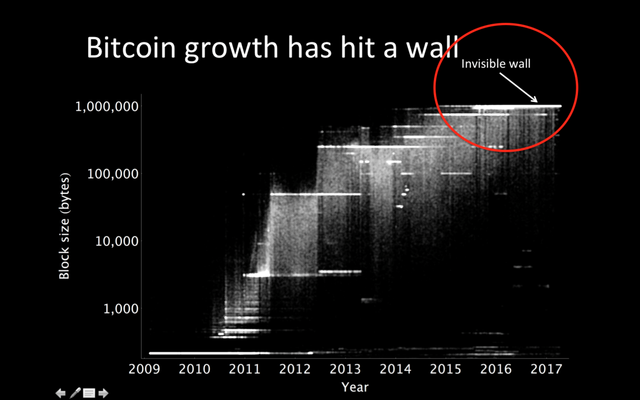

The wall of Bitcoin!

At the close of 2017, eight years on from its original launch, Bitcoin’s future looks stronger than ever. Following years of stagnation, its value has skyrocketed more than 1,000 percent over the past 12 months, and has surged over $2,000 in just the last few days.

Though it’s a relatively new phenomenon, many claim to know what the future of Bitcoin holds. Despite that confidence, should it be invested in freely? Anyone who remembers the hype train of the dot com bubble will remember too well the dangers of investing in the next big thing.

Then again, many of today’s biggest technology giants were spawned in that era, and survived to become billion-dollar companies. Is Bitcoin, like Amazon or Google, on the leading edge of a revolution? Or is it, like Lycos and GeoCities, a good idea doomed by fundamental flaws?

Bitcoin could hit $100,000 in 10 years, says the analyst who correctly called its $2,000 price Bitcoin could hit $100,000 in 10 years, says the analyst who correctly called its $2,000 price. Bitcoin's price has the potential to hit over $100,000 in 10 years, which would mark a 3,483 percent rise from its recent record high, an analyst who correctly predicted the cryptocurrency's rally this year told CNBC on Tuesday.

In December, Saxo Bank published its annual report called "Outrageous Predictions" with one of the forecasts calling for bitcoin to hit $2,000 in 2017. At the time the note was published, bitcoin was trading at around $754, so the target price represented a 165 percent rise. Bitcoin hit $2,000 on May 20.

But now, Kay Van-Petersen, the analyst behind the call, is looking long term and sees a big rise ahead for bitcoin.

How will bitcoin hit $100,000. Here's how he came up with his price target in 10 years.

Van-Petersen is assuming cryptocurrencies in general – not just bitcoin – will account for 10 percent of the average daily volumes (ADV) of fiat currency trade in 10 years. Foreign exchange ADV currently stands at just over $5 trillion, according to the Bank for International Settlements.

Ten percent of $5 trillion is $500 billion. This is the ADV that cryptocurrencies could have. Bitcoin will account for 35 percent of that market share, which would that $175 billion of the $500 billion figure, he said. This would mean that $175 billion worth of bitcoin would be traded every day.

How high?

It is perfectly reasonable to think that Bitcoin's price could go to $1 million or more.

That's not a prediction. It's just a fact.

(I have no idea what Bitcoin prices are going to do. I also don't own Bitcoin, so I don't care what the price does. And I'm not "encouraging speculation." I couldn't care less whether you buy or don't buy Bitcoin.)

So, there, I've said it. Bitcoin is probably a gigantic bubble that will leave its early religious devotees looking and feeling like fools. But in the meantime, Bitcoin could make people dynastically rich. Because the price of Bitcoin could go all the way to $1 million or more. Just as it could go (back) to $0.01.

$10,000, the “Psychological Level” Passed, Anything is Possible?

LIMIT, does that even exist?

The global average bitcoin price across major markets including the US, Japan, South Korea, and Europe has surpassed $19,000, peaking at $19,858.

George Kikvadze, a highly regarded bitcoin investor and vice chairman at leading bitcoin mining firm Bitfury, stated that the $10,000 mark was the psychological level for the majority of investors and traders in the bitcoin market. Once the price of bitcoin breached $10,000, it skyrocketed to $15,000 within a period of several days, and according to Kikvadze, anything is possible beyond $10,000.

“What a momentum. Buying up more at $13,000. As I said $10,000 psychological level was passed. Now anything is possible,” said Kikvadze.

Over the next few weeks, especially through the launch dates of CBOE and CME’s bitcoin futures exchanges and the holidays, the price of bitcoin will likely continue to surge. As the two largest options exchange in the global finance market, the entrance of CBOE and CME into the bitcoin market is expected to result in the flow of tens of billions of dollars into bitcoin in the short-term.

Peter Brandt, a prominent trader and author, emphasized that given that an interim target at $14,800 has already been met, the price of bitcoin will likely surge to $18,800 in the near future.