Don't Just Ignore The Anti-Cryptocurrency Talk, Capitalize On It! By Gregory Mannarino

Over the past several weeks it seems that the anti-cryptocurrency rhetoric being unleashed on the uninformed has hit a fever pitch.

When Bitcoin broke $2700 and then pulled back around $300, there was talk all over the place about how the Bitcoin bubble had burst, what total nonsense. In fact I said publicly that any pullback in Bitcoin should be used as a buying opportunity.

At the time I am writing this article, Bitcoin is now nearing $2600 again, and I have no doubt whatsoever that it is going much much higher, (along with many other cryptocurrencies including Steem)

What we have seen, and a trend that will remain in my opinion, is a loss in the value and thus purchasing power of the US dollar, but the anti-cryptocurrency crowd seems to be oblivious to this.

Another way to look at the anti-cryptocurrency crowd is this: there always has to be two sides of a trade, one will lose and one will win. I have no doubt whatsoever that those of us who recognize what I feel is unprecedented opportunity with regard to holding and owning cryptocurrency will not only win, but will win big time.

Gregory Mannarino

Jump on the Steem Train!!! Steem headed to $2!!! @marketreport

It will be over 1000$ in 2020

For that to be true steemit's market cap would have to be 234 billion... or BTC would have to be really up there itself and/or by the USD having lost much of its value. But I'd love to see $1000 steem :P

I'd love to see it but I think that's highly unlikely. I'd be happy with $10 a token in 2020.

Yeah! maybe!

Oh my, I'm starting to feel giddy!

Totally agree! IMO, there are not a lot of great places for people to park their money anymore.. with the exception of metals, cryptos. Especially when the Index bubble finally pops

More and more these days what is driving my investment decisions is third party risk. Physical metals and cryptos held off-exchange are the only two that I've found that meet this criteria. I thought about real estate, but with property taxes, liability issues, mortgage market manipulation, and the need to get a 3rd party tenant, I've decided there's too much risk there. I agree with you, metals and cryptos are where to park your money.

Smart thinking. I used to think RE was the place to be but property taxes are the razors edge for me.

Real Estate is problematic. Foreign investors have seriously impacted the price in a lot of the major markets helping those areas re-bubble. Also the goverment is having money problems an increase in property taxes is not completely out of the question. Crypto and precious metals (metals depending on quantity) can be moved where as real estate cannot. So crypto and precious metals is probably where to go now.

Also precious metals mining companies... The profit made from the increase in price of metals will increase yet mining costs will remain same... $$$$

The thing about Bitcoin is that with no derivative market, no way to short or trade HFT it is very hard for the mainstream to manipulate Bitcoin's price. Bitcoin is trading in a real market meaning fear and greed are the real drivers. As Greg said, the trend is up.

Is it physically impossible to have a derivatives market because of the way Bitcoin is designed, or have they just not gotten there yet? I have heard of ways to short Bitcoin (can't remember where though), and have always assumed it is just a matter of time.

The banks won't create BTC derivatives because they can't control the price and they can't control the price because BTC doesn't have derivatives. Positive feedback loop for us ;-).

I so agree and the pullbacks are the perfect buying opportunities.

Me too!

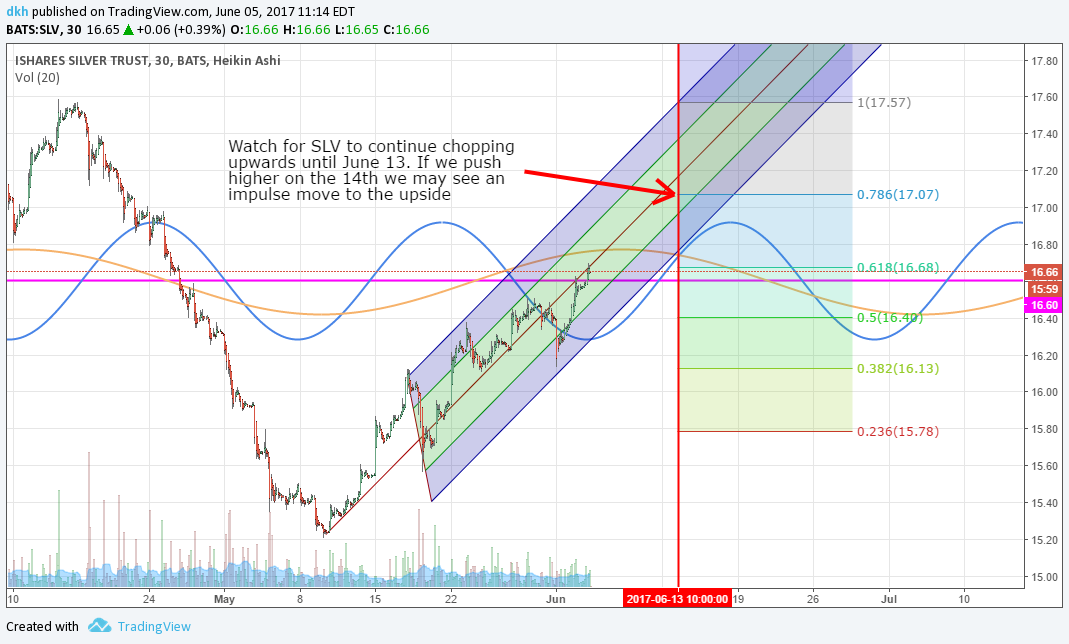

I believe you are right Greg, I know you don't like the paper metals but I don't think JPM would try to steal from themselves. In any event the technical may help those who are buying the physical

Thank you Greg for letting me know about steemit

Cryptocurrency will be the future... which coin will win or bust? Only time will tell. Steem is very promising! Investing more soon!

Greg, this post just encouraged me to buy some more bitcoin! And I recently joined steemit through you, thanks!

@marketreport, Gregory could you please share your thoughts about what other crypto's you like a.t.m.?

How true Greg. The only problem is, every time there's a price dip, I have no reserves. I need to start holding my reserves back until there is a dip, and not invest on the way up. You're like that little guy on my shoulder telling me to wait and have patience!