Solving the Byzantine Generals Problem with Proof of Stake (PoS)

Solving the Byzantine Generals Problem with Proof of Stake (PoS)

Proof of Stake (PoS) is an alternative consensus algorithm to Proof of Work (PoW). Unlike PoW where new transactions are confirmed through mining on powerful computers, PoS sees users pledge (or ‘stake’) their existing assets to validate new transactions. Instead of expensive mining equipment, users need nothing more than a standard computer, an internet connection and to hold the asset.

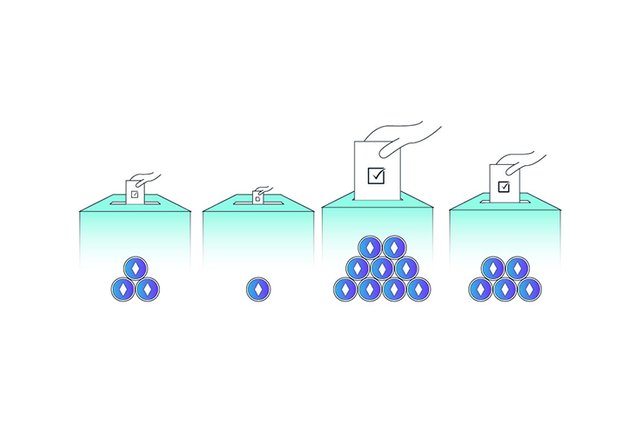

A PoS system works by asking users to lock their funds in a form of an escrow. Once funds are locked, the user (henceforth validator) can begin to validate new blocks of transactions. The network algorithm then selects a validator to process the next block through a quasi-random process. The more funds you stake, the more proportionally likely you are to be chosen to validate a block and therefore receive the associated rewards. It can take into account other factors such as the length of time validator funds have been staked for, randomizing the process. A dishonest validator is punished through the loss of their funds.

First implemented by PeerCoin and Nxt in 2012 and 2013 respectively, PoS aims to build upon some of the perceived weaknesses of PoW and is growing in popularity with Ethereum (currently the second largest DLT by market capitalization) aiming to fully transition from PoW to PoS in the near future.

Like PoW, PoS solves the Byzantine Generals Problem – albeit through a different means. It empowers the distributed and un-coordinated Generals to come to an agreement despite communication not being instantaneous and with potentially contradictory signals being sent:

- The Generals become validators by depositing their assets

- The pre-set algorithm selects a General to become a validator for the next block, which the General creates

- Another General is subsequently chosen to become a validator and references/builds upon the previous block to form a growing chain. As a result it becomes clear which chain most Generals are contributing to

- The Generals know how quickly each block takes to be created under the PoS consensus algorithm and so after a period of time will be able to know if enough of the other Generals are working on the same chain to be able to make a successful attack

This solves the Byzantine Generals Problem in a more efficient and environmentally friendly manner, eradicating the high energy and hardware costs associated with PoW. Through doing so it also removes the economies of scale the largest miners in PoW profit from. PoS gives all users an equal chance, proportional to their holdings, to receive a reward. As PoS allows small stakes the same participation rights as the largest, it should lead to a more decentralized network.

Furthermore, PoS ties validators to the network by incentivizing them. Whereas miners may mine Bitcoin and immediately dispose of it, or switch to mining something more profitable, PoS ensures that validators lock their funds up for a set period of time for the use of the network. Additionally, dishonest actions put their stake in jeopardy. This further allies a validator to the network they are securing.

Potential problems with PoS

There are several concerns that critics raise surrounding PoS.

Firstly, although PoS is theoretically more democratic (as it gives all users an equal chance to participate, and avoids economies-of-scale issues that PoW suffers from) it will suffer from the same issue – decentralized networks edging towards centralization. The biggest holders will receive the most rewards, and therefore grow larger, creating a vicious cycle in which the big get bigger and the small get increasingly diluted.

As these large interests accumulate, it is likely they will then begin to collude rather than compete. This may lead to these owners making changes that benefit them over the needs of others. Because your funds are “locked” when staked, it is likely that only a minority of network users will participate in staking and thus receive rewards, this accumulation of power could be pronounced. This lack of participation also means that a 51% attack on the network only requires a malicious actor to possess 51% of the amount being staked, not the total supply.

Proponents argue that the network could be forked in the event of an attack, and the attacker’s staked amount destroyed. The idea is that unlike PoW (where an attacker need solely buy enough mining equipment to take over the network and could redirect said equipment to another PoW system after the attack), with PoS an attacker would have to buy 51% of the total staked supply every attack. However, this relies heavily on an attacker not having the resources or the determination to be willing to make these sacrifices, and that the forked network could survive the loss of confidence an attack would bring.

Many PoS networks also require validators to possess a minimum (usually significant) amount of the asset to be able to stake. As the majority of users will not possess enough, staking pools will spring up as mining pools did before them, leading to further centralization.

PoS is also potentially vulnerable to the ‘nothing at stake’ problem, where validators have nothing to lose by voting for multiple forks of the network. Through this, a validator would gain stakes in two chains. The value retained by the Bitcoin and Ethereum forks Bitcoin Cash and Ethereum Classic highlights the motivation to do this. Whereas a miner on a PoW system such as Bitcoin could only dedicate 100% of their resources to one network at a time, PoS enables validators to easily validate both chains.

PoS remains in relative infancy, but project teams have already begun to try improving upon it, merging the good parts of PoS (energy efficiency, allying users to the network) with other means of achieving consensus.

Join The Radix Community

Telegram for general chat

Discord for developers chat

Reddit for general discussion

Forum for technical discussion

Twitter for announcements

Email newsletter for weekly updates

Mail to [email protected] for general enquiries