⚔️ Quick lesson: Panic and Emotion in Crypto⚔️

Over the last couple of days, crypto prices have been bleeding down to double digit losses as a result of massive panic and a tsunami of sell orders.

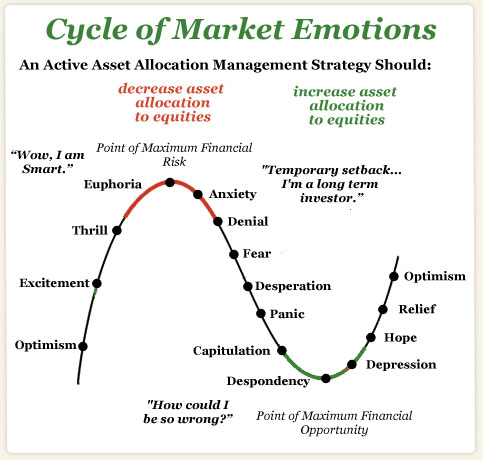

There can be many catalysts in which blame can be directed to during bear markets, however, emotion filled markets such as the Cryptocurrency market can overextend the true current value and outlook towards the underlying product.

2017 has been a Great year for all Cryptos, many have gone up exponentially, several lucky few have become rich as a result.

Unfortunately, many have just begun to find out about such opportunities and want to grab a piece of the cake before it's gone. This is called the “fear of missing out”. It is a deadly reaction every human has and experiences at some points in our lives.

So many small investors flooded the market extending it to such a point beyond its true value that risk began to set in and scare away many investors. This creates a lack of demand and sends the price downwards hitting stop losses and creating a waterfall of selling.

Fig. 1

Fig. 1

We have now reached a point where we’re at or under the true value of the actual cryptocurrency and its potential uses. As you can see in -Fig 1, a huge dip in the chart caused by panic selling and desperation have created the “ Point of maximum Financial Opportunity “, this is where we stand today. Even though sentiment has changed, no negative physical changes have been made to many undervalued and oversold crypto’s, now is the time to enter a long position.

Disclaimer: I am not in any way responsible for your financial decisions or any transactions based on my consensus. Do your own Due Diligence before entering any financial investment. This is for educational purposes only.