Why i hate the Bitcoin Investment Trust and the culture they breed?

You don’t have to look far to find financial luminaries and talking heads declaring the death of bitcoin. Again… In just the past few months:

- JP Morgan CEO Jamie Dimon declared bitcoin is “not a real thing, eventually it will be closed”.

- “Wolf of Wall Street” Jordan Belfort called it a “fraud”.

- An article in the Wall Street Journal claimed bitcoin “is probably worth zero”.

- Billionaire investor Howard Marks said cryptocurrencies “aren’t real”.

These talking heads all have one thing in common…

They’re victims of the default bias.

Have you ever been overwhelmed by the choices in a restaurant’s wine menu and just decide on the house wine? Or, when you buy the latest mobile phone, do you just accept the factory default settings and not even bother changing the ringtone?

Most people are happy to stick with the standard options. Even when we have several choices, we go with the default choice because it’s easier and more comfortable. Governments and other authorities know this and use it to nudge us in a certain direction.

Even when there is no default, or standard, option given, we tend to use the past as our default setting. Most people like to stick with what they know and are anxious about making big changes or taking on new risks, even if the change would be good for us.

This default bias is the offspring of two other biases: status quo bias and loss aversion. Keeping things the same (status quo) is convenient, and the pain of losing is greater than the joy that comes from winning (loss aversion).

Put these together, and our brains often tell us it’s just easier to keep things the same and avoid any potential pain that might come from changing things.

Still, for now, Bitcoin is king with a network — and that shouldn’t be overlooked — even for retail investors. The conventional EBITDA multiple doesn’t work when valuing Bitcoin and cryptocurrencies, and that’s what confuses the likes of Howard Marks and other Wall Streeters. So the valuation conversation is a bit confusing and perhaps futile. Bitcoin is doing what PayPal initially set out to do – create a new world currency. The idea was to create a system that was just a massive database ledger where you had debits and credits, and you never had to leave the system. When PayPal got bought by eBay, all that changed.

Some call Bitcoin a commodity, some a currency, others a security. Bitcoin doesn’t want to be the next MasterCard, so it’s not about being a transaction network.

Thinking of Bitcoin as a payment processor is wrong – hence, the reason valuations can be misconstrued. Bitcoin taking some of the fees that MasterCard collects is nice, but the function of Bitcoin as a payment is secondary. Anyone that tries to value Bitcoin as a payment processor is missing the point.

It happened with the Internet

In the early 1990s, the Internet was just starting to go mainstream. And many otherwise smart folks were convinced it was just a fad. Because too many people in the tech/startup world want to build a $1B company but don't want to do the hard work, just talk.

Here’s a quote from U.S. astronomer Clifford Stroll in 1995:

“Visionaries see a future of telecommuting workers, interactive libraries and multimedia classrooms. They speak of electronic town meetings and virtual communities. Commerce and business will shift from offices and malls to networks and modems. And the freedom of digital networks will make government more democratic. Baloney.”

Even the inventor of Ethernet, Robert Metcalfe, didn’t believe in the Internet.

“I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse."

And telecommunications expert Waring Partridge had this to say:

“Most things that succeed don’t require retraining 250 million people.”

These people fell for the default bias. They believed in what they knew and were anxious about making big changes or taking on new risks. Plenty of investors who fell for this bias too. And they missed out on big gains as the Nasdaq – which is home to many tech stocks – grew 400 percent from 1995 to 2000.

I met a wealthy investor from China. I explained in slow words about some of the companies we’ve backed in the past that became worth more than $1 billion. Our firm has funded many of them. On average they have taken 9–11 years to reach this status and most of our investments have never gotten there.

I was trying to tell a real story about grit and risk and determination and seeing the markets early but struggling to persuade others. He smiled midway through my story and said, in broken English, “oh, you have unicorns!”

No. We fucking don’t. We have companies that became valuable through founders that sacrificed for years and through hard work — and partly through luck — achieved great things.

But the status symbol of this milestone is driving investors, entrepreneurs, the press and everybody into thinking you magically can achieve this status in a matter of a few years with a great team and an astounding idea. The truth is that many “unicorns” have reached the status solely because the funding markets have said so. At least for now.

We’re seeing the exact same thing happen with bitcoin and cryptocurrencies today… it’s like a replay of the status quo bias.

Most people don’t understand cryptocurrencies

Anyone who claims bitcoin isn’t “real” or it will “close” (as JP Morgan CEO Jamie Dimon did) doesn’t understand the cryptocurrency at all. As for the concern that bitcoin is purely “digital”, it’s worth remembering that more than 90 percent of all money that exists today around the world is not physical (i.e., not notes or coins). Bitcoin is just a cryptographically secure medium of exchanging value. It’s not “fraud” or not a “real currency”.

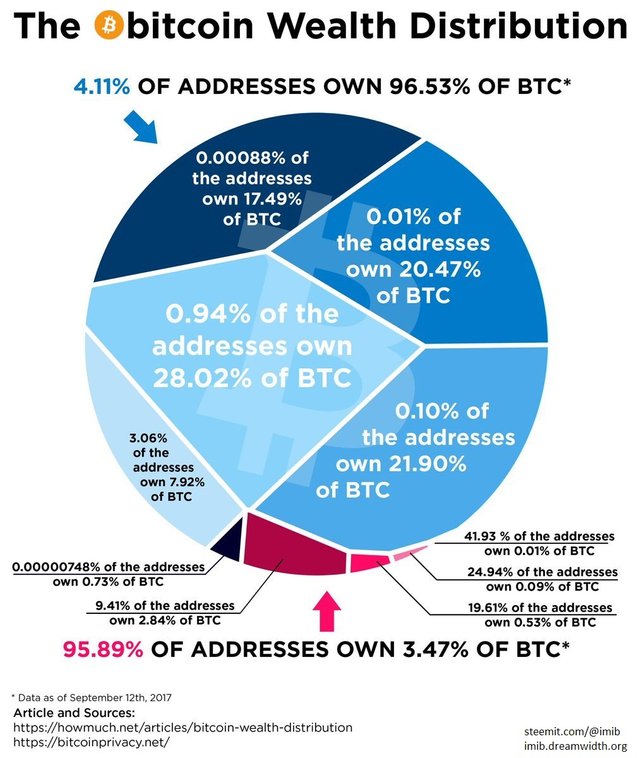

As a Bitcoin holder, think of yourself as a shareholder and the network/blockchain/protocol is the company. The company grows as more networked applications are built on top of the network. Sure, applications running on the network will be in competition and those trying to build the Visa on top of the blockchain will have to fight off a lot of competition, but there will be big winners (i.e. applications build on the protocol). But regardless of who wins, the blockchain benefits and the only way for most people to participate is by owning the crypto token – Bitcoin. Modelling that is tough, and next to impossible to old-school analysts on Wall Street.

As for Bitcoin’s technology, it gets an upgrade in November. The block size in the Bitcoin blockchain will double and the transaction speed should increase nicely. Faster, and more, transactions is a big positive for increasing the usefulness of Bitcoin. Then there’s the other major catalyst for Bitcoin, which is, as the cryptocurrency industry gets close to $100 billion in market cap, institutional investors can no longer ignore it. With that, there’s more money looking to buy Bitcoin, as well, there’s more pressure to create a sound public market product that more accurately tracks the Bitcoin price — unlike Bitcoin Investment Trust (GBTC).

Even though there’s plenty of hype around it, the level of general public participation is still extremely low. Buying bitcoin is still relatively cumbersome. Exchanges need to do know-your-customer (KYC) checks. Depending on where you live, funding a bitcoin account can require a trip to the bank and an expensive bank transfer. And you still need to familiarise yourself with a new asset class, which takes some effort. But all that means is the opportunity is still there.

The most appropriate course of action for the majority of investors is simply to buy a little bitcoin – and forget about it. Buy, hold and ignore the volatility. It’s not a one-way ride, it’s a bumpy one. Be prepared to stomach big declines and sit tight. Bitcoin is an asymmetric bet… if it falls or even goes to zero, your loss is small (assuming you’ve put in only what you can afford to lose). But if over the next few years it continues go up, then gains of 10 to 50 times are entirely possible… and even bigger gains lie outside of bitcoin in the cryptocurrency space.

For investors looking to get exposure to Bitcoin, the idea is that the only way is the GBTC. But for investors, it’s not hard to buy Bitcoin these days. The biggest exchange is Coinbase and makes setting up an account, funding it, and buying bitcoin rather flawless — all of which can be done from your phone.

Paying a near 100% premium (with the GBTC) for getting exposure to an asset that was created so you didn’t have to go through Wall Street is rather nonsensical. As well, the Bitcoin that the GBTC is not insured and I’m not sure of how well it’s secured against hackers. You don’t have to be tech savvy or have a computer engineering degree to own Bitcoin outright. That high premium for GBTC will also come crashing down a Bitcoin ETF is approved, or even a cryptocurrency ETF.

But as the saying goes, “A fool and his money are soon parted.”

Be wary.

P.S.

Follow, Resteem and VOTE UP @imib

This post was resteemed by @steemitrobot!

Good Luck!

The @steemitrobot users are a small but growing community.

Check out the other resteemed posts in steemitrobot's feed.

Some of them are truly great. Please upvote this comment for helping me grow.

@alchemage has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Congratulations @imib! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP@royrodgers has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.