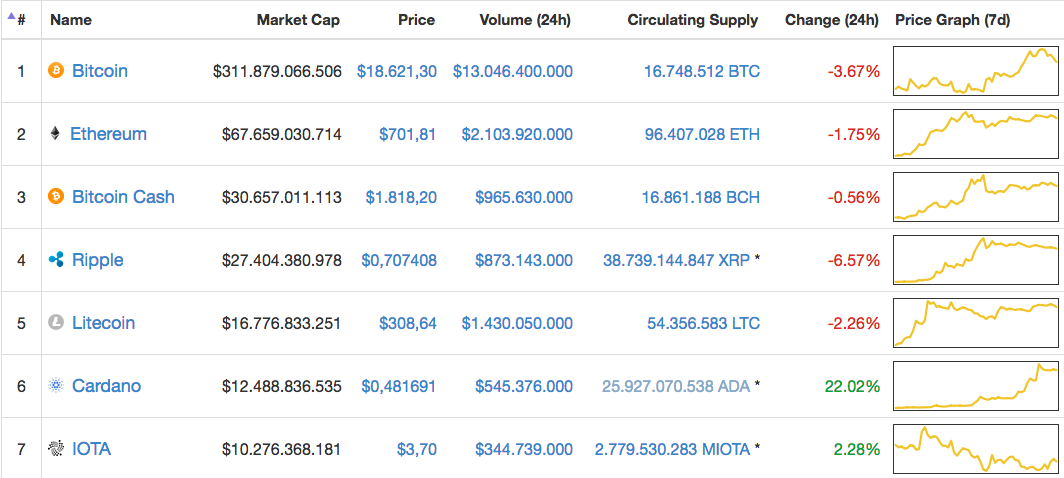

Our top 7 Crypto gems

Let me quickly go over the top 7 crypto currencies according to their market cap and show why they are real little gems that everyone should expect to tenfold in the upcoming weeks.

#1 Bitcoin

Bitcoin is up some 2000% since beginning of the year and Elon Musk tweeted that he wants to see BTC at 42k USD each so it will be. Nothing can stop this bullrun. EVER!

#2 Ethereum

After all the ICO money is collected for the next generation internet the kitties brought it down in a matter of days to a point where exchanges were unable to withdraw token to the wallets of users. After a little bit of homework to deliver a 1000 times increase in capacity it will eventually be possible to deliver all the promises that people already bought in.

#3 Bitcoin Cash

It's basically the smaller half of the elephant in the room but not really different.

#4 Ripple

Almost around as long as Bitcoin and backed by a company that acted as a central bank for the tokens. Of the 100 Billion token in existence all of them belonged to them until they slowly started selling a 3rd of them over time. Applications on the Ripple network pay fees in Ripple but you do not need XRP for anything else. And if you are a big customer then Ripple will make you a private chain with no fees at all. Visa and Mastercard may use the network but will not use the token. Ever. It's the centralized blueprint of BitShares without DEX and without stable coins. But somehow they always stay on top. Is there even a wallet?

#5 Litecoin

What I wrote about Bitcoin Cash essentially also applies to Litecoin. Bitcoin in a different configuration. You know... block times and hashing algorithm. Thats it! And apart from that it has a leader that Bitcoin currently lacks.

#6 Cardano

This gem is so hot it is not even existing yet. Born in the ICO craze by a guy who was a co-founder of Ethereum as a whitepaper without a working network. And the revolutionary idea is to reimplement Ethereum. A shame that this idea is not mine. Well done dude! And maybe in 6 months from now we can execute the first smart contract and start debugging. Something that other projects delivered 4 years ago (NXT).

#7 IOTA

You can use IOTA if you follow some rules. 1) never use the same address twice! 2) hit the sync button around a 100 times 3) never forget rule 1! then you should be fine. The idea is interesting but has proven to be unscalable. In addition the protocol currently is highly centralized to the few nodes that actually run the network and are hardcoded to the wallet which is minimal and consists of the 2 buttons to send and receive. IOTA announced a partnership with Microsoft. Microsoft released a press statement that IOTA is a customer of the Microsoft Azure Cloud service. Not sure why this adds another run up but here we go... Give me my 10 billion already!

Gentlemen, place your bets. You know it is the future! Never stop chasing the price or it will come down and everyone looses.

To sum up, we have Bitcoin, Ethereum and IOTA. The rest are copycats of the latter, Except Ripple. None of them works as expected, except Ripple. And Ripple is only a private Proof of Stake chain of some company. Lets get our act together and go back to work before we make more promises.

Ripple has the potential to revolutionize global currency exchange. Will it? Who knows. Maybe banks will co-opt the tech and use their own tokens. Maybe there's a security risk that we haven't accounted for.

But look at it this way: there's immense value in quickly converting XRP into any currency anywhere any time for less than 4 cents per $1,000. To transact on the Ripple network, you need XRP. Global currency is worth about $90 trillion, with $2 trillion exchanged every day. This doesn't include normal business operations of global companies operating in local markets (e.g., Qualcomm's factory in India buying paper from a company in Mumbai) -- potentially trillions of dollars more in money exchanging hands.

You can do this instantly with XRP, which enables companies to store some of their reserves in XRP as convenience and a hedge against arbitrage risks. Add this to normal use of XRPs for standard currency exchanges ($2 trillion worth each day), you have a huge market. Huge. Add the massive quantity of XRP tokens, the non-existent fear of losing value on a transaction (price of XRP is unlikely to change in 8 seconds, the time to conduct a transaction)...the case is compelling.

Doesn't mean Ripple will win, but, you can't dismiss it as a copycat. It's a real solution with real value.

The problem with Ripple is that it is centralized. In that case a MySQL database is much faster and cheaper. Ripple builds solutions for banks and financial services but they do not connect them to the global network. It's merely a showroom for whats possible. So yes, Ripple might be the future. No, you don't need XRP to use it. You only need a contract with the Ripple foundation to either run your custom version of the network on their server or hand you over some XRP from their bag of 63 billion outstanding XRP.

My understanding is there are two components: the Ripple protocol and XRP tokens. The tokens assure people using the protocol that their transactions will complete as expected. And Ripple subsidizes the use of XRP by large institutions. So, I understand that you don't need XRP to use the protocol...the big question is whether there's value in holding XRP. If nobody uses the token, it will be useless. If institutions use the token, it will be huge. And, if banks are using XRPs for international finance, international companies will have incentive to hold some XRPs to guarantee low-cost, low-risk payments instantly in any locality without having to use any intermediary.

Sounds like you're well-informed about all of this. I look forward to reading more of your posts.

Anyway I didn't mention Ripple as a copycat. I mentioned it as the only working solution.