How cryptocurrencies will change the current economic structure

After recent developments, it is becoming increasingly clear that cryptocurrencies will abandon their marginality within the economic environment and will play a more active role. The propulsive drive that will fuel this transition will be the continued desire of the current monetary and economic system to commit suicide. This has become clear when we saw QEs in Japan, US and Europe. That was the definitive signal that there is no longer any hope of restoring the fiat money system and that the current society will live a preponderant inflationary spiral as soon as the broader economy will be invaded by the gigantic amount of money and credit created ex novo until now. Even in this way, however, the phenomenon of cryptocurrencies could still escape the many. In this regard, we are of the opinion that it is necessary to understand the philosophy behind these new technological tools, otherwise one ends up believing what the media mainstream says without having the knowledge of cause. (https://www.ft.com/content/e04e359a-e9e9-3f8e-8e2f-3f4373e5efb0)

In 1965 Gordon Moore enunciated his observation regarding the number of transistors on a silicon computer chip. I'm talking about the utterance of Moore's Law. The number of transistors would be doubled every 18 months or so. Year after year, Moore's Law has truly revolutionized the world, reducing information costs.

Moore's Law is the extension of a process that we can trace back to the invention of the telegraph. Since then, the information has increased its propagation speed. The cost of information has continued to halve in a predictable way, and today it happens about every year. The question is not the number of transistors on a silicon chip, but the cost of information continues to decline. And with this comes the increase in productivity and the decentralization of information transmission. This is the fundamental process of the modern world, and has overwhelmed the socialist economies.

There is a fundamental law in economics: when the price falls, the demand increases. The price of information is going down. Information becomes increasingly decentralized, and now the cost of communication has decreased to such an extent that the greater the interaction is, the more information is exchanged and the greater the cooperation is. With this decentralization comes the inevitability of the triumph of capitalism. Mises was right in 1920 when he predicted the disintegration of the socialist economy in Economic Calculations in The Socialist Commonwealth. Hayek was right in 1945: The Use of Knowledge in Society. There is only an institutional structure that exploits the productive use of decentralized information: the free market economy. Only with the free market prices we are able to coordinate our activities in the world around us.

Prices are driven by supply and demand. These two forces govern the market signals that are sent throughout the economic environment. This is economy 101. The intersection of the demand/supply curves represents an a priori law in the world of economics that cannot be altered. What cryptocurrencies remind investors are "two-way markets", governed by risk and personal responsibility. Not the nowadays markets governed by a deus ex-machina who, in the event of an error, socializes losses by robbing common people (e.g. price inflation through monetary inflation): the ECB, for example, which has completely destroyed any semblance of honesty and healthy determination of prices in the secondary government bond market. The ECB's balance sheet exceeded €4 trillion, but in this case no one should be careful to enter the government bond market. Oh no! The "traitors" would be the short sellers. In this manner are justified lots of prohibitions and obstacles to anyone who wants to safeguard their investments. Instead cryptocurrencies, through the words of an official of the gigantic European bureaucracy, are "only" determined by supply and demand. And from what else should they be determined? Yet another proof of how the European cage is only a socialist experiment, having nothing to do with the principles of freedom.

Central bank cancer has so deeply permeated the current society that it is impossible to live without it. That without central banks, crises could not otherwise be avoided. Nonsense. The boom/bust cycle is exactly due to the distorting nature of central bank actions.

The justification of the intrusion into the economic environment by a central authority, cultivated over time by economists who thought demand was the engine of economic growth, was initially given birth by Keynes, and then strengthened by Friedman, in the wake of the Great Depression of the '30s. Keynes suggested that the government should borrow its way to prosperity. Instead, Friedman suggested that the FED should find the way to prosperity for the economy by pumping more money. In any case, both pointed the finger at a lack of aggregate demand. Needless to say, these are just fairy tales. The ability of a market player to push demand is determined by his ability to produce goods and services. That is, the more an individual is able to produce, the more he/she will have the opportunity to acquire other assets.

In fact it is through our production that we are able to pay for all those goods that we consider most useful for our existence. Without this fundamental passage, there would be no creation of wealth, nor would there be an improvement in the specialization of the supply of goods. So a reasoning that considers demand an independent parameter is fallacious, because what fuels the economy is not the demand as such but the production of goods. The producers, therefore, are the engines of an economy; or better to say entrepreneurs. Their ability to anticipate the future will allow them to offer certain goods and services that they expect to sell in the market. The more accurate their prediction, the more successful they will be, the faster a company will succeed in prospering. Having to do with uncertainty, they must study it in depth. Their calculations have to be as correct as possible.

This structure of society and production dismantles the Keynesian apparatus, because the entrepreneur employs human resources and capital resources before consumer demand shows itself. If successful, there will be a correlation between the demand for its assets and the profitability of the company. It can not be denied that production precedes consumption, so the economic environment must be as genuine as possible so that entrepreneurs can direct production in the best possible way in accordance with consumer needs.

No government or central bank can change the fact that their tricks will be useless when it comes to stimulating effective demand. If we want to increase our consumption capacity, we need to increase the capacity to produce first. This dependency can not be disavowed by monetary pumping or public spending. On the contrary, the loose fiscal and monetary policies will hinder the signals of the market, making them more turbid; as a consequence they will impoverish the economic environment, going to erode the actual demand. If then you really care about production and prosperity, you should abolish all those methods that facilitate the creation of fiat money and you should drastically cut public spending.

Instead, our monetary politburo has blindly followed the Keynesian and Monetarist dogmas, adopting those measures that waste wealth rather than create it. In fact, the fake economic recovery that media mainstream are talking about has been fueled by ultra low interest rates. Apparently low-cost funds pushed companies into production lines not required by genuine market demand, pushed families to consume beyond their means and pushed the public sector to spend more. This apparent recovery, however, will disappear once the aforementioned economic measures will be reversed, making a recession far worse than the previous one.

The intrusion of central banks into the economic environment has an even more pernicious effect: it makes investors believe that there is a safety net capable of safeguarding them despite their economic mistakes. It created the illusion that uncertainty can be overcome, embedding a growing dependency on central banks machinations. They cannot wield such a power. Central banks, through their unprecedented monetary policies, have pushed investors and entrepreneurs into a labyrinth of mirrors; they have disguised their harmful actions through persuasive appellations as "forward guidance"; they led the market actors to believe that recessions could be abolished, when the very essence of these interventions is to create a cycle of boom/bust.

The only thing that central banks can do is redistribute wealth within the economic environment, not create new one. They redistribute it to the first receivers of the newly created fiat money.

But once real interest rates start to rise again, then we can be sure that a bust is not so far. For example, the FED wants to tighten its balance sheet because of the improved conditions of the American economy. According to forecasts, by October this year the rate of reduction will have reached $50 billion a month, bringing the FED balance sheet by 2020 to reach $2.8 trillion (still greater than $1.9 trillion compared to the start of the Great Recession). Pay attention, however, because although there is the intention to carry out this reduction, it will not be effective, because the proceeds from the sale of the securities in its possession will be reinvested in the same securities if revenues exceed the imposed reduction rate.

Needless to say, therefore, that the FED would continue to influence the money and credit markets, because a total abandonment of its active role in these markets is not in sight. In fact, the last thing that Eccles Building wants is a surge in the interbank rate, consequently a contraction of the money supply will not become evident as long as the following conditions remain in play: the ability and the willingness of the commercial banking sector to expand their balance sheets, and the appetite of investors for the securities sold (sovereign bonds and MBS, mainly).

