Blackmoon Smart Contract for Asset Tokens

It’s time to unveil some secrets. Today we proudly make Blackmoon smart contracts publicly available (view on Github).

These smart contracts govern each and every aspect of Asset token creation, exchange, and redemption as well as the distribution of the rewards to the continuous contributors.

This step is an important milestone in our goal to make the bridge between blockchain and traditional finance ecosystem a reality. It took us half a year to finalize the concept and fine-tune the underlying economics to make them fast, reliable and gas-efficient.

Two-level smart contracts

One of the value proposition of the blockchain technology and especially those blockchains that support smart contracts is “code is the law” maxima. Ethereum-based smart contracts are immutable once they are deployed. This means that smart-contract acts in the same way it was designed to perform no matter how the parties interpret it as it might be the case with a legal agreement.

This value proposition often becomes an Achilles’ heel of smart contracts application to real life.

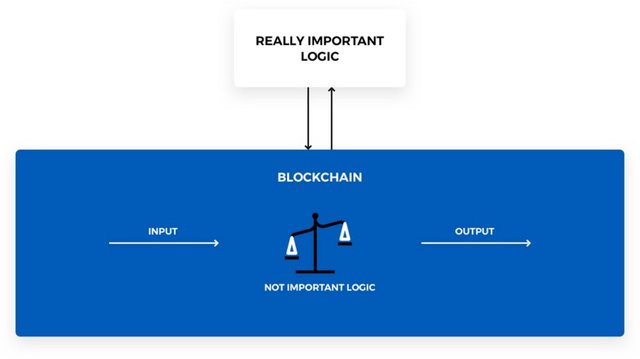

On the one side of the spectrum, the smart contracts might be over-simplified, even primitive, while the mission-critical part of a “digital agreement” is stored and calculated off-chain. Such an approach undermines the whole “code is the law” maxima.

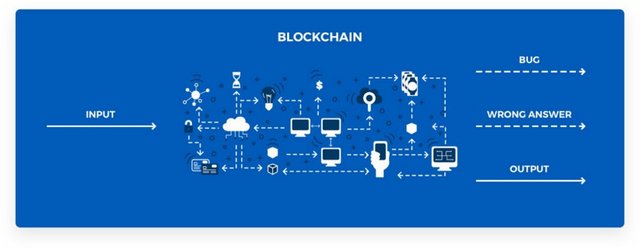

On the other side, there is a monolith, lengthy smart contract deployed to stay such forever. This smart contract gradually goes outdated and its application finds new and new bugs and under-specifications that rest unresolved thus making this smart contract obsolete. Such a dynamics is not necessarily the result of poor coding, but a sheer evolution of the world. Application of old smart contacts might look like riding a horse from Paris to Berlin while you could very well take a plane.

Both these ways of smart-contract construction could not be applied in real life when creating a scalable, worldwide business, especially in finance, that is why we use two-level smart contracts.

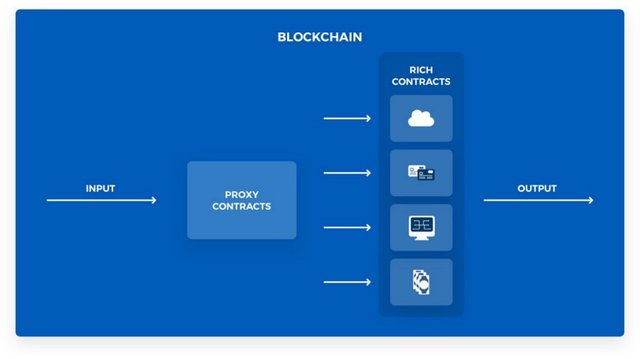

Each smart contract now comprises two parts. The first contract is used by the end users, contains public methods and commands required standards, ERC20 for instance. This is the proxy contract. The second contract contains all the necessary logic, business rules, stores data and so on. This is the rich contract. The proxy contract contains information that communicates the address of the rich contract.

Application of this concept keeps the public contract (the one that faces the user on a daily basis) simple and immutable. Indeed, no one wants to see the address of the smart contract she uses changed each time there is an upgrade of the rich contract or a bug fix. Rich smart contracts in this concept stay up to date with the existing regulation and new developments in the blockchain architecture. The former is of an utmost importance since the regulation in the crypto space is virtually non-existent.

All our tokens on Blackmoon, both BMC and the Asset Tokens are structured in this way, as it was outlined in our White Paper.

Whitelists

One of the fundamental principles governing the financial world and ensuring its functionality is the application of certain rules and regulation to the transacting parties. Just as traffic lights and road regulation ensure orderly and safe movement of the vehicles, the financial regulation ensures a fair and orderly marketplace by applying some requirements — such as suitability criteria of the investors, verification requirements, licensing or exchange membership — to the participants. Of utmost importance are the anti-money laundering and counter-terrorism financing regulations that aim to ensure the prevention of illicit transactions.

The world of the blockchain with all its promise as a technology is largely terra incognita in terms of regulation now. But there is little doubt that, in the nearest future, the blockchain-based financial instruments and contracts will be regulated. As the means to ensure compliance of our Asset Tokens with the regulatory AML standards, Blackmoon platform adheres to the concept of the “whitelists”. The whitelist is ancillary structure to addresses and the balances of the holders that enable the contract to define whether the exchange is possible between the counterparties.

The main rule is that Asset Tokens could be exchanged only between the eligible and verified users. When you register on the Blackmoon platform, submit your KYC and add the Ethereum address upon successful verification, your address is sent to the contract to enable transfers of the Asset Token. This is one of the instruments that enable compatibility between the legal framework and the token in the real world.

If you haven’t registered yet, you can do it now by visiting our platform.

Asset Token architecture

In the real world, there is a whole spectrum of funds from charity to high-profile, high-cost hedge funds and from tailor-made funds to standardized ETFs (exchange-traded funds). We placed a lot of emphasis and efforts to ensure flexibility of the asset token architecture. As a result, we created such a framework that enables us to create tokens that provide exposure to the performance of the wide variety of funds, including custom-made unique tokens. This approach allows the platform to perform the tokenization of any kind without the need to re-write the smart-contracts already deployed to the Ethereum blockchain.

Each asset token includes the following contract:

- ERC20-contract, a proxy contract for wallets, exchanges, etc.

- EmissionPovider, a smart contract that governs the sale and creation of tokens. Each creation event is governed by a separate smart contract.

- BurningMan, a smart contract to buy back (redeem) the tokens and burn them. Same as the EmissionProvider, each redemption event requires a separate smart contract.

- Treasury, a smart contract that receives BMC tokens of the Continuous Contributors and calculated the BMC-days (more on this concept you can read here).

- Profiterole, a smart contract that governs the distribution of the rewards between the Continuous Contributors.

- DataController, the repository of the token holder, their balances, whitelists, etc.

We are sure that such a two-level architecture of the smart contract ensures necessary modularity and flexibility to make Blackmoon platform a scalable marketplace for the Asset Tokens and to provide the holders of the Asset Tokens with a convenient and reliable solution to access the performance of the wide spectrum of funds without leaving the blockchain space.

Join the mission to bridge crypto and traditional universes now: https://blackmoonplatform.com/showcase.

- platform blackmoonplatform.com;

- telegram chat for the investors in asset tokens https://t.me/blackmoonplatform;

- telegram chat for the BMC token holders https://t.me/blackmooncrypto.

Important disclaimer:

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.

Original post - https://news.blackmooncrypto.com/blackmoon-smart-contracts-51a935fc9311