Tokenizing Place [Interview w/ Slava Rubin of Indiegogo and Stephane De Baets of Elevated Returns]

Making Real Estate Real Liquid

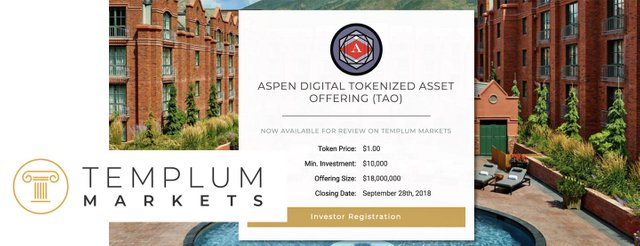

In late August, Indiegogo made headlines when they announced the launch of their first Security Token Offering (STO) with the St. Regis Aspen Hotel. Instead of pursuing the platform’s well-known routes of crowdfunding and more recent equity distribution, they were moving deeper into the blockchain space by offering tokenized equity in property. This would be a landmark move for the established company’s new ICO platform to team up with asset management firm Elevated Returns and regulatory partner Templum Markets to clarify and open up the securities space for new entrepreneurial efforts.

So what does this mean for entrepreneurs, asset owners, and everyone else in the cryptosphere? To learn more about the significance of this project, we had the opportunity sit down with Cofounder of Indiegogo, Slava Rubin, and President of Elevated Returns, Stephane De Baets.

The Creative Crypto CC: Thanks for joining us Slava and Stephane, could you tell us a bit about yourselves and your entries into the blockchain world?

Slava - I’m one of the founders of Indiegogo, which launched in 2008, helping entrepreneurs access the capital needed to mobilize their projects. We wanted to eliminate the gatekeepers like VC’s from that process and we used the internet to do that. We started with a perks model and then lobbied congress and the Obama administration to have the Jobs Act passed in 2012, and in 2016 we launched equity crowdfunding. In December 2017, we launched our first ICO as the regulatory environment has become much more clear and the SEC provided more guidance directly towards securities. With the St. Regis ICO, we’re excited to announce our first securities offering.

Stephane and Slava. (Sources 1, 2)

Stephane - My background is about 25 years involved in capital markets and real estate investment. I spent most of that time in Asia and set up an asset management firm in 2008 and entered the US market in 2010.

My main focus has always been “how do we bring more liquidity to the real estate space?” Real estate is by far the single largest asset class in the world in terms of capitalization. And yet, it is the most illiquid asset. For the last few years, we’ve been focused on bring more liquidity to this domain and once we saw that blockchain was starting to provide the relevant tools, we wanted to create a proof of concept utilizing one of our own assets. We’re hoping that the St. Regis will become the first benchmark in real estate tokenization.

CC: People are quite excited about the applications of a security token. There has been a lot of emphasis on ‘utility’ tokens since securities have become the boogeyman in the space. From the perspective of the St. Regis, walk us through why you’ve chosen to run an ICO rather than traditional equity distribution and investment.

Stephane - One thing I want to emphasize are the roles of the parties involved and how we’re approaching the market. Templum is the regulatory partner and Indiegogo is the marketing partner. We’ve spent close to a year making sure our work is super compliant and follows all the regulations.

Slava - It’s still very early for distributing security tokens. People still need to have their wallets and there needs to be clearer infrastructure for trading. I think in 2019, we’ll see more clarification and St. Regis is ahead of the curve. As of now, there are immediate benefits of using blockchain - increased liquidity, easier access to fractional ownership, and better security, making it almost a different kind of asset. I think this is the beginning of a movement for accredited investors and others to access in a way prohibited before.

CC: And why start with a hotel? What are the most exciting aspects of the project?

Stephane - We chose an asset that checks all the boxes that would ensure the success of tokenization. First, there’s the “trophy” aspect as a highly valued physical thing. Second, we focused entirely on raising money for the already existing product. Third, we priced it super conservatively to attract initial investors. And lastly, we worked to create the strongest partnerships with industry leaders - Templum with regulation and Indiegogo with marketing. I believe that we truly have an object and system of desire that appeals to all stakeholders and will result in a successful first use case.

The key thing for us is different than how other companies have been raising money for the “platform” level and don’t actually have a product. It is complete misconception to think that you can take a hotel, put it through a machine, and that machine is going to create tiny tokens that you can sell. It doesn’t work that way. - Stephane Da Baets

If you look at the purchasing power of cash over a 100 year span, for example, you’re going to lose 96-97% of the value. With real estate as a total asset class, you’re looking at probably 20% appreciation on top of inflation in those same 100 years. So the question is very simple, why would anyone be relying on cash when they could be holding an appreciating asset class? What we need to do right now in the blockchain community is prove that real estate can be liquid. If we achieve these goals, mark my words, in 10 years no one will be sitting on cash ever again. People will be filling their wallets with security tokens and those security tokens will have immediate liquid qualities to them.

