Finterra

What is Finterra?

Finterra is a cloud based financial services platform designed to harness both individual and corporate financial needs in a seamless and integrated platform. The creative brainchild of a round table of visionaries set out to make finance simple again, Finterra integrates time tested financial services and cutting edge financial technology on a blockchain ecosystem enabling transparent, accountable and secure financial services.

Headquartered in Singapore, Finterra’s global presence includes Hong Kong and Kuala Lumpur. The next stage of scheduled expansion kicks off in Jakarta, Abu Dhabi, Dubai, Geneva, and New York. Established with the aim to promote community growth and development, Finterra offers a truly global, fully inclusive financial platform that aims to bridge the gap between consumers and providers. Users in the Finterra ecosystem are able to use their FIN on e-commerce platforms for a wide range of financial services. It offers the world’s first borderless block chain driven, zero fee cloud based platform.

Finterra currently has an extensive network across Asia which comprises of the following financial hubs:

Finterra Ventures Ltd Hong Kong

Finterra Ptd Ltd Singapore

Finterra Technologies Sdn Bhd Malaysia

Vision Statement

Our vision is to become a global technology leader in financial services, promoting community growth and development.

Mission Statement

Our mission is to create a platform that educates, informs and inspires, while enabling freedom to earn, save and spend.

The Finterra Brand

Finterra was founded with a passion based on intelligence and heart to offer a global "Social Solution for Blockchain™".

Values

Finterra values security without compromising transparency and usability.

Finterra is professional, intelligent, heartful and community-minded for a better world for all. Finterra values security without compromising transparency and usability on the blockchain.

Finterra values regulation and aims to be regulated by the World Bank, BNM, and relevant government and regulatory bodies, complying with international standards such as ISO19000 (Information Audit) and ISO27000 (Data Security).

Visit Finterra’s website at www.Finterra.org

Sign up for the Finterra token wallet and access ecosystem services

Social Links Finterra Facebook Page | Finterra YouTube Channel

Finterra Management & Board

Selected Key Appointment Holders

Executive Chairman - Mazlan Ahmad

Mazlan Ahmad has more than 20 years working experience as an all-round leader in the banking industry.

Mazlan, began his career in corporate governance. Thanks to his determination and decision-making, he led Malaysia’s Central Bank having played a significant role in developing the financial system infrastructure in advancing the financial inclusion.

His prior business background, ranges from strategic planning, branch operations, intelligence & enforcement and security management – experience that has helped make Mazlan the most respected banker of his generation.

Chief Executive Officer - Hamid Rashid

Hamid is a hands on Strategic Visionary, bringing his wealth of experience and knowledge from Hewlett Packard, Petronas and U&Me. He creates brands that deliver stakeholders strong tangible results.

He has over fifteen years of professional experience, Consulting in Enterprise Software Business Management and Business Development experience in the B2B and B2C industry sectors, as Senior Business Manager. He has been closely involved in the different facets of Enterprise Business Management, specifically– Strategic Business Planning, Strategic Account Business Development, and Partner Ecosystem Management.

Managing Director - Satesh Khemlani

Satesh has been a successful entrepreneur at the helm of businesses for the past 3 decades. His diverse businesses include Wholesale, Distribution and Retail channels of the Branded Apparel segment. Satesh’s expanded vision includes being the CEO of a Real Estate and Property company. This experience and passion is essential to growing our Endowment projects offering substantial value to our investors.

Director of Blockchain - Terry Wilkinson

Terry Wilkinson is the Director of Blockchain Solution at Finterra where he guides the company’s blockchain strategy and technical solution. He has had over six years’ experience in blockchain, IT, and finance. Past projects include cross-border payment platforms, e-commerce gateways, and asset exchange all being built around decentralized blockchain architecture.

Head, Strategic Relations & Public Affairs - Jean-Luc Gustave

Jean-Luc is a strategist and legal expert with deep experience on multinational projects. His previous experiences include managing projects for large tech companies like Thomson Reuters or D&B and handling Public & Regulatory Affairs for blockchain and crypto currencies fintech start ups.

He is an Advisory Board Member to several startups, a Foreign Trade Advisor to France and co-chairs the Policy and Advocacy committee of the HK Fintech association.

Jean-Luc holds a LL.M. from the Luxembourg University.

Head, Technical Delivery - Farhang Maghdeed

Farhang Maghdeed is the head of technical team delivery, he has more than fourteen years experiences of consulting, training, and software developments. He has been leading a Mobile Application Company based in Dubai for more than 3 years. He got his MSc. In Real Time Software Engineering from UTM. He started working on the automation of business process modelling and the improvement of the semantic of workflow modelling.

