To Hold or Not to Hold... That is the Question

Should I Use or Should I Hold Cryptos?

A couple of days ago, someone said they were a proponent of using cryptos, not hoarding them. They want people to use them for their intended purpose -- in some cases, a medium of exchange, like Bitcoin Cash or Litecoin -- Bitcoin Core will forgive me, but until their latency and exorbitant fees get handled, I can't recommend them unless you're buying enough volume to warrant a $50 network fee.

And yet, another person expressed a concern about Bitcoin being very volatile and unstable.

Both of those got me thinking, and the answer is behind my approach of HODLing (Holding On for Dear Life) instead of spending.

First and foremost is the use case -- Bitcoin, Litecoin, DASH, Monero, ZCash, etc. were designed as a medium of exchange (with varying degrees of privacy and anonymity). If no one had used them as a medium of exchange, perhaps we wouldn't be where we are today.

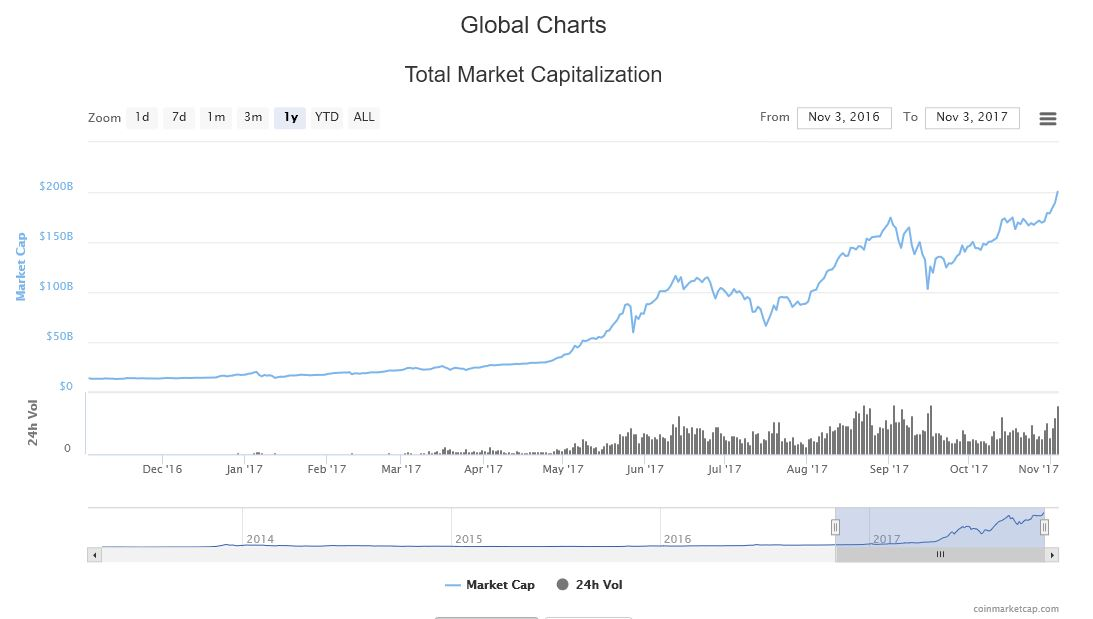

But you can also observe the volatility as people around the world start to adopt cryptos more and more... more demand, higher prices, etc.

Earlier this year there were 40K people a day signing up for Coinbase alone. This number is sure to increase by multiples in 2018 as the rest of the world become the Early Adopters (we're just getting out of the Innovator phase) and eventually Mass Adopters.

In the meantime, the prices will continue to be volatile and it's very hard to set prices in a currency that keeps changing.

Let's start by defining Money. The best definition I've seen defines Money as "an idea backed by confidence." What does that mean? It means you and I have confidence we can use it instead of barter, to buy the goods and services we need, with the same expectation on the person from whom we're buying.

In this great article, Peter Schiff explains the difference between Money and Currency. Essentially, the entire world is using fiat (currency created out of thin air) -- but yet it works? Why? Because people started using these currencies when they were backed by something like precious metals, so, when we got off the Gold Standard, people were still used to trading those pieces of paper. And nowadays, most people don't even use bills... it's all digital, debit cards, credit cards, maybe a few paper checks.

The reason all this works in Confidence. The same confidence as in a Confidence Game, or a Confidence Man (aka Con Man).

The only reason precious metals have value is because we believe they do. We have confidence that people will always finds shiny yellow metal or sparkly stones attractive and desirable, so they will "always" have value.

In some cases, like Silver, there's also an industrial use that gives the metal value, and makes it worth for miners to dig it out of the ground, process it, and finally deliver it to those who want/need it.

