SwissBorg (CHSB)

In October 2017, the market cap of cryptocurrencies surpassed $145bn, this is 6 times higher than the market cap at the beginning of the year. Despite this strong momentum, traditional mutual funds specialised in crypto investments remain very limited. Bankers are eagerly awaiting products that offer the opportunity to diversify their portfolios of traditional assets. The results of the graph below speak for themselves. We are in advanced discussions with institutional clients who wish to invest in cryptocurrencies and trust our expertise. Due to mandate restrictions, regulatory restrictions or lack of expertise, institutional investors do not want to invest directly in tokens. Having the ambition to shape the future of wealth management is not an easy task. It requires the bringing together of experienced asset and Hedge Fund managers, bankers and top blockchain specialist with the objective to think and build the first community-centric Swiss cyber wealth management company. History has to be written and we have already begun to write the first chapters.

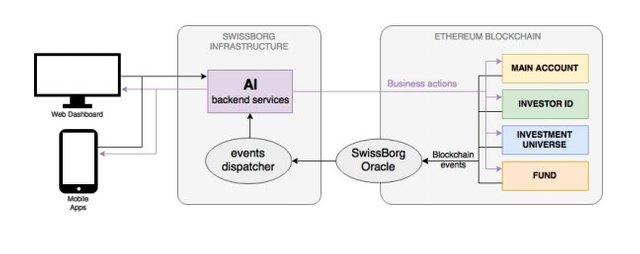

Every Smart Mandate starts with a new or existing Investor ID smart contract which represents an investor and holds all the documentation issued from the KYC process. After established, an Investor ID smart contract will be reusable for multiple Smart Mandates. We believe in the future and the security of blockchain, therefore all the validated documents will be stored encrypted by using existing solutions like IPFS or Storj. The mapping between all the documents and the Investor ID is done by storing all the addresses of the documents in the smart contract. The Smart Mandate is represented by a Main Account, which is a multi-signature smart contract created through our web platform either by the investor or our financial advisors. Every Smart Mandate is first linked to an Investor’s ID by linking its address in the Main Account.

The core part of the Smart Mandate architecture is an Investment Universe, which can be compared to an off-chain portfolio. Each investment universe’s smart contract regroups all the tokens, crypto-currencies and smart contracts of the same level of investment risk. The Ethereum blockchain does not provide the conditions and the performance needed to realization real-time Artificial Intelligence: the latency of time required by the blockchain to approve any new transaction does not meet today’s live investment needs. So, we will externalise this AI computation off the blockchain by intercepting events occurring on the blockchain and send them to our backend microservices’ architecture through an Oracle.

Our microservices will implement all the necessary security and end-to-end encryption to mitigate nowadays security threats and gain our clients’ trust. All incoming events from blockchain are analysed and dispatched to dedicated microservices which will take investment decisions based on mathematical analysis and heuristics. Our web-based dashboard will display state of our clients Smart Mandates, but will also include investment analysis, reports and tools for our clients and financial advisors to manage their assets 24/7. Our solutions will have an associated native mobile solution for most popular mobile devices. Our clients should be able to work transparently between the web-based and mobile applications, by switching from one to the other seamlessly. Such functionality is mainly brought by the nature of blockchain itself and the accessibility of our backend services at any time of the day.

Bounty0x username: predators

Website: https://www.swissborg.com/

An interesting project, I will definitely study it in more detail.

Good project

nice review