Changing How We Live With The Blockchain Series: Pushing For A Much Needed Financial Revolution

I had originally thought I would skip this industry in my “Blockchain series” but with a couple of recent events, I thought it would be unfair not to highlight the greatest use case of the blockchain and cryptocurrencies. In fact, in hindsight, an in-depth research on this topic should probably have been my first article on this series.

The 100 Billion Dollar Goal

Over the weekend, Bittrex’s BTC wallet was put under maintenance in preparation for the ongoing HF. While this was the standard security feature for the customers’ interest, it highlighted the current situation of the industry. Already, payment processors, gateways, BTC-accepting e-commerce sites have been warned to suspend BTC transactions until the coast is clear. While the ongoing frictions are in reality for the progress of BTC, it undermines the huge step blockchain and cryptocurrencies have taken in overtaking the traditional financial system.

Created in 2009 by Satoshi Nakamoto, his goal was to usurp the fiat system that had thrown the world into turmoil. Bitcoin’s goal was to serve as a peer-to-peer electronic currency/cash that would change the way we transact as humans.

The pseudo-anonymous virtual creation with hundreds of similar digital currencies is now a 100 billion dollar industry. All, though with various functions, with the primary goal of revolutionizing the way we exchange value.

The Issue With The Current Financial System

To understand why there was a need for such invention, we have to remind ourselves of the state of the traditional financial system.

Here’s an apt quote from The Guardian:

The heart of the economic disorder is a world financial system that has gone rogue. Global banks now make profits to an extraordinary degree from doing business with each other. As a result, banking’s power to create money out of nothing has been taken to a whole new level.

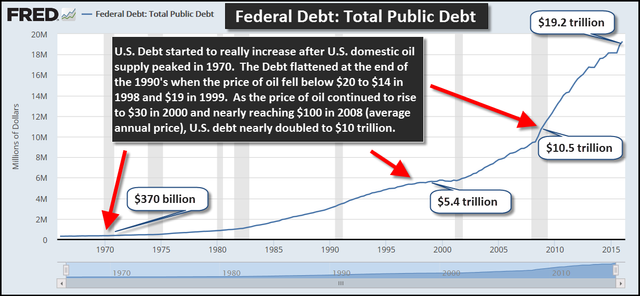

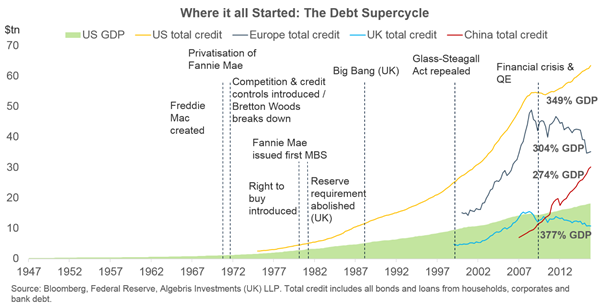

- Global Debt is rising rapidly – countries, companies, and households are deep in debt.

Yet, central banks keep printing money while standards of living keep declining.

Banks are in distress and interest and inflation rates keep rising

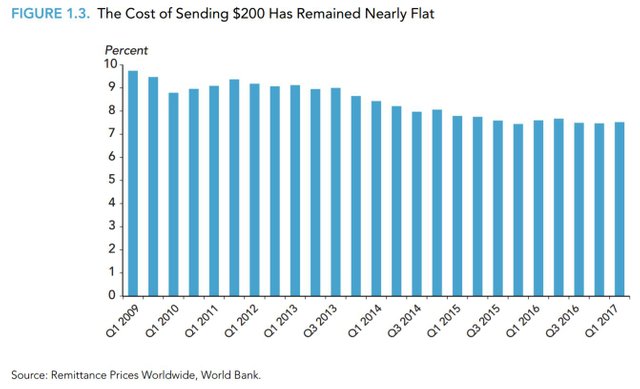

The cost of remittance is absurdly high. For example in 2014, the cost of sending money to Africa was $1.8billion! And despite several promises, this has not changed till now.

These and many more issues plaguing the global financial system led to a burning need for a change.

Blockchain To The Rescue

There are several use cases of blockchain in the financial industry. The biggest of them all is running a (digital) bank that replaces/competes with the efforts of physical traditional banks.

Banks On The Blockchain

A couple of months ago, Polybius raised over $16m hoping to become the first digital bank in Europe. The digital initiative proposed a blockchain-based solution that would provide all the normal functions of a traditional bank while being accessible anywhere.

Here’s a short video describing what they do:

Already, Blockchain.info message to customers in pursuance of Bitcoin’s goal was the ability to be one’s bank.

Also, before their recent pivot, Circle raised a lot of money to provide digital retail banking. All based on the blockchain.

While the aforementioned use cases are attempting to displace traditional banks, some blockchain- based solutions are being offered to traditional banks attempting to bring them to the realities of the 21st century. Ripple and VaultOs (an operating system built on the blockchain for banks) are examples of these enabling use cases.

Payment Gateway and Processors

In the past one month. a lot of interest have been shown in this financial niche with companies raising hundreds of millions of dollars.

Debit Cards’ Race

TokenCard raised over $16million in minutes. Its' aim is to be the first VISA –powered debit card that would help crypto holders transact anywhere in the world. Immediately after that, Monaco raised over $3million in a few days with a proposal to deliver a Etheruem and Bitcoin enabled VISA card. While a number doubted Monaco’s claims, there was no doubt that the need for a crypto supporting debit card was on the priority list of crypto tokens’ holders.

Also, TenX raised $80million positioning its already functioning Visa Debit Cards as an instant cryptocurrencies’ converter to fiat currencies.

These new brands join existing brands like Payza, Xapo etc in the race to bring cryptocurrencies to the mainstream as the new form of exchanging value.

Payment and Money Transfers

The Global remittance industry is worth over $600 billion and yet still riddled with a lot of defects. Not only is there a lot of back and forth communication between the sender, receiver and third party, the remittance fee is absurdly outrageous.

With faster, cheaper and anonymous offerings, Bitcoin and other currencies offer a more powerful solution.

Already, bitcoin-powered remittances have increased in volume to countries like Philippines (tired of PayPal autocracy), Venezuela (dying national currency), South Korea and India.

Abra, BitPesa, and Circle are prominent money transfers that are tackling the huge international remittances industry.

New coins like OmiseGo have also raised funds to join this lucrative niche.

The Giants Are Not Sleeping

Unlike other traditional industries like the media and transportation that paid a blind eye to rising innovations, banks are paying rapt attention to the disruptive nature of the blockchain.

In fact, the banks have been heavily funding their own disruption

The reasons for this surprising action are not far-fetched. Apart from fear, the blockchain offers a lot of benefits to banks and enables them to scale their operations faster.

Applying blockchain technologies could help reduce banks' infrastructural costs by $15-20 billion by 2022, according to a 2015 report.

As far back as 2014, global financial entities like Nasdaq, Citi, and Visa have poured in large amounts of capital to further develop blockchain solutions for the industry.

Already coins like Ripple with a throughput equaling that of VISA are partnering with banks en masse and are already transacting several millions of dollars in transactions monthly.

Other banks like Goldman Sachs and Morgan Stanley have joined the Enterprise Ethereum Alliance while over 70 financial institutions are part of the R3 Consortium.

Conclusion

Blockchain and digital currencies have a huge role to play in ushering in a new financial dawn and there already exists several use cases to make this a reality.

While there are obstacles like regulatory bottlenecks and cyber security concerns, it will be interesting to see how all these innovations play out.

Although the industry is still a young one, what is certain is that there is an urgent need for the urgent replacement of the current financial system. And the blockchain is a viable option.

Over to you:

Which cryptocurrencies do you have? Have you made a purchase with any of them before?

Very educative post, even if this post is more than 4 years, it still touches many point.

Thank you friend ! It is very pleasant and interesting to read information about the system in which we ourselves are tied, I'm trying to deal with this system, but it's difficult! Such thoughts, articles, comments - that I can find in your blog give me the confidence to think that I'm on the right track.

I have not read the history of bitcoin before, but now I know it and I like to read the information on your page, namely the opinions of other people who help us to be closer to the revolutionary actions in the world.

I have bitcoins monero, dash, ethereum, humaniq, decred and golem.

I basically use it for speculative trading.

I'm expanding my portfolio with dollar cost averaging

This is a very well written and informative article and once again you have delvered @infovore keep up the good work, upped.

These crypto debit cards are great as it will make life easier for us and I hope that steem dollars or steem debit card will be available soon. Many uninformed people see these as ponzi.

Feel free to see my latest blog post : Why are Ignorant people Calling Steem & Bitcoin A Ponzi Scheme

Thanks and keep steeming.

Thanks. It will be interesting to see a Steem-backed Debit card. There are so many content creators so it makes perfect economic sense for such a need. The recent stability of SBD = $1 will make it a perfect fit.

This discussion, with you my dear @infovore motivated me to write my latest post..I mentioned you on there :Why Steem debit card will be great for all , pls see it and join the debate

Exactly..I agree with you. I even posted related topic on my blog about our own trading platform.

Hi @infovore I've published a post about you, check it out if you can, thanks.

30 Best Steemit Bloggers Of The Day To Follow 3rd August 2017

https://steemit.com/steemit/@jzeek/30-best-steemit-bloggers-of-the-day-to-follow-3rd-august-2017

@infovore you have the innovative mind..your created the best of the best article i ever read on the cryptocurrency --well said buddy

While there are obstacles like regulatory bottlenecks and cyber security concerns, it will be interesting to see how all these innovations play out.

Although the industry is still a young one, what is certain is that there is an urgent need for the urgent replacement of the current financial system. And the blockchain is a viable option.

the information and the conclusion is very efficient and very much detail.

all and all i love it..

P.s

mrblu

kindly see my post,.i need to be love and be love a poem, hope you will have time to visit my page-please click it here

The Blockchain system is very fascinating. Glad to be part of Steemit. Thanks for the education @infovore

The current financial system is a scourge on society. It may not happen soon enough for me, but I hope that some day the blockchain or some other futuristic technology will liberate the world from this terrible system.

Thank you for this and i know that with this level of awareness people will know cryptocurrencies has come to stay . I actually never believed in all this digital currencies not until i joined this platform and other platforms that talks about digital currencies.

Thank you for this wonderful articles it shows your level of knowledge and understanding when it comes this.

Also have started following you because i want to learn more from you. Please kindly help to resteem, up vote and even follow me I will appreciates you help to resteem some of my articles i know they will be a blessing to you after reading them @optimistdehinde.

Also thank you for your past up vote i really cherish it and am thankful. One love. Writing another article presently on PERSPECTIVE. Watch out.

As I have said elsewhere and will continue to say, "The keyword in cryptocurrency is CRYPTO. We need to keep it that way." If we allow blockchain based financial system to fall back under the crushing dominance of the very same traditional banking systems we are on the verge of leaving behind ... well. There will be no escaping that, of this we can be sure.

It's an exciting and precarious time. Our choices now decided the future.

Miners are the new bankers, we have the power now!

Right! the question now is if the power will remain distributed or if the end result is just power concentration again in a few very powerful miners?

This is the big question?! Take for example the Chinese miners domination of the mining pool and the Chinese market accounting for the largest share in transactions volume.

How do you see a way to avoid this power concentration? the Dash governance model aims for that. Should others follow?

@infovore - A masterly article on the deficiencies in the FIAT money system, why the banks still propagate it and the block-chain based crypto alternative. Having been an executive with multinational responsibilities, I have seen the leveraging of debt that lead to the debt bubble burst in 2008. It damaged the world economy so much. There was nothing much that people like you and I could do because, as you have mentioned, debt was a major business carried out by major banks. I know that there are a lot of teething issues and acceptance issues in crypto currency scenario right now but as you have pointed out, ultimately, the major driver will be the cost of transactions. Banks themselves will adopt this when the costs of FIAT transactions start affecting their business in a major way. Things like crypto debit cards etc that make acceptability for the masses better will certainly help in the process.. I do hold crypto currency but nothing great yet. It is sadly a long process to convert crypto to FIAT money in my location. Crypto based debit cards are not available here yet. Keeping my fingers crossed that it happens in near future. Thank you for this informative article. Upvoted.

Update at my end is that I have posted a blog with Original GIFs of 💕𝓐 𝓓𝓪𝓽𝓮 𝔀𝓲𝓽𝓱 𝓛𝓲o𝓷𝓮𝓼𝓼𝓮𝓼 that you may find interesting. I would be honored if you visit my blogs and take a look. Your valuable comments will be eagerly awaited. Thanks

Wow. What a concise reply. Thanks for backing my point about the current teething problems cryptos face. In relation to the debt portfolio, there is little the common man can do. Whats more saddening is that the debts aint being channeled to better the society.

Your pictures are always so cool, btw.