It's all about exchange, just like the I, Pencil short film explains.

So, what does all that have to do with cryptos? They're all about confidence too. The innovators who used 10,000 Bitcoin to buy a pizza, or other such amount for a pair of socks -- they helped us gain confidence in cryptos. Confidence we are still acquiring. It's a necessary part of the equation, don't you see?

But let's look at the characteristics of money and how they apply to cryptos.

Here's a[] good article from Andy Hoffman of Miles Franklin](http://www.24hgold.com/english/contributor.aspx?article=3853687314G10020&contributor=Ranting+Andy), entitled the 7 characteristics of money:

(1) It must be durable, which is why we don’t use wheat or corn or rice.

Cryptos will last forever, so long as there's electricity and a single computer with the full blockchain on it.

(2) It must be divisible, which is why we don’t use art work.

Most cryptos are divisible to 18 decimal places. For example, 1 Satoshi = 0.00000001 BTC.

(3) It must be convenient, which is why we don’t use lead or copper.

Gold and silver were replaced with certificates called dollar bills, and now dollar bills have been replaced with debit cards and bank transfers. Cryptos are just as portable but are faster and cheaper than the current alternatives.

(4) It must be consistent, which is why we don’t use real estate.

This is the part that cryptos have yet to conquer, and in my estimation won't happen, until we have achieved mass adoption. More on this later.

(5) It must possess value in itself, which is why we don’t use paper.

I disagree with this statement. We've used anything from big stones (Rai Stones) to precious metals, to little plastic cards representing dollar bills that have no value in themselves. The important characteristic is CONFIDENCE. Do we have confidence? Well placed or not, do we have confidence? Confidence in cryptos is rising along with their prices.

(6) It must be limited in the quantity that is available, which is why we don’t use aluminum or iron.

Again, this helps determine the value of the money. If you can create infinite amounts of money, then it'll eventually go down to the equation: 1 / infinity which is practically zero. If you can't hyperinflate it, then it's value won't drop. Perceived scarcity makes something valuable to us, since there's not enough to go around. Like gold or diamonds.

Here, some cryptos like Bitcoin and Litecoin that are mined into existence (using electricity, time and computing power) are limited, and some are not. The most valuable ones are limited.

(7) It should have a long history of acceptance, which is why we don’t use molybdenum or rhodium.

And here, Bitcoin has been around since 2009. Is that long enough? I think so. It's only going to get longer. And remember, cryptos are not just a means of exchange. The technology that powers them, the blockchain, has many other uses, and is not going anywhere but up.

As you see, per the above characteristics, cryptos aren't quite at the level of being money, mostly because of volatility. And as much as I think it's important that people use cryptos (maybe to pay off credit cards, cars and other debts instead of groceries), I do think now is the time to buy and hold. Sure, use a portion, but mostly buy and hold.

My contention is that until such a time as the Free Market has determined Fair Market Value -- in other words, until you and I and everybody else has reached a point where we won't pay any more for a single Bitcoin and its price adjusts down to a more stable point and hangs around there, it's best to dump your worthless fiat that is constantly losing value (inflation, rises in the cost of living, or just earning less every year as we compete with other jurisdictions with lower cost of living) into assets that will retain or increase their value. Like precious metals (store of value) and cryptos.

Good fortune to you, and as always, thank you for sharing your Light with me.

Download the Tor Browser here - protect your cryptos from hackers and malicious websites.

Sign up for ProtonMail here - protect your crypto related communications from hackers.

Hold your own cryptos -- don't leave them at the exchanges:

Download the Jaxx wallet here.

Download the Exodus wallet here.

(I do recommend you download and install both!)

Convert your worthless fiat into cryptos:

Sign up on Coinbase here, and we both get $10.

Sign up for Kraken here

Sign up for Gemini here

Or feel free to shower me with cryptos:

Bitcoin: 12Npj8xAAKnf7EJxZStgeecpniE1pbSvcd

Ether: 0x2636538545ebbcea63fd47af1d4fe3e27f5c3936

Dash: XjGWDB7twAHiN9jk3RUmcQRHq6FxvHvYJu

Litecoin: LN4DeZwJDgTbcaXoBXatrGq2JaXVfkMdi5

ZCash: t1fwHkzXfNGCDV19Xq9esWkCRLcCQFcDddN

And Doge, just because it's Doge: D7wuTkhicw2P2vwKx49RXJ9dhVJoXJoKTQ

Makes some good points on what money and currency are. I've always liked Peter Schiff's opinion, but I think he's got the blinders on with cryptos. Some gold bugs are getting with it, but I'm still not unloading mine!