Awards & Features

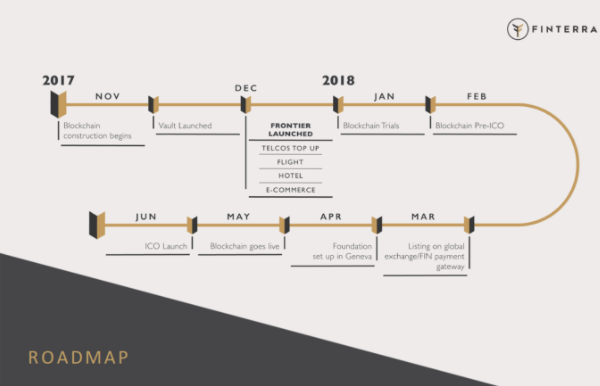

Finterra’s Roadmap

Finterra’s journey is unique as the technology is fully funded. The blockchain is state-of-the-art, designed to be next generation after precedents of Ethereum and Ripple, and already allows users to open wallets, purchase utility tokens, and use more than 2,500 merchants services worldwide. The Initial Coin Offering (ICO) in June will accelerate user acquisition and mainstream adoption by consumers and top merchants, and beyond the ICO where most ICO companies falter, Finterra gains strength by placing endowment assets from all over the world on the blockchain, on-boarding even more merchants globally, and prove utility, security and scalability of its tokens and network, leading to an Initial Public Offering (IPO) in 2019.

Frequently Asked Questions

| FAQ | Answers |

|---|---|

| What is Finterra? | Finterra is a consensus network that enables a new payment system and a completely digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user perspective, FIN (token system) is pretty much like cash for the Internet. |

| Who created Finterra? | The Finterra blockchain was created by the Finterra Foundation, which is a non-profit organisation based in Switzerland |

| Who controls the Finterra network? | The Finterra framework is supported by the Finterra organisation, which oversees the overall blockchain development. The Finterra protocol and software are published openly and any developer around the world can review the code or make their own modified version of the Finterra software. While developers are improving the software, they can't force a change in the Finterra protocol because all users are free to choose what software and version they use. In order to stay compatible with each other, all users need to use software complying with the same rules. Finterra can only work correctly with a complete consensus among all users. Therefore, all users and developers have a strong incentive to protect this consensus. |

| How does Finterra work? | From a user perspective, the Finterra blockchain is nothing more than a computer program that provides a personal Finterra e-wallet and allows a user to send and receive FIN with them. This is how Finterra works for most users. Behind the scenes, the Finterra network is sharing a public ledger called the "block chain". This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending FIN from their own Finterra addresses. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in FIN for this service. |

| Is Finterra really used by people? | Yes. There are a growing number of businesses and individuals using FIN. This includes brick-and-mortar businesses like restaurants, apartments, and law firms, as well as popular online services such as Telco top-up, Utilities bill payments, Flight and Hotel bookings as well as e-Commerce merchandising. While FIN remains a relatively new phenomenon, it is growing fast. |

| Can the Finterra model scale to become a major payment network? | The Finterra network is able to process a much higher number of transactions per second. It is, however, not entirely ready to scale to the level of major credit card networks. Work is underway to lift current limitations, and future requirements are well known. Since inception, every aspect of the Finterra blockchain network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come. As traffic grows, more Finterra users may use lightweight clients, and full network nodes may become a more specialized service. |

| Legal Is Finterra legal? | To the best of our knowledge, Finterra has not been made illegal by legislation in most jurisdictions. However, some jurisdictions (such as Argentina and Russia) severely restrict or ban foreign currencies. Other jurisdictions (such as Thailand) may limit the licensing of certain entities such as FIN exchanges. Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. Finterra as an organization complies to regulatory requirements around AML (Anti Money Laundering), KYC (Know Your Customer), ISO 19000 (Information audit), ISO 27000 (data security) and is also certified by the British Cybersecurity Compliance of Common Criteria certification. |

| Is FIN useful for illegal activities? | FIN is money, and money has always been used both for legal and illegal purposes. Cash, credit cards and current banking systems widely surpass the Finterra blockchain in terms of their use to finance crime. Finterra can bring significant innovation in payment systems and the benefits of such innovation are often considered to be far beyond their potential drawbacks. Finterra is designed to be a huge step forward in making money more secure and could also act as a significant protection against many forms of financial crime. For instance, FIN is completely impossible to counterfeit. Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud. FIN transactions are irreversible and immune to fraudulent chargebacks. The Finterra blockchain allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Some concerns have been raised that FIN could be more attractive to criminals because it can be used to make private and irreversible payments. However, these features already exist with cash and wire transfer, which are widely used and well-established. The use of FIN will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems, and Finterra is not likely to prevent criminal investigations from being conducted. In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood. The Internet is a good example among many others to illustrate this. |

