Instant Assets Tokens (IAT) : Provides real-world solutions & utilities to your real assets

ABOUT IAT

IAT plans to take a leading role in all facets of real estate locally and hopefully globally to make this a reality, starting with disrupting the rental and property market and tokenizing large real estate assets

The IA Tokens concept aims to revolutionize the real estate industry using Blockchain technology through the development of the IAT Platform. Funds raised from this ICO will be used to develop the IAT blockchain and the asset management will be undertaken by our existing management company that is currently operational. The Platform will cater to the Philippines market first and we look to expand into other developing markets in Asia.

THE PROBLEMS

Despite the potential profits of the real estate market, buyers face numerous problems and limitations. IAT, to maximize benefits and minimize losses people might incur, aims to solve the following through the adoption of the blockchain technology:

All Round Transactional Costs

Cutting out inflated costs by parties such as developers, taxes, brokers, and agents. The total cost of buying and selling a property in the Philippines is at times inflated to as high as 24% of the property value. We are looking to cut that total costs down by at least half.

Integrity and Security

The decentralized nature of the Blockchain technology ensures that records stored on it cannot be changed or controlled by a single source, thus providing security against malicious attacks such as hacking.

Transparency of Transfer

Information stored on the blockchain is accessible by all which makes the data transparent and immutable. The possibility of frauds and ownership dispute can be almost eliminated with the high degree of transparency.

Time and Costs Savings

The current process of ownership transfer can take months due to the various parties involved and the need to verify the documentation during various stages, usually with the assistance of a lawyer. The blockchain technology will be able to address the above by maintaining a uniform source of information for all the parties that are involved in the transaction. Also, emerging platforms focusing on other functions such as payments can be integrated in future. The project will also be providing a platform for listings.

Restrictions to Foreign Investors

Countries have been known to implement regulations to curb a growing real estate market by imposing restrictions on foreign purchases in an attempt to slow or stop the market from ballooning or forming a bubble.

Take Singapore for example, prices of subsidized government housing have shot through the roof in the last few years to a staggering US$750,000 which has caused the government to implement multiple rounds of cooling measures to curb the market growth.

THE SOLUTIONS

With the numerous challenges involving real estate ownership, we have deemed it necessary to find ways to make traditional property investing and management easier for investors.

Instant Assets Tokens (IAT)

The IA Tokens concept is a form of real estate tokenization and will be released via a process of Initial Coin Offering or ICO on the Ethereum network and will be ERC-20 compatible.

Funds raised from this ICO will be used to develop the IAT blockchain and assets will be acquired to form the initial bulk of properties in the IAT ecosystem. The asset management will be undertaken by our existing management company that is currently operational.

Native Instant Assets Tokens (NIAT)

The NIAT will be the local token equivalent of the IA Tokens. It will reside within each individual real estate market and is pegged against the country’s native currency. As such, each country will have its own NIAT. It will not be minted on its own and can only be purchased using IA Tokens. This is to ensure that end users are not being exposed to the volatility of the cryptocurrency markets.

Primary Focus

Asset Digitization and Management

One of the biggest factors which property owners are facing in the Philippines is the extremely high all-around costs of a property transaction from the buying to the sale of the property eventually.

Purchasing a property will involve costs such as documentary stamp tax, transfer tax and title registration fee which ranges between 2.25% to 3%. However, if you are buying from a developer, the norm for them is to pass on certain fees and taxes onto the buyer which will increase the total fees to a range of 6% to 12%.

There are also a few smaller charges to be paid upon the completion of the property such as having the connection of water and power supply to be done. One has to also note that property of a certain value will also have a 12% value-added tax (VAT) included in the property price.

Selling a property presents a different set of charges and fees which includes capital gains tax of 6% (charged on the sales price or zonal value whichever is higher) that is essentially a sales tax and agent commission of between 5% to 6%.

As such, all-around transactional costs for a property owner in the Philippines will range between 17% to 24% which is extremely high.

However, if we are able to reduce the total costs drastically by 70% to 90% to a nominal fee, the booming real estate market of the Philippines presents huge potential growth and profitability in the coming years with an excellent administration and commitment to improving infrastructure in the country.

The company will focus on acquiring commercial real estate where demand and the concept of co-working spaces have been increasing over the last few years.

The residential segment acquisition will also be a focus but mainly in terms of acquiring in bulk and focusing on projects within key development areas and Central Business Districts (CBDs) such as Makati, Ortigas and Bonifacio Global City (BGC).

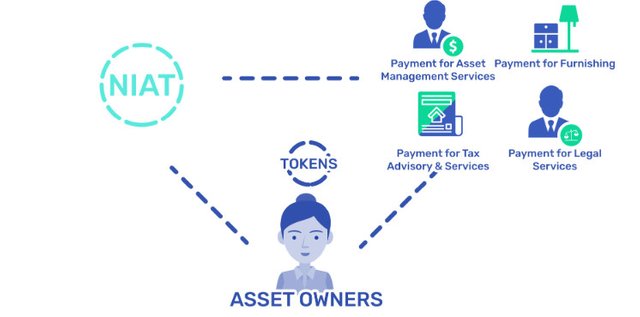

The properties purchased by the company will form the initial asset pool for the IAT ecosystem. The company’s management arm will also be providing asset management services for asset owners who wishes to engage us. The rate of engagement will be lowered if transactions are done over the platform using NIAT.

Lastly, the company will also be open in working with landowners and developers in project development.

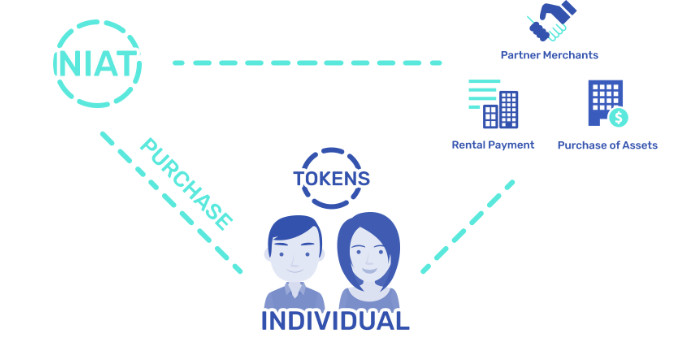

Individual Owners

A section of the web portal will be catered to individual owners where we aim to break the stronghold of traditional channels such as Airbnb and the various booking sites. By implementing a fee of only 5% on successful reservations, we will significantly increase the rental returns of the owners as the traditional channels charges fees of between 15% to as high as 20%.

A nominal fee will also be applied to each listing with payment via NIAT; this is to avoid owners from listing with inaccurate details of their assets as well as unnecessary price competitions.

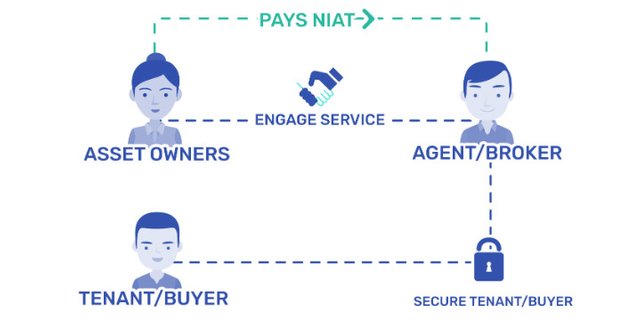

Agents/Brokers

Another section of the web portal will be catered to agents/brokers for their listing of assets for sale and lease. Leasing activities here will be only for long term leases to be in line with the country’s regulations on short term leases by an agent/broker.

A nominal fee will be applicable for each listing. With the continual adoption of cryptocurrency, we envision that cryptocurrency investors will be looking to transfer some of their crypto wealth to tangible assets such as real estate.

Backed by Revenue Model

Unlike other ICOs that has its value pegged to the future profitability and sustainability of their business model, the IAT ICO is based on an existing profitable business model where we have the actual business operations already up and running.

The IAT ecosystem is set to revolutionize the traditional real estate market. In fact, this has been a largely untapped segment in the cryptocurrency market.

