The End of Breakage Businesses

tl;dr: When assets are controlled by individuals, customer experiences will improve. They will have to.

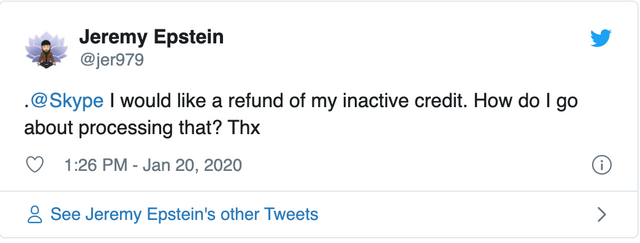

I almost never use Skype anymore.

And by “never use,” I mean that the app isn’t open on any device and it’s as if it doesn’t exist.

Every few months, I might go in and check, but it’s not a factor in my life right now.

The other day, I received an email from Skype telling me that I had a $4.97 credit with them. However, if I didn’t log-in and do something such as make a call or send a text, I would lose the money.

You can probably see where this is going.

As we like to say in my house, “if you never ask, you never get.”

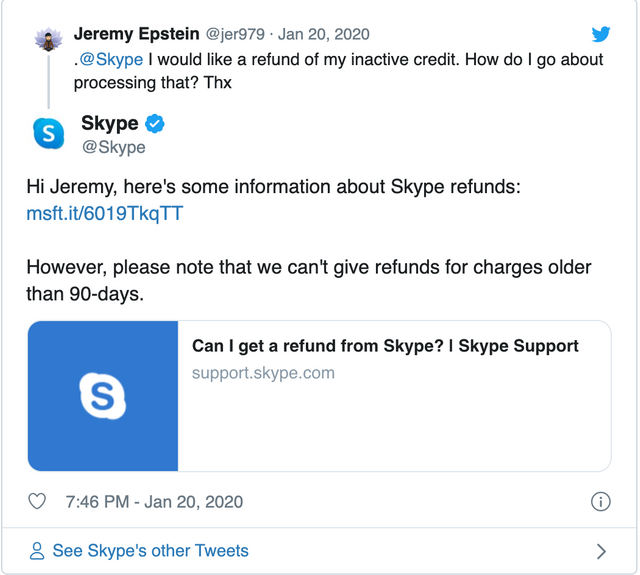

and the semi-predictable response that came in…

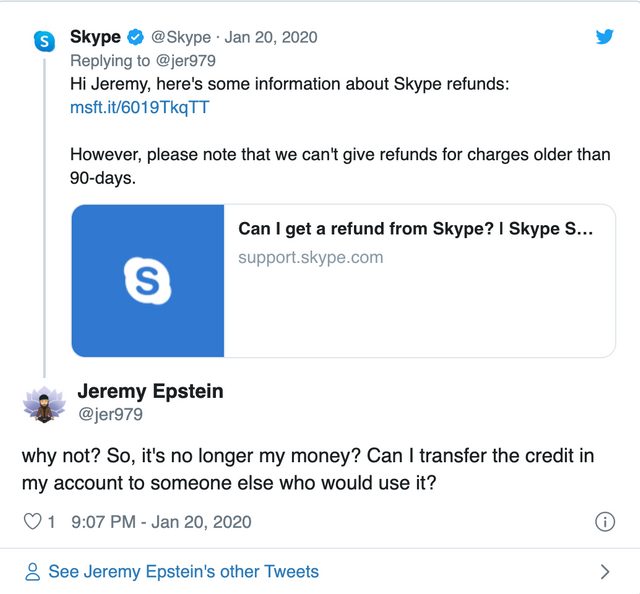

Which, of course, led me down the “whose money is it?” path…

The good news, I suppose, is that it is possible to transfer credit.

Breakage

One of the business concepts behind pre-paid plans like the one Skype has is the idea of breakage.

Basically, it’s an estimate of the amount of money that customers will give you that will never be redeemed for goods or services.

You know all of those gift cards that people send to each other?

Part of the business model is that a portion of those cards or a portion of the money on those cards will not be used.

The real “gift” in the gift card industry is the free money that merchants get when people don’t want to remember that their gift card has $2.34 on it or whatever.

Add that up over 100,000 cards and soon it becomes real money.

That’s breakage.

Controlled Assets

The money that I gave to Skype is an asset.

It is supposed to be for my benefit and use. I am well aware of the terms and conditions of pre-paid. Use it or lose it. I get it.

In this case, I estimated I would use Skype far more than I have. That’s on me.

But I think it points to a vulnerability in these business models which rely upon breakage.

And breakage is something is only possible when you don’t have control over your assets.

Liquid Assets

The alternative to breakage (which is vendor-centric) is liquidity (which is customer-centric).

If I have an asset that I no longer need, the ability to readily exchange it for an asset that I want makes it liquid.

I should be able to trade my Skype credit to someone who does use Skype on a regular basis. Maybe I trade it as a discount and maybe I trade it at full market value. That depends, of course, but at the end of the trade, everyone-including Skype-is better off.

I turn the $4.97 from something I can’t use into a latte. Someone else gets more credit to make Skype calls.

And Skype has two people who have had more positive experiences with the brand.

Customer-Centric Apps

I think that, one day in the future, the idea that people had assets (Skype credit, airline miles, gift cards, rewards points) that they couldn’t freely buy, sell, or trade with anyone they wanted to on a platform like 0x is going to strike people as ridiculous.

“What do you mean you couldn’t trade your airline miles for 7 scented candles at Walmart?”

When individuals have control over their own assets, it forces institutions to deliver and create ever more valuable experiences.

That way, you earn customer money because of the value you deliver to them.

Not because you get to accrue interest on the value they gave you but never use.