📰 2/8/2018 Mask off, "utility tokens": all of them can be recognized as securities in Asia; July token sales attracted a record low amount of funds; news by ICO Telegraph

🕑 5 min read

What did we collect for you today:

- Daily review of BTC market;

- Exchanges/listing/ICO news: new tokens, announcements;

- And more related information.

📌 Bitcoin vs Bears

Major players are moving to the market, but the price is falling

Good afternoon - this time we are seeing that Bitcoin's price has jumped a little up, gained support at the level of $7,500, while the resistance level was set at about 7800.

Morgan Stanley's new headof digital assets markets is "Bitcoin expert"

Morgan Stanley, one of the world's largest investment banks, hired Bitcoin specialist from Credit Suisse (A.Peel) as the new head of the digital assets division. It is not yet known what are the official duties of Andrew Peel, but it is clear that now bank can be aimed at work with various types of assets, including crypto-currency.

Is long-term investment "needed" in the Bitcoin's fall? Possible that for big players it will be necessary to reduce the cost of the BTC, in order to enter the market with the maximum volumes. A pessimistic forecast of the BTC's price shows that the "drawdown" zone for Bitcoin may be at levels slightly below this year low. To recall, the world-larget cryptocurrency fell below the $6000 mark in 2018.

📌 ICO began to attract less money

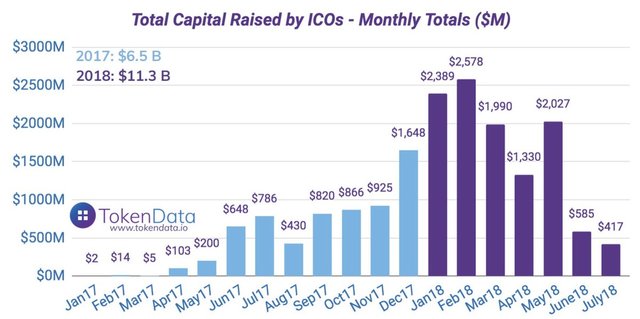

The amount of funds received through ICO during July is the lowest since June 2017

ICO, or Initial Coin Offering is probably the best way to attract funds with the goal to build the decentralized network, new cryptocurrency or world-known product. The largest amount of funds that was invested in blockchain projects was registered in January, February and March of this year.

Then, investors gradually began to lose interest in the opportunity to acquire a new bunch of tokens.

Image: source

So, we see that the last surge in start-ups financing was observed in March and May, however, we see that July closed very badly in this respect. For the past month, was raised a record low of $ 417M. For example, this month there was no ICO, which would have collected a record amount. Last year, in July, it became Tezos, which you probably know.

It is believed that with the market's recovering, investments in ICO will also increase.

💰Market Cap: $268 001 363 721

💵24h Vol: $13 256 576 267

📊 Prices TOP 02.08.2018

↗️↘️ BTC: $7563.51

↗️↘️ETH: $414.71

↗️↘️ XRP: $0.434075

↗️↘️ BCH: $748.06

↗️↘️ EOS: $7.01

↗️↘️ XLM: $0.266703

↗️↘️ LTC: $76.09

↗️↘️ ADA: $0.132593

↗️↘️ IOTA: $0.894759

↗️↘️ USDT $1.00

♻️ Exchanges

📌 Precedent: Brazilian Exchange won a case against its freezing

Limitations of cryptocurrency activities should not be preventive

The Brazilian cryptocurrency exchange Walltime, working with the Caixa Econômica Federal bank was subjected to a freezing of its account (costs $ 200,000 in total) on March 22 this year. Specialists, interested in this case, explain that the bank had no objective reasons to freeze an account. Despite the fact that the anti-money laundering program is also actively developing in Brazil, the exchange has not officially received any accusations. Therefore, this restriction was considered undeservedly preventive.

At the moment, despite losses, this exchange has a formal right to return to work. At the same time, there was already a similar case with another cryptocurrency exchange. Orionx platform from Chile was also frozen, but then managed to win the case.

📌 Philippines want to recognize all tokens as securities

The Philippines denies the status of "utility" tokens and equates them with securities (by default)

Securities and Exchange Commission (SEC) of the state published the new plan of rules by which new ICO process will be regulated.

Among other things, the commissioners are sure that investors can not independently identify fraudulent ICOs, which are often hidden behind "utility tokens." Therefore, the level of responsibility should be increased by SEC conclusion, as we understand.

«tokens are securities unless proven otherwise». However, the possibility to issue a token which is not regulated as security, remains. To do this, the team that started the sale must attach proof, why their coin is not a security. In addition, according to the new rules, ICO must pass a credit check, and the authors of the project themselves undertake to provide their personal data.

📌 Other updates – new projects, tokens and more

- Verge (XVG) confirms integration into the PundiX POS system. Earlier, XVG was also listed on Huobi. To know more, how real products can be buyed by using PundiX + XVG, read source.

- Reminder — OKEx exchange will support Hcash (HSR) mainnet swap. Hcash is an open-source cross-platform cryptocurrency which can be included in both blockchain/non-blockchain processes. At this moment, HSR has a price of $4,79 and 53 072 588 USD as 24h volume.

- TradingView analytical tools are now integrated with EXMO exchange interface.

- Other: Cryptodaily released an article stating that the creator of TRON project Justin Sun is Satoshi Nakamoto himself. It's not a critique, but, at anyone's side, it may be one of the funniest assumptions about Bitcoin's creator identity.

Know more interesting events/important updates? Please write a comment about it.

💱 Exchanges TOP

Binance 1.30B → 16.87%

Huobi 961.82M → 12.52%

🕮 Subscribe: Telegram (ENG), Telegram (RU), (GOLOS.IO)

This post was resteemed by @steemvote and received a 85.98% Upvote. Send 0.5 SBD or STEEM to @steemvote

How long do these altcoins last? Very few if any are generating income they are living off coins what happens when they run out? For many of the newer ones, it's been over a year, test nets galore but is anyone generating $? Honest question.

You are absolutely right, @vgc5000. Most of the altcoins came from ICOs and a lot of them will die over the long term. Probably more than 95%, I think this ratio is similar for most startups. Only the projects who has real product and usage will continue in the market in next few years. Thousands of ICOs will disappear from the coinmarketcap and new thousands will come. But I think some altcoins will survive over the long-term and some of them will compete with biggest existing cryptos.

I think that it's fine that ICOs start to collect less. Because a lot of them aren't good enough.

Yes, strong projects always will collect as much as they need.