Crypto Market Analysis: Indodax.com June 2018

Hello everyone!

I am trying to routinely post my analysis about cryptocurrency market once in every week or two. The purpose? To exercise my technical analysis and observation skills, and perhaps to attract discussions from the other people who know a thing or two about cryptocurrency.

Before we continue, please read my disclaimer:

DISCLAIMER

This post is not an investment or any financial advice. I only try to post as a mean of exercising my technical and fundamental analysis skills, which are far from perfect. If you decide to follow what I do, you hold full responsibility and accountability of your action and its consequences to your financial condition.

As usual, I will use price actions and market from indodax.com , Indonesia's biggest crypto exchange. And note that the number may look funny (100 millions or more). Don't worry, it's just that I use Indonesian Rupiah (IDR) as the unit (1 USD = approximately 14000 IDR, data per 08th June 2018).

This time, I will look at 3 Bitcoin (BTC) as the prices of altcoins still rather affected by its price. The second is a little bit about the prediction of the market. Lastly, sharing what I will do during this month.

BITCOIN

Even though I'm not a big fa of trend lines, I can see that in big time frames, they are reliable. Such as in this BTC weekly chart. Looking at the trend line, on a bigger scale and very long term, I am still bullish on BTC. We can even expect it to reach at least 130 million IDR on October, if the trend line remains respected.

Looking closer, on daily timeframe, BTC still consolidating and doing support-resistance switch around 107 million (red line) after failed to break the resistance of around 156 million (upper black line) since early March.

I also identified 3 key levels:

The green box: Acts as a resistance before breaking the upper black line. If BTC can gain momentum, it will be most likely to smash through this level and even through the upper black line (156 million area).

You can also see that the price now almost intersects with the trend line I made on the weekly chart (blue line). One would easily expect for the price to bounce up after hitting the trend line, thus starting to buy and expect the price to rise.

However, I don't think that would be the case. I have been in the crypto space for too long. My intuition tells me that manipulation is coming (well, that's what you get after being sucker-punched so many times by the manipulators). And I think that the price will drop to orange, or even red box instead. Why? because of these news (source: googled bitcoin news)

The second news told us that the latest volatility might force a big breakout. Of course, the price is being wedged by the red line (daily level) and the blue line (trend line from weekly). There can be only two options: breakout above, or breakout below. However, the first and the third news are definitely FUD (fear, uncertainties, doubt), and as far as I know, FUD is one of the most effective trigger for dumping the price. That is why I am still bearish on BTC, not on the long term, but on the short-mid term (on a scale of days or weeks).

The other factor that makes me kinda sure that the price will still drop further, is that now we are approaching weekend and Eid-al fitr. If you are in the this industry long enough, you would notice that about 80% of the weekends are when the price would drop only to rise again on Monday. I even made some nice profits by applying this knowledge.

Furthermore, like Christmas and Chinese New Year, this holiday will most likely affects the market. People are selling their assets on holiday occasions. So a sell-off, and ultimately drop in price is highly probable.

Should we, investors be worried? After all, one cannot help but to think that their investment can go to zero anytime now.

I don't think so. Even if the price does plummet, it will be just a temporary manipulation for the big players to kick small and weak players. We can see that no too long ago, billionaire George Soros decided to invest in cryptocurrency. Also, the institutional investors have made their move to start to invest in bitcoin.

Taking into account that most of the social media wanted to ban any cryptocurrency-related ads this July, everything starts to make sense. Their decision to ban cryptocurrency-related ads was to drive away, or at least minimize scams and the so-called shitcoins from the market, so that the real, big, and reliable investors can play safely in this crypto space. If that's the case, do you think the price will plummet lower? at least than my predicted levels? Investors are starting to get their eyes on bitcoin instead of stocks. Therefore, this crypto market is actually going towards healthier market (I cannot say anything about the future state of manipulation, though). As I said before, I am bearsih on short term, but bullish on the long term. As investors, we have to be patient after all, don't expect to gain 10x overnight without risking to lose 90% overnight.

BITCOIN AND ITS DIMINISHING DOMINANCE

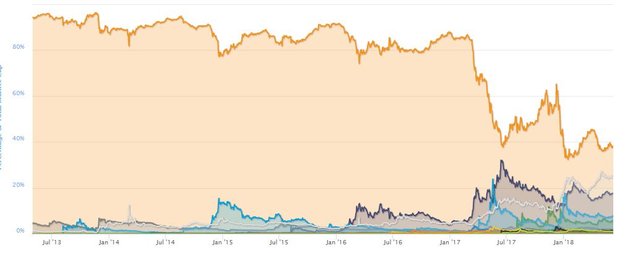

Another factor to take into account is the diminishing dominance of bitcoin, and how we can take advantage of it. From coinmarketcap.com, we can see this chart:

You can see that the dominance (a.k.a percentage of capitalization relative to overall market cap) of BTC is falling from over 90% long ago, to only about 35% now. What does this mean? It means that people are starting to look away from bitcoin and moving on toward altcoins. If that's the case, then we would finally see the day when altcoins' prices are not affected by bitcoin's price. We can finally invest in a market that not being dictated by only one asset.

Here's another opportunity:

I told you that institutional investors, big players, etc. are going to invest in bitcoin right? If you observe them, the billionaires, institutional investors, basically the owners of big money, they are very careful on investing. In fact, too careful and cautious. For example, Warren Buffet once refused to invest in a technological company until years later he finally decided to invest in Boeing. Their principle is to not invest in something until they really know about it (which figures out why the "big players" are starting to invest in bitcoin now).

For us, millennials, perhaps this is the opportunity to invest in altcoins. I don't think many of the big players are eyeing for LTC, XRP, ETH, let alone small coins with lots of potentials. So it might be almost the best time to invest in altcoins. Here's why:

- Their price will go down as well if BTC price plummets to the level I mentioned

- Once it is over, with more and more adoptions and BTC's diminishing dominance, altcoins will break free from bitcoin's influence.

- The big players will most likely leave it as it is for a while, while rigorously (or rather, being too carefully) studying the altcoins.

MY STRATEGY

The next breakout will be interesting. Either bitcoin will plummet, or it will skyrocket. Either way, I use dollar (in my case, rupiah) cost averaging strategy to make sure that I can get some profits, while saving my capital. Instead of waiting for the best time to buy, I would just buy little by little cryptocurrencies. Let's say every weekends, during the weekend swing that I mentioned before, I buy some XRP, then next weekend, I buy some LTC, and so on and so on.

This strategy works best for me. I don't have to really look at the chart that often. Instead I just consider that my transactions (buying crypto every weekends) is like saving money. And I won't use the money unless in emergency, and I invest not more than I can afford to lose.

And once again, I want to stress that if you decide to follow my analysis and steps, you are responsible for anything that happen to your financial condition, as I am not giving a financial advice, rather only sharing what I know.

Happy weekend!

Coins mentioned in post: