Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS: Price Analysis, March 06

Harvard economist Kenneth Rogoff believes that Bitcoin's value will fall to $ 100 in the decade. He noted that increasing regulation is one of the things that reduce Bitcoin's value. We, in turn, believe that in ten years the crypto currencies have much more use cases and that they increase their demand, which increases prices.

Bitcoin entrepreneurs have begun to restore the Puerto Rican economy that has been affected by a natural disaster and lack of funds. This is a new experiment, and if it succeeds, it will be implemented in many other places.

In addition, the increased participation of large companies in the crypto world increases their growing acceptance, which is a rising sign.

BTC / USD

We had been waiting for Bitcoin to break the back and shoulder strap from the neckline and move to the $ 13,000 target. But the bears strongly defended the $ 12 200 level.

Yesterday, March 5, the BTC/USD pair reached a high of $11,934.08 but could not break out of the overhead resistance. Currently, the cryptocurrency is pulling back and is likely to find support at the trendline of the ascending channel at $11,100. If this support breaks, the next support lies at the 20-day EMA and below that at the 50-day SMA.

Therefore, traders can raise their stops to $11,000 on the remaining half-position. Once the price sustains below the channel, we expect it to stay range bound between $9,500 and $12,200.

ETH/USD

We had recommended traders to raise their stops on Ethereum to $830 in our previous analysis, which was hit today, March 6. The bulls have failed to break out of the 20-day EMA for the past nine days.

Since the price is below both the 20-day EMA and the 50-day SMA and descends from the descending channel resistance line, the bears have the upper part.

Now it is likely that the bears will push the ETH / USD pair to $ 780. If this level breaks down, the next aid is $ 723.

BCH / USD

We had recommended the purchase of Bitcoin Cash over a break, but the horses could not raise prices for more than 20 days of EMA and overtime.

Now the bears are likely to attract the prices to the lower end of the $ 1,150. If the BCH / USD pair is disconnected, it is likely to fall to the $ 950 price target.

Our declining view will be canceled if the encryption currency is $ 1.355.

XRP / USD

In the previous analysis, we were uncertain about the Ripple's price performance. Yesterday, March 5, the price went from above, but could not clear the 50-day SMA.

Prices fell sharply, and the XRP / USD pair is likely to continue trading in the area again. If the bears return the prices back to less than $ 0.85, it can drop their fall to $ 0.72.

We do not currently find any trade structures.

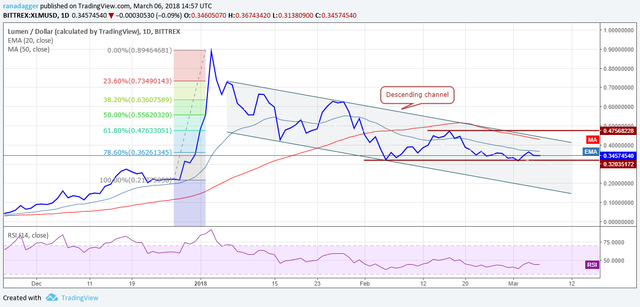

XLM / USD

Stellar continues trading with a range because the bears could not split below $ 0.32.

Above the XLM / USD pair has been opposed to the 20-day EMA. If it breaks down $ 0.32, we can detect a $ 0.22 drop down subsidy line.

The beasts continue to resist 20 days of EMA, 50 days of SMA and the top of the area.

LTC / USD

Although Liteco continues to trade more than 20 days of EMA, it has lost momentum. Both moving averages have stabilized, suggesting close-term bound activities in the next few days. We recommend traders to keep a stop loss of $ 200.

Yesterday, March 05, the bulls attempted to break out of the downtrend line, yet, they could not sustain above the line.

The LTC/USD pair is likely to correct towards the 50-day SMA. If this level breaks, a move towards $175 is also possible, where we expect strong buying to emerge.

We should turn bullish if the cryptocurrency sustains above $225.

ADA/BTC

Cardano has been holding above the critical support level of 0.00002460 for the past four days, but a lack of buying at the support level shows that the bulls are not interested in buying even at these levels.

If the price breaks down of 0.00002460, it can slide to 0.00001690 levels.

On the upside, the ADA/BTC pair will face resistance at the 20-day EMA and the 50-day SMA.

We need to wait for buying to emerge before recommending a trade on it.

NEO/USD

We expected the $108 levels to provide strong support but we were proven wrong, and NEO broke below our suggested stop loss of $105.

Good post I think this one written by @saleh9

Waaaw.

Gade tout posibilite ki genyen