Crypto week in review: bear market, huge news and opinions. August 6-12, 2018

This time we will review the most important news that happened this week. At this point, we could start this one with technical analysis, for example, look at possible patterns from the classical analysis, however, we now have one important trend: patterns of technical analysis on the crypto-currency market are deceptive.

You could see for yourself the approach of the so-called bull wedges in near future. This would mean that the market would expect a new wave of growth, however, at the moment we have serious discrepancies with the patterns used, and the real situation.

Bitcoin will fall deeper again?

In the conditions of a bear market and a long plateau after a bull trap at $8400, we see that Bitcoin can potentially reach the new bottom again. Moreover, this movement can be caused independently by major players.

As for the shortest period, literally Saturday-Sunday, the green zone can last for the weekend, but on Monday the opening can bring a return position, however, it's too early to predict anything. The rules of crypto market behaviour just begin to form.

📌 Major players are interested in blockchain investment and regulation

- Goldman Sachs is considering the possibility of offering custody for crypto funds

Goldman Sachs, one of the largest investment banks, is considering the possibility of launching custodian services for crypto funds .As we remember, Goldman Sachs was near to launch crypto derivatives for institutional investors in May.

In May, Oki Matsumoto, CEO of Monex, said:

"Regulators really hated derivatives in 1980 but just soon after that they really embraced them, what's happening in the crypto world today is very similar to derivatives in the 1980s, and sooner or later all of those regulatory frameworks will be fixed."

- Regulators from different countries are going to form 'Global Sandbox' (GFIN) including blockchain technology.

It is important that this idea is under development. But it is likely that, at the initiative of the UK, there will be a joint formation of regulators among such countries as the United Kingdom, the United States, Australia, and some others. These regions have not only a strong investment potential but also the need to regulate the area, including at the international level.

- Shinhan Bank and KT Corp will issue vouchers on blockchain

One of the largest banks in the country together with KT Corp, the telecommunication giant, will create a platform for the implementation of blockchain vouchers. Initially, it is stated that this will help stimulate the economy, and will increase the possibilities of technology within the regions. Here we also see the transformation of a classic financial instrument on blockchain.

- Commonwealth Bank of Australia (CBA) launches first blockchain bonds with World Bank

The bond, a classic financial debt instrument, will be available on the blockchain. As in the previous news, it is important to note the initiative of large institutions to create a blockchain-based infrastructure. It is quite clear that in the next few years we will see an upgraded financial industry that does not remember how to work with "archaic' paper assets.

- Another Swiss Bank enters crypto

And yes, Maerki Baumann, the second Swiss bank wishes to transfer the crypto-currency funds to itself. Of course, this country is a house of money, but at the same time, from the point of view of regulation, it is one of the most conservative regions in our time. Maerki Baumman will offer accounts to firms which activity is connected with cryptocurrency (operating, mining etc.).

You can also see other news that repeat this trend. For example, $18 Billion IPO by Bitmain and so on.

And also, according to the Bitmain pre-IPO document, mining giant has sold much of its Bitcoin for Bitcoin Cash. Redistribution of the portfolio or something new?

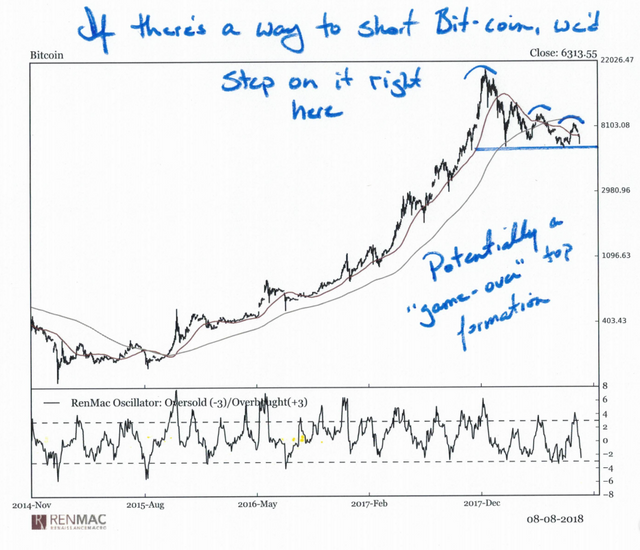

Bears: «game over» for Bitcoin

This message was followed by many news sources. Of course, with such sudden changes in prices, many have already stopped trading. It is now widely believed that the potential of Bitcoin, or other currencies, is concentrated in the proverbial "HODL", which, by the way, is still a good advice. However, according to the expressed opinion on CNBC, the life of Bitcoin may come to an end.

This opinion was tied to the picture below, with an unambiguous words: "potentially a game over?".

Summary

Bitcoin significantly drops from $8000 to $6 180 dollars, with unstable recover between $6300-$6400. The general momentum was lost; delayed regulation of the crypto-currency market is the main cause of this summer depression.

Series of delays and failures do not allow big players to move into Bitcoin, so we often see them in investing in infrastructure, rather than directly participating in the formation of prices. On the wave of this panic, many bad forecasts have appeared. Many players have abandoned their portfolios forever. At the same time, in the near future, we can be on the verge of "huge news".

Receive news about crypto-currencies every day.

Thank you for your post. :) I have voted for you: 🎁! To call me just write @contentvoter in a comment.

Thanks. We hope it's helpful for you.

Congratulations, your post received 97.86% up vote form @spydo courtesy of @icotelegraph! I hope, my gratitude will help you getting more visibility.

You can also earn by making delegation. Click here to delegate to @spydo and earn 95% daily reward payout! Follow this link to know more about delegation benefits.

You got a 67.79% upvote from @brupvoter courtesy of @icotelegraph!

Congratulations @icotelegraph! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPThis post was resteemed by @steemvote and received a 87.33% Upvote. Send 0.5 SBD or STEEM to @steemvote