BTCCREDIT

BTCCREDIT - Next Generation Decentralized Banking Ecosystem.

overview

Blockchain makes history by transferring power from centralized enterprises into the hands of consumers. This allowed people to manage their assets without interference from banks, brokers or institutional observers. This is a long-awaited necessity, as people today take too much risk, allowing the central facility to control their crypto assets. They do not understand that it is not they, but the wallets, exchanges and credit platforms that control their assets. Consequently, they gave up control over their identity, confidentiality and money, because they believe that they have no choice. But no more.

We aim to be the access point that provides people with this choice. BtcCredit is a universal decentralized wallet that gives you full control over blockchain assets for storage, exchange, lending, borrowing, investing and cola. This document describes the structure of the next generation decentralized banking ecosystem, which is based on a decentralized multicurrency wallet, decentralized p2p lending and decentralized p2p exchange.

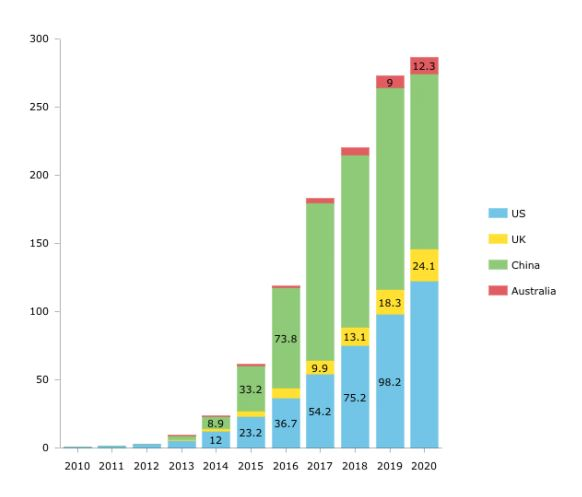

P2P Lending Market Analysis

Cited that “according to Morgan Stanley, the global lending market can reach $ 290 billion. by 2020, with an expected cumulative annual growth rate of 51% from 2014 to 2020. "

The BTC Credit team is trying to demonstrate the potential of this market in order to explain that their truly innovative peer-to-peer wallet solution has great potential.

Credit Market Correction

Today, interest rates adjusted for inflation in different countries vary depending on the available liquidity. In Europe’s highly liquid market, interest rates are 0.5–5%, in Russia, 12–15%, in India, 12% and in Brazil, 32%. This indicates a clear disparity in the distribution of access to the lending market throughout the world. We believe that this inequality between borrowers should be smoothed out and a huge market value can be created in the process, especially with the help of arbitrage opportunities. Banks charge 5–12% interest on loans and reimburse you 0–1% for keeping your assets. With the growth of cryptocurrency and blockchain you can become your own banking institution. Btccreditmakes it a reality for you. Not only this, you decide who you want to borrow money for, at what interest rate and in what mode. All this is available thanks to the Blockchain technology, which BtcCredit purse relies on .

Traditional P2P Lending

Traditional P2P lending is similar to institutional lending, which takes into account some measure of the credit history and creditworthiness of the borrower. The creditworthiness of the borrower determines the type of credit transaction offered to him. The method of calculating the risk / credit rating is controlled using its own algorithms / artificial intelligence. Differentiation is also supported by the way default values are processed and penalties are imposed.

Crypto P2P-Lending

There are several Crypto lending platforms that follow different business models. On the one hand, they are similar to the traditional p2p lending platform with the ability to accept cryptocurrencies as collateral. On the other hand, they deploy the entire loan contract on the blockchain and fulfill the events of the loan agreement using intelligent contracts.

The blockchain technology, with its fully transparent and undecided transaction register, forms the ideal system for managing a loan with its parameters such as tenure, interest rate, cryptographic software, etc.

There are many platforms offering cryptographic lending:

Sofin

Everex

Ethlend

Lendoit

Btcpop

Competitive Analysis

P2P lending platform can be divided into three main categories:

- Traditional P2P - Lending within the same country and in the currency of that country

- cryptocurrency without a smart contract - Lending around the world with cryptocurrencies like Bitcoin

- cryptocurrency using the smart contract - lending using Blockchain gyrus Contract as an interim.

Famous competitors

Lending Club (Traditional P2P) - Lending Club is an American peer-to-peer credit company headquartered in San Francisco, California. It was the first peer lender who registered his bids as securities with the Securities and Exchange Commission (SEC) and offered to trade a loan in the secondary market. Lending Club manages an online lending platform that allows borrowers to get a loan, and investors to buy bank notes backed up by payments on them. Lending Club is the world's largest peer-to-peer credit platform.

The company claims that loans in the amount of 15.98 billion US dollars were received through its platform until December 31, 2015. BTCPOP ( Cryptocurrency loan without a smart contract) - BTCPOP Ltd. was founded in 2014 and has become an established peer-to-peer lending site. BTCPOP peer-to-peer lending is based on reputation, not credit score. Users can get loans from other members or make money by lending - all through bitcoins. BTCPOP Solution does not offer Smart Contracts.ETHLend (cryptocurrency using a smart contract) - a fully decentralized peer-to-peer credit platform using a smart contract on the Ethereum blockchain for a credit broadcast using tokens as security. But ETHLend does not generate points and does not offer any compensation fund to protect creditors. Recently, they added a section on oracles and insurance to their White Paper, but this is contrary to their approach to using tokens as collateral, so the situation is unclear

SALT (Fiat, which uses cryptocurrency as collateral) - A centralized loan platform in fiat currencies worth over $ 5,000. He uses a smart contract only to deposit cryptocurrencies as collateral. Their target market is borrowers with cryptocurrencies who do not want to liquidate their cryptocurrency in fiat currencies. Only accredited investors and qualified financial institutions can become SALT lenders.

Lender's pride

Lender's Pride platform offers a credit market with some unique features. The proposed system will form a forum for lenders and borrowers to verify loan offers and loan requests, including the proposed loan parameters. Based on their own risk perception ability to repay interest, lenders and borrowers will “shake hands” with each other to create a blockchain loan agreement.

How it works?

As a creditor, the user logs in and replenishes his USDT-generated wallet. The system creates a credit profile in which its acceptable credit parameters are recorded. The lender’s credit profile becomes part of the “credit market”. As a borrower, the user logs in with his generated bitcoin wallet. Funds in bitcoins in the wallet are the key to a potential loan. The borrowing requirement also becomes part of the “credit market”. The internal logic of the system automatically matches and offers existing loans and borrowers. The borrower or lender can also manually select from a set of loan offers or borrower requirements.

Once the loan is selected, and both parties agree with the parameters of the book, they say that a “handshake” has occurred, which will lead to the deployment of a smart contract on the Ethereum network. The borrower's wallet will be replenished with the requested USDT, and a repayment schedule will be created.

Repayment is recorded when the borrower pays the USDT back to his WSDT wallet. A set of conditions takes effect if the payment is delayed, is not sufficient or exceeds the required fee.

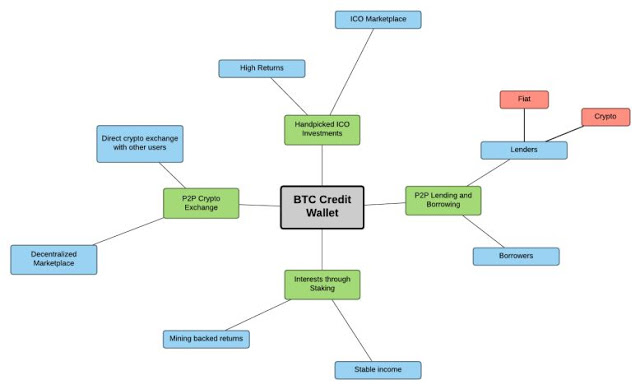

Defining the BTC credit platform Bearing in mind the competitors and analyzing market conditions and trends, BTC Credit was able to identify 4 key verticals when it comes to the services offered by its wallet:

- P2P lending and borrowing

- P2P crypto exchange

- Selected ICO investments

- Hobbies through share

All these services will be offered using the wallet on the platform. Think of a platform as a bank, and a wallet as a bank account. By analogy with the banking system today, a user can load a wallet with fiat or cryptocurrency and use the funds to provide services in all 4 of the above verticals.

Terms of payment

When the Contract is completed or in the event of a foreclosure, the borrower's request for the return of the BTC collateral is deposited, it can submit a request for the withdrawal of the BTC, and it can be executed.

Regular payments - the Administrator regularly pays a fee to the Lender, and the Borrower regularly pays the Administrator, the system will be notified by the blockchain of the date of the next payment by the Borrower.

Installment payment delay - if the borrower misses the due date for the installment payment, the API will notify the interface of the missed installment of the borrower. The borrower receives 3 days of grace period to pay the fee. if the installment is paid within 3 days, no fee will be charged.

Deferred payment delayed and missed - if the Borrower missed the installment date, it will be given 3 days of grace period, and even if he misses the payment, the Borrower will be fined for a specific fee.

Default Borrower - If the Borrower cannot pay 3 consecutive installments, the system will be notified by the blockchain, since the Borrower is the Default, and the Client may confiscate his collateral.

Loan before closing - if the borrower wants to pre-close the contract, he can close the contract by paying the Principle + 5% and close the contract, but he can only do this if he has paid 3 consecutive installments.

Payment by installments - here the amount of installments 1010 Every 30 days, provided that the user makes 1500 USDT / LTD, and he is willing to pay more than the amount of installments he can do, but the amount of the next monthly payment does not change his type of redemption meant that the additional amount will be deducted from the last installment, so if the amount is more than the last installment, then it will take into account the second last installment, and so on. or he can reduce the tenure to 3 contributions.

IF the user makes a penalty, he can pay 5% and close the contract by paying the remaining principle and 5%.

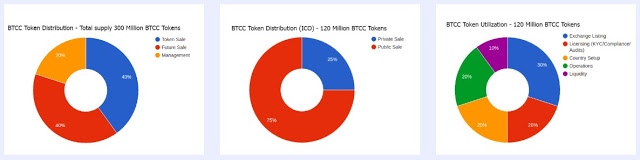

TOKEN INFO

Token name: BTCC

Token Platform: Ethereum

Token amount for sale: 120,000,000

Preico token price: 1 BTCC = 0.05 USD

ICO token price: 0.1000 USD

ICO token supply: 40%

INVESTMENT INFO

PERSONAL CAP MIN: 100 USD

ACCEPT CURRENCIES: ETH

SOFT CAP: 2,500,000 USD

HARD CAP: 10,000,000 USD

Token Distribution

ROADMAP

Q4 2018

P2P Crypto Loan System Launch

The journey begins with Borrow-Lending, a Peer-to-Peer Crypto Loans System Launch.

Smart Contract On Ethereum

LDT Tokens Contract, BTCC Tokens Contract.

Q1 2019

USDT Lending system Launch

Users Can Lend USDT which is backed by LDT

Tokens and Smart Contract

Getting Apps Available on Mobiles

Getting the Lending Platform Compatible with

Mobile Phones.

Acquiring Licences

Acquiring Crypto Wallet and Lending Licences

Crypto Wallet Launch

Crypto wallet Launch.

Q2 2019

BTCC Token Listing on our Lending System.

Now users can Lend Using BTCC Tokens and can use BTCC as collateral.

P2P Exchange Launch

Peer-to-Peer Cryptocurrencies Exchange

Platform Launch.

Q3 2019

Staking Plan Launch

Staking plan launch for investor, who will be

benefited with interest on BTCC / BTC hold as

staking

ALT Coins Lending and Colateral

Now users can Lend Using Alt Coins and can

use Alt Coins as collateral.

Q4 2019

Crowd-Funding Platform

Peer-to-Peer Crowd-Funding platform

For more information you can follow the link below:

Website ; http://btccredit.io/

Whitepaper ; http://btccredit.io/pdf/btccredit_whitepaper.pdf

Telegram ; https://t.me/btccredit1

Twitter ; https://twitter.com/btc_credit

Facebook ; https://www.facebook.com/BTCCredit-1017662868433011/

Medium ; https://medium.com/@info_60688

Youtube ; https://www.youtube.com/channel/UCLE1iXyR2aTEgx4x6mQ0Lig/featured?view_as=subscriber

Instagram ; https://www.instagram.com/btccredit

Author ; Emy_l33

Profile link ; https://bitcointalk.org/index.php?action=profile;u=2099289

ETH address ; 0x838d9F4750DFC63f9A75bdA335840C0A84aD3afc