Lightning Was Released This Week – What Will be the Impact for the Bitcoin Network and the Cryptocurrency Market?

The much awaited Lightning network was released on Thursday by Lightning Labs in beta version for the Bitcoin network. Even though it is beta, it includes all the features that is billed to increase transaction speed and reduce fees for the network. This means actual users can immediately begin to use it today. And wallets and payment processors can begin to fit their applications to utilize it. Given the scaling drawbacks that holds the network back from being able to sustain the billions of people that could potentially be using it, this release could be a game changer. Note that this is one of a few implementations, one other being the implementation by Blockstream which is currently still in alpha stages. (Ethereum has similar ongoing development in Raiden.)

Bitcoin Fundamental Metrices Still in a Slump

Prior to this release bitcoin values have been falling. From a high in late December 2017, its value today has fallen to between 60-70% lower. However, even more important is that the fundamental metrices that have marked its growth over its first eight years have now started to trend slightly lower.

In prior articles about a month ago, I pointed readers to watch the daily unique address as one of the strongest fundamental metrices that would tell when the network would be back to its prior growth rates and likely recovery of sustained growth in value. At the time, chart readers were divining rising wedges and inverse head and shoulder patterns, and pointing to a recovery to over $12,000 when fundamentally that was pretty much unsustainable based on the user growth underlying the network.

The article then is here:

“There is Little Chance Bitcoins can Sustain any Real Recovery Until This Fundamental Metric Begins to Turn Upwards Again”

https://steemit.com/bitcoins/@kenraphael/there-is-little-chance-bitcoins-can-sustain-any-real-recovery-until-this-fundamental-metric-begins-to-turn-upwards-again

And a review of the fundamental metrices that drive bitcoin values was presented here:

“A Review of a Few Fundamental Metrices that Drive Bitcoin Value and What They Currently Indicate”

https://steemit.com/bitcoin/@kenraphael/a-review-of-a-few-fundamental-metrices-that-drive-bitcoin-value-and-what-they-currently-indicate

A network effect-based analysis currently places values closer to $5,000 (this should not be taken as a prognostication of a price fall to that level) and the daily unique user addresses actually still continues to be low! This slump is not just news driven. And there is a chance that artificial demand could be a part of the equation, given the current lack of availability of a clear tether audit. For more on that check the article calling for a full tether audit here:

https://steemit.com/bitcoin/@kenraphael/audit-the-teths-a-macro-case-for-why-tethers-need-to-be-audited-for-confidence-to-return-to-the-market.)

These are enough reasons to stay away from day trading or chart analyst readings in the interim to avoid getting sucked into a cycle of buying high and selling low.

So will Lightning strike for Bitcoins? (Apologies for the admittedly not too creative pun use.) First a brief description of how Lightning works.

How Does Lightning Work?

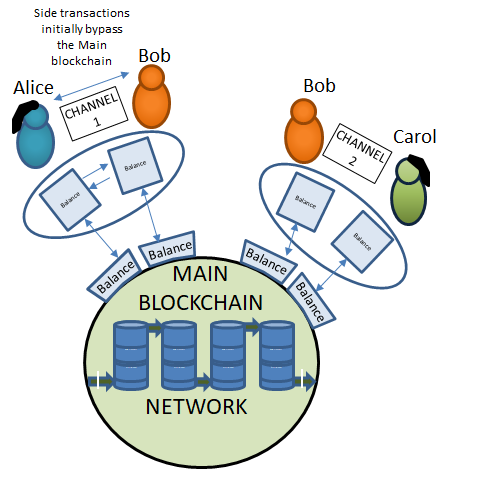

The Lightning network is a form of side chain network linked to the main bitcoin blockchain network. Side chains have existed ever since the first Exchange opened to sell bitcoins. Centralized exchanges are basically side chains. Buying and selling of digital currencies on exchanges are instant and do not write to the parent blockchain on every transaction. But they are centralized. In a decentralized parallel, a side chain or channel can be established directly between two users; where one user deposits an amount in an account on the blockchain potentially to the benefit of the other user. The first user can then make payments to the second user outside of the blockchain, or off-chain, and have it recorded between them, obtaining the necessary signatures for each transaction. At the end of some time period, only one transaction is needed to be posted on the blockchain, representing the final balance of how much the first user has spent on the payment channel they opened on the blockchain.

The Lightning network works in similar manner, but extends this concept over bidirectional channels between the users, and over multiply connected network of channels. The network allows users who do not have a channel between them to link over existing channels of other users to find a connection. This is explained using the schematic below, taken from an article I published on Trustnodes some months ago.

Source: . Trustnodes.com - “The Ideal Digital Currency Needs Scaling Solutions”

Will Side Chains Work?

There are some compelling analyses that state that there is little incentive for users to open channels and fund it with expensive bitcoins sufficient to make Lightning effective as a scaling mechanism. And if there are not enough channels to go through, then most transactions continue to take place on-chain and continue to require the regular bitcoin fees and take the average of 15 minutes or more to get mined. The work by Jonald Fyookball, Prof. Jorge Stolfi, and Egor Homakov, with rebuttals to the former by Bitgo Software Engineer, Murch, and Diane Reynolds will make a good read for those interested in details of the derivations behind these arguments.

However, I believe that the demand for fast and cheaper bitcoin transactions are significant enough that Lightning could indeed see some significant adoption. But that adoption could also quickly consolidate in form of centralized nodes that provide the liquidity for those channels to stay open. If so, this should be in the medium term. On the long term, cryptocurrency use will likely continue to increase. At this point, it is not certain that much of that increase will continue to pass through Lightning network channels. The next few months will be interesting for those who love analyzing data and watching the evolution of technology and its adoption.