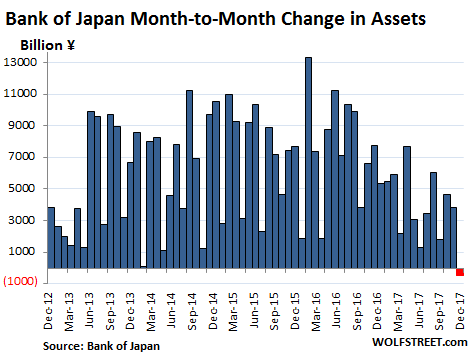

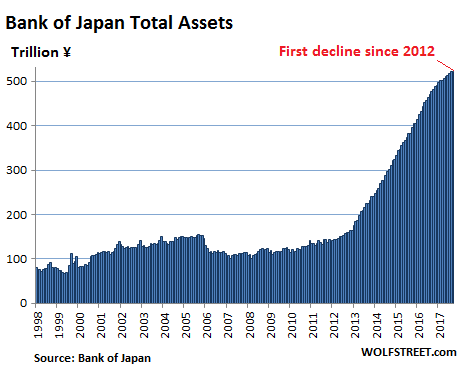

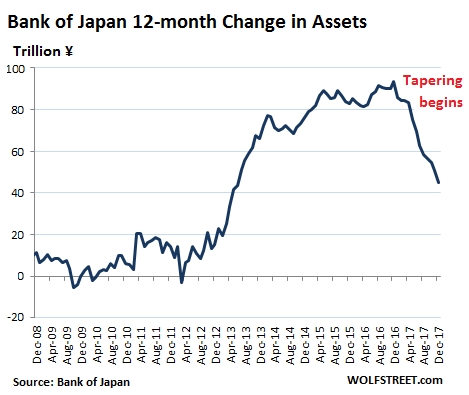

But be careful, because given the current interconnection of the world financial system, the catalyst for an economic crisis could not be exclusively internal. In fact, after the Japanese QQE, where the BOJ has literally bought everything (government bonds, equities, ETF, Japanese corporate bonds, Japanese REITs), it seems that the birthplace of the quantitative easing is pulling the oars in the boat. It is news of a few days ago that the BOJ budget fell by ¥444 billion in December; not a large sum compared to a ¥521.416 billion balance sheet, but it is the first month that BOJ purchases fall into negative territory.

The sacrificial lamb in this case is represented by the JGB, that is, the Japanese sovereign bonds: on December 31 had fallen by ¥2,900 billion. In short, it is very likely that the BOJ will simply let them mature without renewing purchases. Even if this decline seems almost imperceptible if we consider the total assets, amounting to 96% of the Japanese GDP, it is interesting to note that it coincided with the will of the FED to restrict its balance sheet.

And let's not forget that last April the ECB cut its QE from €80 billion a month to €60 billion a month, and from this year a further cut is expected up to €30 billion per month. As a result it seems that the propellant supplied to the financial markets by QE is now fading, leaving empty hands all those who thought that central banks were omnipotent. Without forgetting, of course, the mammoth Chinese economy, which despite the numbers say it is growing 6.5% a year, is fueled by a growing money supply to 14% a year and a public debt now quadrupled since the beginning of the Great Recession. This scenario would not be worrying if in return there were solid economic returns, while instead almost half of the companies in the Hang Seng index contract debts to repay the interest on the old ones and now China needs about four times the debt it had needed in 2007 to generate the same growth.

The overcapacity of the Chinese industry is preparing to invade the rest of the world and the gigantic real estate bubble has made high-risk debt attractive. China is also a big risk, because while the Chinese Communist Party shows its political and economic muscles to the world, it is ignoring the financial time bombs that its reckless search for absurd statistical records has triggered.

Alongside the continuity of the present monetary system, something new has appeared since 2009: cryptocurrencies. What do they represent? A discontinuity. Both these forces will eventually collide. What will come out, will represent a new paradigm within the economic environment. Cryptocurrencies, therefore, are nothing more than the free-market response to obsolescence that over time has been infesting the monetary system. It is the way in which the a priori of economics theorems reveals itself always true: laws in economics can be circumvented, but not violated. By virtue of this, a new industrial revolution could be at hand. From 3D printers to cryptocurrencies, the world as we know it could change in one or two generations at most.

