support line is a strong support and a likely Fibbonacci related stop for Wave C of the ABC correction. If so, a very sudden and bullish turn should occur at this level.

The third dotted horizontal is traced out to take into consideration of a possible panic downdraft which is often common and rapid. Due to their rapidness, these bottoms are brief before a violent turn up occurs. So, if Bitcoin Wave IV progresses by breaking the first dotted horizontal support, I will have two buy ladders ready. One will be at the first stop for C on the second horizontal support line and another ladder at the second C stop point within the third dotted support line.

What's Laddering?

I've also frequently recommended laddering one's entries and exits. This means to slowly scale in your buys, and throughout past blogs, examples have been posted. Laddering is immensely sensible as it removes much emotion, especially buyer/seller's remorse. How often have you purchased an entry in a single transaction only to see prices go lower and lower your buy point? For most, this is emotional pain and leads to rash buy high and sell low incidents. Laddering allows the maximum control against the worst enemy: emotion.

Here is an example using a chart of Tokencard. Let's say I wanted to buy this coin and so I would setup the rungs to my laddered entry. Using support/resistance levels, I would place buy orders. In this case, I place 50% of my buys evenly across the black dotted horizontal line price levels and the rest evenly across the green dotted lines. And that's it! You'll sleep better at night with this technique but as importantly, make you wealthier.

Here is another laddering example I gave using NEO:

As always, I wish you all MASSIVE profits!

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTC Wallet - 19gHMJc9wi9KkP47wokz8y4cFNgz1kAAUE

ETH Wallet - 0xf83641dbf1a53498eae6d0d568c969790da48a36

LTC Wallet - LU1mEw1LHvffoWf9VDEVdP7Day4jv6VLqu

EOS Wallet - 0xf83641dbf1a53498eae6d0d568c969790da48a36

Legal Mumbo Jumbo: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Great post. Resteemed, and forwarded separately to many of my friends who still are not on steemit!!!

Upvoted. Agree exactly what you said. The recent weeks was a dead cat bounce of a to b.

So after wave four is complete it goes up one more time before dropping drastically to around 2800?

INTERPRETATION AGAIN, PLEASE :So after wave four is complete it goes up one more time before dropping drastically to around 2800? Or it keeps dropping to c around 2800? Too many words and pictures for me to digest.

Yes, once Wave IV is complete, Wave V is next bringing prices to >$5,000 to $7,000

great article, thanks for uploading. Followed, up voted and resteemed 👍

Well done sir. Ty very much @haejin

I also use this technique. I simply say: Buying in predefined price steps. It is a very good method, but it requires a very rigorous money management!

I often enter my buy orders and walk away and check at evening to see what got filled. Often, of the 6-8 rungs, only 3-4 get filled but that's ok as it increases my net liq on daily/weekly/monthly/annual basis.

Thank you Haejin...

Special note to @sanj > implement what @haejin tells you!!! :)

Interesting prediction on the dive, although it was really caused by JP Morgan's CEO comments.

Elliott Wave states that a reason or a news shall arrive to justify the forecast. and not reverse. JPM CEO's comments fits well into this statement.