At least the problem of BITCOIN scalability seems to be solved...

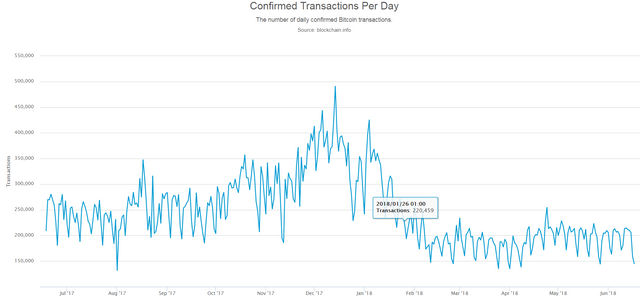

According to https://www.trustnodes.com, "After years of debate and endless arguing over how to address bitcoin’s scalability problem, the currency has seemingly finally found a solution: lack of interest in transacting with it."

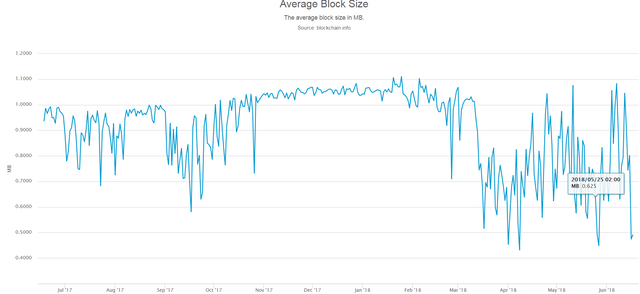

Seems that the Average Block size has been reduced from 1MB size to less than 0.5MB which is the lowest size since 2015, even if the price is 10 times higher.

And this is because, the number of transactions with BITCOIN have been reduced dramatically...

(Chart from https://blockchain.info/charts/avg-block-size)

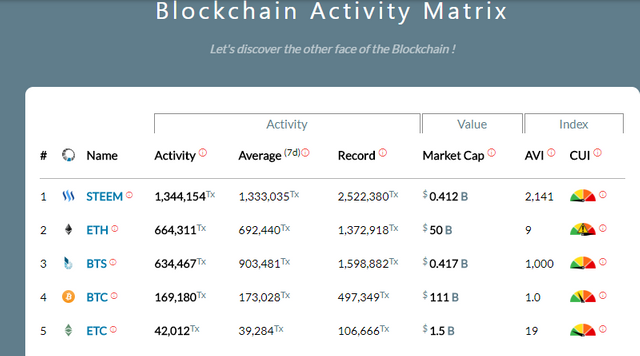

So, despite that, in a first glance, it would seem a bad performance for a crypto, the fact is that people start preferring to use other "more efficient" altcoins in order to do transactions better than BITCOIN, so STEEM, BITSHARES or ETHEREUM ar more used instead....

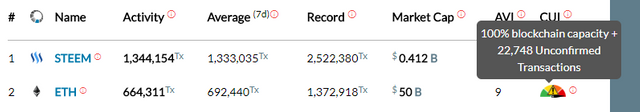

... By the way, as you can see, ETHEREUM already reached its capacity level...

So, I imagine that all the concerns about "Scalability" have now limited to ETH more than the rest of cryptos.

It is really funny how what it looked like a weakness, looks now a strength for BITCOIN and a Problem for the rest...

Altcoins base their success in their "Use Case" proposal, and so, the "usability" itself becomes a problem of scalability which all of them have to face and resolve, instead, BITCOIN solution is to become only the "Reserve of Value", so, no more worries about usability and scalability...

BITCOIN itself solve, and very well, one necessity of the cryptosphere.

The rest have to solve some others...

Enjoy Cryptoland!

Actually the decline in pending tx set in right around the time when big exchanges like Coinbase were implementing Segwit as well as batch-withdrawals. Previously each withdrawal from each customer was done as an individual transaction, but now they are all batched together and go out as one big transaction.

People have thus speculated that last year's high transaction fee and backlog was basically the result of Coinbase (and a handful others) 'spamming' the network due to the fact they hadn't implemented batching and Segwit yet.

Additionally, I visit this site a lot to see what the status of the blockchain usages are. I find it very helpful (and relaxing)

http://cryptolights.info/

It's clear that Bitcoin is the one where value gets transacted and Ethereum is the one for 'micropayments' of some kind. It has been this way for months. Neither Litecoin nor Nano see much action, although Nano really is terrible in that regard.

if you look at the $$$ being transacted in Bitcoin I would daresay it looks pretty good for BTC

Wow! amazing webpage, really relaxing.

You are right...seems that BTC has less transactions but with higher value but, now seems that there are more litecoin transactions as well :-)

Thanks for sharing it

Coins mentioned in post: