Dharma Protocol: Tokenized Debt and Funding Through Decentralized Systems

Image Source: Dharma on GitHub

The biggest problem of the modern era is receiving funding for a project or company. The market has become almost too efficient. Investors are able to leverage that to their advantage. The scrutiny in investment process for equity has become a barrier to efficient capital allocation. So while some people consider ‘debt’ to be evil, it may be a necessary evil to keep our world thriving.

The modern start-up is open to debt funding. At some level, the risk is higher considering the constant cash outflow throughout the loan tenure, but it leads to long term rewards as the founders/company hold a larger ownership stake. At a seed stage, start-up funding is still majorly equity-driven given the lack of cash flows. But if a company has product revenue or some other form of cash flow, debt makes sense given the long term incentive it holds.

Why Debt Funding?

The venture debt market in the US is pegged at $2-3 billion annually. It serves as a financing link between two rounds of valuation and fundraising. Despite putting strain on company cash flows, it gives startups access to funds without diluting equity and it gives VC’s and Angels the ability to keep the ship alive before figuring out if this company is worth sinking more equity capital into. Considering debt investors have recourse to their money before equity investors, it is actually a safer alternative for investors.

The problem with debt is extensive paper work in a bureaucratic process that takes week or months to go through. The paradox is that companies issue debt or take loans when they are in need of immediate liquidity. But the loan-issuing entity cannot be completely blamed for the inefficiency of the process. The governance angle plays a huge role in slowing it down. Firstly, all loans must be handled and disbursed as per the law. The background checks are extensive yet they are done at a much slower pace than necessary. This boils down to the fact that the third parties who verify data and run background screens take their own time to do so. Moreover, the people they get their data from also take their own sweet time. The countless middlemen and reporting to federal agencies is what creates the inefficiencies.

Dharma as a Solution

ERC-20 is the standard for developing a decentralized network today. It is one of the most effective ways to build decentralized applications over a blockchain. But this tokens standard has its own drawbacks. It cannot retrieve payments or machine readable meta-data (interest rates, investment amount, etc) and it doesn’t allow you to factor external risks and events into the pricing of the ERC-20 token. Despite these drawbacks, it is still the best option currently in play. More dApp platforms are being developed so Ethereum will see a mob of competition if it fails to scale.

Dharma works on the same notion of crowd-funding. What ICO’s are to stocks, IDO’s (Initial Debt Offering) are to bonds. They work on the principles of making markets more efficient, transparent, and accessible. The bureaucracy in loan processing is evaded by instilling underwriters who are incentivized and penalized based on the loans they’ve written.

For people unfamiliar with the concept of an ‘underwriter’, it’s a person or entity who determines the risk profile for a loan and sets the terms according to that risk. Underwriters are an important part of traditional markets as they serve as the basis for risk management in loan issues. Morgan Stanley, Goldman Sachs, J.P. Morgan, and Jeffries are few examples of underwriters in the current system. Dharma would introduce underwriters that are effectively incentivized to accurately assess loans and their possibility of default.

Why Do We Need Efficient Debt Markets and Transparency?

As of today, global equities are valued at approximately $87 trillion while global debt is at nearly $270 trillion. Given the market is roughly 3 times larger, it makes up an incredibly significant portion of the world economy. Credit Suisse’ global wealth report estimates global wealth to be $317 trillion. That means debt is nearly 85% of total global wealth. With a vast amount of money in the world being debt, it goes without saying it is an important component of the financial system, despite how risky it is.

Equity tokens have several dimensions of risk (regulatory, market, liquidity, technology, and platform risk) but debt tokens have all these plus 3 more: credit, default, and transparency risks.

The need for transparency comes from the sheer size of this market. Today, most people are oblivious to the role of debt in functioning the entire world. Yet, the market is relatively opaque as not much information regarding issues are shared publicly. Other than the debt covenants (the contract between issuer and lender that states what the issuer can and cannot do during the life of the bond), nothing about the issue or use of the debt is given to the public eye. Many large institutions release reports and data regarding the state of debt markets and the parties involved. But coming from within the system, from a member of the financial cartel, are the reports and data truly trustworthy?

This is where the need for a more transparent debt market stems from. Rather than relying on a third or fourth party to tell us how the market us, what if we built a decentralized debt platform that bypassed the bureaucracy and invoked transparency? That is exactly what the Dharma Protocol aims to create.

Features of the Dharma Protocol

First and foremost, Dharma runs on the 0x protocol, putting it on par with any decentralized exchange (DEx) in terms of decentralization. It is a platform to issue, fund, administer, and trade non fungible debt tokens. Don’t misinterpret fungible here – it doesn’t mean it cannot be exchanged easily, it means it cannot be redeemed for another token or asset until it matures.

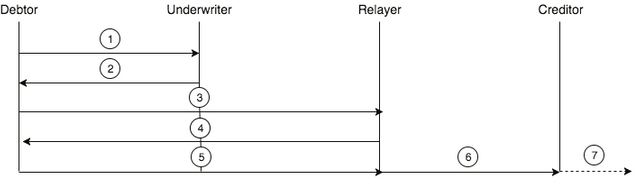

There are 4 main agents that operate the network: Borrowers, Lenders, Underwriters, and Relayers. Borrowers and Lenders are simple operators, so I’ll briefly explain the other two.

• Underwriters: As mentioned earlier, these are the agents who identify the possibility of default and structure the terms of the debt issue. Their job is solely to accurately identify the potential for default and liquidity risk and issue an approval or denial for a loan. Additionally, they enforce the contract after it comes into play. They ensure repayment and distribution of interest payments as well as collect on collateral for defaulted loans

• Relayers: The agent(s) that relays orders and aggregates all approved debt issues are relayers. Their job is to host the order book for potential lenders to browse through. They provide lenders with all meta-data associated with the potential loan.

(Source: Dharma Protocol Whitepaper)

The underwriter is free to create terms and collateral necessity as per their will. They can choose to get off-chain, legally binding contracts that are enforceable through courts or they can demand on-chain collateral. It’s important to note, Dharma is agnostic to this entire process; the entire underwriting process is strictly between the underwriter and borrower (and any necessary parties from either side such as lawyers and consultants). Responsibility to resist Sybil attacks and to gain the trust of potential lenders is solely on the underwriter.

Advantages of Dharma

• Low cost and transparent debt issues

• Eliminate inefficiencies of the current loan processing system

• Trade tokenized debt with ease on the same platform it is issued on

• Lend and borrow money at risk defined interest rates

Disadvantages of Dharma

• No guarantee of underwriter expertise is estimating risk of loans

• Lack of reputation integration for lenders and borrowers

• Unsecured loans are highly risky for underwriters and lenders as there is no legal recourse. Borrowers must have some collateral they put up for the lender to have a degree of confidence.

End-Game

Dharma can change the way debt is issued and traded. It can create a transparent ecosystem that drastically cuts shady practices and corruption. But all said and done, it does have its own flaws.

The lack of a reputational system is a big negative for Dharma. If they were to implement a reputation protocol that created an identity for each underwriter and carried all their information and the experience lenders and borrowers had with the particular underwriter (ease of cooperation, straightforwardness, efficiency, etc), it would help future lenders take more specific actions with regard to ascertaining the trustworthiness of the underwriter and their process.

Luckily, Sid Ramesh and Nadav Hollander have addressed this issue and see implementation for such a reputational system in the future. It’s important to note that Dharma is incredibly young and have done fantastic work so far despite being in a nascent stage and challenging the very competitive financial system that exists today.

Sources

• Dharma Protocol Whitepaper

• Sid Ramesh and Nadav Hollander explaining the future course of Dharma

• Credit Suisse Global Wealth Report

• The Imminent Crash by Jiyad Ahsan

-- AB

ReverseAcid Monthly Recap

- ReverseAcid Monthly Recap - November 2018 (Vol 1)

- ReverseAcid Monthly Recap - December 2018 (Vol 2)

- ReverseAcid Monthly Recap - January 2019 (Vol 3)

Crypto Analysis Series

- Part 1 - Basic Attention Token and How It's Revolutionizing the Internet

- Part 2 - Golem Network Token as a Potential Giant Killer

- Part 3 - Augur and the Future of Decentralized Predictions Markets

- Part 4 - Dogecoin - Such Meme, Much Value

- Part 5 - Zilliqa

- Part 6 - IOTA

- Venezuelan Economic Crisis: An Outsider's Perspective

- Barriers to Stablecoin Adoption: Detaching from the Traditional Notion of Markets

- Why Bitcoin Proves Markets Function on Behavior

- 2 Key Areas Zilliqa Identified Weakness in the Ethereum Protocol and Improved It

- Ujo as a Platform for Music Revamping - An Innovation Review

- Transforming Real Estate Investment on the Blockchain

- Determining the Role of Clearing and Settlement Houses

- Crypto Analysis Series - Part 6: IOTA

- The Stablecoin Ecosystem and It’s Importance to Digital Payments

- Looking Back at the Ethereum Hard Fork Timeline - A Precursor to Constantinople

About Reverse Acid

Be a part of our Discord community to engage in related topic conversation.

Follow our Instagram and Twitter page for timely market updates

Hi @reverseacid thanks for inviting me to read your post. Although the subject is way out of my expertise it is a very logical step in the process of moving away from fiat currencies and using the blockchain into a postive force for advancement of trust in a new system.

I am not a great fan of debt but I am a realist so it maybe a necesary evil.

I still cant understand why countries are in debt it just smacks of bad management of our taxes.

But a new company which needs funds for a new start up and a sound repayment program has obvious advantages for small people to be part of new and exciting projects for the advancment of society. 😎

Posted using Partiko Android

I agree with you @andyjem

Debt is a danger, but a necessary danger. It helps provide liquidity in between equity financing. It also helps lift people up from tough situations. Arguably it has put a lot more people in tough situations compared to lifting them out.

Dharma is quite interesting in this regard. It's a great take on the current financial system and actually quite ambitious given the size and monopoly of banking. This could do a lot of good for companies and startups. It can make debt investing (bonds and debentures) a much more transparent market.

Fiscal deficit is a whole other topic. Let's not even get into governments mismanaging funds 😝

Posted using Partiko Android

Hey @reverseacid, thanks for this write up on Dharma. First time reading about it. Informative and interesting.

A few days ago, came a across https://bitbondsto.com. Trying to wrap my head around the two platforms to see the differences. Perhaps you could help out. Thanks.

Posted on twitter: https://twitter.com/invest_country/status/1109826251722838016

Hi @devann

Glad to hear from you after a while!

I did a bit of homework on Bitbond STO after reading your comment. Here are some of the main points of difference or concern from me:

Anyway, this is my take away. Hope it was helpful. Cheers!

4% for business debt is not worth the risk, nor is 7% IMO. You can earn a solid 18% ROI right here on steem by investing in and powering up your steem, then leasing it. Honestly the ROI is higher then 18% with the inflation factor and how you get daily payments which can be rolled into more leases. Why would you put money into a company you nothing about like that.

To each their own, but this is very high risk lending. If they could get a real loan they wouldn't mess with this space and the potential regulatory issues. High risk business debt should be paying much higher rates. Go purchase junk bonds in some very large multi national companies and you get paid more then 4-7%.

Depends on where you're speaking from. In India 7% business loan is a great deal. The same goes for Russia, Brazil, and other emerging markets. Talking about USA, France, UK, etc, 7% is too much.

The point is various factors of risk build your interest rate. It includes financials, geography, and your business model. The point of such debt models is to help kill the bureaucracy. From a quick, study Dharma has great potential.

I need to look into Steem leasing more, but I believe the demand as well as supply is insufficient for something like that take off.

Posted using Partiko Android

There are tens of millions of SP leased and the rates tend to stay between 18-22% ROI.

7% is not cheap in the US for small business loans. And really not cheap for the type of business that needs cash quickly. I get 24-36% for loans that are used to fill purchase orders. They are designed to be short term 30-90 day loans and the people need cash now to purchase materials or inventory. Anyways lets just say I know way to much about business finance to think 7% interest rates are even kind of a good rate. Heck many fortune 500 companies are paying higher then that rate for their loans.

There are also massive regulatory issues of offering high risk lending opportunities to people who aren't financially educated to understand the risk factors.

Thank you for the insight @pifc

As I said, 7% is great for emerging markets. And it was just an example. As I said, loans will be based on various risk factors. And of course, companies are always free to go through the traditional route if they feel it is more advantageous.

Geography will be a huge part of the risk. The economy of the country the borrower is from will play a role in their potential cash flows. In a country like the USA, the premium will not exist. Where as in India or Poland, it most definitely will.

This is based on the fixed income concept of "country risk premium".