CC: People still get an allergic reaction when it comes to “blockchain” and “crypto.” Is Indiegogo’s position to target crypto-fluent investors or is there also an educational component to bring others less familiar into the space?

Slava - We’re starting to clarify the difference between ICOs, which most people think of a team working on software and hoping to create a network effect, and STOs (security token offering) and ABTs (asset-backed token). ICOs are still highly speculative and really tricky to figure out, resulting in high volatility. We’re dealing with offerings backed by something real. This is a hotel worth hundreds of millions of dollars and has appraisers that determine what the value should be. It has consumers and can be occupied in various ways. In general, and this is my opinion, real estate is an appreciating asset over time and having access to something like the St. Regis is exciting from a token point of view.

Stephane - The key thing for us is different than how other companies have been raising money for the “platform” level and don’t actually have a product. It is complete misconception to think that you can take a hotel, put it through a machine, and that machine is going to create tiny tokens that you can sell. It doesn’t work that way. We start with the product, which includes the hotel itself, the appraisers, the lenders, and all of the other stakeholders, then we raise money at the platform level, backed by those products.

CC: What do you think this will do for entrepreneurship in general and how people get into this space?

Slava - I think blockchain is a pretty big movement and for now, Bitcoin is only a proxy for how people think about the technology. In the future, we’re interested in how it’s creating more liquidity and options for traditional markets. In the past 6 months, there have been half a billion dollars invested in security token infrastructure, which will really build out in 2019. There will be much clearer markets for access soon.

...St. Regis is ahead of the curve. As of now, there are immediate benefits of using blockchain - increased liquidity, easier access to fractional ownership, and better security, making it almost a different kind of asset. I think this is the beginning of a movement for accredited investors and others to access in a way prohibited before. - Slava RubinStephane - Our customers are now becoming our partners. The token holders will mostly be repeat clients of the hotel. They love us, we love them, and we can now share stake in any asset in a much easier way. We’re connecting the person to the product, and this is what we think blockchain does and will create more opportunities in the future, without the perks-based model many companies are starting to create now. This will become a growing trend.

CC: Speaking of perks, are you Stephane looking to stick with simply replacing equity shares with tokens or will you move to a more utility model where, for instance, you can use these tokens for a night at the St. Regis and increase the fungible quality?

Stephane - Our focus right now is replacing traditional equity with tokens. We are acquiring the necessary licenses from parties all around the world to become the premiere real estate tokenization player. As we expand into the future, we are also pursuing the idea of “one asset, one coin” to provide clarity so each investor knows exactly what they’re buying. There will be dozens of properties like the St. Regis and each will have a dedicated token. As this asset class grows, we’re expecting the development of ‘multi-dimensional matrices’ for exchange, which means that in a few years, you won’t need the intermediary of cash to go from token to token. The beauty of the blockchain revolution is that you don’t need to be everything in one company and can distribute responsibilities to different parties that provide value. I’m already being approached by very smart people offering to be the liquidity provider. You did not see this being done in the old markets. People are motivated to contribute to a community because they can immediately become partners.

As we move into a cashless society and we move into an economy where people contribute what they can, the regulator will actually become a driving force in the technology instead of a policeman. I’ve been in capital markets all my life and I’ve never been more excited than I am now. This is only the first step in a very very long journey.

Thank you to Slava and Stephane for joining us! We also want to extend our gratitude to Wachsman for making this interview possible. Be sure to follow the news on Indiegogo concerning their current token offering.

Name: St. Regis Aspen Resort, Aspen Coin Token Offering

Website: https://ico.indiegogo.com/projects/aspen/

Posted from my blog with SteemPress : https://thecreativecrypto.com/tokenizing-place-interview-w-slava-rubin-of-indiegogo-and-stephane-de-baets-of-elevated-returns/

This project is being supported by @Fundition

Fundition is a next-generation, decentralized, peer-to-peer crowdfunding and collaboration platform, built on the Steem blockchain.

#upfundition and #fundition tags on Steem represent the projects that are started on https://fundition.io.

Are You Prepared to Make the World a Better Place too?

Read the full details of Fundition Fund program

Learn more about Fundition by reading our purplepaper

Join a community with heart based giving at its core

Very interesting interview, it's great to see that big players are creating token project based on real property (hotel), not only

applications based on blockchain. These initiatives can help build public confidence in the benefits of blockchain.

Liquidising real estate (and anything related) is going to be BIG. Watch this space!