📰 Weekly Crypto Meta: Ethereum Hard Fork Completed; JP Morgan May Issue JP Coin For Wide Public; Users Say #DeleteCoinbase — Why? And other news

The U.S. Federal Reserve Is Observing 'Bitcoin Crash' As Another Market Risk

Fed Stress Tests - tests for financial sustainability in the modulated conditions of unfavorable economic scenarios. Mostly, these tests are used to assess the stability of the U.S. banks.

Recently, the Board of Governors of the Federal Reserve System reported that crypto market crash scenario may be included in the next stress-test. And, although now it is not entirely clear how the collapse of the cryptocurrency market can be controlled by the Fed (and what responsibilities does it have?), this statement signals the attention of US government services to digital assets.

'The commenter recommended that the Board consider extraordinary shocks, such as a war with North Korea, the collapse of the Bitcoin market, or major losses caused by trader misconduct, in its scenarios.'

Thus, the regulator monitors the stability of the country's financial system and tries to reduce risks, even those that are, as it were, outside today's discourse. Probably, the Board should give more comments on what risks can be faced (considering that the market is chaotic enough and it can not be controlled - although there are those assets that are observed by the SEC, CFTC and so on). If the 'Bitcoin market crash' scenario is approved, it will be used from April 1st.

JPMorgan Is Testing Ethereum Technology To Increase Customers Privacy

JP Morgan, one of the largest banks today, that previously announced the release of its own cryptocurrency JP Coin, told about a new solution prepared in the blockchain area.

This new solution for improved user privacy is based on Ethereum, and also implements the principle of zero-knowledge proofs (ZKPs)'. The advantage of this method is that private information cannot be disclosed, but the truth of the statement can be proved, which is probably very useful for the bank.

To develop this privacy solution, JP Morgan partners with the London startup AZTEC, which name is used for the ZPK system itself. And, according to private sources as told by Coindesk, JP Morgan is 'generally looking to industrialize zero-knowledge proofs for Quorum.'

JPMorgan Does Not Deny That JP Coin May Be Issued For Commercial Use

Of course, it is important that the bank creates its own cryptocurrency, the tests of which should begin within the next few months.

However, the type of cryptocurrency itself and its actual use is even more important. Initially, it was simply assumed that this asset could work as a digitalization of money, for their quick and secure transfer, as proposed by Ripple, for example. But there was no mention of any private use or public offering of JP Coin that could be widely available on the market.

As Jamie Dimon (JP Morgan) said:

'JP Morgan Coin could be internal, could be commercial, it could one day be consumer,'

At the moment, of course, the organization does not make any public offers related to the sale of the not yet released, but already famous cryptocurrency. However, as we understand, in general, they do not exclude the possibility that their coins will be available to individuals (in theory).

What would it bring to the digital asset market? At a minimum, the presence of a global player, whose name is universally known, who has not previously been associated with cryptocurrencies, but now has many advantages in it. Of course, from this perspective, the hypothetical competition with Ripple (as far as it can be) probably is not something to look at first.

Ethereum Constantinople: Hard Fork Completed

Ethereum's Constantinople hard fork successfully completed on the block #7280000. The update also includes another hard fork, Petersburg (completed), designed to fix problems with Reentrancy vulnerability, which became the forerunner for the planned fork in January.

:) #Ethereum

Péter Szilágyi (@peter_szilagyi) 28 февраля 2019 г.

The hard fork enables:

- optimal smart contract execution

- reduced mining rewards

- 'Difficulty Bomb' delay

At the moment, Ethereum (ETH) is the second crypto by market capitalization, which market price estimated at $130. This week, the price of this digital asset also climbed above $140. This hard fork is also not a final development, and is part of another, larger upgrade called Metropolis.

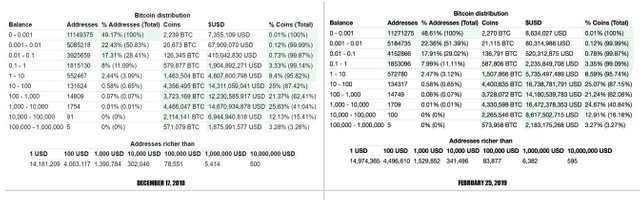

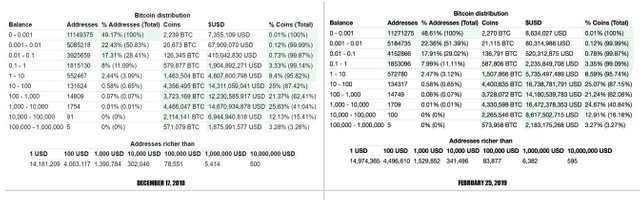

The Biggest Bitcoin Holders Acquired Another 150 000 BTC On The Wave Of Bearish Trend

The movements of large amounts of virtual funds have always attracted users attention. On the one hand, we can evaluate the tactics of major players (holders of large amounts of BTC) in order to strengthen the 'hodl' feeling. On the other hand, it is not always possible to speak of a clear correlation between what Bitcoin whales do and how profitable this is in the medium term.

According to Bitinfocharts.com, over the past two months, the top 100 whales have managed to accumulate 151,405 BTC ($ 572 million). Such holders have all the opportunities to make profits, as the current market situation shows. Only about 2 weeks ago, Bitcoin spiked quite high in a short period of time, up to $4100. In general, according to statistics, the market is waiting for more than one such wave of growth, but what if this is a long-term investment?

](

](

'The remainder of the top 100 whales (some of which are smaller exchanges) managed to accumulate 151,405 BTC ($572 million) in less than two months. Holders who have 100-1,000 BTC (14,749 addresses) have seemingly given up a lot of coins to the much larger holders as wallets of this size have decreased from 72.13 percent to 62.08 percent.'

It is worth noting that some of the top wallets with big amounts of BTC belong to cryptocurrency exchanges, but a lot of wallets belong to individuals. It is also possible that whales may be mistaken as ordinary people, not as insiders or great investment strategists.

#DeleteCoinbase: What Happened In Twitter Community?

The tag that sounds quite loud, #DeleteCoinbase, is now used by clients of one of the most popular cryptocurrency exchanges. This tag is designed to demonstrate that users close their accounts on Coinbase to protest the 'controversial acquisition'.

Coinbase recently acquired Neutrino (startup), so cryptocurrency users who, in general, highly value not only privacy, but also human rights, are concerned about this. Neurino’s key staff are affiliated with Hacking Team, namely Giancarlo Russo, Marco Valleri and Alberto Ornaghi worked in a team that sent user data to various services more than once, including not only the money laundering agency, but in general, served as information providers for all interested parties.

This is how Coinbase explained the acquiring of Neurino:

'Increasingly, third-party blockchain analysis companies are requesting customer data from cryptocurrency companies that they serve. It was important for Coinbase to bring this function in-house to fully control and protect our customers' data and Neutrino’s technology was the best we encountered in the space to achieve this goal.'

Coinbase early began to advertise itself as a 'crypto bank', that is, an organization that has sufficient priority and financial strength in the market. However, now Coinbase potentially violates one little thing that could be really good in their service, namely, information security and high standards.

QuadrigaCX Has Withdrawn All Funds From User Wallets One Day Before The Founder’s Death

Well, the collapse of QuadrigaCX exchange has become one of the most unpleasant occasions in the cryptocurrency world 2019. It not only indicates the high risk that cryptocurrency platforms have (no matter what measures and restrictions are created), but also leads to many questions. Nevertheless, the formal proceedings are ongoing, and this is what Ernst & Young Inc found.

So, the Canadian exchange QuadrigaCX stated that it had lost access to cold wallets that held users' funds in the amount of $140 million. Since only the creator (!) had access to the wallets, after his death in India, all the money can't be found now. At least that's what the people associated with the exchange said.

However, according to Ernst & Young, only 103 BTC left on the platform’s wallets were sent there already on February 6, that is, when the founder of the exchange could no longer manage the funds, and in general no one could. All the funds that belonged to the Quadriga, to users in fact, withdrawn in 2018.

The withdrawal of funds occurred quite a long time ago, in the spring, with use of various wallets (only one wallet was active back in December). Specialists involved in the audit of the case, can not tell where all the crypto that belong to users, because the movement of funds early holded on QuadrigaCX wallets could not be traced.

Malta: The End Of 'Crypto Island'?

Cryptocurrency companies experience difficulties with opening their bank accounts in Malta. At least several different sources report this.

Malta, one of the states that is most loyal (but at the same time attentive enough) to cryptocurrencies, is probably in a dual position. Legislation allows cryptocurrency/blockchain companies to work here on effective terms.

However, what is operating without a bank account today? Commercial members are not even allowed to do this. Why is a cryptocurrency 'system' currently develops in such form that it still needs an intermediary? All this is a big question. And this situation is also reflected in the 'Maltese approach' to cryptocurrency.

The actual situation lies in the fact that cryptocurrency companies began to experience a little more difficulty with banks here. At the same time, regulators seem to support this approach by saying…

'One should make a clear distinction between blockchain operators and crypto operators'

(As Parliamentary Secretary for Financial Services Silvio Schembri told the Times of Malta).

Which, of course, looks restrained, even alarmingly in relation to cryptocurrency. While Malta was widely advertised as a 'blockchain-island', regulators (as well as financial organizations) are likely to adhere to the same restraint as in any other country where crypto has semi-free status.

Will Facebook Launch Its Crypto Product? The NY Times Says Yes

Finally, several large companies want to release their cryptocurrency. Earlier we heard that they could not do this because of the bear market. But now, probably, some steps are being taken in this direction.

The New York Times reports that major players, such as Signal and Telegram are also planning to issue their tokens over the next 12 months. As for Facebook, the company is in talks with cryptocurrency exchanges for listing their newest digital asset. However, it is not clear how relevant this information is.

Earlier Bloomberg reported that Facebook is developing a cryptocurrency for WhatsApp transfers. So this currency will not be integrated into the processes of the social network Facebook, most likely. It is hard to say why the news is actively promoted now, in a market for which it is difficult to take a really bullish and long-term positive impulse.

The current progress of named projects:

- Facebook: is negotiating with the exchanges.

- Telegram: 90% is ready, so far there is no cryptocurrency, there is also a fake video that allegedly shows the TON platform (Telegram Open Network) 'in action'.

- Signal: development is underway, the currency will also not be integrated into the messenger.

💸 Research: Can JPM Coin disrupt the existing stablecoin market? | Dukascopy Bank SA started the airdrop of Dukascoin, its new coin

💱 Cryptopia: 'we have calculated that worst case 9.4% of our total holdings was stolen' | Coinomi user lost about $60 000 in crypto because of googleapis.com vulneability | Simulated Trading Competition on Binance DEX starts on March 7, 2019 (8:00 AM, UTC) | Starting from March 6, BitMEX will no more provide services for residents of US and other 8 regions

🏛 The Court has denied the plaintiffs' motions to remand in the Ripple's 'unregistered security' case

📱 Samsung presented out-of-the-box blockchain solutions for Samsung Galaxy S10