As far as the markets, the use of the new Lightning network even if it catches on will likely take weeks to months for its deployment to penetrate to users and tools. However, if early indications show promise, this could be sufficient to improve outlook even in the short term. So those interested in this development for investment purposes would also do well to watch how adoption is going in the next few weeks.

References

Leigh Cuen, March 15 2018 Lightning Labs Launches Beta With Twitter CEO Backing, https://www.coindesk.com/a-version-of-bitcoins-lightning-network-is-ready-for-real-money/ Accessed Mar 15 2018.

Joseph Pook * Thaddeus Dryja, Jan 14 2016, “The Lightning Network: Scalable Off-chain Instant Payments,” https://lightning.network/lightning-network-paper.pdf, Accessed October 31 2017.

Ken Alabs, Nov 5 2007. “The Ideal Digital Currency Needs Scaling Solutions,” http://www.trustnodes.com/2017/11/05/ideal-digital-currency-needs-scaling-solutions, Accessed November 30 2017.

Jonald, Fyookball, June 26 2017, “Mathematical Proof That the Lightning Network Cannot Be a Decentralized Bitcoin Scaling Solution,” https://medium.com/@jonaldfyookball/mathematical-proof-that-the-lightning-network-cannot-be-a-decentralized-bitcoin-scaling-solution-1b8147650800, Accessed October 31 2017.

Jorge Stolfi, July 2017, “Responding to Murch's "Responding to Jonald Fyookball's article" article,” https://www.reddit.com/r/btc/comments/6jxem4/responding_to_murchs_responding_to_jonald/ Accessed October 31 2017.

Egor Homakov, December 16 2017, “Why Lightning and Raiden Networks Will Not Work” https://medium.com/failsafe/why-lightning-and-raiden-networks-will-not-work-d1880e4bc294, Accessed December 31 2017.

Murch, June 27 2017, “Rebuttal to Mathematical Proof That the Lightning Network Cannot be a Decentralized Bitcoin Scaling Solution,“ https://medium.com/@murchandamus/i-have-just-read-jonald-fyookballs-article-https-medium-com-jonaldfyookball-mathematical-fd112d13737a Accessed October 31 2017.

Diane Reynolds, July 2 2017, “Simulating a Decentralized Lightning Network with 10 Million Users,” https://hackernoon.com/simulating-a-decentralized-lightning-network-with-10-million-users-9a8b5930fa7a, Accessed October 31 2017.

About the Author

Ken has a doctorate in Engineering, and a master’s in Computer Aided Engineering, An IT professional, programmer and published researcher with over thirty publications in various fields of technology, including several peer reviewed journals and publications.

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only. It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

If you liked the article, upvote it so more people can see it, and follow or check for earlier and future in-depth articles on technologies such as blockchain and artificial intelligence.

Hope to see bear market turn into bull soon. Its getting so boring.

😇

What I have experienced in my previous days or if I say in a year and looking forward I believe lightning is the future of bitcoin and if bitcoin has to survive then it will have to be implemented.

If we look at the current scenario, the time one transaction takes to go through and sometimes fee we have to pay, that is too much.

Steem transactions are free & instant.

One more leg down to 7200 than were bouncing hard watch this!

If this is based on "analysis" from a chart reader, the problem is they said the same at 10,000, then at 9,600, then at 8,200, and now it's 7,200. They even saw all manner of bounces, rising wedges, and inverse head and shoulders. Yes at some point it would reach a bottom and they would claim to be right. And if it isn't 7,200 there would be no apology or explanation, they'll just point to a new support line.

The leak of regulation, together with the undeclared war of big corporations toward the young crypto world (e.g. goole & fb ban on crypto ads ) slow down the adoption. Ligning unfortunatelly is not the answer for the stated problem, but definately the big technical improvement.

See the Bitcoin unique wallet usage graph:

Its a really nice information and it is a fact written in the blog. I agree with your post. Thanks for sharing such a valuable post.

You got 29.54% upvote | Courtesy of @thedawn!

Delegate us Steem Power & get 97% daily rewards share!

20 SP, 50, 75, 100, 150, 200, 300, 500, 1000 or Fill in any amount of SP.

Click For details | Discord server

Thanks for explaining the lightning network and side chains. They work in theory, let's see how they work in action. As far as the price dropping to $5,000 nobody knows but we have to test $6500 first. It's funny how when bitcoin was at $19,000, people thought it would hit $50k. When it's low people think it'll keep dropping. Obviously, things don't go down forever and go up forever. We could very well be finding good support at this level.

This article is not claiming the price will drop to $5,000. Arguing against that maybe comes from a mindset of following too many chart readers. I do not project or predict prices but only analyze technology and the fundamentals behind them. Please try not to glam on to a number as a target from this article.

If one goes to a mindset of fundamental value investing rather than a daily trading one you'll see that there is little difference from a risk/reward standpoint between buying at $6,500 or $5,000 if the technology is indeed valuable to the point that it gets to say $50,000 in some months or few years.

Hi, thanks for the informative Post.

Isn't the Lightning Protocol open Source? And Lightning Labs is just one of many who are implementing their Version of it? Will be interesting to see which "Lightning Network" will make it in the long run. Please correct me if I'm wrong...

We are already in Alpha 0.3 and things are looking great

This is a great game! 😍

nice post @kenraphael