【BlockVC Strategy Study】Do not HIT gently that good night,seize the opportunity to find good projects

The market fell into a phase of weak rebound and consolidation, and began to enter garbage time.

Do not HIT gently that good night, seize the opportunity to find good projects.

BlockVC Strategy Study is mulling decryption. What are we talking about when we discuss strategies?

BlockVC Strategy Study Team

Contact:Kira Sun

E-mail:[email protected]

Thank you for your attention. You are welcome to send mails to this email to exchange more views on market.

At present, cryptocurrency still lacks attribute definition. Currently, governments such as Japan and Germany define it as a currency, while governments such as Denmark and Mexico define it as “unregulated speculative assets”. In the multi-party exploration and game, cryptocurrency has become a “Schrodinger's cat” in the financial field to some extent.

The party that supports the cryptocurrency as currency has been in the limelight. A listed company in Japan is offering cryptocurrency loans. The currencies involved include Bitcoin, BCH and Ethereum. The cryptocurrency can be used directly as collateral without prior liquidation. In Japan, clearing cryptocurrencies may require up to 55% of taxes.

In addition, the United States, where the definition of cryptocurrency is much entangled (five independent agencies have given different definitions, covering multiple attributes such as securities, commodities, and currencies), has also over-weighted currency attributes. Companies including Starbucks, ICE, Microsoft and BCG are launching a new company called Bakkt, which expects to complete the global purchase and use of cryptocurrency by November. Its major shareholders will also show their special prowess in promoting cryptocurrency. Starbucks is committed to making its products available for purchase in cryptocurrencies, while ICE, the owner of the New York Stock Exchange (NYSE), is trying to integrate Bitcoin into 401(k) s, credit cards and retail.

The current market is sluggish, asset-driven funds entering the market are not running smoothly, and the small-capital funds in the payment field may become a little star for the road ahead.

(Bitcoin, as an asset, is regulated and matured enough to be worthy of US markets.)。According to Singularity Financial Report, the proposal for the Bitcoin ETF listing submitted by Winklevoss Twins was rejected on July 26, which does not seem to have much impact on the expectations of the Bitcoin ETF. There is enough evidence to support the confidence of current investors, just as SEC official Hester Peirce’s remarks, “Bitcoin, as an asset, is regulated and matured enough to be worthy of US markets” after the application was rejected.

According to a recent Gallup survey, only 2% of investors in the US hold Bitcoin, and the proportion of investors interested in holding Bitcoin is as high as 26%. In view of the current strong demand for index fund products, and many organizations competing for the rights to sell Bitcoin ETFs, the history of multiple trial and error has also accelerated the compliance and improvement of Bitcoin ETF products. For example, VanEck and SolidX's recent contract proposal with 25 Bitcoins for full insurance as a product that has been optimized for entry barriers and anti-manipulation will further impact the SEC's regulatory bottom line. At the same time, it also includes the physical delivery Bitcoin contract with a delivery period of one day and cold storage that the above-mentioned ICE Group plans to launch in November this year.

However, as far as the current market performance is concerned, large amounts of funds still lack suitable access channels. At the same time, due to the mutual restraint between bear market and policies, the close attention of ordinary investors to the encryption market is difficult to convert to stock funds. In the short term, the cryptocurrency market has fallen into a low tide.

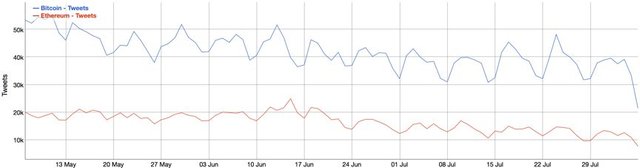

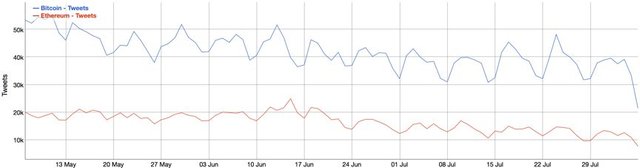

The Bitcoin ETF bounced cheque again, at the same time, the market continued to be inactive, causing market sentiment to fall to freezing point. The amount of Twitter information on Bitcoin has broken through the recent daily average of 30,000 discussions, and the decline is obvious. The cryptocurrency market has already fallen into a trough, both on the asset side and on the topic side.

Data Source:Bitinforchart

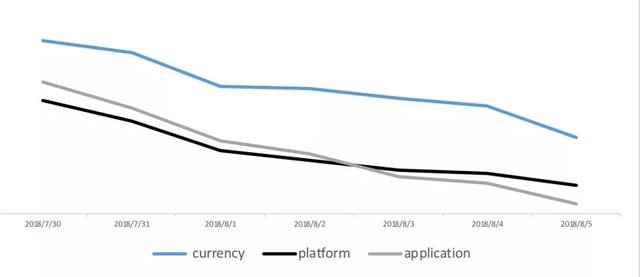

As of August 5, this week's Bletchley 10 index closed at 856.02 points, down 13.39% from the same period last week; the Bletchley 20 index closed at 1102.82 points, down 20.37% from the same period last week; the Bletchley 40 index closed at 184.59 points, down 21.55% from the same period last week;

In terms of industry performance, the Currency Index was down by 14.73%, the Platform Index was down by 14.20%, and the Application Index was down by 19.01%.

Data Source:Bletchley

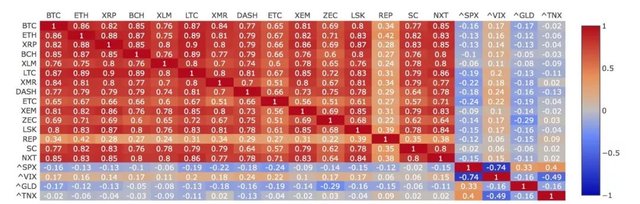

In the sorrow of the market last week, all kinds of currencies are hard to escape. In comparison, the mainstream currencies that failed to follow the previous Bitcoin independent rise in the market have also maintained restraint in this downturn, and the initial signs of market differentiation began to appear in the mainstream currencies.

It is expected that Bitcoin will drive a weak rebound in the mainstream currency this week, but except for a small number of special qualifications that are eligible to get out of the independent market, most currencies can only be passively silenced in the shock, or go down slowly.

Fig. 3 Data source: Tradingview

Do not HIT gently that good night.

If we crack an unfunny joke, except for the performance of new online currencies such as HitChain, one of the biggest highlights of the stock currency in the market this week may be UDST. After all, the RMB has depreciated to more than 6.9 relative to USD, but the OTC price of HuoBi is still around 6.78. For the first time, the fully invested USDT has brought a little comfort to many ordinary investors for the first time.

Fig. 4 Data source: Internet

The monthly chart of Bitcoin in July presented a major rise on schedule, but many problems in the market are exposed. The rising trend of Bitcoin was unique, which was not followed by other mainstream currencies. The small and medium-sized market capitals suffered a significant low tide. The mighty strong trend ultimately welcomes a declining period: During the decline of Bitcoin, the mainstream currencies followed suit, and Bitcoin took the lead to stabilize. Instead, the currencies of small and medium-size market value oscillated sideways. As Bitcoin gained support in important moving EMA, the market generally showed a "unique" bottoming trend.

Fig. 5 Data source: sifrdata.com

The peculiarity is that in the past two weeks, the currencies of small and medium market value and the mainstream currency experienced a massive fall in trade volume in recent two weeks, indicating that the fund in secondary market was stronger than expected. Some currencies of small and medium market value have even dipped to the bottom. In light of market news, rumors have it that some major clients begun to focus on hoarding the mainstream spot currencies, and some project managers have begun to repurchase their token money at low price, which may be the main source of undertaking strength of the trading pit.

BlockVC Strategy Research believes that the market operation will become more difficult in the next period of time. For most investors, the market will enter garbage time, the price correlation between currencies will drop rapidly, and some currencies have the possibility to go out of independent market. According to the BlockVC Strategy Research, many currencies of small and medium market value have recently shown signs of receiving goods at the bottom. Therefore, the most important and difficult strategy in the following period is to chase the currencies of small and medium market value in the market and the violently rebounded monster currencies. This strategy may not be suitable for the general investors, but during the downturn, the monster currency has powerful siphon effect, which will absorb most of the gambling funds of a trading platform, and it is therefore worth opportunistic buy-in.

