What is Bitcoin? - When Money becomes a content type!

In this blog post, I'd like to highlight some key aspects of Bitcoin and answer the question "What is Bitcoin?" Although I write about Bitcoin, more often than not, the statement applies to the broader concept and addresses the implications and possibilities of this technology in general. Bitcoin serves as the representative example of the implementation of this new technology/idea.

Introduction

Before we jump right into the topic of cryptocurrency, I'd like to go back to a vital question one more time. One that ultimately needs to be asked and answered before the topic of Bitcoin and Cryptocurrencies can be addressed. The question is: What is Money? You can find my take on answering that question in the blog post linked below:

In summary, the essence of money can be reduced to the exchange and store of value, thus a specific object used as money becomes an abstraction of value. The objects that represent money, its common abstraction, change over time. From simple things like feathers and shells to precious metals like gold and silver. Later, it evolved into its current shape of pieces of paper and plastic, backed by bits and bytes in centralized ledgers.

What is Bitcoin?

In today's world, money already became an abstract construct, which isn't backed by physical objects anymore. We already got digital money, its nothing new, we know it for years - what makes Bitcoin different? Why in the world should Bitcoin be that much of a game changer?

The general answer to this question is, it is because Bitcoin is more than just a currency, more than just digital money, Bitcoin is the next step in the evolution of money. For the first time in human history, anyone can exchange value on a global scale without trusting the other party and without the need of an intermediary that controls the transaction. Trust is provided by the network, defined in the protocol and secured by mathematics and cryptography. It is accessible for anyone and anything from anywhere at any time. It is censorship resistant, it is neutral to the sender, the recipient and the value of the transaction. Anyone is free to innovate, no one needs to ask for permission.

"What's really exciting is the possibility of fundamentally changing the way we allocate trust on this platen - opening up the ability to collaborate, transact, and engage on a global level with everyone" Andreas Antonopoulos - The Internet of Money Vol. 2

...and what exactly is Bitcoin?

Bitcoin and cryptocurrencies as the next step in the evolution of money, providing countless possibilities, confronting you with expressions and things like "Blockchain", "Public & Private Keys", "Programmable Money", "Smart Contracts" and so on, don't really help to make this topic more tangible. In order to keep things simple, let's get back to Bitcoin and the question: What is the technology behind Bitcoin? which allows addressing the question: How does Bitcoin work? The answers to those two questions should provide an insight into what Bitcoin is.

What is the technology behind Bitcoin

Often times, blockchain is referred to as the technology behind bitcoin, which by itself is not true. Bitcoin is built upon four fundamental technologies, none of which can provide the full spectrum of functionality by itself. The four technologies are:

- Blockchain

- Proof of Work

- P2P Network

- Cryptography

Only the combination of these four technologies allows Bitcoin, a network of trust, to exist. It is only the combination that paves the way for all possibilities and Bitcoins huge potential for disruption and innovation.

How does it work?

Let's have a look at core aspects of Bitcoin and how the technologies mentioned above are incorporated into Bitcoin.

The public ledger

With traditional abstractions of money, the banks and currencies we currently have, there's always a trusted party that keeps track of all transactions. It's the party that holds the ledger and ultimately decides, whether a transaction is valid and whether it was or will be executed. Although this can work in some cases, this approach eventually leads to corruption and censorship, distinguishing transactions by the amount, the sender or the recipient. In Bitcoin, there is no central authority holding a ledger, the complete ledger is shared amongst all participants of the network, thus the expression Public Ledger. The public ledger is shared utilizing P2P Network technology mentioned above.

Hashing and Asymmetric Cryptography

At this point, the term Hashing and Asymmetric Cryptography become a crucial aspect of how things work, which is why I try to explain the concept as simple and short as possible. The basic concept of hashing is to generate a random value from a file, text or dataset. Independent of the size of a file, text or dataset, the generated value has always the same length. Another crucial attribute is that it can only be generated in one way. The same file, text or dataset will always produce the same hash, but never can you retrieve the file, text or dataset from a hash.

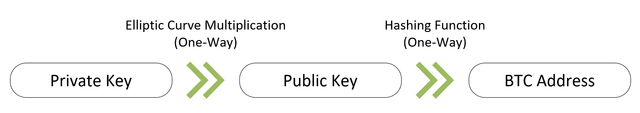

Asymmetric Cryptography like the Elliptic Curve Multiplication follows the concept of a "one-way street". In the case of Bitcoin, it is used to create the public key from your private key. The public key can then be used to verify whether a transaction was signed with your private key or not, which validates the origin of a transaction.

