A Bitcoin Pizza Decade

Bitcoin Pizza Decade

The introduction from the first time the “Bitcoin Pizza Day” topic made Forbes in 2013 when BTC exchange rates reached over $100, is just about as timeless as internet content gets.

This is a fable for the Bitcoin bubble (or not?) that we're living through this year. Back in 2010, Florida programmer Laszlo Hanyecz talked someone into accepting the 10,000 Bitcoins he'd "mined" on his computer in exchange for two pizzas.

Since then, every year in early March, media outlets begin running the same ‘how mad are you that you could have been rich?’ story about the programmer who “talked someone into accepting” Bitcoins for pizza.

At the time, there was no exchange rate for BTC. There was no Mt. Gox, no Binance, no Coinbase. There were less than 300 active Bitcoin wallets in existence. Uber Cabs had just launched their beta services that month. At the time, online food ordering was totally uncommon. GrubHub had been founded years prior, but had only raised $12 million in venture funding to provide services in only 12 states.

This was months after the devastating earthquake in Haiti which killed roughly 160,000. Europe was at risk of a double-dip recession after reporting the Eurozone only grew by 0.1% in the last quarter of 2009. In America, Obama had just signed the HIRE Act, putting $17.5 billion into job creation and $20 billion into the highway trust fund, while Goldman Sachs was in court for securities fraud, eventually paying out $550 million without admitting fault.

Since the internet boom of the early 2000’s the value of the USD dollar had plummeted. The 2008 financial crisis brought about the lowest U.S. Dollar Index Value of all time. In May 2010, it was dropping right back down again, and with this slide came the beginning of a global currency war.

But tucked away in a little corner of the internet in May of 2010, Laszlo posted his fabled request for pizza to the 7 month old BitcoinTalk community of no more than 200 total members. He offered what was roughly $40 worth of BTC for two large pizzas, maybe loaded up, maybe not:

I like things like onions, peppers, sausage, mushrooms, tomatoes, pepperoni, etc.. just standard stuff no weird fish topping or anything like that.

I also like regular cheese pizzas which may be cheaper to prepare or otherwise acquire.

No matter the interview, it’s clear the guy isn’t mad about the past. He was just having fun with the possibilities of a new technology and its infant community. Not only was he trying to give a deal, he was accounting for tipping the delivery driver.

The exchange is favorable for anyone who does it because the 2 pizzas are only about 25 dollars total, maybe 30 if you give the guy a nice tip. If you get me the upgraded extra large ones or something, I can throw in some more bitcoins, just let me know and we'll work something out.

In fact, he was getting flack for his imbalanced pizza to BTC exchange rate just two months after he proposed the open ended trade by other users on the BitcoinTalk forum thread, when the value of a Bitcoin grew from less than pennies to a few whole pennies.

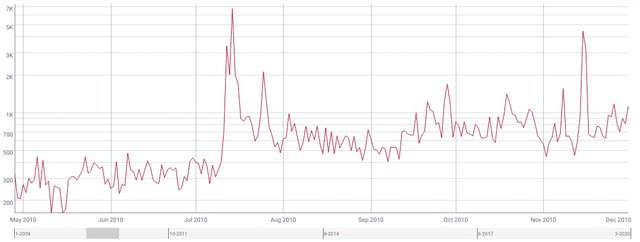

By the end of 2010, the price had reached over nickels, over dimes, to two whole quarters per BTC. The market as a whole, all of Bitcoin, reached a $1 million USD value on November 6th 2010, and by the end of the year, there were over 1,000 active Bitcoin wallets. 837 new members joined the BitcoinTalk forum in the month of January 2011 alone.

Network Effects

One of the common arguments against Bitcoin and other cryptocurrencies is that they have no inherent value. This can be defended in a number of ways, but one of the most basic principals working for Bitcoin is network effects - the correlation between additional users of a product or service and its value to potential customers. Tangible examples of the result of network effects for cryptocurrency are services such as Bitcoin ATMs, cryptocurrency payment processors and the increase in value since its creation in 2008. But on a smaller scale, trading Bitcoin for pizza is an example of the kind of user engagement that sparked this potential for Bitcoin to become a globally exchanged currency.

In 2010, just as countries around the world were bailing out governments, corporations, and pouring stimulus money into the economy, Laszo started the same with his extra Bitcoin on a micro-scale. Instead of hoarding them or storing them on a hard drive to forget about, he looked for opportunity in the present. And It’s important to note that Laszlo thanked “everyone” who bought him pizzas, for two reasons.

Network Effects - How many users did buy him pizza? Did anyone specifically decide to mine Bitcoin to make $40? Remember that with less than 300 active Bitcoin wallets at the time, just one person making that decision affected the whole.

This was a gift exchange between Bitcoin community members. Laszlo didn’t just purchase two Papa John’s pizzas for 10,000 Bitcoin. He gifted another user the BTC, in exchange for the service of ordering two pizzas and paying for them with USD. In one way, this negates the benefit of Bitcoin as a “trustless” medium of exchange, because the two payments were made separately. However, this kind of trust-based community engagement is a consummate example of why some products or services catch on, while others never gain the momentum needed to reach a mass audience.

Today, there are millions of BitcoinTalk forum members, the active wallet number is more like 600,000, the total market cap value for Bitcoin is over $120 million, and the total after taxes but before a delivery fee to order a couple sausage, pepperoni, banana pepper and onion, large pizzas from Papa John’s are $45.45.

So while Little Caesars Hot-N-Ready Pizzas have been $5 since 1997, focusing on the efficiency in pick-up service, Papa John’s seems to be working a different angle to continue their growth, including a pivot from a pizza place to… papadias? A niche combination of “Part Pizza. Part Sandwich.”

However neither Papa John’s, Little Caesars or any other of the major pizza chains accept direct cryptocurrency payments. Many food delivery services have followed Grubhub’s growth to a $3 billion dollar company. There are several around the world which offer delivery that accept cryptocurrency payments.

You might ask, why a Papadia? Why not just get a pizza? Why not just get a calzone? Why not just get a warm italian sandwich? But in the same light, one might ask, why Bitcoin? Why not just use cash? Why not just use Paypal? Why not just a credit card?

The world is now dealing with another potential financial crisis due to widespread business closures in the wake of COVID-19. The EU is looking at up to 1.5 trillion Euros. America is preparing a stimulus bill for as much as $2 trillion.

Why buy pizza with Bitcoin? Because you just never know.