Wave 2 progressing, part III

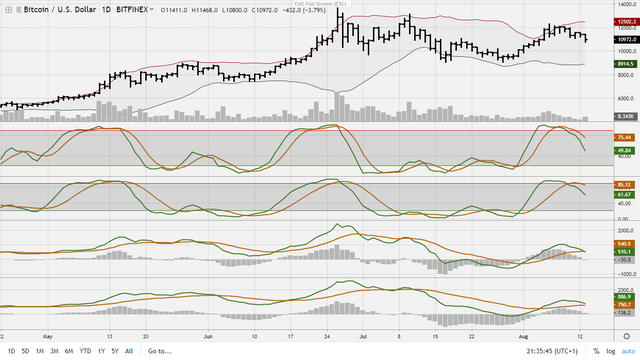

Corrections are notoriously difficult and this one is no exception. On the one hand there is the argument that we should go down more as the 21 exponential and simple moving averages have not been hit; as well as the Fibonacci target area which has been touched only slightly. For this to be a nice, principled correction, we should make another bottom at or at least near the previous one at $9100, preferably a bit lower.

On the other hand, there is the continuous threat of breaking out to the upside - and we can move towards the previous top at $13.5k easily - before dropping down hard to again $9100.

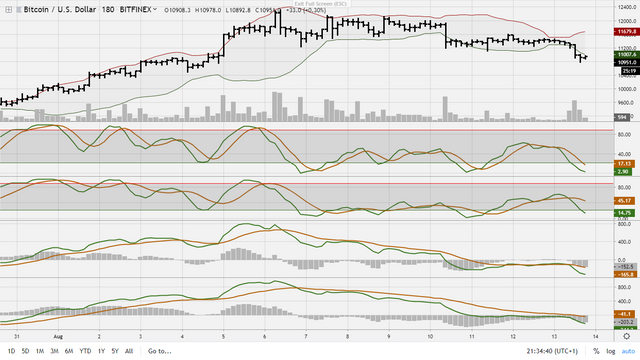

In addition, the shorter term indicators look very oversold with even some divergence on the 3 hour chart.

We should therefore move up short term. What kind of a move that will be remains a surprise. Only when the indicators enter less oversold terrain will there be room for more downwards momentum.

I have sold half of my shorts at more or less break even (my entry was plain bad).