BTC - How close to a bottom are we?

Is the bottom for bitcoin in sight?

The price of bitcoin has been drifting lower pretty much all year, but we may be close to a bottom.

Anyone who bought in the last 10 months is likely losing money at this point.

However, we may be close to a turnaround.

Why might I say that you may be wondering?

Well for many reasons actually, but several rather specific ones tend to stick out.

1. The sentiment is finally starting to be decidedly negative.

Why is that needed?

Anytime you have everyone on one side of the trade there is no one left to keep pushing prices in that same direction.

You often see this near market tops as everyone is in agreement that prices are going to go higher.

Right about that time, prices head south catching everyone off guard.

Something similar often happens in reverse too.

When everyone is bearish and thinking prices are going to keep going lower, they often don't.

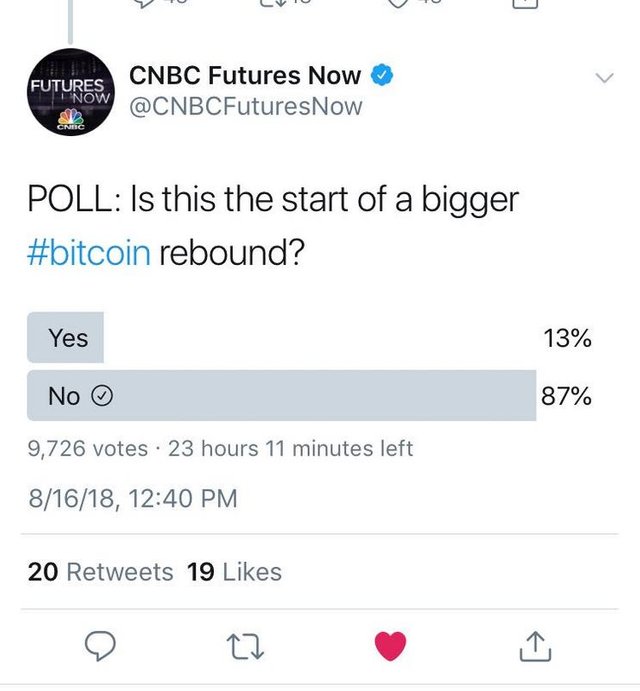

Check out this poll from CNBC:

(Source: https://twitter.com/BullyEsq/status/1030159661343883265)

This poll shows that of the roughly 10k people polled, the vast majority think prices are likely to keep going lower.

How's that for everyone being on the same side?!

2. Short positions are very high.

Everyone has been blaming short sellers for some of the weakness seen in 2018, and they may be partly right.

However, keep in mind that a short position also provides fuel for a rally.

In order for someone to close a short position they must buy.

Often when prices start to move up, it causes short's to exit their positions rather quickly to try and preserve profits or minimize losses.

This often can build on itself and cause exaggerated up moves.

Check out the short to long ratio seen on Bitfinex currently:

(Source: https://twitter.com/alistairmilne/status/1029605420741128193)

It recently hit 1.4.

That is the highest level seen in 2018. The previous high was 1.2, which hit in April. Shortly afterwards bitcoin rallied from around $6,800 to about $10k in a matter of days.

This doesn't necessarily mean that history will repeat, but it goes to show that the kindling is there for a short squeeze.

3. The news flow has been decidedly positive.

No, we didn't get our bitcoin ETF, but it also didn't get rejected either.

It was simply delayed by several weeks or possibly months.

Also, there was the launch of a bitcoin ETN which will effectively work similarly for investors looking to buy bitcoin in their IRA.

(More about that can be seen here: https://steemit.com/crypto/@jrcornel/we-didn-t-get-a-bitcoin-etf-but-we-got-the-next-best-thing)

Plus we also got the news that ICE, the parent company of the NYSE was going to provide a custody solution as well as create a crypto exchange as soon as November of this year.

More on that can be seen here:

https://steemit.com/bitcoin/@jrcornel/big-news-bitcoin-settled-futures-are-on-the-way

https://steemit.com/crypto/@jrcornel/biggest-news-of-the-year-and-bitcoin-hardly-reacts

And these are just two of the many positive pieces of news we have seen over the past several months.

Final thoughts:

We have seen the fundamentals and infrastructure continue to get stronger while the price has been getting weaker.

In my opinion that is the kind of environment you want to be buying into.

It looks more like a market that is just resting before it resumes its next leg up as opposed to one that is getting ready to go away.

Stay informed my friends.

Image Source:

https://toshitimes.com/will-bitcoin-bottom-to-5000-before-springing-all-the-way-to-50000-this-fall/

Follow me: @jrcornel

Some valid and important moments raised. But them are not equaly important to everyone. To someone (like myself) who has plans not to start spending his cryptos before 2025 (or before $300K, whatever comes first) these intermediate ATL's & ATH's do not mean much. As well as if they took place in July, August or December.

Dont watch the daily charts - switch over to "all time" logarithmic, and enjoy the show.

That is a good point. Curious though, what made you pick $300k or 2025 as your targets?

I think this entire correction was just part of a much bigger bubble that will dwarf that of the .com bubble.

Then you and I share the same view.

Facebook & Google blocking crypto ads started the bear market. Fighting back against them will end it.

Details of the drops:

These bans dramatically slowed the flow of new people into crypto and prevented projects getting users and funding.

That's why JPB Liberty is enabling everyone in Crypto to claim damages against them by Joining the Class Action against the Crypto Ad Ban.

Its anonymous, no win no fee and you even got bonus tokens for signing up.

Tired of bottom fishing 🎣

Time for the good news to translate into a Rally

💰👍💰

Some of the biggest fish are caught off the bottom.

Great article jr! And i agree: when 90% of opinion is neg that is prime-time for the honey badger to start smackin’ the shit outta’ snakes and eating larvae!

😎👍👍

Yep, when everyone is one side there is no one left to keep pushing the price in that direction.

Who knows...

Well said....

Posted using Partiko Android

Be greedy when others are fearful. I believe that but sadly Im building up my emergency fund due to my work situation so I have no spending money.

certainly agree with u.

I love your hustle! How much content you put out is amazing. Keep going. Love from Germany! PS Just upvoted and started following you :D

Yes its just a matter of time at this point. Bitcoin will prevail as a global currency!

Perhaps. I think it will prevail as a store of value at the very least.

I enjoyed this article @jrcornel! Great content..