Bitcoin Price and Cryptocurrency Markets Sputter

In the last 7 days, the price of a single bitcoin has mostly moved sideways as economists and politicians at the World Economic Forum in Davos discussed regulating bitcoin. During this period, bitcoin has traversed the range between $10,000 and $12,000, reaching a high of $11,926.41 on Sunday morning. Its price has retreated since then.

At 14:25 UTC today, the price of a single bitcoin was $10,524.94, down 5.68% from a day ago. Analysts have forecast a drop to $9,000 levels in the next couple of hours, if bitcoin’s price falls further.

Ripple, which was criticized for overstating prospects of its cryptocurrency XRP, staged a brief rally yesterday after financial institutions stepped up to outline use cases for XRP. But investor enthusiasm for Ripple was short-lived, and it is down once again this morning. As of this writing, its price was $1.23, down 7.2% from 24 hours ago. (See also: If You Had Invested $100 In Ripple In Jan 2017, What Would You Have Now?) Another report out this morning highlights the company’s partnership with SBI Capital, an institutional investor in Japan.

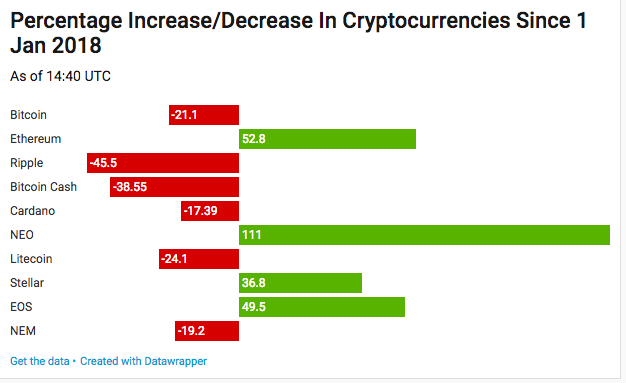

The winners among the top 10 most traded cryptocurrency platforms were ethereum and NEO. Both have registered remarkable gains since the beginning of this year even as cryptocurrency markets have slid.

The cryptocurrency markets were valued at $535.2 billion at 14:41 UTC, down from a high of $570.4 billion this morning.

Bitcoin Is Not An Investable Asset Class: Blackrock

The chief multi-asset strategist at Blackrock doesn’t think bitcoin is an investable asset class. “This is not something where we are advising anybody to put their money in unless they are willing to lose their entire stake,” said Isabelle Mateos y Lago in a Bloomberg interview.

In her comments, Mateos y Lago echoed those from other institutional investors who have been wary of investing in the cryptocurrency due to its price volatility. Recently, Inigo Fraser-Jenkins wrote a missive for Bernstein Research that outlined bitcoin’s problems, including regulatory and required returns, for institutional investors. The end result is a chicken-and-egg situation for bitcoin’s price. Institutional investors and regulation are necessary to bring stability to bitcoin’s price. But their absence has resulted in insufficient liquidity and an unpredictable system, where prices are controlled by a select group of investors or bots.

But Mateos y Lago did not discount bitcoin completely. According to her, regulation will be another step towards maturity of the bitcoin ecosystem. “The fact that interest has persisted despite repeated hacks, despite regulators…weeding out illegal users suggests that there may be something to it,” she said.

Bitcoin Futures Since Launch

The CME Group released data relating to bitcoin futures, which it introduced in December 2017, this morning. According to the data, approximately $2.3 billion in notional trades have occurred in bitcoin futures by more than 820 accounts since its launch in the CME market. Those are not impressive numbers, when you compare them to the spot exchange markets. For example, bitcoin volume trades across spot exchanges was $7 billion just in the last 24 hours.

An earlier WSJ report stated that institutional investors are mostly shorting bitcoin’s future price while individual investors are on the opposite side. The low volumes have translated into a reversal of typical futures dynamic. Bitcoin futures prices follow spot exchange prices instead of vice versa. (See also: Four Problems With Bitcoin Futures.)

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin.