MoneyToken: Quick Loans, Backed with Cryptocurrency

Many cryptocurrencies (Bitcoin, Ethereum, Litecoin, Monero) have showed a relevant value increase. They also seem quite perspective in the future. It means two things: people lose faith in traditional finance and they are getting more and more confident in the blockchain.

But if we take cryptocurrencies as payment instruments, they still don’t work properly. A lot of users regard them as investment assets and not as a currency. So, many market players prefer to hold cryptocurrencies instead of purchasing something. Thus, other users are not encouraged to transact them, as they fear to lose their investment position.

Moreover, the traditional finance system doesn’t even recognize cryptocurrencies (despite their millions worth). Even if the cryptocurrency is regulated legally and financially by the government - the crypto assets will not be applied for credits in banking.

Thus, our society needs an up-to-date cryptocurrency-backed credit model where crypto-assets (despite their volatility) serve as collateral so that a borrower may get credit in traditional money.

MoneyToken as a modern credit model with the use of the latest technologies.

Recently, there’ve been made some attempts to apply for cryptocurrency-backed loans between different market participants. But usually, they failed to provide the appropriate risk management procedures to the clients because the prices are highly volatile meaning a great risk to all parties. In addition, who is willing to get volatile crypto-assets for a collateral at all?

MoneyToken will offer a great solution here. This model will manage customers’ risks and create a relatively stable cryptocurrencies-backed credit model where these assets serve as a security deposit. This will give an easy credit access and create a next-generation market of loans and credits – crypto-collateral loans, based on the transparent and secure blockchain system.

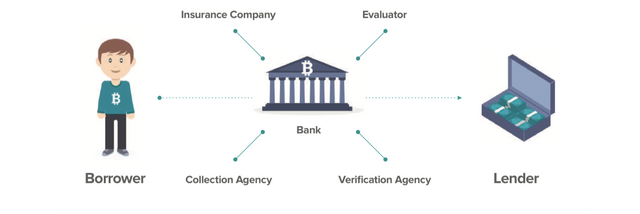

Today, before granting a loan, banks and other financial institutions assign the cost of borrowers’ assets in order to minimize the risks in case of borrower’s default. Their secondary functions: to verify assets, check credit score and collect duties and debts. This function is frequently charged to other financial organizations.

Credit system based on blockchain eliminates these obstacles. Here, the collateral asset value is completely open any time. Smart contract fixes the credit terms that are always transparent.

So, smart contracts are going to replace banks and some other organizations in the new ecosystem of cryptocurrency-backed loans. The cost of the loan will be decreased. Moreover, all the general contract conditions will be completely clear to the parties.

Now, let’s take a look at the advantages of the crypto-credit model:

- Loan is confirmed automatically within seconds;

- No credit scoring check;

- No verification procedures are provided for assets;

- The customer chooses the loan conditions himself;

- The use of several cryptocurrencies as a collateral;

- Risk minimization;

- Transparency.

How it will look in real life

Let’s say Jack owns a mining farm. He urgently needs a credit to grow his to buy the equipment that costs 500,000 USD. He has some Bitcoins in his crypto-wallet that he might sell and receive liquid money. Bitcoins can be also used as a payment for the equipment. But in this case, he loses all his investment assets.

Jack is aware that by taking a loan, backed with Bitcoin or Ethereum, he will get an established amount in a fiat currency.

When the loan is repaid, he gets back his collateral, despite it may have grown in its value a lot. Thus, by crypto-backed loan, he’s able to receive fiat funds, save his crypto investments and continue investing.

AI Helper: Amanda

Amanda provides automated loan operations, performed on the MoneyToken platform.

Amanda has a profound algorithm of AI with the machine learning. She aims at providing “human” functions for the parties to the contract. So, she acts like a real loan assistant: she analyzes the customers and their whole activity. She can also order extra financial services, track collateral or monitor loan repayments. In other words, she performs all the routine job needed within the ecosystem that cannot be carried out in a centralized way.

Amanda removes managers and intermediaries, eliminates the unknown payments, fees, vague commissions and contract terms typed in tiny print (i.e. no more “dirty game” the banks play now).

Let's briefly review the main aspects of the ICO.

Hurry up as ICO is going to close in just a day! Don’t miss your chance to invest into a new perspective loan model.

- Token - IMT

- How much - 1 IMT = 0.005 USD

- Bonus program - Available

- Platform - Ethereum

- How to pay - ETH, BTC, BCH, LTC

- Softcap $3 mln

- Hardcap $43 mln

- Location - UK

Useful and official information:

Official website

Whitepaper

Medium

Telegram

Youtube

Bitcointalk Username: CapnBDL

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=212645

My Ethereum address: 0x577FA2553Af35908072Af7fc61270fd98022002b

A lot of competition in lending, I do not understand how they collected so much money so quickly? Maybe it's falsified?

You can check by getting an investing address, look through the etherscan for example.

The author, as always, explained everything in detail and correctly, thanks to him! I'm attracted to this project and I will add it to the investment portfolio!

With the help of such a platform, many will be able to get a loan without any problems, especially those who already have a lot of cryptocurrencies.

Yes, now there are a lot of such people who managed to earn a lot of cryptocurrencies.

Cryptocurrency is very volatile, as they will be able to take it into account as a security. I do not understand until now :(

Learn the whitepaper in more detail, and you can find many answers to the questions.

Im follow and voting you

Thanks!

An excellent project, I have been watching it for a long time!

Just recently I came across this project, it turns out there are already a lot of funds collected during the ICO. I managed to invest, I think we will get very good after going to the exchanges.

I also think so. He can be listed in good exchanges.

You got a 14.10% upvote from @upme thanks to @veseloff! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).

Here is a very good team, studied it in detail, it is worth taking part in this project. Especially on so much a profitable sphere with a large capitalization.

I agree with you, thank you for your opinion!

A very good business model, how thoroughly they thought it through, I'm amazed. I hope that they will succeed, I have not seen competitors with such advantages and ideas.

I think that everything will be at the highest level, clearly, the future is excellent!