And what the nineteenth-century industrial revolution mainly alleviated? Poverty. Take for example one of the latest ICOs: the Everex project (https://bit.ly/2pHNt8a), which considers financial inclusion an integral part of its mission. The company that has developed this project plans to provide microlending, remittances and merchant payments to all those individuals who can no longer turn to the commercial banking system. This suggests that there is no more need for the state to look after the poor, as the instinct of solidarity is present in all of us without the presence of third parties to redistribute personal income.

Not only that, but the philosophy behind cryptocurrencies is also bringing with it a change in mentality: a departure from socialist policies in favor of a vision more focused on freedom. As a completely decentralized payment mechanism, Bitcoin has shown us the power of markets to create valuable "digital assets" and limit the ability of governments to preclude its use. Moreover, by its nature Bitcoin is mathematically scarce in supply, shielding it from an arbitrary devaluation (something that even the commodity-money could not boast). Despite this, skepticism is still prevalent in regard to cryptocurrencies, mainly due to their "unorthodox" birth. The objections are two mainly: cryptocurrencies will never be money and cryptocurrencies are a bubble.

Let's start with the first objection. Although cryptocurrencies do not violate the Misesian Regression Theorem, perplexities remain regarding its immateriality and widespread acceptance. Given the way in which a commodity spontaneously becomes money, and how it has a pre-existing value based on its "non-monetary" use, is it possible that cryptocurrencies can become widely accepted means of exchange? It is. People accept euros, dollars and yen because they know their pre-existing purchasing power. In other words, they have a point of reference for assessing fiat money today because they know what they could buy yesterday. Well, the same goes for cryptocurrencies: just look at what they can buy today compared to yesterday. Moreover, the list of companies that accept cryptocurrencies is getting larger day by day (https://bit.ly/2bRQoRJ). Not only that, but consider also the employees who accept them as wage. (https://ind.pn/2pHkDF0)

"Being money" does not mean crossing a threshold, rather it means that some goods are more salable than others and their continued adoption over time tends to reduce price volatility. And here comes Bitcoin: it is not the most popular commodity, but it is moving from not being money to being money. If we were to remain strictly in line with the definitions, then not even gold would be money, since nowadays almost nobody accepts it as a medium to buy other goods and services. Bitcoin is following this path because no one forces its use, instead it's freely chosen by individuals. The more its adoption increases, the more the price will grow until it finally stabilizes. We can trace back its purchasing power until we reach the first transaction in which Bitcoin was used as a means of exchange. The reason why someone acted in this manner is irrelevant, what matters is that someone actually did it and in this way provided an objective point of reference so that the market as a whole could evaluate Bitcoin.

Regarding the second objection, recent price surge did not come out of nowhere but was the result of financial and technical improvements that encouraged the use of Bitcoin. Over time, more and more perplexities have grown over the scalability of the cryptocurrency invented by Nakamoto (https://bit.ly/2pK3MAv), with concerns about use and security. Fortunately, the network avoided a hard fork last November and instead chose a harmonious progress (https://bit.ly/2IXeTPm). In August 2017, a change called "segregated witness" (https://bit.ly/2uDD9xu) was activated. This would have increased Bitcoin speed without compromising security or decentralization; while in December, giant steps were taken to implement "lightning network" (https://bit.ly/2kgLvIp), an infrastructural development so that small transactions can be speeded up without running into high fees or slowing down the blockchain. Not to mention that at the end of last year two Bitcoin futures were launched on Wall Street.

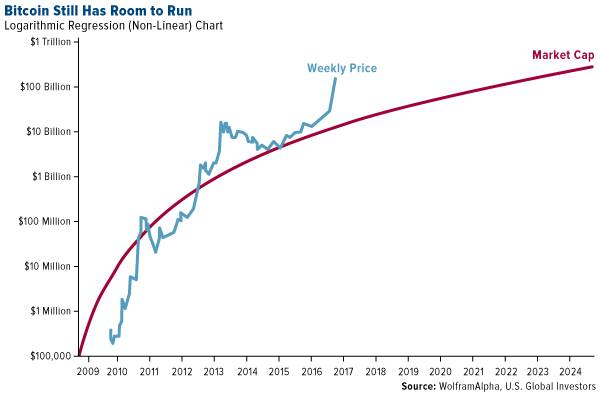

In short we are practically witnessing a voluntary transition from a lower to a higher level currency, and its adoption is embodied by the individual actions of market players rather than imposed by a monopolist able to manipulate the system. In fact, from a theoretical point of view, the growth of Bitcoin can be analyzed according to the Metcalfe Law, that is, as the users network increase, its value increases. It is a reasoning applicable also to cryptocurrencies. On a normal chart it may actually look like a bubble, but if we set a logarithmic scale we can see that the peak has not been reached yet.

