Debitum.Network — a system of credit to small and medium businesses.

Greetings friends, I welcome new readers in my blog, nice to see a lively replenishment, so same will pleased receive from you comments to my posts and me it is important to see your opinion about projects and technologies which I review.

Today, my attention was drawn to one very small, but at the same time global in its scope the topic of lending to small and medium-sized businesses. Those who conduct some business now, probably, strained and think that here it is possible to tell or discuss, but in this regard I have an opinion and the review of the project which is called to simplify and make financing of small businessmen easier, more clear and more transparent.

I present to you the DEBITUM NETWORK project that will change the approach to investing in small and medium-sized businesses.

What problem does the project solve?

Small and medium business is the driving force of the economy of all countries, small and medium taxpayers bring the most funds to the Treasury. But small and medium-sized projects have a big problem in terms of financing them with standard banking instruments, businesses do not have the proper assets, turnover and guarantors, which makes it almost impossible to obtain a loan for the development or provision of a large order.

I as an entrepreneur in the past who kept the online store of computer and it equipment can safely say that to go through all the bureaucracy of banking institutions to obtain financial assistance in providing a major transaction is almost impossible. I met a many problems, or rather barriers in the form of requirements that were presented to my business, of course I could not satisfy them in full. As a result, I was refused, and when I asked what was the matter I was told that my business is high-risk and I do not have a proper history in the credit line. But here’s the paradox, with more smaller financial tasks I cope on their own, but when required a Bank guarantee for a round sum to secure the deal, which has already signed the contract and scheduled delivery of equipment I refused.

I am sure that many of the caste of small entrepreneurs refuse to play in the large market of their services or goods due to the lack of lending to their businesses. This attitude of the banking system is really depressing and does not give any development, one trampling on the spot. For myself, I realized that the real business in the working position does not guarantee you that the banks will finance you for the development or ready-made deal, they always need to have had in the past confidence in you, your reliability and solvency. Even if you manage to do almost impossible and get funds in the loan for your project, the interest and financial control will absorb you in full, at least this picture I watched from my friend who was given money for development and he settled in the office of the auditor of the Bank, which helped to make “right decisions”. All this is not fiction, but I really share my experience with you, so if such technologies were, when I was doing business, I would immediately study it and take advantage of the situation.

How does DEBITUM NETWORK?

DEBITUM is a platform based on the blockchain, where there are direct investors, money and trusting community. Small and medium-sized businesses can create an application on the platform to finance their business, thereby attracting their potential investors. The DEBITUM crediting platform successfully combines Fiat money and Сryptocurrency, which makes the system more flexible for quick start of USERS from both sides. The platform works on the basis of ETH blockchain and supports Smart-Contracts (what is a smart contract), thanks to the functionality of which the system is completely transparent and automated.

The main advantages of DEBITUM NETWORK

The principles of DEBITUM NETWORK.

Features of the network.

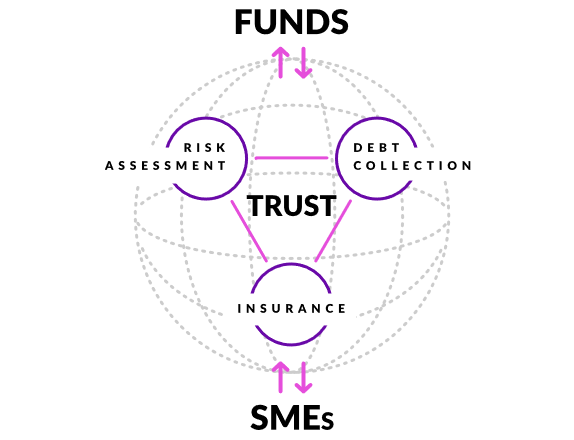

Network DEBITUM all basic actions performed by the community, including borrowers, investors, debtors, creditors and experts to verify the assets and documents of value. An organized community has its own trust that shows how competent and successful the community is in its workflows. The overall trust in the community develops on the basis of the trust of each participant, thus we can say that success depends on everyone. Community leader, its creator is motivated by a smart contract reward for creating and developing a business network in his community, and attracting new members.

On the principle of General trust in business loans (financing) are issued after the community verifies the reliability of the information provided.

How to use the system and get financial assistance for your business?

detailed description of the financing system by steps:

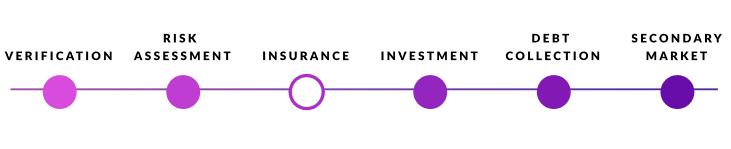

Registration of the borrower and its verification.

The borrower registers with the Debitum system, uses his official documents confirming his scope of activity, providing the System with legal documents confirming that he is a company. The borrower is tested for initial trust compliance on the Debitum network to be able to apply for a loan. After passing the checks, the borrower must have DEB tokens before applying for lending, this is required to pay for the formation of an asset with the system. All actions of the borrower are recorded in the blockchain, and in case of non-compliance with the requirements of the system, the borrower can refuse to create an application, this is solved by agreeing and eliminating the identified shortcomings of the borrower during the initial inspections.

Checking the borrower’s assets and risk assessment.

The borrower declare its assets to the assessment, which is carried out by members of the community with verification of each of the participants. The asset can be checked by several auditors at once, at the request of the borrower. When you validate an asset, a smart contract is created, and all the validation data is written to the blockchain. In case of positive evaluation of the asset, the procedure of borrowing is advanced further, if the asset has not been verified, the data are transmitted under the smart contract, and the application for funding is removed from the network. Similarly, an audit of an asset is requested by the borrower or investor on the risk of financing a business. A smart contract is also created and all audit data is recorded in the blockchain.

Insurance of the risk from non-fulfillment of the borrower’s smart contract.

The investor can insure his / her financing risks in the system against the borrower’s default on partial or full repayment of the loan.

This stage is executed at the request of the investor or borrower, all data is also recorded in the smart blockchain contract.

Investment.

Investing in the system is as follows: the investor chooses the borrower’s contract, analyzes his smart contract and risks, and invests it. The investor can invest in both Fiat and crypto currencies. The system also allows automatic investment, according to the requirements for borrowers.

Secondary asset market.

The network of financing of small and medium-sized businesses also provides a secondary market for investment and resale of credit assets to other borrowers. This functionality is implemented through tokenization of already invested assets. Tokenized assets-existing investments in the borrower’s business. Investors can sell highly profitable or unprofitable asset with a discounted price or at an inflated price.

Credit assets that are not repaid in time.

At the outstanding credit assets creates a smart contract for the recovery of debt. The enforcing counterparty makes changes to the smart contract by offering different scenarios for settling the recovery. Investors vote for the option they like, the one that will gain more than 50% of the votes and will be executed. The fact of debt collection is recorded in the blockchain, and the costs are imposed on the borrower.

First of all, it should be noted that the regulation of the system is carried out by communities, and thus it is completely decentralized, which can not be said about the banking system today. The motivation for each DEBITUM NETWORK member is to trust HIM / her as a performer. As a result, we get a system of financing where the credit is easier and perhaps even more profitable than in conventional financial institutions. From myself I can add that I as a small business such a system is interesting, and probably, if necessary, I will use it. I want to wish you always properly evaluate the risks when selecting a credit organization, and not to jump above a head.

Friends the amount of information on the project presented by me is minimal, you must understand that this is a very complex financial instrument. To learn more about the project and its functionality in the field of financing small and medium-sized enterprises, you need to follow the link to the project website: DEBITUM NETWORK and read the full documentation: WitePaper.

Join now and be in the know:

Site : https://debitum.network/

Bounty : https://bitcointalk.org/index.php?topic=2733965.0

Announcement : https://bitcointalk.org/index.php?topic=2321064.0

FACEBOOK : https://web.facebook.com/DebitumNetwork/

TWITTER : https://twitter.com/DebitumNetwork

Author: iBenGunArmor

aka @CryptoFounders

My Bitcointalk account:

https://bitcointalk.org/index.php?action=profile; u = 1188415

Congratulations @cryptofounders! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP