The ECB says Bitcoin is not a currency, and that's ok!

The ECB just recently updated its website to include their thoughts on Bitcoin.

Their conclusions were both encouraging and not so encouraging at the same time.

On the one hand they stated that there will not be a ban of bitcoin.

The exact wording can be read here:

"It is not the ECB’s responsibility to ban or regulate bitcoin or other cryptocurrencies. But, given the lack of consumer protection, it is important to exercise caution."

Good news, no ban coming from the ECB!

However, they did pour cold water on the notion that bitcoin is indeed a currency.

In fact they summed up their thoughts pretty well in one simple chart:

Ok, so bitcoin is not currently a currency, but guess what, that is ok!

Lets counter their reasoning why it is currently not a currency one by one.

1 - No one is backing it.

Yes that is true in the sense that no government or single entity is backing it, however, that is also one of its strongest selling points.

The fact no one country or entity controls it makes it incorruptible, it also protects against rampant inflation as it cannot be printed at will.

So yes, there is no central authority backing it, but that is a good thing.

There is a large network of people that are starting to use it and support it. As that network grows there will be plenty backing it.

2 - It is not widely accepted.

While this is true currently, it may not always be the case.

With the Lightning implementation expected to roll out later this year on bitcoin, there is a very real chance that transactions will take place almost instantaneously and with fees costing fractions of cents.

In that world it will be interesting to see if merchants start adopting it as a form of payment.

3 - Users are not protected.

This is an interesting statement.

On the one hand, if I am holding $100 in cash and I am robbed in the parking lot, who is there to protect me?

To me, this seems like pretty much the same thing.

Yes there are protections regarding banks and credit cards in the form of insurance, but that is also something exchanges could start offering as well.

There is no protection for users holding cash, should we not accept cash then either?

4 - It is too volatile.

This is probably the most reasonable reasoning of them all.

Yes the currency is volatile, in fact, it's extremely volatile.

So much so that no one wants to accept payment in it for fear that it's purchasing power could erode by 50% within a week.

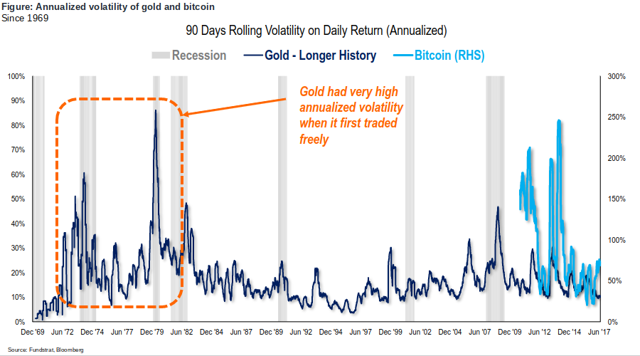

However, I recently saw a chart of gold when it first started trading freely.

The volatility on it was actually very similar to what we see now with bitcoin.

Check it out:

(Source: https://steemit.com/bitcoin/@jrcornel/store-of-value)

The premise here is that the longer bitcoin exists and as it makes its way into more and more hands, much of that volatility will come out of the price.

Much the same way that gold has.

There is no guarantee that this will happen, but the logic makes sense.

All in all, the ECBs conclusions are mostly spot on, however, most of them won't be spot on forever.

I am just happy they are taking a wait and see approach, as opposed to banning something they don't fully understand the potential of just yet.

In that regard, I would say their commentary has been a win!

Stay informed my friends.

Follow me: @jrcornel

No one cares what they say. They should not be acknowledged, but merely only be used as fuel to work towards making all government workers unemployed forever.

Good article and good analysis. I could care less if their definition does not rate BTC as a currency. Let’s just keep buying/selling/trading it. Some day conventional thinking will catch up.

💰💰💰💰💰💰💰💰💰💰💰💰💰

I think as the technology matures and catches up with the hype, conventional thinking will also be forced to "catch up". :)

Indeed!

To add to that; when buying/trading continues en increases their stance will change because it will be more widely accepted! (And the no one is backing it and user protection arguments are already a bit iffy, as mentioned in the article)

I believe the ECB hasn't properly researched the Streisand Effect. LOL

We should ask the ECB what they are backed by: https://www.reuters.com/article/us-steinhoff-africa-bonds-ecb/ecb-sells-steinhoff-bond-at-loss-after-scandal-idUSKBN1EX1M6

It can't denied that Bitcoin is still the standard for all crypto!

In the big picture, the game never changes. There will be early shrewd veterans who get in early. There will be overly eager fools who stay in too late. The players won’t change. The end result will always be the same.

If (Gold == currency && Bitcoin == Internet Gold){

Print 'Nobody Cares What ECB thinks :)';

}

Currency can be anything as long as people accept it. Dollar is not backed by anything, since Richard Nixon removed the gold standard. It exist only, because people have "trust" in it. But for how long?

For how long? I guess we will find out in the next 2 years to come.

Basically as long as the US government and military is the big kid on the block.

Which itself might not be that much longer, China will be the next major world power, if you do not already consider them as such. The US might be able to "quantitatively ease" their way out of a massive economic depression for a while longer, MIGHT, but that is a temporary fix. The writing is on the wall, and I cannot imagine a way that the government or the US citizens mobilize in a meaningful enough way to save a total economic collapse in our lifetime. And worse yet, as the US economy goes, so goes the global market, the debts are too intertwined.

I really think we are in for something worse than we can imagine, and yet it appears to be maintain the status quo from most officials and politicians. Talk about burying your head in the sand.

Thanks for the post.

@bloomberg215 That is a point people do not know. If people read books like "currency wars" and other books by same author they will see it for themselves. US dollars is nothing but a paper trusted by the people as a veritable means of exchange. Trust has always been the backbone of the massive adoption of any currency, crypto or fiat.

Eyes will clear in few years time. Its just a matter of time.

great posts @jrcornel

Actually has a value because you pay your taxes and common utilities with it. And that is precisely why BTC has zero value in the current world setup. The blockchain, on the other hand, it is a priceless tech. Even damn wood has more intrinsic value than BTC.

Thanks for sharing - in a nice readable condensed version.

Pablum for the masses.

I think I'll go take a short nap, LOL

that's good, them saying it is not a currency means they can't regulate it.

Actually currency is something that is acceptable by the public, divisible and as a mean of exchange. Bitcoin is shaking the core of the goverment's core control, ie fiat currency, hence, not accepting any 'competition'. This argument will definitely go on for awhile.