Securing the Public Ledger

Since this ledger is shared amongst all participants of the network, it better be secure as hell, which is where Blockchain, Proof of Work and Cryptography enter the playground. They're used to secure the network by preventing double spends and other malicious attempts of fraud. The first step in securing the ledger is provided in form of a blockchain. As the name implies, a blockchain is just a chain of concatenated blocks. Every block has a predecessor and each block has a successor, the first and last block are the only exception. Every transaction on the bitcoin network is eventually stored in such a block, which is the moment when a transaction changes to the status confirmed. This process of collecting transactions and storing them in a block is also known as Mining. To ensure that the history of blocks is not changed, each block header contains the hash value of the previous block header, which also includes the so-called Merkle Root of this block's transaction. In short this means: If anything in a previous block is changed (including any transaction), the computation of this hash fails. This means, that if anyone wanted to change a block in the past, the hashes of all of its successors need to be computed again.

From tamper-resistant to tamper-proof

Unfortunately, the concept of the Blockchain alone, isn't enough to really secure the public ledger, which is why Proof of Work (PoW) is required as another fundamental technology behind Bitcoin. The problem lies in the fact, that a hash of a block alone, doesn't require much effort to be computed. One could easily change a block and calculate the hashes again. Other participants could only notice the change and might even start changing old blocks themselves. Soon enough, there would be countless conflicting versions and no one could tell, which of these versions is the real one. This means that we need something to harden the block, it must need time, it must need work, it needs to be something that proves that work has been done. This is where Proof of Work comes for the rescue and introduces a simple concept that became one of the four technological pillars of Bitcoin. Proof of Work simply adds a layer of complexity by adding an additional requirement to the hash that is produced. Instead of just hashing the content of the block (the transactions), Proof of Work introduces a nonce (nonsense) value, which is hashed along with the other attributes of the block header, thus influencing the resulting hash value. This allows defining a certain requirement for the resulting hash. In the case of Bitcoin, the convention is that the resulting hash has to start with a certain amount of zeroes. The amount of leading zeros directly correlates with the difficulty of finding an appropriate nonce that produces the required hash value. This is also known as the "Mining Difficulty". Introducing this concept, one can no longer just change the blockchain, since blocks don't just need to be hashed, the hash also needs to comply to the requirement, which (with today's hash rate and difficulty) needs unimaginable amounts of hashing power. In simple terms, this procedure has some similarities to a game of Sudoku. If you have an unsolved Sudoku, you know that it will take time to solve it. You can not just fill in the numbers. The difficulty of the Sudoku itself depends on the numbers given at the start and can be mathematically determined. And once solved, any Sudoku can be verified easily and independent of its initial difficulty. With Proof of Work, Bitcoin is not only tamper-resistant but becomes tamper-proof - it achieves true immutability.

Money as content type

The last part which makes Bitcoin revolutionary is the transaction itself. Not only is it neutral to the amount, the sender and the recipient, it is structured in a way that allows money to become a content type. In contrast to current systems, where the transaction contains critical data and needs to be secured, a Bitcoin transaction is not critical at all. While a Visa transaction contains all the critical information and therefore needs to be sent over a secured network, a Bitcoin transaction doesn't contain any critical information at all and can be propagated to the whole world. The thing that makes this possible is the fact, that a transaction is signed with a private key and only the signed transaction is propagated to the network. In order to be verified and processed, the transaction needs to be signed with the private key that controls the corresponding funds, otherwise it will not be accepted by the network. The only critical variable in this equation is the private key that controls the funds. Anyone in possession of a valid key can control and move the funds associated with it by creating a valid transaction. The transaction itself is an artifact created by the use of a private key, but the private key can never be retrieved from a transaction. This is why a transaction doesn't include any critical information and can be propagated to the whole world without any risk for the sender. This is also what truly makes money a content type and has huge implication regarding censorship resistance. The transaction can be sent in any way, shape or form, it doesn't need to be encrypted any further. I could print a transaction send it to someone as a letter and the person on the other end could process and propagate my transaction on the Bitcoin network. It could be transcoded into emojis and sent to a Telegram bot, which then processes and propagates the transaction to the network. Junks of data can be transmitted using radio signals and transaction is processed and propagated to the network by the receiving end. There is no way to censor or prevent a transaction from happening. And the fact that the transaction itself doesn't contain any critical data but is a content type strongly adds to its capabilities of censorship resistance.

Conclusion

With this blog post, I ventured the attempt to explain the technical aspects of Bitcoin as simple as possible. It is my try to focus on the broader concept/idea and highlight the huge implications it brings for the future. Making them tangible on a level that doesn't require a degree in computer science. I think it is important for people to not only follow the hype but also appreciate the beauty that lies within the technological concepts as well as the idea of Bitcoin and Cryptocurrencies. In order to limit this blog post to a comfortable size and not to lose myself in technical details, I had to make some compromises in the extent to which things can be explained. I plan to create detailed posts that aim to focus on only one technological aspect in order to provide a deeper insight for those interested - so stay tuned and hit that follow button.

I hope that my venture was successful and that I was able to explain the broader concept and implications of this technology in an easy and understandable way and appreciate any question, feedback or comment.

Thanks for reading and have a great day!

@sblue

Sources and Additional Information

- Bitcoin Whitepaper

- Bitcoin.org - Open source P2P money

- Bitcoin Wiki

- GitHub - bitcoin/bitcoin: Bitcoin Core integration/staging tree

- Bitcoin Block Explorer - Blockchain

- Andreas M. Antonopoulos – The open blockchain expert

- Andreas M. Antonopoulos (@aantonop) | Twitter

- Books – Andreas M. Antonopoulos

- Bitcoin - Wikipedia

- Blockchain - Wikipedia

- Merkle tree - Wikipedia

- Public-key cryptography - Wikipedia

- WTF is Money? And why Bitcoin is more than just a currency. — Steemit

- What is Git / Github? - The 3 minute journey through Bitcoins GitHub history — Steemit

Content type: long, expert/technical

Awarded 4 out of 6 owls:

Good job!

Details: The citation and sources owl was not awarded since the pictures require sources. In addition in text citations are absent. The originality owl was not awarded since it requires that the content is explained in a creative/novel way.

Note: This post was not upvoted since it was past its payout date. Instead this post was upvoted

Hey @mathowl!

Thanks for stopping by and owl-curating one of my posts! I feel honoured, and I'm grateful. I'm happy to see that the posts met the standards of 4 owls! :)

Since there seem to be some shortcoming in the citation and sources department, please allow me to do the citation and sources owl some justice.

I always try to include all necessary sources but thought that a fully blown APA standard might be an overkill. Maybe I'll get there since I feel like transparency is crucial. Also, I think every source deserves the credit.

So... why didn't I include the sources?

Thanks again for taking time to curate my post. I feel honoured and appreciate your feedback!

I'm hoping to see your owls again on another blog post of mine.

Keep up your excellent work and have a great day!

Cheers - @sblue

Good job. If you use CC0 images it is also nice to include the photographer/creator since it might lead to extra exposure for them. :o)

I absolutely agree! 👍Will do so in the future!

Wow nice post. Keep em coming. will folloy you for more in the future :)

Thanks for your reply! I'm happy to hear that you liked it and that I have a new follower. 👍😎

This is great! I have more confidence in this technology now with your help. To the average Joe, bitcoin and cryptocurrencies seem like an abstract thing, out of his reach. Since its said to be the technology of our future, it's important that more people understand what's all about.

I understood that a transaction with bitcoin cannot be traced back and it cannot be interfeered with. That is marveleous in this day and age where we are under watch by big companies. I am not implying that our data is used with bad intend, but it gives some food for tought.

Hey @pink-coco! Thanks for your reply, nice to hear that it was helpful. I really believe that this technology will play a big role in the future and is able to change the world and have an impact like the internet had. But also, we're just at the beginning, there are still so many challenges to overcome.

Regarding the "cannot be traced" aspect, there might be a misunderstanding. A decentralized Cryptocurrency like Bitcoin is neutral to the sender, the receiver and the amount sent, it doesn't distinguish, there's no censorship. That doesn't mean that there is privacy. In fact, with Bitcoin, there's only a very limited form of privacy. You can look up the funds of any address or check any transaction on websites like https://blockchain.info. Someone only needs to match your name with your bitcoin address and your privacy is gone. Of course, you can have multiple addresses and wallets, but in the end, the information about all transactions, funds and addresses is public, not private. Your private key just stops someone from moving your funds, not from seeing them. At least in the example of Bitcoin. There are other Cryptocurrencies out there that focus on privacy, Monero is one example.

Thanks for clearing that up. I misinterpreted.

Very well. I had to take a break to eat because it was delivered but I was going to give you my support nonetheless. Maybe we will talk on Discord again. It seems very well written and from a technical point of view I couldn't find any discrepancies. Keep on writing and you will grow here.

Cheers!

Hey @alexdory! Thanks for your reply and thanks for your support! It would be a pleasure to meet/talk on Discord again. Thanks for your feedback regarding my post, I'm happy to hear that you liked it and that there weren't any mistakes from a technical point of few. In case you find any in future or other posts, I always appreciate if you point them out to me. Thanks again for your support and feedback & have a great day!

Cheers - @sblue

I am also a Software Engineer, have you also tried to join @utopian-io ? I think they are the largest Steem group and could also back you up. Not saying to move there as I am a firm believer in multiple backers for stability.

Nice to meet a fellow Software Engineer! 😎I only had a brief look at utopian-io, it looks very interesting, I'll have a closer look as soon as I can. 👍

Upvoted and resteemed this informative post.

Hey @melpost! Thank you very much! Happy to hear that you liked my post! 👍

For future viewers: price of bitcoin at the moment of posting is 9614.40USD

Plz vote me