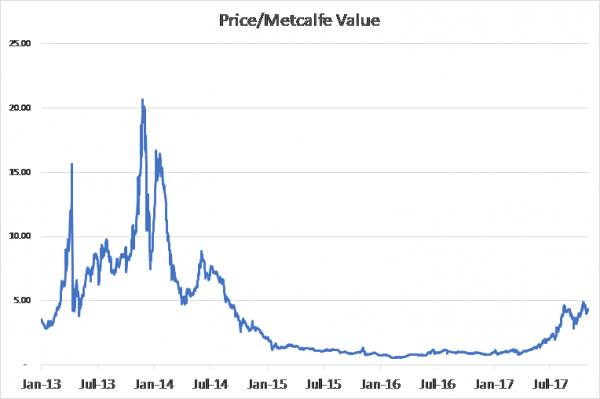

Finally, if we analyze the price of Bitcoin according to a Price to Metcalfe Value Ratio (similar method used for equities with the Price to Book Ratio), we will note that the price was more buoyant in 2013/14 rather than today.

The beauty of the world of cryptocurrencies is precisely the fact that it is all a becoming. Nothing is immutable, but all is in transformation. Then it is clear that we must carefully choose which cryptocurrency to trust. Not all are good, and not all are equal. Beyond the fluctuations of the quotations, it is the development of the technology that will decide which cryptocurrency will survive in the long term. From this point of view Bitcoin challengers are divided into two large categories.

On the one hand the coins that try to overcome the problems of scalability, i.e. the fact that the blockchain is becoming increasingly clogged and fees highly expensive, therefore proposing an evolved version. This is the case of Litecoin, which makes transactions less "hefty" and faster, or Bitcoin cash, a recent schism from the original Bitcoin. These technologies will help cryptocurrencies to establish themselves as an effective medium of exchange, a fundamental feature that has remained marginal until now.

On the other side there are other altcoins that are born with an autonomous blockchain and have different vocations. For example, Ethereum is a platform for the creation of smart contracts, which pays the use of its computing power with an unit of account called Ether. Cardano is a similar version born in Japan, while Neo was born in China. Ripple is different, since it is an evolved alternative to Swift. It hooks a virtual currency to its service that could be used to facilitate international trade. Not really a follower of Bitcoin, which arises as an alternative to the traditional banking system. Project similar to this, and designed for the banking world, is Waves. Moreover, for those worried about their privacy and believing that the anonymity of Bitcoin is not enough, there are alternatives like Monero and Zcash: the first creates false addresses to hide the recipient, while the second one encrypts it.

Among the other cryptocurrencies, those to be particularly looked after are: Lisk, following the example of Ethereum and aiming to create a decentralized application system, presenting itself as an alternative to services such as the Apple app store or Google Play. A system whereby developers can build apps, via SDK, and distribute them to the public without a centralized control system. Dash, a cryptocurrency whose project aims directly at a real use (i.e. from wine to rent) and the replacement of traditional fiat money. Another important detail is the fact that Dash uses a PoW-PoS hybrid system. Iota, a cryptocurrency with the potential to trigger global interoperability, and Decred, a cryptocurrency censorship-resistant anchored to a public proposal platform. Stratis, a BaaS (Blockchain as a Service) platform designed as a service for companies and professionals. Each user/client can create his own private blockchain to use as he sees fit (i.e. logistics management). It is more precisely a sidechain, bound to the main blockchain.

Hi, I just followed you :-) Follow back and we can help each other succeed! @hatu