In addition, according to the BlockVC Strategy Research, the mine fields are currently undergoing industry clearing due to the continuous decline in the price of the currency, and some mine owners are actively relocating the mines to seek to cut the cost of electricity; some mine owners may choose to shut down the electricity and stop operation. It is possible that some mines will undersell large amounts of mainstream currencies such as Bitcoin in the market, and the impact on the price of the currency may continue until September.

In this garbage time, if ordinary investors are not willing to take high risks to chase up the monster currencies, it is better for them to keep calm and refrain from any impulsive action, "Don't hit gently that good night."

What are BlockVC talking about when discussing strategies?

Recently, the Bitcoin prices have experienced ups and downs, mainstream currencies such as ETH have not followed suit, and currencies of small and medium market value have generally fallen. This phenomenon has caused widespread concern and heated discussion among investors. The previous increase in Bitcoin prices was mainly due to the market's bullish expectations for ETF approval by the SEC. However, even if this ETF gets approved, it is just a pro forma, and there is not much impact on the introduction of real funds in the market—Investors are sensitive to ETF events which indicate that corresponding events will duly arise when the time is ripe.

The rise and fall of investment behaviors are generally related to the bullish and bearish conditions of the market. However, in fact, it is not the bullish and bearish market itself that lead to the change of the market. The factors affecting the market change often come after the inflection point of the equilibrium state. The market needs only one catalysis or one reason to induce the the inflection point of the equilibrium state in terms of risk return.

The most sensational market information this year should be getting the public block-chain main-net online from the beginning of April to the beginning of May. According to the weekly report of strategy of BlockVC Strategy Study, released on May 9 and May 28 respectively, boosted by the EOS super nodes, numerous public block-chains followed suit to release the plan of campaigning super nodes and getting the main-net online, which stimulated the full-scale outbreak of the public block-chain theme. However, at the end of April, the sharp rise in the price of the currency has led to a reversal of the risk-to-reward ratio. It is difficult to reap the same increase in the subsequent release of the similar public block-chain currencies, and it is even classified in the “benefit-out” range. In May, the market started to be subject to significant adjustment along with the downward condition of the market. The BlockVC Strategy Study commented on such "benefit immunity" phenomenon and predicted the market adjustment in advance.

The medium-term currency price trend is inevitably subject to the influence of the change of the risk-to-benefit ratio brought by the changes in the fundamentals. Even without a series of events concerning the event of getting the public block-chain main-net online or the Bitcoin ETF, the market will still follow the original medium-term pattern and changing trend, and short-term events will instead bring the opportunity for reverse operation.

Many investors or analysts tend to attribute market changes to specific events, giving people the impression of “being wise in retrospect” and this can also be deemed as a psychological need of avoiding responsibility, because certain events are completely unpredictable before they appear, and it is just when people explain the market condition will it be mentioned --because of this, investors or analysts are often confused as to when we are really talking about when we discuss strategies, or what BlockVC strategy research is based on when we make judgment about market changes?

According to the BlockVC Strategy Study, the most important thing in strategy analysis shall be the analysis of the medium-term fundamentals, the assessment and grasp of the risk-return inflection point, as well as the judgment of the level of the market condition at the time of an incident and the formulation of strategy for coping with the incident.

When making pre-judgment for the market condition, investors always hope to find events and reasons to support decision-making. Such events are generally divided into emergencies, trend events and noise events. Different strategies should be adopted to deal with different events.

It is difficult for an emergency to have a major or sustainable impact on trend of the currency price. Nor is it the focus of strategic allocation. However, it is strategically suitable to make reverse operation. For example, during the pre-market weak period, IOST announced that it had registered in the Korean Exchange, and the price of the currency fell again after skyrocketing. It is obvious that the sudden profit is a good opportunity to leave.

