The U.S. Department of Justice announced two individuals have been indicted for bank fraud and money transmission in relation to cryptocurrency operations.

The Department claims that Reginald Fowler (Arizona) and Ravid Yosef (Israel) lied to multiple US Banks in stating the accounts they opened were for real estate investments while in reality they were for trading virtual currency.

According to court documents this took place in 2018.

Which is a bit unusual considering US Agencies who enforce the law regarding these types of offenses generally take time, as in years of time, to conduct their investigations. The time frame of which they investigated the two men concluded in October of 2018 spanning 8 months prior.

One could argue that the lengthy investigation periods could be due to the HSI (Homeland Security Investigations) manufacturing its own evidence where there otherwise isn't any and this might is a case of someone actually breaking a rule somewhere, however, there are no facts to support that other than the obvious.

"Reginald Fowler and Ravid Yosef allegedly ran a shadow bank that processed hundreds of millions of dollars of unregulated transactions on behalf of numerous cryptocurrency exchanges, their organization allegedly skirted the anti-money laundering safeguards required of licensed institutions that ensure the U.S. financial system is not used for criminal purposes, and did so through lies and deceit.” U.S. Attorney Geoffrey Berman

Fowler was charged with bank fraud, conspiracy to commit bank fraud, operating an unlicensed money transmission business, and conspiracy to operate an unlicensed money transmission business and Yosef was charged with bank fraud and conspiracy.

In a nutshell, lying to a bank or any FDIC insured financial institution is a recipe for disaster as is evident of these indictments.

Banks ask each business account applicant what the nature of the business is as part of it's CDD/KYC procedures and additionally specifically asks if the business is a financial services firm or related business and specifically asks if the company is an MSB.

Stating otherwise when the truth and intent is to use the account for financial or related services is flat out illegal pursuant to 18 U.S.C. § 1001 which states that anyone who knowingly:

- falsifies, conceals, or covers up by any trick, scheme, or device a material fact;

- makes any materially false, fictitious, or fraudulent statement or representation; or

- makes or uses any false writing or document knowing the same to contain any materially false, fictitious, or fraudulent statement or entry;

I breaking the law of which comes with potential penalties of up to 5 years in prison (8 years under certain circumstances).

This doesn't stop with business accounts either, lying on personal applications for credit or things like a home mortgage can also land an offender in the same hot water.

That said, nobody has to answer any question that any bank asks nor is one required to fill out an application in full. Those seeking these services in the United States certainly have the right to withhold any information they so choose to and "it's none of your damn business" is a perfectly legal response, however, this is unlikely to be of any assistance in opening a bank account.

Unless the intent is to commit fraud, there's really no sense for any of the above legal silliness.

There are plenty of banks that welcome virtual currency businesses and whereas accounts at these banks may not be as easy to open (as easy as a national chain for example) and come with additional requirements as well as high monthly fees, they exist in the United States and all over the world for that matter.

Sure there as plenty of banks that shun the industry and those are predominantly in the headlines for that very activity, but they do not make up the banking industry as a whole and where one says no, another says yes.

Which makes the actions of these two men that led to these charges a bit ridiculous if they were just trading bitcoin. If they were up to other fraudulent activity which may well be the case, then that's another story, but regardless, illegal is illegal.

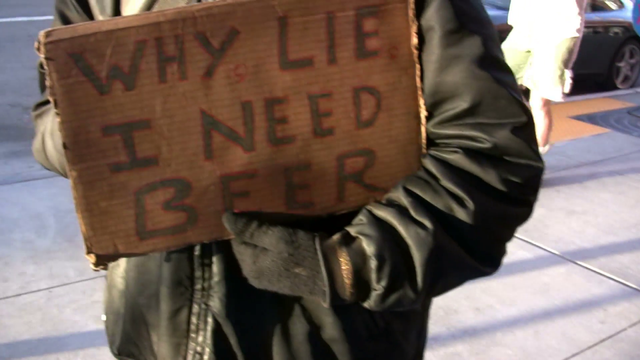

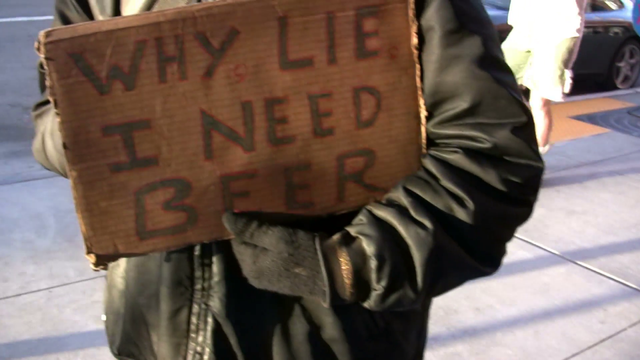

Perhaps the street corner guy was on to something all along with his "why lie? I need a beer" sign and honesty really is the best policy .... but in Fowler and Yosef's ... it was the law.

Posted from my blog with SteemPress : https://247cryptonews.com/justice-department-indicts-two-for-bank-fraud-and-money-transmission/