I will start looking into the potential of Steem in this process.

Posted using Partiko Android

Good follow up mate.

Hey @reverseacid, thanks for the help. Will check them out again later.

No worries about the memo, piotr uses them loads. People here on steemit may not like them much. Anyway, I also spent time in India, I'm impressed you are living there...unless you were born there of course.

I like the name "Dharma". Do you know that it is a Sanskrit word meaning "constitutional position" not just "religion". Religion is something you can change but constitutional position is something inherent, like the dharma of sugar is to be sweet. Our dharma is to be a servant of the divine. It doesn't matter if you are brahmana, ksatriya, vaishya or sudra and have mundane dharma in that caste, The dharma of every living entity is to be prakriti in relation to purusha. So I like the name.

But I don't promote debt in any form or shape whatsoever. It is immoral. Maybe I'm old-fashioned, it just intuitively repulses me. I have never been in debt and am approaching 60 years old now. Bad use of a good name with "Dharma".

And you like the "we" reference when talking about yourself. I presume you are writing for a company or something. What's that all about?

Hi @julianhorack

I'm aware of the meaning of "Dharma". Actually, I was told it meant 'duty' rather than 'constitutional position'.

The "we" and "I" variation can get quite confusing. Two people run this account. We're into different areas of expertise so we combined our heads and made this blog to help battle misinformation.

I think your stance is debt is quite respectable, sir. Many people have the same opinion. But in this case, it is more toward a business vertical than personal debt. Whether we like it or not, we cannot deny the need for debt while trying to scale a small business into a much bigger entity.

I believe (and this is a wild guess) the name "Dharma" was chosen based on the accurate depiction you've given. The platform will judge your for your default risk; not your social status and beliefs. You will not be charged higher because you live in a poorer area of a city, you will not be given a lower loan because your father knows a local politician.

Thanks for your comment and support. It's greatly appreciated.

Posted using Partiko Android

Good to hear your further description of the loan system. Many thanks guys. I understand businesses often need to start with a loan. And your ethic sounds commendable.

Yes "dharma" usually is translated as duty and "Constitutional position" could be a deeper understanding of that.

There are safety measure in place to protect the public and investors. I am tired of bailing out these loans. Doing away with these safety measures does make the process faster. Faster may not be best.

In order to get the investors to finances the loans there has to be some kind of security.

Best of luck with this adventure

That's the exact point here. These are targeted at businesses. This is because your loan has to be secured for something, given there is no legal recourse for on chain loans.

Safety measures are adequate for such use cases and will be strengthened by the reputational system that comes into play. Instead of extensive paperwork, it is merely code based mathematics and actuarial.

You would be surprised how much of the process in traditional loans are redundant. It is a lot simpler than it is made to be. I've been studying and working in this sector for years now and the biggest lesson I've learnt is finance guys love to overcomplicate simple things.

Posted using Partiko Android

I have no doubt that the process is overwhelming and can be simplified.

Hi,

Please take me off your memo message list, I (among most other established steemians) regard contacting people via memos as an abuse of the steem ecosystem unless it involves genuine financial transactions or urgent warnings about potential scams/ security breaches.

I also suggest you stop contacting people in this way, you are basically spamming people and doing your reputation no good!

Thanks.

Hi @revisesociology

We're just trying to reach out to people who are interested. It isn't out intention to spam people who do not want to receive such memos

I apologize for the inconvenience and hope you can forgive us for this. You will be immediately removed from the list and your advice will be taken into consideration

Posted using Partiko Android

Thank you!

Posted using Partiko Android

Congratulations @reverseacid! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Dear@reverseacid,

Thank you for your invitation to comment on the Dharma protocol and I do wanted to comment about it. However, since I do not have any "concrete idea yet" and, it might take some time for me to read the white paper and research, I just wanted you to know that I might do a post in the future- after honoring my current obligations.

Kind regards

Anne

Hi @nurseanne84

The point of articles like this are to help spread information. It's a compact summary of the whitepaper and important working points of the protocol.

But if you prefer to read the whitepaper and do your own research, you have my respect. Nothing better than observing things for yourself!

Cheers

Posted using Partiko Android

Thank you for using Resteem & Voting Bot @allaz Your post will be min. 10+ resteemed with over 13000+ followers & min. 25+ Upvote Different account (5000+ Steem Power).