DISTRIBUTED CREDIT CHAIN: A DECENTRALIZED AND OUTSTANDING FINANCIAL CREDIT SYSTEM

Like other industries or businesses whose mode of operations are centralized, digital revolution has found its wayinto the world’s financial credit system. The financial institution is heavily centralized, starting from the apex bank - central banks and the chain runs down through to the banks with clandestine monopoly much to the detriments of the borrower.

The existing mechanism is such that credit rules are very stringent and most times, if not all, not so very favourable to customers. Apparently, these are not alien.

CHALLENGES

The challenges existing in the traditional system are;

• In every nation of the world, it's the characteristics of the Apex bank to determine the lending interest rates, however, hidden charges placed on the credits issued to customers shots up. The idea of hidden charges are usually targeted at accumulating more profits for themselves especially, for long-term borrowing.

• The traditional credit system is not cordial with small to medium scaled enterprises. For example, these businesses are often times at the mercy of the banks that have suffered losses as a result of delay or the inability to pay as at when due on loans issued to these businesses.

• The time duration involved in issuing credits to borrowers by financial institutions is usually a lengthy one. This as a result of the processes it underdoes for verification and approval of credit.

The efficiency of the credit system to fast-track these process is a huge challenge especially for a business whose survival is on the verge of collapse. Generally, the bureaucratic process of the centralized system does not in any way encourage efficiency and such turns to be a negative feedback to the financial consumer.

SOLUTION

The current digital era is providing a much easier and efficient way to the various existing system or institutions and such as solving the problems of the setbacks centralization has posed or failed.

For credit systems, an innovation to solve the existing has been put forth. This project is blockchain powered to facilitate the ideas behind the distributed economy called “Distributed Credit Chain”

ABOUT DISTRIBUTED CREDIT CHAIN (DCC)

The distributed credit chain is a project whose platform is basically to decentralize the monopoly existing within the financial institutions over borrowers.

The implications of breaking this monopoly are to create an open market that will boost competitions between credit houses, assist in developing business without being at the mercy of any lenders, and also with favourable and reasonable interest rates.

One unique feature of the platform is its transparency and so, all forms of hidden charges will be off the board.

Again, DCC project will tackle all the problems associated with long-term borrowing.

This project is promising and as such the platform will readily attract and encourage young and coming business, the ones on the verge of collapse and consolidate on existing business.

On efficiency, the platform creates no room for bureaucracy, paper documentation and verification as information stored can remain valid and indelible.

So, the issue of creditworthiness becomes a bygone and, of course, saving an enormous amount of time and energy which will turn boost productivity.

Distributed credit chain platform is much secured and with a high level of encryption, therefore, security is assured.

On the platform, Smart Contract is applied and the transaction token that is used is DCC token which is compatible with Ethereum wallet.

DCC TOKEN INFORMATION

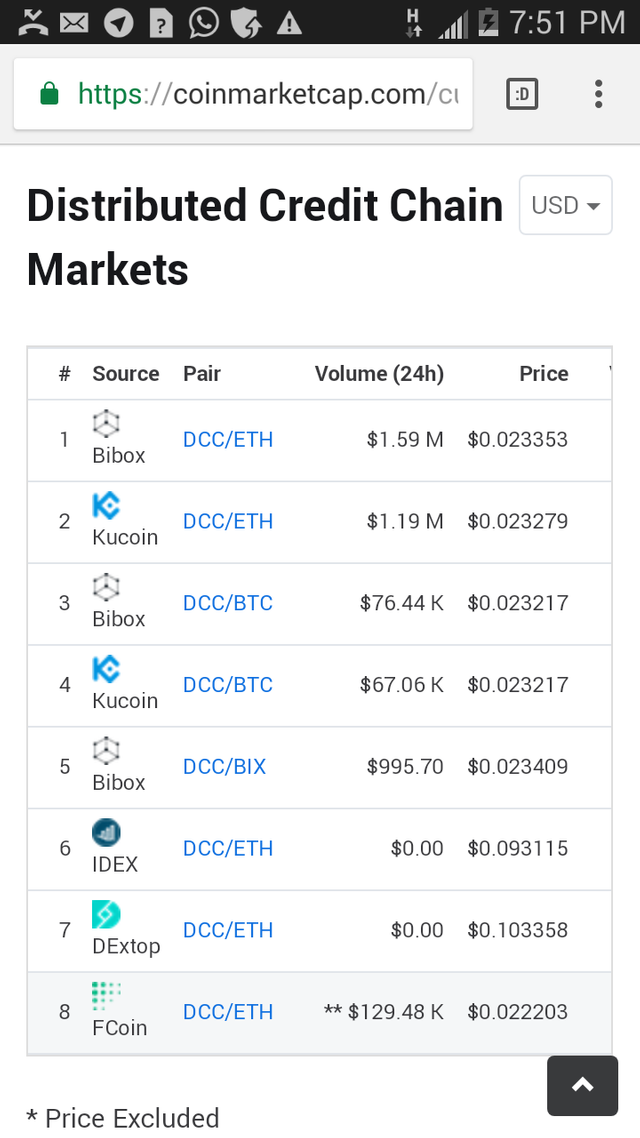

DCC is an ERC20 token with a total supply of 3,385,008,508 DCC . ICO has long ended successfully, DCC token is already listed on coinmarketcap, see link for prove https://coinmarketcap.com/currencies/distributed-credit-chain/#.WzW35rbBTMk.twitter and it's already trading on exchanges such as Kucoin, Bibox, Fcoin, and Dextop

Want to bag some 50ETH ? Cool! DCC trading competition is live now on KuCoin, dive in and stand a chance to win 50 ETH! https://www.kucoin.com/#/rank/DCC180725

In conclusion, the distributed credit chain solves the challenges in the centralized credit system, promote and strengthen existing business.

MEET THE TEAM

The CEO of Distributed Credit Chain project Stewie Zhu is a finance executive and scholar who has this passion and is dedicated towards improving the fintech industry.

A must watch exclusive interview with Stewie Zhu

DCC team comprises of versatile expertise that would make this project a huge success. Visit this link http://www.dcc.finance/ to know more about the DCC team.

DCC PARTNERS

DCC also recently partnered with Plug and play, Datawallet, Certik and University of OXFORD - Said Business School.

TO KNOW MORE ABOUT DCC PLEASE VISIT:

Website: http://www.dcc.finance/

Whitepaper: http://www.dcc.finance/file/DCCwhitepaper.pdf

Telegram: https://t.me/DccOfficial

Facebook: https://www.facebook.com/DccOfficial2018/

Medium: https://medium.com/@dcc.finance2018

Twitter: https://twitter.com/DccOfficial2018/

Github: https://github.com/DistributedBanking/DCC

Author Bitcointalk username- ijsera82

Bitcointalk profile link -

https://bitcointalk.org/index.php?action=profile;u=1569887;sa=account

This is amazing. Enterprenuers now have a cause to smile.

That's #DCC's goal, even the undeserved are well considered.

Coins mentioned in post: