Who leads the Bitcoin Industry?

Here is a Sneak Preview of my Guest Speaker Address to a big "Bitcoin" meet-up in Austin, Texas next Monday evening.

I'm still working on what I'll say, but knowing me, it's probably going to be controversial. Here's the meet-up organizer's flyer - I'll allow them a little poetic license with the facts.

Presentation Overview

I thought I'd give you the general outline and points of controversy and solicit a few hoots and catcalls. Dare I mention BitShares in the same company as elites like Bitcoin and Ethereum?

Why, exactly, are they considered "the elite" anyway?

And what about Steemit, Peerplays and EOS? Don't worry, they are covered as part of the growing "BitShares Industry." And with all the high-quality, legal ICO's we've got coming and able to operate at light-speed, Katie bar the door!

I understand why coinmarketcap.com uses market cap as a popular way to rank the thousands of coins out there. After all, that's directly proportional to "price" which is what everybody wants to see grow for the coins they bet on. But market cap is such a lagging indicator. It predicts the past! What other metrics can better predict the future? I've picked two of them. I'm sure you can think of more.

People speculate on Price under the theory that "nothing succeeds like success." That's true, but what will ultimately matter is adoption. And that, I think, is more a factor of Utility and Performance. At least that's what I'd like to think my high-priced engineers are looking at when they choose which platform to build on. If I ever thought they were basing my company's choice of foundational platform on its token price or its popularity with their peers, I'd have their heads.

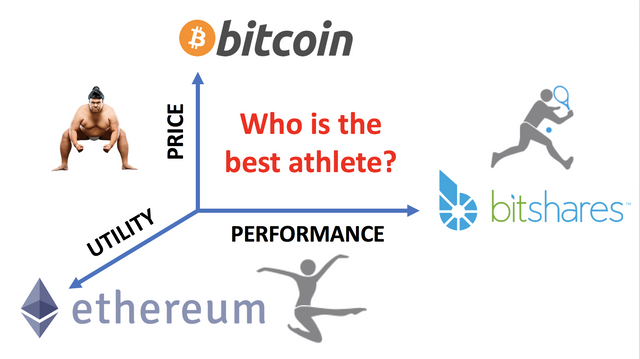

What happens if we compare merits on a 3-D graph?

Suddenly some new insights come into focus!

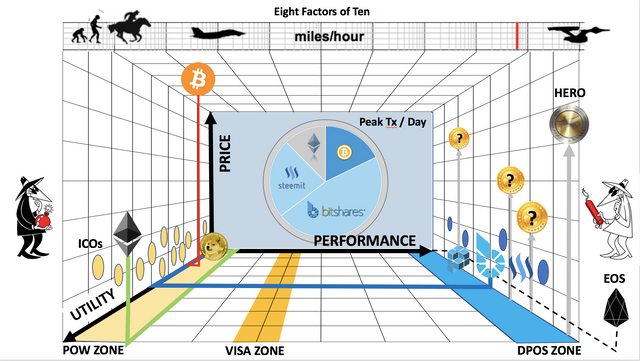

The first thing you should notice is that I have plotted the coordinates of several well-known cryptocurrencies on the three axes of Price, Utility and Performance. Bitcoin, Ethereum, and BitShares all sit at the max for the axis they dominate and fall significantly short on the other two.

The Price axis is linear, while the Performance axis is logarithmic - spanning eight orders of magnitude between Bitcoin and BitShares when you consider the product of latency, bandwidth, and efficiency. That's the difference between the performance of the pony express and NCC-1701 (no-bloody A,B,C, or D).

The Utility axis is the most subjective with Bitcoin having just one function made more useful by its level of adoption. Ethereum's utility is greatest because it is "Turing complete" and "Programmable" by anyone. BitShares is somewhere in the middle as a full-featured smartcoin factory and decentralized exchange. (It is also Turing complete and programmable using the C++ language, but you have to get approved by its owners to make any changes.)

All the other ICO coins and clones sort out into three regions of the cube, generally associated with the coordinates of these three platforms. EOS lies "outside the box" at this point, but is likely to soon stretch all three dimensions.

The most striking feature of the chart for me is how clinging to mining has kept the other two "leaders" confined to the narrow Proof of Work "POW Zone" characterized by transactions per second under 30, latency measured in minutes to hours, and contributions to global warming comparable to a squadron of coal power plants. The Delegated Proof of Stake "DPOS Zone" puts the BitShares family in a whole different category by itself, setting records in the VISA band at 3300 TPS and scalable into the 10,000 to 100,000 TPS band to handle all the world's needs.

This will be decisive, because Performance the only thing that should really matter to companies building on it. What, exactly, is the benefit of your platform having flexibility for anyone to change your code on the fly or a market cap that doesn't affect the users of your product in any material way?

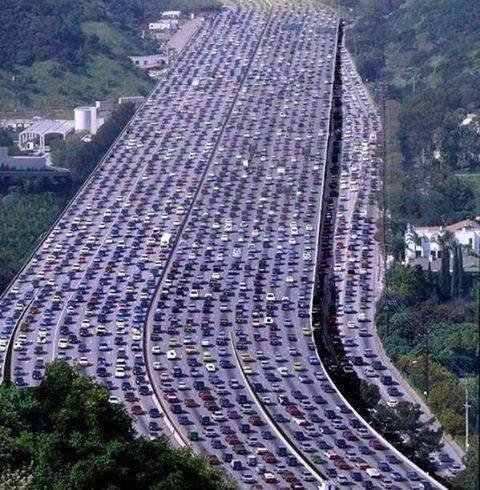

This is where I make the most hay when talking with CEOs of companies getting ready to deploy a new blockchain based business. I point out all the products being developed in the POW zone and they beam, "Isn't that great? We were smart to pick the same platform everyone else is using!"

Then I ask them what happens to their millions of anticipated customers when all those new products come on line competing to use the same 30-or-less transactions per second? Won't it be like cleverly putting their mission-critical traffic on the same crowded highway at rush hour?

They don't usually fire their technical advisors until after I leave their board room.

Actually, adoption is a mixture of utility value and public perception, which is managed by marketers. Thus it becomes a balance between technology and business interests.

Marketing AND technological prowess are the 2 primary factors projects have direct control over. It's no surprise to me that the projects with the biggest marketcaps are those with strong marketing (not counting Bitcoin, it is biggest b/c it has 1st mover advantage & years of additional use / history).

@stan & co have been making some HEROic efforts to move public perception!

Any nerd that buys a Bitcoin I suppose.

100% Free Bitcoin - Instant Payouts

Earn Free Bitcoin At BitFun: http://bitfun.co/?ref=E055C4EECADC

Earn Free Bitcoin At Bonus Bitcoin: http://bonusbitcoin.co/?ref=904878D5EC1B

Earn Free Bitcoin At MoonBitcoin: https://goo.gl/eBx3ZF

Use The Free Bitcoin CoinPot Wallet: http://CoinPot.com

Buy, Sell And Trade Bitcoin At: http://FlippyCoin.com

Earn Free Bitcoin On This Mobile Game Free Bitcoin Spinner: http://coinspinner.me/c/3N0MXG

Hello & Cheers!! I'm a content detection and information bot. You are receiving this reply because a short link or links have been detected in your post/comment. The purpose of this message is to inform your readers and yourself about the use of and dangers of short links.

To the readers of the post: Short links are provided by url shortening services. The short links they provide can be useful in some cases. Generally their use is benign. But as with all useful tools there are dangers. Short links can be used to hide all sorts of things. Quite frequently they are used to hide referral links for instance. While not dangerous this can be deceptive. They can also be used to hide dangerous links such as links to phishing sites, sites loaded with malware, scam sites, etc. You should always be extremely cautious before clicking on one. If you don't know and trust the poster don't click. Even if you do you should still be cautious and wary of any site you are sent to. It's always better to visit the site directly and not through a short link.

To the author of the post: While short links may be useful on some sites they are not needed on steemit. You can use markdown to format your links such as this link to steemit. It's as simple as

[steemit](https://steemit.com)Unlike short links this allows the reader to see where they are going by simply hovering over the link before they click on it.I don't see Bitcoin spending money on marketing. Word of mouth is it's biggest advertisement which has always been the most effective means of advertising, especially if that mouth is one that the listener trusts!

Yep, which is why I excluded Bitcoin from my marketcap generalization (last sentence in parenthesis).

Segwit2x has been cancelled: https://steemit.com/segwit2x/@usethebitcoin/mike-belshe-segwit2x-will-be-suspended

Take a look at it. Thank you.

Yes. Marketing and industry networking skill could definitely be another revealing axis to consider.

Indeed. I would love to see the magnitude of the marketing money projects spend.

Segwit2x has been cancelled: https://steemit.com/segwit2x/@usethebitcoin/mike-belshe-segwit2x-will-be-suspended

Take a look at it. Thank you.

Absolutely stunning post @stan. This is the type of content I wish to see more of on Steemit.

Though I am of agreeance that Proof-Of-Work is sub-par in comaparison to the new model of Proof-Of-Stake model, it was matter of evolution. Bitcoin gets a pass as the genesis of the Blockchain and POW was absolutely necessary for getting off the ground, not to mention the only workable model when Satoshi modeled it.

It is still shocking to me that all of this has conspired in just 9 years after the release of the Bitcoin Whitepaper, and as, yes, there is alot of enrgy wastage in Bitcoin POW model, it will run out eventually, but in return, we have ushered in a revolutionary technology. For that I believe the cost is well deserved.

I absolutely love your 3d representation of a coins value and you are absolutely dead on the money.

I am tall by nature (1.91m) and people ask me all the time if I play basketball, for the singular metric that I am tall! By virtue of my heright I must be great at basketball. Nobody asked me if I have practiced tossing a ball accurately into a hoop 10,000 times to be any good at it.

The answer is no.

In another scenario, yesterday, a good friend of mine asked me if I was certain the price of Steem will increase in due time.

My answer was, I have yet to educate myself on whether or not that would be the case. Perplexed, he asked how I could be so invested in the Steemit platform if I wasn't sure if the price of Steem would increase?

My point was that I was on Steemit because of it's utility and almost nothing to do with it's price.

This is the first I've heard from you, but I am certain I'll be around for more.

Thank you for the great post and God Speed Brethren.

Would be nice to see Steem and Bitshares get a little love!

This is one seriously good answer, humble, to the point, a tribute to the development of Bitcoin as well as Bitshares, Steem, and so on...

Great job again! Namaste :)

Thank you brethren! Always good to see you making the rounds!

I am already working on my next big piece ;)

It is a pleasure @bitopia. Mine coming up today, later... ;) I look forward to seeing the next one. Namaste :)

Segwit2x has been cancelled: https://steemit.com/segwit2x/@usethebitcoin/mike-belshe-segwit2x-will-be-suspended

Take a look at it. Thank you.

steem is forming a beautiful cup and handle. technical analysis shows us of the sentiment, i believe it will moon.

I'd love to know more! I have not put in the necessary time to find out why Steem's price would increase. Care to enlighten me?

i'm basing this purely on the charts. i'm a long term investor, and i've learned that it's best to buy at the right time -- not when it's all time highs. if you check other alt coins (like vertcoin or verge right before they mooned), they formed this pattern - a "cup and handle patter". it's market sentiment.

i also believe this is true of bitshares as it is still forming the bottom of the cup

Hi, Stan!

I'm glad you posted this so it can get some scrutiny before you jump into it. As always you are bang on when it comes to technicalities. And that is all good.

But you don't understand market capitalization. Contrary to what you think, MCAP is a indicator for the future. After 15 years, including a financial chrisis in the stock market, I know this too well.

A standard industrial company is typically priced at 10 years earnings. A pharmaceutical company often 30 or even more years of earnings. Even if they loose money at present, it's not uncommon to see forecasted earnings priced in.

When market cap falls under a certain level compared to its peers, the market predicts negative growth.

The market is never 100% efficient. It is also never 100% right. But it has a escalating effect when negative growth is to be expected.

Now this is related to stocks. You could argue it don't apply to currencies. And I would say you're right. But when you examine (especially) the dpos systems, you will find they all have a corporate democracy. One share, one vote. So I would argue that market cap is an important measure. It says something about the company's ability to generate growth and prosperity. And for bitshares (and steem) it is pricing in negative growth.

the good news here is that the market is never right. That's why it keeps moving up and down. There is more good news. It is only the markets PERCEPTION that equals the price, or market cap when you compare with peers. Change the perception and you get a trend reversal.

So how to change perception? Make a profit! Be excelent! Innovate! Be responsible!

Check out this site. It's designed to alter the perception the market has towards cryptocoins.

Blocktivity.info

I already know that. I have shared that site where I find it appropriate. Like when I meet somone that likes waves. One would like to think they would understand there is a uneven match? No. There is not. Bts is heading for negative growth. + the team is so cool in the peer. It's not rational. The fear for negative growth and missing out on the cool team makes waves soooo much better.

Segwit2x has been cancelled: https://steemit.com/segwit2x/@usethebitcoin/mike-belshe-segwit2x-will-be-suspended

Take a look at it. Thank you.

Great points. Market cap can be thought of as the integral of perception over time. It does, theoretically, integrate all public knowledge about the product, including performance and utility and misinformation and faulty conventional wisdom. I'm pretty convinced that in this industry the last two so distort the metrics, that its better to look at raw performance and utility...

ESPECIALLY if you are evaluating which product to build you own business on instead of merely which coin to buy as an investment.

Segwit2x has been cancelled: https://steemit.com/segwit2x/@usethebitcoin/mike-belshe-segwit2x-will-be-suspended

Take a look at it. Thank you.

Segwit2x has been cancelled: https://steemit.com/segwit2x/@usethebitcoin/mike-belshe-segwit2x-will-be-suspended

Take a look at it. Thank you.

i believe the charts and technical analysis help us discover the sentiment of the people regarding a company/crypto. if this is true, bitshares and steemit are actually bullish!

Quip of the Year

This is one of my very favourite post of yours so far: The 3-D graph is powerful and speak loudly!

Thank you for sharing and educating us all, giving us all a chance to partake, learn and share in this venture to be grown beyond compare and all our dreams.

All for one and one for all! Namaste :)

Segwit2x has been cancelled: https://steemit.com/segwit2x/@usethebitcoin/mike-belshe-segwit2x-will-be-suspended

Take a look at it. Thank you.

I really have no idea what makes one coin stand out vs another.

Well thought out Stan and love the graphics. You have my full support mate :)

Fantastic post @stan and I look forward to watching your interview with your guest speaker when it's uploaded.

Anton

Great post

Awesome article!