Introducing a Digital Currency Alternative to Traditional Payment Systems - COTI

Do you know over 1.6 billion people make payments online? Are you aware of the fact that $2 trillion of business activities took place online in 2016 and is projected to be minimum double in 2020?

E-commerce is a major player in the digital world with more people coming online to make diverse transactions rather than engaging in the traditional (offline) method of trading. The value of US in-store mobile payments according to recent findings is said to grow 80% yearly from 2015-2020 which will automatically attract a corresponding increase of over 150 million mobile users in the same year.

Many platforms have invented quite a number of decentralized online payment technologies to advance e-commerce but are yet to scale in volume and fast deliveries which negatively affects cryptocurrencies. Even with blockchain systems to help ease and speed up the issue of transactions per second (TPS), the problem still proves difficult.

For emphasis, below are some of the major problems faced by online payment systems denying users and merchants of their maximum satisfaction:

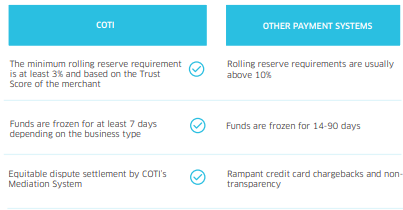

• High Processing Fees and Long Settlement Periods: To make transactions online, you will be charged certain fees like annual fees, late fees, and many others by credit card networks for a successful activity with the lengthy period of time used in processing these payments.

• The absence of a Shared Trust Mechanism: Buyers and sellers who have worked hard to reach high ratings especially with the online marketplace that uses credit scores and ratings will likely lose their positions whenever they migrate to a different marketplace.

• Lack of Diverse Currency Support: Credit cards accept fiat money but users do not have control over currency exchange rates and besides, digital currencies do not work on credit card networks.

Despite how recognized the online payment system is, there are some issues that need to be addressed. So many platforms have tried; so many technologies and systems have been invented but all to no avail. Can anything be done about this? Yes, COTI has invented the solution to these issues facing the industry.

COTI is a decentralized and scalable global payment system, out to end negative feedbacks facing e-commerce and to make digital currencies largely acceptable by buyers and sellers as a method of payment. The currency of the Internet (COTI) will be adopting the following features:

• Instantaneous Remittance: A DAG (Directed Acyclic Graph) approach will be used in distributing ledgers across to users and merchants in order to be able to track diverse payments.

• Trust Scoring Engine: This technology will be used in coordinating interactions between buyers and sellers worldwide. It gives users and merchants the opportunity to make their own decisions and makes available a numerical representation of every transaction.

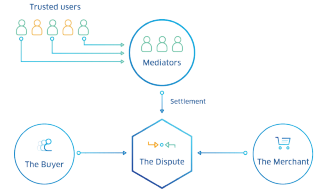

• Mediation System: This aspect of the network serves as the solution centre as it settles disputes between users and merchants maintaining its reliability.

• Currency Exchange: Unlike other platforms, COTI accepts diverse currencies both fiat and digital and migrating from one marketplace to another is HIGHLY encouraged. Integration, exchange and migration are maintained by an automated market-maker in order to ensure fair and organized activities in a range of currencies.

• Application and Services: COTI provide it consumers with wallet and debit card for secured and successful transactions while merchants use the network’s processing solutions for payments and accepts diverse fiat and digital currencies at a lower processing fees and mediators will also be allocated to specific clients who they can contribute to and be compensated for every successful transaction.

Every year, online payments amount to over $50 trillion but consumers and merchants still complain of high charges and low approval rates on transactions. Some of these online channels are seen below:

• Cross-border E-Commerce: In 2020, cross-border B2C online business is projected to hit $1 trillion. Card payment using this channel attracts higher transaction fees, high abandonment rate coupled with lower approval rates.

• Online Marketplace: This channel connects buyers and sellers to an existing payment system. Payments are done internally by the operators but the marketplace lacks the relevant funds to manage the operational issue facing it.

• Peer-to-peer Commerce: Money transfer is the key function here and because of this, it fails to associate itself with the delivery of goods and services.

COTI was designed to correct every fall facing the industry and to introduce the next-generation payment network that will encourage more users and merchants to adopt the online payment system without any fear. The following are some of the problems the network is out to solve:

• Scalability: Due to the ever-growing nature of online payment, it has faced serious congestion resulting in increased charges and slow settlement times. COTI provides instant payment solution to ensure speedy settlements at lower charges making it more accessible and user-friendly for traders.

• Speed and Consistency: It takes more than 6 times to process and 30 minutes to 16 hours on an average to verify Bitcoin. COTI has made this easier with an improved system that will take less than 30 minutes.

• Legality and Security: Online payment is associated with issues like money laundering and fraud getting people scared of engaging. COTI network safeguards against errors, frauds, and other suspicious acts.

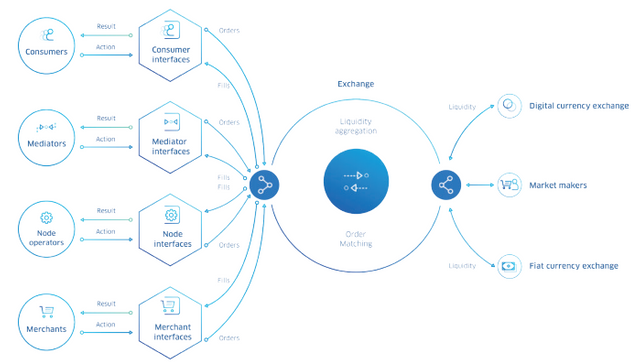

THE COTI ECOSYSTEM

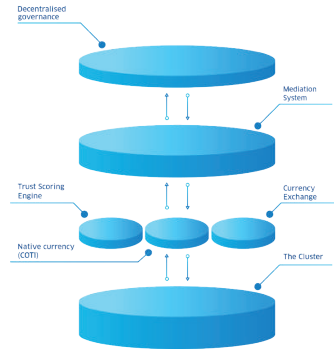

It provides an advanced payment solution through a distributed ledger technology (Cluster) that functions better than the existing card and cryptocurrency systems. COTI base protocol, native currency, mediation system and trust-scoring engine were built for payment solutions where users, merchants and mediators can operate decentralized and scalable activities.

Confirmation Process

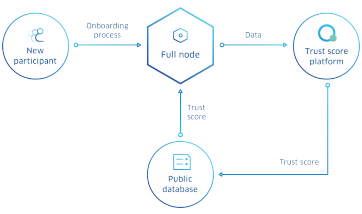

To be added to the cluster, every user’s transaction through a trust score must validate two former transactions with the same trust score threshold and this transaction automatically forms a trust chain.

Nodes

With a decentralized payment system, every transaction is safe and carried out on the distribution of transactions in a cluster to different nodes ran by users. The nodes comprise the full nodes, DSP nodes, and History nodes.

Trust Scoring Mechanism

COTI uses a novel approach to build users and merchants trust through its Trust Score Mechanism. The network also adopted the DAG-based consensus algorithm to validate transactions through its Trust Score to ensure the reliability of information.

Mediation System

This aspect of the network ensures a decentralized governance, security and reliability of the system in order to provide users and merchants verified information rather than errors, fraud, and counterparty abuse.

Some areas that require mediation include:

• Billing errors.

• Inadvertent transfers

• Unauthorized charges

• Undelivered goods or services

• Non-conforming goods or services

Currency Exchange

COTI provides a platform where diverse currencies can be accepted for a friendly payment solution. It creates a network for continuous access to tradable markets in a range of digital and fiat money pairs.

Decentralized Governance

For a successful ecosystem where anybody can make online payments, COTI explored different decentralized governance models. It gives users and merchants every right to trade different currencies in different markets with low-to-zero charges. What are you still waiting for? Try COTI today.

Other Key distinctive features of COTI

• The wallet supports multi-currency payments and also enables users to securely store digital and fiat currencies.

• Provision of a secure Point-of-Sale system solution, payment widgets and API to enable merchants easily connect with buyers and also select their preferred method of payment.

• Provides hedging services for merchants due to the volatility of digital assets.

• users will have access to COTI debit cards

• Allows third-party vendors to leverage on the COTI technology to develop their applications

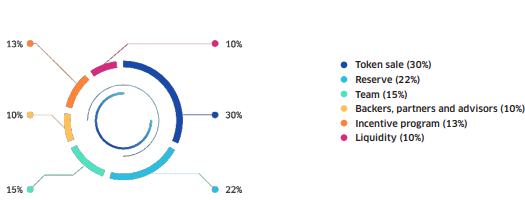

TOKEN

The COTI token (COTI) will be issued in the form of an ERC-20. It will function as a multi-utility token which will be used to fuel the COTI platform.

Total Supply: 2,000,000,000 COTI

Token symbol: COTI

Hard cap: 30,000,000 USD

Current price: 1 COTI = 0.1 USD

Mode of payment: ETH, BTC

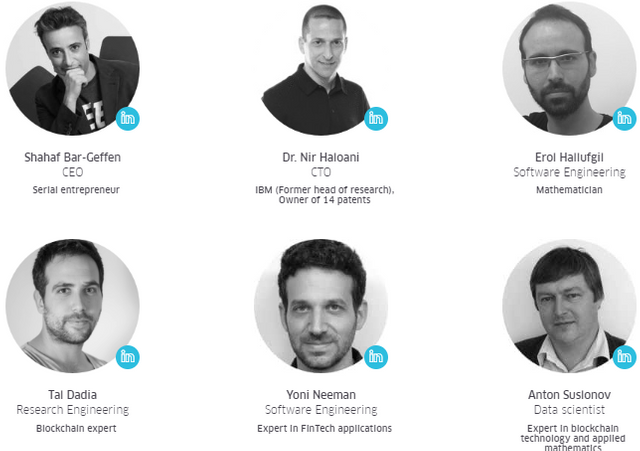

TEAM

Kindly visit https://coti.io/ for more information.

Whitepaper: https://coti.io/en/files/COTI-technical-whitepaper.pdf?v=c392fd0bc30

Twitter: https://twitter.com/COTInetwork

Telegram: https://t.me/COTInetwork

Bounty0x user: ammier