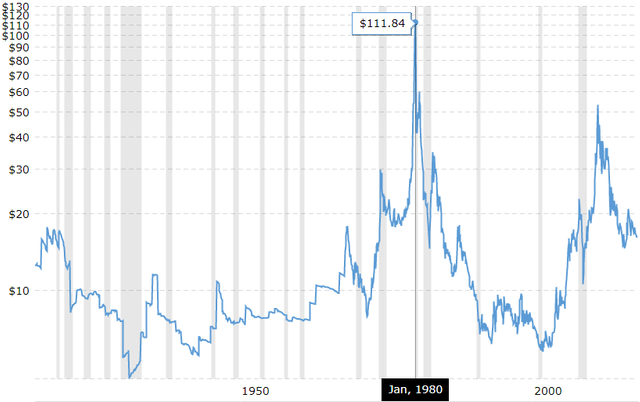

Is Bitcoin's rise mirroring Silver's rise in the late 70's?

Back in the late 1970's Silver went on quite a run.

One that might resemble something close to what bitcoin is currently doing.

Back in 1970 an ounce of silver was trading for a mere $6 an ounce, by the end of the decade it was trading at $49.50 ($112 in today's dollars).

That may not sound like that big of a move, but considering that the majority of that move actually took place in late 1979, as the price of silver was trading for around $12 at that time.

Which means that silver went up by over 4x in less than 4 months.

What caused the spike?

There were several factors at play but one of the main ones had to do with the collapse of the Bretton Woods agreement.

The agreement that pegged the US dollar to the price of gold.

On first glance one would assume this would lead to a decrease in the demand for precious metals, however, part of the reason for the breakup had to do with concerns over the amount of gold and silver countries were actually holding.

It became clear that there likely wasn't enough of the precious metals to back the amount of dollars that were floating around out there.

At a time when fundamentals might have been suggesting prices were about to go lower for precious metals, something very interesting happened...

A couple large institutions started getting short in a major way.

A couple of billionaire brothers caught wind of this and came up with a plan using margin to buy up a large portion of the silver market, forcing a short squeeze by the big institutions shorting it and cause prices to sky rocket.

As prices rose the retail sector started to pile in, driving prices skyward.

Eventually the rules on margin were changed and prices collapsed but the damage had already been done for most.

Is what's going on now with Bitcoin prices similar to what went on then?

To be honest, probably not.

I am sure there is manipulation going on with the price of bitcoin, but there is also heavy adoption taking place world wide which is the major difference.

This is very different than a short squeeze orchestrated by a few wealthy players using margin.

For that reason, the end result is like to be very different as well.

I do expect there to be a significant correction in bitcoin at some point, but I highly doubt it's chart will look anything like the chart of silver did back in 1980.

Silver ultimately started it's run at $6, ran up to about $50, and was trading back at $6 again 2 months later.

I don't see that same kind of price action on bitcoin.

Stay informed my friends.

Sources:

https://www.cryptocoinsnews.com/bitcoin-price-mimicking-trajectory-silver-1970s-legendary-trader/

Image Sources:

https://www.cryptocoinsnews.com/bitcoin-price-mimicking-trajectory-silver-1970s-legendary-trader/

http://www.businessinsider.com/jeffrey-gundlach-webcast-december-9-2014-12

Follow me: @jrcornel

wow! what a way to look at it.

Great read overall! Thanks for sharing! Looking forward to hearing more of your thoughts on the crypto markets!

https://steemit.com/bitcoin/@college-is-dumb/bitcoin-crash-sunday-bitcoin-overpriced-investment-banks-manipulating-futures

https://steemit.com/bitcoin/@college-is-dumb/bitcoin-crash-sunday-bitcoin-overpriced-investment-banks-manipulating-futures

Yea, that's why I have a good diversification of Bitcoin and alt coins. When Bitcoin goes down, alts usually go up and vice versa.

I'm hoping you're right. I've been slowly moving away from bitcoin and into other alts. Especially ones that offer something different like ethereum and ripple.

Very good explantion, Im looking at this moment with a lot of care. I heard a bit about this, and how it compare...your explanation is very clear

BTC has only one way; UP !

yes but not a straight on...it will settke a bit...correction is always a step away!

Finally it is up 👌

I am looking at Amazon stock price chart... its growing and growing and growing. why not the same with BTC? there are corrections but seems like it ever goes up

What if it falls what if it falls badly someday? Just thinking

Then other alts will go up.....

Bitcoin is up from pennies just 7 -8 years ago. No metal compares to this move

Bitcoin will keep climbing higher. No stopping it. All the scared fiat money is searching for this safe harbor before it is rendered as worthless as the paper it's printed on

Bitcoin market cap is under 300 billion

We ain’t seen anything yet

I'm still trying to wrap my head around what could happen once it hits the futures market.

My biggest question is. Does a future on a commodity really do anything to the price or is it just insurance encase your main position (long or short) doesn't play out.

Can a future really predict the price of that commodity? Like people buy a short future against corn encase there is major floods that destroy corn crops. But the future itself doesn't cause it to rain or not rain.

Umm may be true may be false no ideaa id i dnt think bitcoin is the right buy at the moment its too much of a risk...I would preffer investing in zcash and monero than going for btc cz they gt lower market cap and high popularity

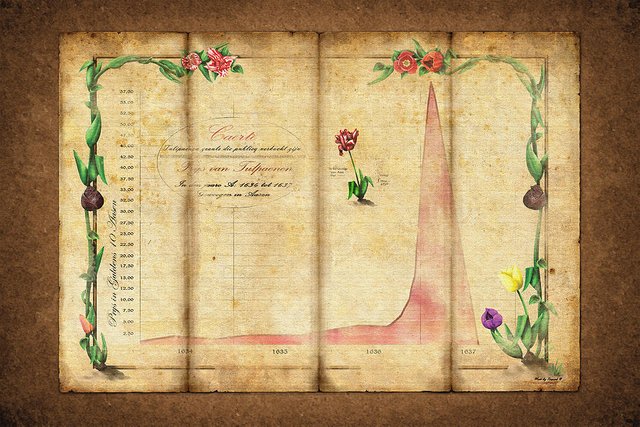

Good points however if you look at the comparison I made to Tulip Mania here:

https://steemit.com/bitcoin/@stealthtrader/what-if-the-bitcoin-bubble-pops

You'll see this is a new beast all together!!

Nice post. Nothing can compare whit rise of bitcoin. And this year was just a beginning. Bitcoin is not even in bubble, since it needs to be largely held, but many people do not even know what it is. It is just my 2 cent opinion.

Most people in USA have heard of it at this point. We are past the 1% phase and on our way to mass adoption. Bitcoin is blowing up here.