Bitcoin is going DOWN!!!. Should I be worried? Guide for the nervous trader...

These are the day-to-day words every new trader, -or anyone encouraged to invest their money in bitcoin or any of the more than 1600 altcoins that exist (such as ETH <3)- have to listen. So it's very likely that some of you have come to this post looking for information about the fear of losing everything you've invested in. A concern that has already brought some to the brink of suicide.

So, this post started with a premise that opens the way to new concerns. But before I answer it, let me ask you the same question.

Your wife might cheat on you in the future. Should you get divorced for this?

Another one... The career you study could no longer be profitable in the future as a result of the changes that society is going through. Should you stop studying?

One more and that's all... Maybe if you go out on the street, a little bird will poop on your head (or you'll have to face a criminal). Should you never leave your house?

The same answer can be applied, mutatis mutandi, to the case of bitcoin and cryptocurrencies in general.

Something bad can happen? Yes…

Should I, therefore, refrain from investing? No, you don't... what you DO have to do is follow the market's movements objectively

Warning 1:

This article is intended for beginners. Many things are explained in general terms. But of course, expert opinions are greatly welcome if you keep it simple ;-)

Warning 2:

In this article I will only talk about bitcoin in particular, although the premises could be applied to altcoins as they follow the same principles, and in many cases their behaviour follows the same bitcoin pattern as it is the reference pair (a pair is a currency with which the value of another is measured, e.g., BTC/USD says how many dollars are paid for a bitcoin. Likewise, crypt pairs are usually measured with bitcoin, so BTC/ETH, BTC/LTC or BTC/TTC are exchange pairs).

Moving on...

In the case of bitcoin, negative opinions arise at a time when Wall Street began to get its hands on the bitcoin ecosystem, with the opening of the futures markets in this crypto.

And... What are future markets?

Technically, they are risk management instruments that allow investors to sell an asset in the future at a price agreed upon in the present, regardless of the value of the asset at the time... For those who do not enjoy the technicalities much, then the following could be said: The futures market is a bet in which the parties speculate on the price of an asset (in this case, the bitcoin) at a future time.

Perhaps the best way to understand this is to quote from cointelegraph:

For example, if an individual owns one Bitcoin priced at $18,000 (hypothetically) and foresees that the price will drop in the future, to protect themselves, they can sell a Bitcoin futures contract at the current price, which is $18,000.

Close to the settlement date the price of Bitcoin, along with the price of the Bitcoin futures contract, would have dropped. The investor now decides to buy back the Bitcoin futures.

If the contract trades for $16,000 close to the future settlement date, the investor has made $2,000 and therefore protected their investment by selling high and buying low.

In Bitcoin, the futures contracts that won were bearish, i.e., the "Wall Street Wolves" bet (and a lot) that the price of bitcoin would go down. This new tough guy who arrived to stay in an ecosystem that until now only had people doing traditional operations, has meant a new edge for an environment that now also has to deal with significant figures in the financial world and important governments that upon seeing their power diminished, began to make significant efforts to maintain their hegemony by controlling or regulating the bitcoin trade in order to benefit from it and to promote the use of traditional FIAT money instead of virtual currencies.

But... What sustains Bitcoin? What gives it its value? If we merely say that the bitcoin is worth what it is worth "for trust" and that the distrust in it is what has generated its fall (which you will read in many of the sources... and which I certainly do not deny), then, it is precisely trust that underpins the value of traditional money today since the United States decided to set aside the Bretton Woods Treaty, basing the value of its currency on an imposed confidence and not on a reference to gold as a means of determining its value (once again, this is a very simple explanation).

Then why HODL? Here are some reasons not to sell in a hurry:

1.- The production costs of Bitcoin:

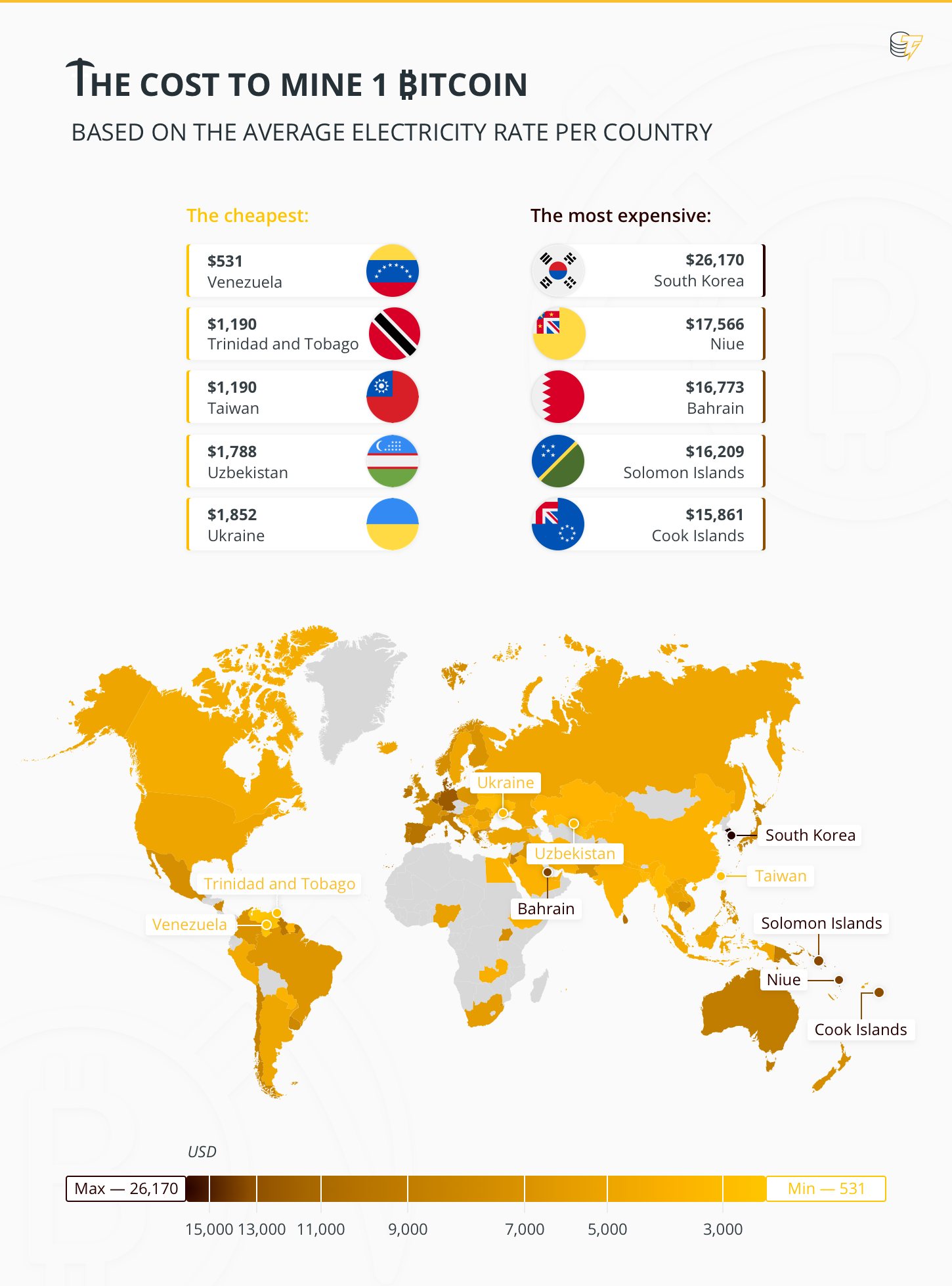

Bitcoin is the strongest crypto in the Blockchain ecosystem. A technology that many compare in importance with the one that at the time had the appearance of the Internet. But Bitcoin has some costs associated with its mining, which are currently quite high, averaging over $4000.

Below we can observe the production costs according to the countries where the most important mining pools in the world are located: In mainland China (Antpool, F2Pool, BTCC, BW), the production of 1 BTC costs $3172 in electricity alone, in Hong Kong it costs $7000, in Georgia (Home of Pool BitFury) it costs $3316, in Sweden (Home of KnCMiner) $4716 and in the United States of America (home of pool 21inc) the production amounts to $4758.

Just look at the production costs in the world to get an idea:

Just for comparison, if you want to know the production costs of 1 BTC in the United States, you can see the graph by clicking here

What does this mean?

Bitcoin's price is based on a limited offer and the need to use cryptocurrencies due to the lack of trust in the traditional system, in addition to the other benefits it provides (transparency, global acceptance, debureaucratization, "speed," etc.). This Demand will continue over time as these needs will persist, and in fact, demand is likely to increase as it becomes more widely accepted, but if the price of bitcoin continues to fall, it will reach a point where mining will not be profitable for large pools (a point it is already approaching). When that time comes, the pools will simply stop mining an unprofitable currency and go on to mine another crypto that will bring them more revenue.

But the generation of more bitcoin is precisely the reward that the miners get for validating the transactions made on the Bitcoin network, so there is no Bitcoin if there is no mining.

The simple fact of its worldwide adoption and the current difficulty of its mining means that bitcoin has to increase its price, at least to the point of stability. When that happens, the need to acquire more bitcoins to satisfy the requirements not only of new people but of the current ones that after seeing a low price decide to change FIAT for Bitcoin, will make its value rise again... then when it goes up a lot, people will stop buying it and go down, and when it goes down they will buy it and go up... and welcome to the roller coaster of the economy.

The behavior of bitcoin can be understood a little more with graphs.

Let's have a look at the explanation. (Please take a deep breath, don't get bored, and if you have any questions, do not hesitate to comment).

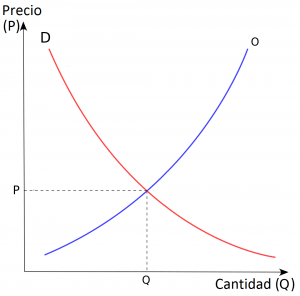

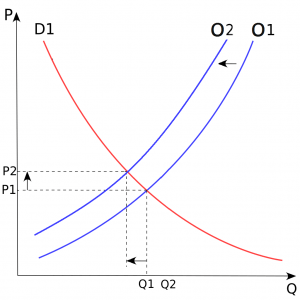

The market is like a kind of rope game, in which two opposing teams pull the rope tightly, and the one who manages to bring the other side to their field will win. The equipment is called "supply" and "demand." The graph explains the relationship between the two in the'market.' The market is the rope, where the number of goods sold and money spent will be equal to the number of centimeters that the rope moves to one side.

"Q" (X-axis, or abscissa) expresses quantity

"P" (Y-axis or ordinate axis) represents prices

So, 'D' represents the behavior of demand. The lower the price, the more goods you want to buy (something like: it's cheap, give me two). Economists say that in demand, the amount of goods bought is inversely proportional to prices.... I repeat, the cheaper this something is, the more they will want to buy it... Imagine two shops that sell candy: 1 sells them for 1 dollar and another for 2: Which one do you think will run out of candy first? Well, that's the demand graph.

"O" represents the behavior of the Offer. The higher the prices, the more sellers will want to sell. Look at it another way... If you go into a shoe store to buy a pair of shoes, and there are some at "old price" and others at "new price", which do you think the manager will try harder to sell you?, the more expensive it is, the more attractive it is for a person to sell and the more items will be put on sale ;)

When the supply and demand graphs meet, we talk about a balance. At that point, "ALL" offered is "DEMANDED." In the other points of the graph a space is produced telling that there are many unsold products because they are costly, or on the contrary, everything was sold very cheaply and buyers were left wanting to buy more. That's the point (P, Q)

Now comes the interesting part. Look at this chart.

This graph shows what happens when there is a cut in supply (for example because Jihan Wu decided to mine something else because bitcoin is not profitable). If the demand for bitcoins is the same, but the supply is reduced (the supply goes from O1 to O2), then the standard equilibrium price "P1" moves up to "P2".

Then by law, the price of bitcoin at that point will go up. Bitcoin is already an instrument of global acceptance that will hardly die.

Right now (in my view), there is simply a change in the hands of those who own Bitcoins. And the change is taking place from the "Weak Hands" (people who sell in haste, almost always at a loss, when faced with the first shock) to those who buy by betting on a natural change of trend (read Wall Street, the prominent financial actors with a lot of money, the Whales, etc.). The poor who bought expensively, are selling cheap tokens to the rich and those are purchasing cheap bitcoins now because they can store them and sell them expensive in the future.

2.- The Indicators.

This is study material, and many publications, books, and courses have been made about it. It is tough to explain in a few lines (yes...a few) what each of them represents. But very briefly, let me establish a rule that everyone has in common: Economic indicators work because they allow us to read market behavior and almost everyone (not to say "everyone"), follow these indicators and act according to the rules of the market. It must also be said that "everyone else" follows these trends. To do the opposite is to bet on the stroke of luck (like those who bought e-coin and in one day won 4000% lol). Of course, the market does not always act in trend, but we are all always looking for these patterns.

It's like the youtube videos in which a man watches a crowd run, and without knowing why, he does it... then he sees a crowd duck, and he also does it... if a good part of the investors understand that a Fibonacci spot represents a change of trend, they will act on the basis of a high probability that a shift in trend will occur even when no one can foresee the future.

If we follow these indicators, we will see that in December, the behavior of the bitcoin, which led to raise its price to $19,000 implied an over-sale of this crypto, which at any time was going to generate that all those people who bought bitcoins sold it looking to convert their investment into FIAT or altcoins. A correction was to be expected, especially in a market like this, where people enter and buy bitcoin without doing a very good job on price research.

Another indicator that many investors pay particular attention to is the Fibonacci Retracements. This indicator generates areas that are globally accepted as supports and resistances. Investors see these lines and open or close positions waiting for changes in trends to occur (changes that they contribute to produce). Minimum bitcoin prices between $4000-6000 were in a strong support zone, which led to rising prices in the 6000-9000 range.

There are many other reasons and indicators that could be studied making us conclude that there is no reason to worry, perhaps faith and confidence in the potential of bitcoin is the most important philosophical reason, but if you think Bitcoin is going to die, just ask yourself:

- Why would JP Morgan seek to ban a dead coin?

- Why do governments like China, Korea, and other European Union countries want to regulate operations and benefit from a dead currency?

- Why do the "Wall Street wolves" invest in a dead currency?

Of course, Bitcoin could go down... In fact, it might even reach 0$! But the same could be said of the market for gold, diamonds, oil, the Nasdaq, etc. It is extremely unlikely to see such pessimistic scenarios. The natural tendency of bitcoin is still bullish despite this correction, which is not yet the strongest in percentage terms that this cryptocurrency has suffered.

There's no need to be afraid if the bitcoin drops in price. There's no reason to be afraid. Perhaps the only person with real reason to be scared is John Mcafee, who bet on eating his own penis live on TV if the bitcoin didn't cost 500k by 2020.

John McAfee tweeted @ 17 Jul 2017 - 19:02 UTC

John McAfee tweeted @ 17 Jul 2017 - 19:02 UTC

@maguraaa if not, I will eat my dick on national television.

Disclaimer: Kudos to Twitter bot for the format :)

And we don't want a dickless McAfee ;)

Disclaimer: I am just a bot trying to be helpful.