Q&A with the Haven Protocol / XHV team

^^There it is, the logo that represents the most innovative coin in a long while.

Our vision and plan for Offshore Storage is far grander than anyone knows or has completely realised. — tl;dr

I’ve been lucky enough to get some of donjor and havendev’s precious time to ask them a few questions I had myself, and which some Twitter followers had asked me to dig into, as well.

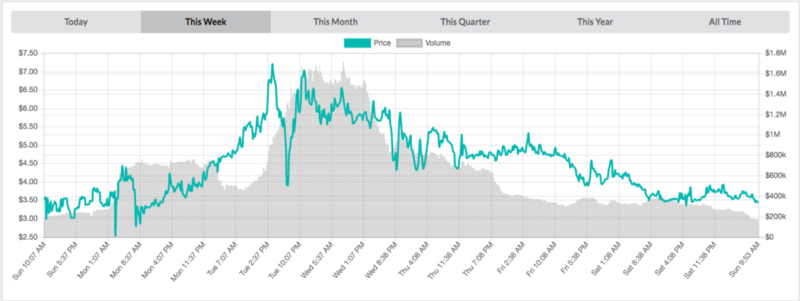

Before I start this Q&A piece with the dev’s behind the Haven Protocol, lets take a moment to analyse the events that triggered what we se in the image below.

Sunday 22 April — Sunday 29th of April (time of publishing) — XHV has been on one hell of a ride, way up, FUDed way down, and now residing at what (imo) is a great entry for new adopters.

At the time of writing it is around 14 days since I wrote my initial piece about the Haven Protocol. Back then, the price of 1 XHV was Around 1,05–1,1$

At the time of writing the coin is lingering comfortably around 3,5$- after peaking at 7,61$. And for XHV last week had so many crazy turns of events that it got kind of dizzying, a normal week in crypto in other words.

The week started of seeing the coin going from around 3$ to above 7$ in a matter of days, then an article emerged which triggered the downtrend we see beginning on Wednesday. I’ve published my reactions to how that article was published and my thoughts on price manipulation in general, in another piece.

But the week also had a lot of positive news, and — after this Q&A session with the Haven Protocol’s core dev’s — I expect the coming weeks and months to provide us with much more exiting news and developments around this coin.

So without further ado, here is my Q&A with Donjor and Havendev of the Haven Protocol.

Krüger: First of all congratulations on what has been, at least for us on the outside looking in, a very successful first launch phase. How have the last couple of weeks been for you?

XHV: Thank you! Pretty amazing, we have had overwhelming positive feedback. In terms of the value of Haven, we expected it to get to this level, but it’s perhaps a bit sooner than we thought. It’s awesome to see.

Krüger: Can you share a little info about the team behind this project, how many are contributing to the Haven Protocol, and what are your backgrounds?

XHV:Sure, but as we are a privacy coin we aren’t going to divulge too much personal information. We are trying our best to be de-corporatised and continue to subscribe to the open-source mentality of crypto.

Havendev: Worked corporate in c++ and backend web dev positions for years, dropped it to work full time on Haven. Born and raised in Auckland, New Zealand. Been in crypto since late 2014. Have worked on a handful of crypto projects in the past but nothing serious. My only focus now is on Haven and Offshore Storage.

Donjor: Also born and raised in Auckland. Full time working at New Zealand Software companies. Mainly working in SQL, .NET/C# with some knowledge in blockchain development.

We have a few others picking up work such as backend webwallet, mobile wallets and setting up remote nodes. We have been inundated recently with developers wanting to get involved.

Krüger: Is there any Blockchain expertise on the team right now with experience from other, known, blockchain projects?

XHV: Havendev has worked on blockchain projects in the past. We also have had major intrigue from all sorts of developers, including ones that have been involved in other projects. We aren’t going to disclose other developers and projects.

Krüger: One thing that struck me about your whitepaper, is that you have taken a very unique approach when creating this coin. I’m used to seeing some mind-bending “Alice and Bob” examples in the Whitepapers of projects I’m studying. Your explanation on the Offshore Contracts was not just easy to follow and comprehend, but this is the first Whitepaper I’ve ever read that introduces an economic concept as a solution, not a purely mathematical one.

Is the Haven Protocol really as simple to describe as you have done in the WP, or do you have a big pile of extra documentation laying somewhere which you did not decide to include in the WP.

XHV: The fundamentals of Offshore Storage are as straightforward as they seem, but as one would imagine the implementation is far from it. We have got a working solution for minting and burning coins as of writing this. We are planning to release an in-depth paper in Q3 2018, describing how the Offshore Storage process works at a technical level and how we are going to create the Haven Oracle.

In addition — we are putting together an FAQ which will address some of the common questions we receive on the economic principles.

Krüger: As you stated in your interview with Catoshi, you have mobile wallets as your next upcoming releases. I also noticed that Android won your Twitter survey.

I’m an iOS user, myself, and eagerly anticipating the mobile wallets. Can you give some approximate target date for release of those apps?

XHV: We have stated a Q2 release. At this stage we are aiming for late May and all is looking on track for the release.

Krüger: Are you looking for beta-testers for those apps via Apple’s Testflight or Google Store? If so I hope you let us know via Twitter!

XHV: Very likely that we will do. We will certainly let people know on Twitter and Discord if they want to test.