When you invest, the goal is to put money to work today and let it increase by 3x, 5x, or even 100x and more, so the return you generate is enough to cover the risks you take or the taxes you pay. The same is true for real estate investing, however, there are some minor differences - it requires higher capital and has less liquidity than fiat currencies. In addition, there are always restrictions on foreign ownership, strict financial regulation, and lack of transparency in all processes that deter many potential investors. What if we can certify real estate and make it affordable and available to more people? Imagine a world where real estate investments are simple and transparent. It will be a dream come true for those who always want to invest in real estate and real estate owners to get liquidity. Complies with Instant Asset Token (IAT) .

HOW DOES THE IAT WORK?

There are two types of tokens that serve the solution provided by the company.

Instant Asset Token (IAT)

It will be released through the ICO process on the Ethereum network and will become a compatible ERC-20. Funds obtained from this ICO will be used to develop IAT blocks and assets will be acquired to form most properties in the IAT ecosystem. There is a total inventory of 4,500,000,000 tokens and will be pegged to US $ 0.01 per token.

Original Instant Asset Token (NIAT)

This will be a localized token of the IAT as it will only be used in any real estate market and pegged to the country's original currency. To protect investors from the volatility of the cryptocurrency market, NIAT will not be printed on its own but can only be purchased using IAT.

Tenants can pay their rent with NIAT and receive a discount. The company will also seek to bring in various trading partners into the IAT ecosystem so that NIAT can be used for merchandise goods and services.

NIAT can also be used to purchase assets in the IAT ecosystem and token holders may choose to use NIAT to make payments for asset management services or involve tax advisory services, attorneys or legal counsel.

In cases where commissions must be paid to a property agent, the token holder may choose to pay commissions with NIAT. The asset owner may also choose to receive rental or sales results in the form of NIAT after registering the assets on the web portal.

In other words, NIAT will be the currency that drives all transactions that occur in the IAT ecosystem. To provide liquidity, the company will continue to look for various token utility channels to reduce the token supply and will order some of the funds collected to create a liquidity pool for NIAT purchases using IAT.

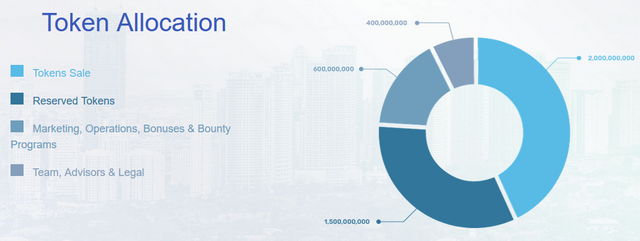

IAT TOKEN

IAT will be issued via a Token sale with a total supply of 4,500,000,000 IA Tokens. The price of the IA Tokens will be pegged to US$0.01 per token, ETH and BTC will be accepted. Value of tokens for sale will be US$20 million (inclusive of Early Investors, Pre-sale and Crowd-sale) with distribution according to the table below. Unsold IA Tokens (cap at 40,000,000 IA Tokens) will be given to charity organizations and remaining IA Tokens will be burned. Pre-Sale will commence in early April with the crowd sale subsequently commencing in 15 June 2018.

Token Info

Platform - Ethereum

Type - ERC20

Price in ICO - 1 IAT = 0.01 USD

Tokens for sale - 2,000,000,000

Min. investment - 0.1 ETH

Accepting - BTC, ETH, Fiat

Distributed in ICO - 44.44 %

Soft cap - 1,000,000 USD

Hard cap - 20,000,000 USD

FOR MORE INFORMATION ABOUT IAT PROJECT, VISIT THE LINKS BELOW:

Website : https://www.iatokens.com

Whitepaper : https://iatokens.com/docs/IAT%20WHITEPAPER.pdf

Twitter : https://twitter.com/IA_Tokens

Facebook : https://www.facebook.com/IATOfficial/

Telegram : https://t.me/iatokens

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1409779

Get 50 upvotes and your post resteemed to over 72,000 followers. Go here https://steemit.com/@a-a-a