Trend events are the types of events that are strategically focused and deployed. They can be reasonably analyzed according to the changes in the industry and directional and trending judgments can be made accordingly. Firstly, basic logical judgments must be drawn based on technological developments and changes in industry fundamentals, such as Metcalfe's Law, Bitcoin halving cycle, and major killer application explosions. Secondly, various high frequency events, chain behaviors and chip distribution indicators should be traced, and roughly judge the possible time points of the trend events based on data analysis. Finally, analysis shall be for the capital liquidity, risk preference, investor sentiment, and position ratio, etc., according to the market stage and style characteristics so as to judge whether the currency price will change.

It can be found that in the judgment of trend events, logical judgment is not difficult. But data analysis requires tools and skills. The judgment of market stage and style characteristics is a process that involves experience, feeling and art. To make a forward-looking and effective response, you need to have a unique insight into whether the trend event is “Price in”, and have a clear understanding of the cycle and level of the market condition.

For noise events, Strategy Research focuses on the risk-benefit balance state at the time of the noise event instead of the noise event itself. When the market is about to have a trend-turning point, there will always be a lot of bearish or bullish news in the market. These bullish and bearish news tend to produce a messy situation. It seems that any explanation to the turning point is justified. Or most often, many events that have already occurred before but had no considerable influence at all, are dug out at a messy situation just to confuse people. The BlockVC Strategy Study believes that, in many cases, the noise event is just a catalyst or an excuse. The market begins to move out of the inflection point when the risk-return equilibrium is losing balance. Any noise or catalysis is only used to provide explanations and psychological comfort.

For such noise events, investors often like to ask whether an event is “good” or “bad”, but the noise event itself cannot be summed up simply with the work “good” or “bad”, because the market is always a complex system, and it is hard to judge the level of influence of individual news on market trends. One can only say that if the market goes up, the news is good; if the market falls, then the news is bad.

The judgment of the event is only the starting point of the strategy research, and the strategy research is to find the optimal profit strategy in the market environment. The general investors need to make forward-looking predictions for strategic research. The simple prediction is tantamount to fortune-telling, where there are a lot of uncertainties; but the countermeasures worked out based solely on market changes involve too much information at the transaction level and disable the allocation of large funds. Therefore, real large institutional investors tend to make directional predictions, choose the left-side buying point, and formulate coping strategies based on short and medium-term predications.

Investors' favorite strategy research reports are those that give clear advice on buying and selling points and pre-judgment of rise and fall. However, these predications are mixed with too many subjective judgments, and the predictive behavior is based entirely on existing information, and it is impossible to predict the in-process events. By doing so, the results are: Very often, even the prediction is in the right direction, it is hard to grasp the time accurately, resulting in the loss of the transaction. Especially in the currency market, where market changes too fast, the forecast period is too short, and there are too many constraints. In this case, the important thing is to verify and respond to the forecast because even if your own views are correct, it is also impossible to verify whether the underlying logic is correct or not. Once the market enters into a stage where falsification is impossible due to the dominance of the general public, it is very dangerous to overemphasize the individual’s prediction.

For strategic research, the adjustment and revision of opinions are therefore particularly important. The change in the currency price means that the risk-return equilibrium power is changing. The rise of price results from the accumulation of risk, while the decline means the release of risk. Remember not to allow personal point of view become shackles for individuals.

Investors should pay attention to the role of overall planning. Opportunity is more a hypothesis and test than a belief and gambling. The actual grasp of opportunity is to realize bulk holdings after confirmation instead of simple trading--the combination of prediction and response is the ultimate essence of strategic research, especially the combination of research, investment and trading.

BlockVC Strategy Research has always been endeavoring to create a perfect forecasting system and develop a response system. Models, research, and data analysis are the components of the forecasting system. The more sophisticated countermeasure system is reflected in the dynamic grasp of key variables such as market style, risk preference, investor psychology, and risk-benefit balance, etc. to form an organizational framework of thinking.

Recommended rating: HitChain

BVC16 index

Risk warning

The mind fields are recently experiencing industrial supply clearing, which might be detrimental to the currency price.

BlockVC Strategy Research Team

Contact: Kira E-mail: [email protected]

Thank you for your attention. You are welcome to send emails to this email for more exchange.

Congratulations @blockvc! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!