Krüger: In just a matter of few weeks, XHV has been listet on currently 3 exchanges — this is very impressive. If I’m not mistaken there has been mention in your discord about 2–3 more listings to come, can you tell us something about that?

XHV: Nothing is set in stone. We have been listed on further small exchanges since receiving these questions. We are hoping to be listed on larger exchanges soon but nothing further can be confirmed.

Krüger: A Twitter user, and fellow XHV enthusiast (@alanawolf777), made me aware of a possible issue that have been discussed about the mint & burn feature, and the fiat pegging:

How will Haven address the challenge faced by stabilized currencies with regards to trustless transactions? In other words, will the value of $XHV upon entering a smart contract be determined by an average of exchange values? What’s to prevent a large holder from dropping or spiking the price of XHV on exchanges just prior to entering or exiting a smart contract, albeit an expensive move?

XHV: The price determined will be a weighted average over all exchanges. This will account for any drops or spikes. We are planning to address questions like these in our Offshore Storage FAQ.

You touched on the most important point — ‘albeit an expensive move’. Any market can be manipulated by someone with enough money, this isn’t an exclusive problem with XHV. The recent news regarding Haven being targeted by a pump and dump type scandal shows this is very difficult. They only got a fraction of what their supply goal was.

Krüger: The Roadmap on your website states Q4 as a release target for the Offshore Contracts. Do you feel confident that you will be able to finish this feature by deadline?

XHV: From a coding perspective, yes. At this rate we will be within a network maturity level in Q4, where our community will be confident in its release.

Krüger :Are you looking for volunteers on any part of this project, if so what areas of expertise would you benefit the most from right now? I can only speak for myself but this project is so promising that I would have no problem aiding when needed, and I’m betting that applies to a lot of webdevs, graphical designers, system admins, etc as well.

XHV: We have had lots of interest from many different professionals. We need to balance our Open-Source philosophy and avoid over corporatisation (aka centralisation). We aren’t the typical project in 2018 where ICO’s are the norm.

We want genuine people who want to help Haven grow get involved, rather than just earn a bounty. Haven Protocol is Open-Source. Any Developers/SAs/Graphic Designers/Marketers can get involved by directly contributing.

Contact us for approval, but so long as it doesn’t go against what we are trying to achieve we are totally receptive.

Krüger: Before we finish off this Q&A — I just have to ask if you have other features planned for Haven Protocol that have yet to be announced, and if so is there anything you can share about that now?

XHV: Yes. All we’re going to say is our vision and plan for Offshore Storage is far grander than anyone knows or has completely realised.

That wraps up the Q&A and I think it is safe to say that the Haven team seems to be on to something huge with regards to the Offshore Storage feature. Keep an eye out for the Mobile wallets to be released soon, and the Q3 whitepaper detailing the Haven Oracle and Offshore Storage in detail.

Also, while I was finishing off this piece I noticed the following announcement in the Haven Protocol Discord, which I am sure will please a lot of its adopters:

For those wanting an electrum wallet experience we now have 2 new remote nodes available! eu-remote.havenprotocol.com us-remote.havenprotocol.com For both use port 17750.

For my own part, I think XHV has gotten the attention it deserves from me for a little while. I have the XHV team to thank for triggering me to start writing on Medium, an idea I had been contemplating for a while but the discovery of XHV finally got me off my ass (or on my ass, writing — to be specific).

Now it’s time to move on to other topics and as the twitter survey linked to below reveals, there is a lot of interest around how I will set up a portfolio that will thrive while I serve a 5 year prison sentence for selling drugs on Silk Road (a story I also will detail further in the coming weeks and months):

https://twitter.com/K_Uuuger/status/989082641696804864

I want to give a thanks (and a follower recommendation) to the following Twitter users for their support and valuable input so far, which have been greatly appreciated by me:

https://twitter.com/alanawolf777

https://twitter.com/Pedrosquares

https://twitter.com/cryptonator1337

Finally (if anyone is still reading this far down the article) I would like to encourage anyone with a topic they’d like me to get into to either reach out in the comment field below, or on Twitter.

Also, thank you to everyone else who has reached out to offer help in any way, Scott W. for instance who is offering me free proof reading for all new articles — that is a very valuable service that I’d probably never have the means to afford — but that I most certainly will take advantage of until he grows sick and tired of correcting all my errors :)

If you’d like to contribute to help me spend more time on writing my pieces, and also to my investment plans for the time I spend in prison, you will find my tip-jar adresses below, any addition is greatly appreciated and very motivating for my writing:

If I could choose, I’d prefer my tips to come in the form of XHV — of course;)

XHV: hvxyCxSYVGLSysjcLhRUhEfpHX3p9wXjpGNFC7iR84DPewEuZ3BxoYAaC7uUVvMxxVVBWwsxWkzPLPfFqwtVxveE7S9tdCbok4

BTC: 14iKgia5wtdjmLXs7QiJui3Sb6KVP6XebL

ETH: 0x913c1CD95Dc971B304C5217831102E350230efaB

BCH: qq5tjpm0jv460tvk4pa050pwc6u2aj46gs2tce2rd4

NEO: ARdd2cqCSajpzkSZGFtSqAPvBLYcquD7WH

Coins mentioned in post: