When Regulators Get Disintermediated

.jpg)

tl;dr: an exploration of how regulatory goals could be achieved more effectively with decentralized governance.

There are points in your life when you feel old.

Then, there are points in your life when you feel ridiculous.

And there are moments when you feel old and ridiculous.

One of those happened to me the other night when I was lying in bed, getting ready to go to sleep.

With my reading glasses on my nose (only a +1), I caught myself reading Money, the Financial System, and the Economy.

Yep, that’s as lame as it sounds.

I was “winding down” from the day around 10 pm and my reading of choice was an economics textbook, published in 2002.

I kind of smirked, thinking how sad my life had become, but then I got excited because (and yes, this is potentially even more embarrassing), I got to the section on….wait for it…. financial regulation.

Why I Got Excited About Regulation

In one section (p. 53 of my edition) called “Maintenance of Financial Stability,” the text reads:

“Because most financial assets are held by intermediaries such as banks, pension funds, or insurance companies, policymakers are concerned about the financial soundness of those intermediaries.

The federal government has implemented four types of regulations that address such concerns: disclosure of information, prevention of fraud, limitations on competition, and safety of investors’ funds.”

I sat up with a metaphorical light bulb over my head.

In a blockchain-based world, I started to wonder, “does regulation come standard? If so, what does that mean?”

That is, while regulation of the four types are still valuable, the method for regulating could be different.

Let’s look at them.

Disclosure of information

You can look at the blockchain any time you want.The software that guides the protocol is open source. So is the software for smart contracts. At a minimum, all of that information about where funds are, how they will be held/secured, and what your rights are, how they are protected, etc….all of that is available 24/7. Admittedly, it’s not easy to understand all of the code, so there’s an opportunity there, but the information is disclosed.Prevention of fraud

There have been enough ICO scams to show that fraud is indeed very possible in the blockchain world. I would think as the smart contract auditing and insurance industries mature to provide a decentralized rating system (think Moody’s without the centralized conflict of interest), we’ll have better warning systems for fraud prevention.Limitations on Competition

I could see two sides to this.On the one hand, since the software is open source, anyone is free to take it and create something new. No “patent trolls” and no “patent surround” strategies that are common in many advanced industries. A good example of this is the Ox-Hydro fork. As people in crypto like to say, “permissionless innovation.“On the other hand, with network effects being what they are, it’s easy to see a scenario (especially in some markets) where it really is “winner take all” and all the value accrues to one network.

That is where the governance of the network comes in and I think (hope?) that the decentralized nature of it prevents monopolistic behavior that doesn’t serve the interests of all of the stakeholders…who are also the shareholders. (I call that Shareholder 2.0, but that’s another post)

- afety of Investors’ Funds

See above for Smart Contract section and this post as well. There have been plenty of smart contract hacks to date (‘The DAO” and Parity wallet being two big ones). In theory, though, the transparency that smart contracts afford can provide the guarantees about the safety of investor funds.

Ok, so it’s possible to do many of the jobs of regulation but without the regulators as intermediaries.

The Cost of Regulation

All of this regulation doesn’t come cheap, I am sure.

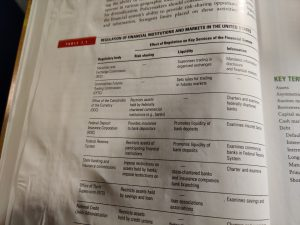

I couldn’t find numbers easily, but here’s a picture of the chart from the book, highlighting key regulatory bodies in the US. Remember, this chart is from 2002. Here’s another list from Investopedia.

Aside from the government waste, it just costs money for the people and systems to get the job done.

We can also leave aside the cost of people making mistakes that as well as potentials for conflicts of interest or illegal behavior.

The cost of the system is one thing, but the impact is another.

Hubbard continues:

“Regulation affect the ability of financial markets and institutions to provide risk-sharing, liquidity, and information services.

Restrictions on the types of instruments that can be traded in markets affect liquidity. Regulations limiting the ability of financial institutions to hold certain types of assets or to operate in various geographic locations affect risk sharing and the potential for diversification. Policy makers should consider the effects of regulation the financial system’s ability to provide risk-sharing opportunities, liquidity, and information. Stringent limits placed on these activities in domestic markets create opportunities for international competition.”

In other words, all of these rules add friction to the system. Plus, there are unintended consequences (see housing bubble).

The Opportunity for Regulation 2.0

As blockchain-based markets evolve, they can meet the regulatory expectations and needs of society (in theory) but deliver it at costs that are potentially orders of magnitude cheaper than existing alternatives.

In other words, the “international competition” that Hubbard warns about could also apply to “decentralized competition.”

Regulation is supposed to serve the needs of communities (of varying size).

A decentralized governance model, running on a scalable blockchain, offers us the possibility of a community-driven regulatory model. It would be lower cost than today’s solutions, more adaptable to changing market needs, and have lower internal friction. Combined, this enables value to transfer more rapidly, making everyone better off while keeping them safer.

As the talk heats up about regulation everywhere, it’s worth remembering that ends can be achieved through different means.

Not saying it will be easy, but I think it will be possible.

If you really want to dig into regulation, Coin Center is a great place to start (and a great org to support).