My two-cent on China ICO Ban

A Brief History

Outlaw Bitcoin for Financial Institutions

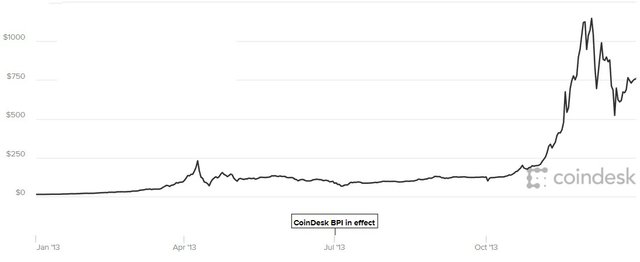

To many people, 2013 is the Year of Bitcoin. Bitcoin price surged from $12 per coin to as high as $1,242. Demand from China was believed (and often blamed) to be one of the main driving force for this run-up. On Dec 5, 2013, People's Bank of China issued a statement that classified bitcoin as commodity, not currency. Financial institutions were banned from dealing with bitcoin, and payment processors (Alipay, TenPay, PayPal, etc) were prohibited from working with bitcoin exchanges.

As a result, bitcoin price fluctuated with near 50% drop after the initial announcement; exchange users were left fewer funding and withdrawal options. While Chinese Yuan withdrawal was promised to remain open, many feared they would not be able to deposit new funds. However, this feared turned out to be short-lived. As it turned out funding Chinese Yuan from a bank account remained open until today.

Withdrawal Freeze

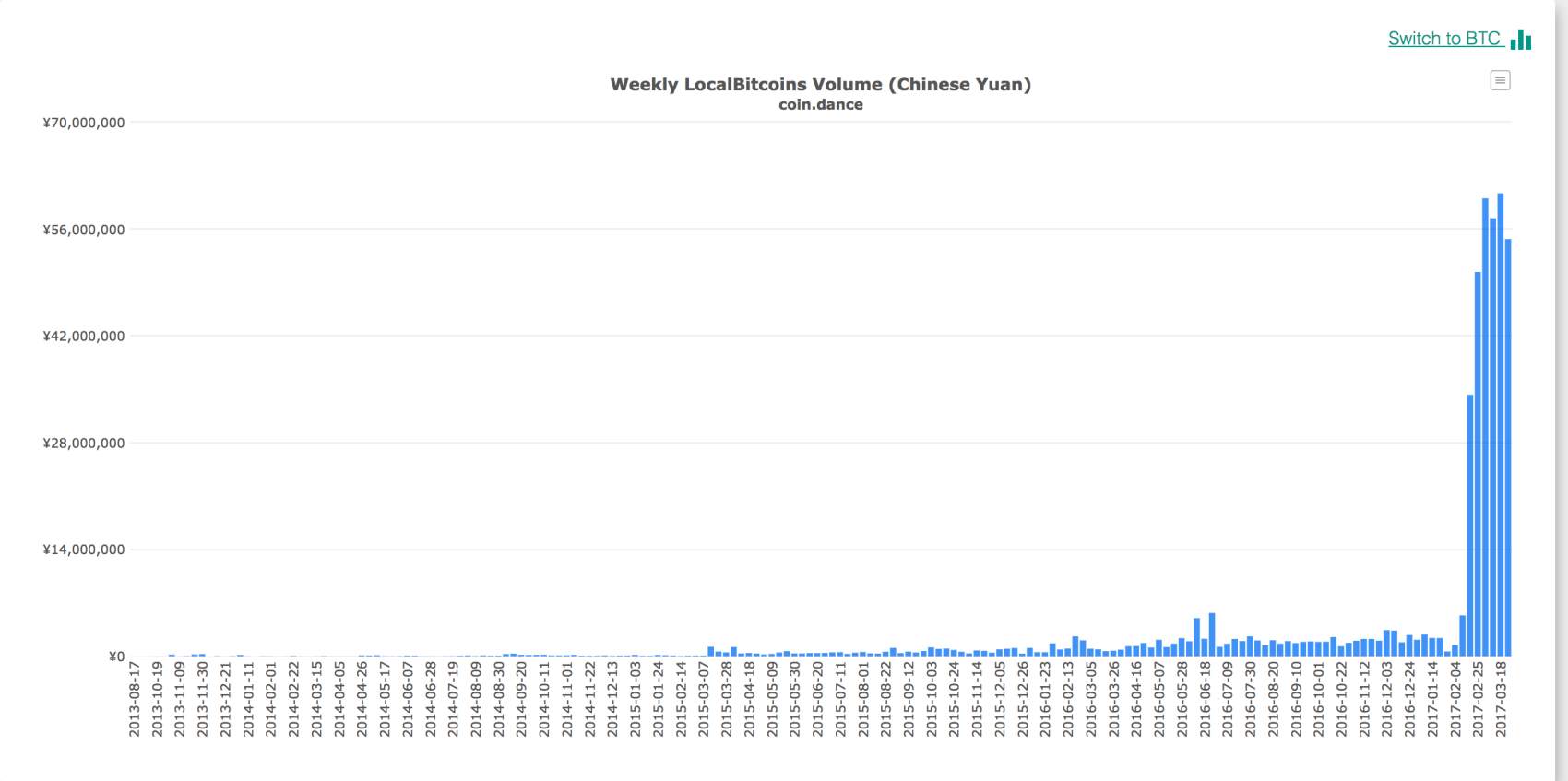

Coming out of nearly 3 years of pessimism, the bitcoin market had recovered from its low in $200-$300 range to approach $1000 in the first month of 2017. Activities in China started to boom again, with the largest three exchanges accounted for more than 90 percent of the global trading volume (under the zero-fee policy) in Jan 2017. The main reason for this high level of activity was often attributed to speculation or wealth transfer offshore. On Feb 8. 2017, under the direction of People's Bank of China, two biggest Chinese exchanges announced to suspend bitcoin withdrawal for one month effective immediately. Soon other exchanges followed the suit. Uncertainty prevailed in the Chinese market with bitcoin traded at a discount compared to exchanges outside, a phenomenon that did not happen often. On June 1, 2017, almost 4 months after initial withdrawal freeze, Chinese exchange started to restore withdrawal services.

When the official channel was shut down during the freeze, activities went underground or to other jurisdictions. The LocalBitcoin volume chart from Coin Dance shows a 10-fold increase in OTC transaction following withdrawal suspension at major exchanges.

China ICO Ban

If 2013 is the Year of Bitcoin, 2017 is definitely the [Year of ICOs] (https://www.coindesk.com/ico-tracker/) with the ICO (initial coin offering) funding surpassed early stage venture capital funding for internet companies for June and July. As usual, China had its own hype, with over 40 platforms popping out of nowhere to provide services for ICOs. Over 60 ICO projects had been completed, the committee said, raising 2.6 billion Yuan. On Sept 4, 2017, People's Bank of China made a joint statement that declared all ICO financing activities were illegal in China. According to CoinMarketCap, Market reacted by a 25% decline in the value of crypto assets issued by way of ICOs.

How things will fold out? Will other countries follow China's lead to ban ICOs outright? Is ICO ban in China permanent? Here is my 2-cent.

My 2-cent

Social and financial stability is and will always be the top priority of Chinese government. On the other hand, China definitely will not see itself left behind major technological and financial innovations as it once was. These are the two forces that will drive China's decision in the crypto space.

If financial institutions were to completely cut their ties with exchanges, people would have to rely on cash/voucher to fund their crypto account. This increase inconvenience for the users and exchanges does not yield any gain for policy makers. On the other hand, if people cannot withdraw their crypto currency from an exchange, they essentially never owned the currency. In either cases, exchanges in China would likely cease to exist. Is this what Chinese government would like to see? Definitely not! Otherwise, it would not bother classifying bitcoin as commodity, allowing its people to trade it, asking exchanges to stop marginal trading and to start charge transactions fees. The real intentions of these actions aimed at educating people significant financial risks associated with crypto currency, reducing volatility, preventing illegal capital outflow and money laundering.

Thanks to crypto currency, ICO becomes a new way to financing. It allows an average people to participate in ventures that have been accessible only to the richest few. It also provides liquidity that is not available in traditional venture capital investments. However, investing in ventures is a challenging endeavor. It requires knowledge, experience, mentality and resources. People may easily become the victim of frauds and scams. It is in this background, China took the outright action to ban ICO financing activities.

There is an old Chinese idiom "纠枉过正", meaning that to make a bended stick straight again, one has to bend it towards the opposite direction. I believe this is what China is doing right now. And as another phrase "堵不如疏" says, to prevent something, blocking it may not be the most effective way; a better solution is to build a channel so that it can still happen following a predefined path. I share the same view that ICO ban is only temporary. At the end of the day, cryptographic secured tokens can represent not only equity in a company. They may also provide access to utility (like membership and voting power) in a system, represent physical and financial assets (like gold and loan) and as well as abstract concept (like user attention). They are the enabler of decentralized autonomous organization and important building block of sharing economy. I do not believe China is willing to be left behind.

Nice post! Been looking for some research on China bans