[0243] - Bitcoin: The "Breaking Floorboards" Pattern

A post or two ago, I wrote an article on the psychology of crypto trading. https://steemit.com/bitcoin/@skyflowers/0240-a-forensic-analysis-of-the-recent-bitcoin-price-crash

The gist of that article was to look at the currently monthly chart for Bitcoin and see if there are clues about where the market is heading. There are plenty of hints and the February chart is a text book case of "whale trading" and profit taking by the big players.

The fact that the trade that moved the market on Feb 9th was done publicly, rather than privately OTC, told me that it was a false move higher and that profit taking would take place a couple of weeks later. Thus dumping the market on everyones heads.

Anyway, check out that article as it lays out the case why I think that. Now, let's talk about what is happening right now and add to that blog post.

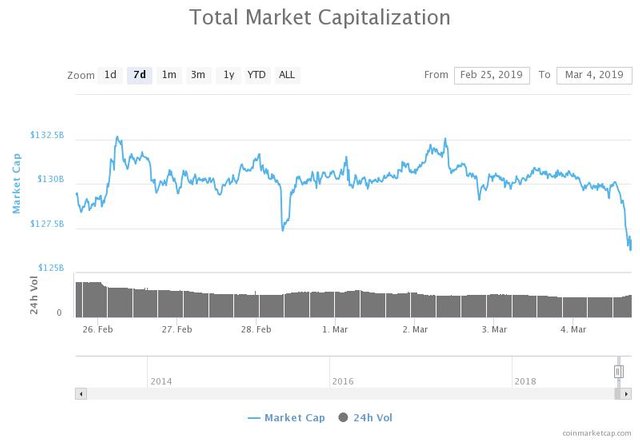

Let's look at this week.

Weekly Chart

While everyone is looking at the sideways movement and trying to guess whether it's going to go up or down, I've been tweeting since before the price dump around Feb 23rd that we are in for a fairly steep correction.

The following chart pattern is what I call the "breaking floorboards" pattern.

Here you see the sideways movement of the last 7 days. You also see cracks appearing and finally a breakdown of price.

The point is that sideways movement isn't "nothing going on". It's ambivalence. It's when the price of the market is caught between two equally opposing forces.

- Ethusiasm. Hope of a price increase due to bear market blues.

- Price drop. A correction to wipe away the false numbers caused by the whale trading. I.e. A sharp correction.

That's my take on the last 7 days. They are very much in relation to the events of Feb 9th onwards. An event that is still playing out and reverberating through the markets.

The sideways movement is really false hope trying to drive the bitcoin price higher. Caused by a starvation of green candles from a long bear market. The cracks are downward pressure that has been temporarily suppressed. We're tip toeing around and hoping for a price move higher.

There are no strong signals of confidence in this chart. The price needs to fall but retail investors are trying to prop the price up in the hopes it drives higher.

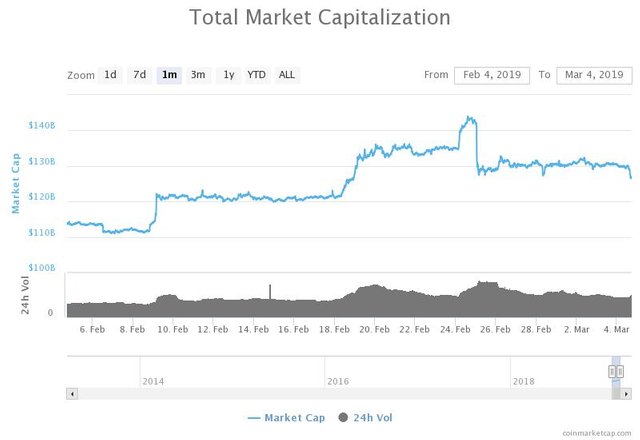

Monthly Chart

If you pan out to the monthly charts, you can see the story playing out that I presented in the other post. But now we can add the cracking floorboards as reality breaks through the false optimism and corrects the price.

The movement downward will happen and will cause s a"double bottom" and a price confirmation that we have indeed hit the bottom and the bear market is ending. Until that happens, there won't be a sustainable drive higher.

As you can see, we need to shed about $20B to get back to normal. To get back to the real figures and price discovery before some Wall St whale decided to test the market.

They've obviously taken profits around Feb 25th. But what I didn't think of is that they probably have a short position set on BitMex and will be really taking profits on their leveraged position when the retail market dumps due to their sell off.

Anyway, the next 24 hours will tell you whether I'm wrong or right. If we do get downward movement, you can expect a bottoming of the market for at least a month or two before we get a real climb higher.

Which suits me perfectly.

Thanks for watching,

Brendan Rohan - Indie developer of 'next gen' natural medicine from Melbourne, Australia

Www.Skyflowers.co ( see "botany" tab for the plant research )

Www.ClinicalFlowerTherapy.com

Social @iSkyflowers

YouTube Skyflowers.Tv

If you support natural medicine and an independent research project that began in 1997, then steem me. The creds I get will help me provide a solid body of information that future generations can build upon.

DISCLAIMER: This article and all information on this channel & all content is offered purely for educational & entertainment purposes. Always do your own research when investing money and seek the help of a registered financial advisor.

Congratulations @skyflowers! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!