What’s the Bitcoin Misery Index?

The Bitcoin Misery Index (BMI) is a tool that helps crypto traders understand the cryptocurrency market sentiment as they try to predict if there are any crypto investment opportunities.

Simply put, the BMI measures the momentum of Bitcoin by its trading value and volatility rate.

The index was created in March 2018 by Thomas Lee who is the founder and managing director at Fundstrat Global Advisors. Lee is an accomplished Wall Street strategist who has over 25 years of experience when it comes to equity research.

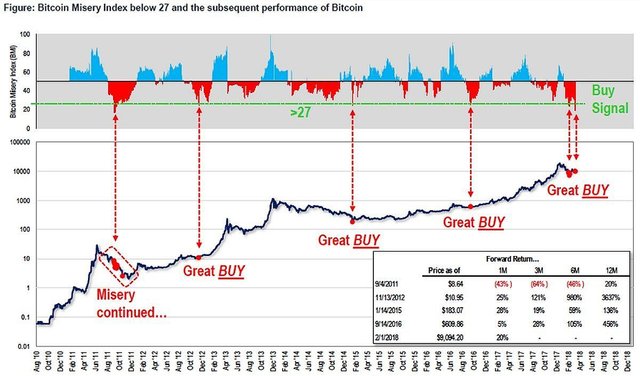

According to him, the index is a way to measure how happy or sad investors are owning Bitcoin based on the prevailing prices. After launching the index, he told CNBC that “When the bitcoin misery index is at ‘misery’ (below 27), bitcoin sees the best 12-month performance. A signal is generated about every year.” Adding that “When the BMI is at a ‘misery’ level, future returns are very good.”

The Bitcoin Misery Index is calculated on a scale of 0 to 100 while taking into account factors like volatility and also the number of winning trades out of the total. When the index is below 27 its considered to be at the misery level. And since it’s a contrarian index, the closer it gets to zero the louder the “buy” signal.

Given the highly risky and speculative nature of cryptocurrencies, investing in coins like Bitcoin favors sophisticated traders who can quickly analyze shifts in price and also understand what impact different news announcements have before acting on the insight gained to place buy and sell orders.

BMI is designed to be a tool that investors can use to know when they can place buy and sell orders for attractive returns. However, seeing a low index on the BMI can prompt less sophisticated investors to rush into purchasing Bitcoin before even analyzing other factors that have the potential to impact prices.

Even though the BMI had not been invented by 2016 when the demand for Bitcoin registered a dramatic increase, it is believed that less sophisticated investors have been behind its growing demand ever since.

Its also important to note that even though the BMI can predict the market sentiment, some predictions are beyond it. For example, it cannot predict if there will be theft on a major crypto exchange or what rules the SEC or any other regulator may pass and their potential impact on prices.

A Short History On The Price Of Bitcoin And How The BMI came About

After its creation in 2008 by Satoshi Nakamoto, Bitcoin became the first decentralized cryptocurrency in the world. , and this saw it gain popularity among tech enthusiasts who believed it represented the future of money.

Even though it was well known by many, its price remained less than $20 up until the start of 2013. However, by 2016, the interest on the crypto-coin grew dramatically leading to the price of one Bitcoin to increase by 123 percent by the end of the year.

In 2017 the interest grew even further to reach an all-time high. Bitcoin started the year trading at around $900, and by December 20th it had peaked to almost $20,000.

Investors who would have expected the price of Bitcoin to continue rising were met with huge disappointment as the price declined by almost 50 percent within the first three months of 2018. Given that Bitcoin is not controlled by any single entity or government, as it has gained popularity so did concerns about its use for illegal activities. Some governments were concerned about money laundering, financing of terrorists and embezzlement.

At the beginning of 2018, governments around the world started to take tough stances against Bitcoin and other cryptocurrencies and this affected its price negatively. A good example was the Chinese government which was concerned about the amount of electricity that was used to mine Bitcoins on top of fraud and money laundering concerns.

Additionally, investors have also had to deal with other uncertainties like the possibility of their virtual assets being stolen online. A good example is the millions of dollars’ worth of cryptocurrency that has been lost when major crypto exchanges like Coincheck and Mt. Gox have been hacked.

It’s a combination of these regulatory and security uncertainties that led Thomas Lee to create the Bitcoin Misery Index to gauge how “miserable” Bitcoin investors are depending on the ongoings within the crypto market.

How The Bitcoin Misery Index Has Fared So far

Ever since its inception last year in March, the Bitcoin Misery Index has not fared that well despite indicating numerous times that the misery level was at an all-time high and it was time for investors to buy. Even Thomas Lee, the man behind the index has been unable to correctly predict the movement in the price of Bitcoin using his creation.

Bitcoin went on a freefall throughout the year for reasons not many seemed to understand. By November of last year, it had somewhat managed to stabilize above $6,000 however this all changed by mid-November after a contentious Bitcoin Cash hard fork that saw the prices of cryptocurrencies even sink further.

Image source Investopedia

The rally that was expected to occur in 2018 never materialized and if anything the crypto market experienced an unprecedented meltdown. Lee who has always been very bullish about the price of Bitcoin was made to swallow his words numerous times as his BTC price predictions fell short innumerable times.

His inaccurate predictions began during the Consensus conference that took place in New York last May. At the time Bitcoin was trading just above $8,000, and he predicted a 70 percent rally which never materialized. His prediction at the time was based on the fact that the conference saw three times more attendees compared to the previous event that had occurred in 2017.

Also, at the beginning of the year he had predicted that Bitcoin could end the year above $25,000, but by November he was forced to cut his prediction by $10,000 to stand at $15,000 by EOY. However, as we already know even that price was almost five times what Bitcoin was trading for by the end of 2018.

Want to know more about it, join us on our Discord and Telegram channels and get into the discussion, or join our 8000 member community on our ICO DOG Investment Platform:

Discord: https://discord.gg/d4EpnZc!

Telegram: https://t.me/ICO_DOG_POOL!

ICODOG: https://icodogpool.com/! ; https://icodog.io/

You can find the link to the original article on our website here: https://icodog.io/bitcoin/bitcoin-misery-index/

Congratulations @icodog! You received a personal award!

Click here to view your Board