Initial Development Offering - a new approach to fundraising

Intro

Making a complex blockchain project incurs huge development costs, which is why traditionally founders resorted to running a crowdfunding campaign in form of an ICO. It proved to be a decent fundraising tool, however over time its downsides started being more and more apparent.

The problem with ICOs is that most of the time projects end up overfunded, which by itself wouldn't be a problem if it wasn't for numerous occasions when the project founders ran off with the collected money or failed to deliver their promises, leaving early contributors with a bright yet worthless "candy wrap" tokens. Another huge problem with ICO is that it stemmed from IPO, which is a way to sell stocks of a company that’s been around for years and has a working product. It was not designed to fund the development from the ground up.

Our team has a history of funding and launching blockchain projects, so acknowledging our experience and the problems that come along with ICOs we realized that our next blockchain project, that turned out to be Array.io, has to be funded in a different way. A way that we would deem fair for all the people involved.

We started off with listing the bullet points, the pillars, that would become the foundation for the new funding approach.

- The contributors want to see the project succeed (and make a profit)

- The project team wants to be paid (obviously)

- Making long-term cost estimations for R&D projects is a nightmare (whoever says the opposite - lies)

- The team is more productive when they know that the financial success of the project directly influences their income (it’s about the money)

After a series of brainstorming sessions we came up with what we call an alternative to ICOs - Initial Development Offering, or IDO for short.

IDO & Salary Tokens

This concept took its first form by the name of Salary Tokens laid out by @vladiuz in October 2017.

As the name suggests, the main purpose of Salary Tokens is to be a means of payment to all the people involved in making a project - developers, marketing team, project managers, etc. Rewarding the project team with ICO tokens is no big news, however, unlike many of them, Salary Tokens have one important feature - their price is guaranteed to be not lower than a certain baseline. It is achieved by minting the tokens in advance, listing all of them on an exchange and buying them out at a 1:1$ ratio.

This works well when the company has enough money to fund the development, however what if it’s not the case and the project needs external investments?

Please welcome, the Initial Development Offering.

IDO Tokens

IDO builds upon the concept of Salary Tokens, expanding it and adapting to the realities of crowdfunding. Similar to Salary Tokens, the IDO tokens (IDTs) are intended to be a part of a paycheck, so their price must also have a baseline. To achieve that the tokens are minted in the exact same proportion to contributed ETH, e.g. sending 10 ETH to the smart contract will yield 10 IDTs. To all of you wondering if this sounds like doubling the money - no, it’s not. All of the contributed ETH gets locked inside the smart contract, so even the project team can’t not take advantage of it.

One important distinction between ICO tokens and IDTs is that the latter can be refunded, unlocking the same amount of ETH which is then transferred back to the account that initiated the burn. This gives token owners to break all ties with the project in case they no longer believe in its success and rather forget about it.

IDTs are not designed to be a dead weight on the wallet - they are just as tradable as any other ERC20 token. Listing them on exchanges is an absolute must - token price is a clear and universal indication of how well the project is received by the community.

So, an IDO Token owner has two courses of action:

- Refund the IDTs in exchange for ETH.

- Sell his IDTs on an exchange at a price not lower that the baseline - 1 ETH.

Granted that IDTs may carry an added project-specific value, it is very likely that their price will be a lot higher than the baseline, in fact, it’s expected. An example of added value could be a discount, offered in exchange for owning tokens or, as you will see later, it could be a means to distribute shares of the Project Tokens.

Going back to the purpose of IDTs, using them instead of fiat money kills two birds with one stone:

- The teams feels a lot more involved in the project than if they were paid by fiat money and/or granted a share of tokens in a usual 'ICO way'.

- It makes it explicit for the project contributors that their money is put to a good cause of creating the project, not used to get a new yacht for the founders (owning a yacht is nice, though)

Now there is one question left unanswered - what happens after the IDTs are minted and where do they go? The IDO is not a form of gratuitous donation, as it may have yet sounded, that’s why we thank the contributors by sending them a share of IDTs minted after their contribution.

Each new batch of tokens is divided into two parts.

- Payment fund part goes to the project team's wallet to be used as a means of payment to team members

- Contributor's part is sent back to the contributor

The next logical question is what is the exact split proportion?

Token Generation Round

Before the project is started, a management team goes through a planning stage during which it devises a roadmap and estimates preliminary risks and costs. It might be tempting to come up with a funding strategy based on this alone, however the reality is that at the beginning of an R&D project it is impossible to say how much time (and money) exactly the development process will require.

Everyone who is involved in the software engineering scene knows that modern software products are developed in iterations. So, we realized that the funding model should correspond to the realities of software engineering and introduced the concept of Token Generation Rounds (TGRs). Each TGR is a time-limited event whose goal is to attract funding for the upcoming development iteration or a subsequent release.

Provided the experience of the management team and a shorter planning span, it becomes a lot easier to come up with cost estimates for each iteration. For TGRs these estimates took form of a lower investment limit (mincap) and an upper investment limit (maxcap).

The team is expected to schedule a few rounds in advance for each upcoming iteration, however in case the estimations were incorrect, or an emergency caused the team to spend all of the IDTs minted during the previous round, a new round should be started automatically.

Stages

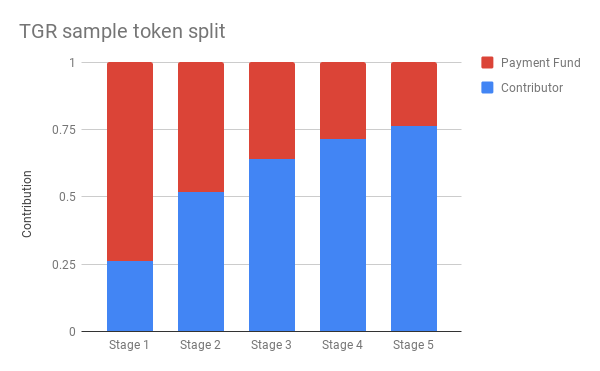

As good as it is by now, we felt that the IDO scheme needs a sense of competition, especially given the limited maxcap. To incentivize the potential investors some companies run pre-sales, some run Dutch Auctions - we came up with TGR stages.

Stages of a TGR are equally* spaced time intervals that determine the split percentage of the minted IDO tokens according to a simple principle: “The later the stage, the larger the contributor’s share”. Price-wise it means that 'early birds' get less tokens for the same amount of contribution (that's the exact opposite of what 'early birds' usually expect), which might make the investor wait for the last stage.

However, a stage doesn’t have a maxcap per se. There is only the TGR maxcap and considering that it is very limited, it becomes possible that an enthusiastic contributor comes early and fills up the fund demand, effectively closing the round. As good as it may be for the company running the IDO, all the other contributors who were waiting for a better offer are now bound to wait for the next round.

Due to the way ETH blockchain works, we can’t rely on time to limit the timespan of a round, instead we measure the length of each round in blocks.

Example token split graph

As you can see, the token split graph is not linear - it takes form of a geometric progression, in which the common ratio determines the increase of the contributor’s share.

TGR parameters

Note, that all implementation details are intentionally omitted.

Below is the list of all parameters that define each round

- Round maxcap (in ETH)

- Round length (in blocks)

- Number of stages

- Contributor’s share

- Payment Fund share

- Contributor’s share increase per stage

End of the IDO

Like all good things, IDO will also come to an end. The project is complete (or at least in a release-ready stage), there are lots of people hodling IDTs, that are priced well above the baseline 1 ETH, so what comes next?

The answer is - it depends on the project. IDO was designed with a specific blockchain project in mind - the one that runs on its own blockchain with its own utility tokens.

The project that will be the testground for IDO is called Array.io - a platform, that combines a custom blockchain and an SDK that makes cross-chain DApp creation and usage as accessible as ever.

The Array.io blockchain is based on a DPoS consensus, which requires that the blockchain's own tokens, RAYs, are distributed among the community upon the project’s launch. Here is how IDO helps this happen.

IDO for Array.io

IDO Tokens for Array.io are called eRAYs. Project Tokens are called RAYs.

Mainnet Launch Event

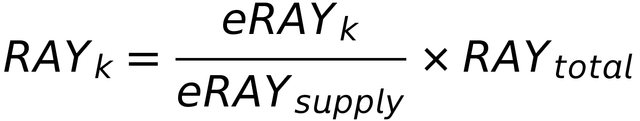

After the last round of IDO commences, it comes time for a Mainnet Launch Event. The Array.io's blockchain makes no use of eRAYs, so all token holders are required to burn eRAYs in exchange for RAYs in proportion to their share in the eRAY pool. The exchange process is conducted in a semi-automatic manner according to the following formula:

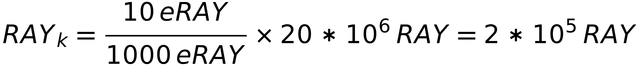

For example, if RAY emission is 20 million tokens, eRAY supply equals to 1000 tokens and the person K holds 10 eRAYs, he will receive

This process:

- Helps distribute RAYs required for the blockchain to operate

- Rids us of obsolete eRAYs

Sounds right, but there’s one thing that you might have noticed. What about the ETH which backs up the eRAYs (IDO Tokens)?

ETH Return

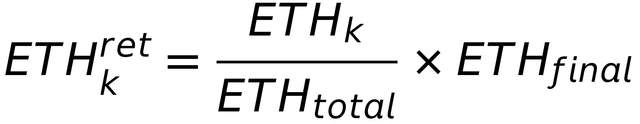

All the remaining ETH in the contribution pool is returned back to the contributors according to their share in the total ETH pool.

Remember, that a certain part of that ETH may have been refunded at this time, so assuming 500 ETH of collected 1500 ETH have been refunded, each contributor will receive

If it sounds unfair or unconventional, think of ICO tokens that shoot up in value by orders of magnitude, yet being just a way to make money.

IDO puts ‘funding’ over ‘profit’ and plays with human psychology by making the contributors realize that they can support the project, get most of their contributions back and at the same time make money off of trading eRAYs. Or keep the eRAYs to receive a share of RAYs that will only become more and more valuable as the project grows.

Conclusion

Raising money is a rather tender topic. When blockchain came around the world witnessed a wave of ICOs raising enormous amounts of money in exchange for nothing but virtual proofs. After the ICO craze has cooled down and the dust has settled people realized that ICOs are not a silver bullet to fund raising. There have been just too many cases of overfunded projects or fund theft with founders exploiting the lack of regulations and blatantly disappearing with the money.

Unlike the ICOs that present a completely unrealistic roadmap which may span years (sic) and have the courage to ask for the whole batch of money in advance, IDO’s funding model is designed to be more adaptive to the realities of the software development process and catering to both the contributors' desires and the project team.

In your free time feel free to check out Array.io - the first project that will raise funding through IDO. Our team believes in both the success of Array.io and IDO in general and expects more teams to use IDO to fund their software projects.

✅ @array-io, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Congratulations @array-io! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!