| Can FIN be regulated? | The Finterra blockchain protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use. Attempting to assign special rights to a local authority in the rules of the global Finterra blockchain network is not a practical possibility. It is however possible to regulate the use of FIN in a similar way to any other instrument. Just like the dollar, FIN can be used for a wide variety of purposes, some of which can be considered legitimate or not as per each jurisdiction's laws. In this regard, the Finterra ecosystem is no different than any other tool or resource and can be subjected to different regulations in each country. The Finterra blockchain could also be made difficult by restrictive regulations, in which case it is hard to determine what percentage of users would keep using the technology. A government that chooses to ban FIN would prevent domestic businesses and markets from developing, shifting innovation to other countries. The challenge for regulators, as always, is to develop efficient solutions while not impairing the growth of new emerging markets and businesses. |

| What about FIN and taxes? | FIN is not a fiat currency with legal tender status in any jurisdiction, but often tax liability accrues regardless of the medium used. There is a wide variety of legislation in many different jurisdictions which could cause income, sales, payroll, capital gains, or some other form of tax liability to arise with FIN. |

| What about Finterra and consumer protection? | The Finterra ecosystem is freeing people to transact on their own terms. Each user can send and receive payments in a similar way to cash but they can also take part in more complex contracts. Multiple signatures allow a transaction to be accepted by the network only if a certain number of a defined group of persons agree to sign the transaction. This allows innovative dispute mediation services to be developed in the future. Such services could allow a third party to approve or reject a transaction in case of disagreement between the other parties without having control on their money. As opposed to cash and other payment methods, Finterra always leaves a public proof that a transaction did take place, which can potentially be used in a recourse against businesses with fraudulent practices. It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers. The way FIN works allows both individuals and businesses to be protected against fraudulent chargebacks while giving the choice to the consumer to ask for more protection when they are not willing to trust a particular merchant. |

| Economy How are FIN created? | The Finterra blockchain protocol is designed in such a way that new FIN are created at a fixed rate. No central authority or developer has any power to control or manipulate the system to increase their profits. Every Finterra blockchain node in the world will reject anything that does not comply with the rules it expects the system to follow. |

| Why do FIN have value? | FIN have value because they are useful as a form of money. FIN has the characteristics of money (durability, portability, fungibility, scarcity, divisibility, and recognizability) based on the properties of mathematics rather than relying on physical properties (like gold and silver) or trust in central authorities (like fiat currencies). In short, the Finterra blockchain is backed by mathematics. With these attributes, all that is required for a form of money to hold value is trust and adoption. In the case of FIN, this can be measured by its growing base of users, merchants, and start-ups. As with all currency, FIN's value comes only and directly from people willing to accept them as payment. |

| What determines FIN’s price? | The price of a FIN is determined by supply and demand. When demand for FIN increases, the price increases, and when demand falls, the price falls. There is only a limited number of FIN in circulation and new FIN are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. Because the Finterra ecosystem is still a relatively small market compared to what it could be, it doesn't take significant amounts of money to move the market price up or down, and thus the price is still very volatile. |

| Can FIN become worthless? | Yes. Although previous currency failures were typically due to hyperinflation of a kind that FIN makes impossible, there is always potential for technical failures, competing currencies, political issues and so on. As a basic rule of thumb, no currency should be considered absolutely safe from failures or hard times. No one is in a position to predict what the future will be for FIN. |

| Is Finterra a bubble? | A fast rise in price does not constitute a bubble. An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. Choices based on individual human action by hundreds of thousands of market participants is the cause for FIN's price to fluctuate as the market seeks price discovery. Reasons for changes in sentiment may include a loss of confidence in Finterra, a large difference between value and price not based on the fundamentals of the Finterra blockchain economy, increased press coverage stimulating speculative demand, fear of uncertainty, and old-fashioned irrational exuberance and greed. |

| Is Finterra a Ponzi scheme? | A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money, or the money paid by subsequent investors, instead of from profit earned by the individuals running the business. Ponzi schemes are designed to collapse at the expense of the last investors when there is not enough new participants. Finterra is a free software project with no central authority. Consequently, no one is in a position to make fraudulent representations about investment returns. Like other major currencies such as gold, United States dollar, euro, etc. there is no guaranteed purchasing power and the exchange rate floats freely. This leads to volatility where owners of FIN can unpredictably make or lose money. Beyond speculation, Finterra is also a payment system with useful and competitive attributes that are being used by thousands of users and businesses. |

| Doesn't Finterra unfairly benefit early adopters? | Some early adopters have large numbers of FIN because they took risks and invested time and resources in an unproven technology that was hardly used by anyone and that was much harder to secure properly. Many early adopters spent large numbers of FIN quite a few times before they became valuable or bought only small amounts and didn't make huge gains. There is no guarantee that the price of a FIN will increase or drop. This is very similar to investing in an early start up that can either gain value through its usefulness and popularity, or just never break through. Finterra is still in its infancy, and it has been designed with a very long-term view; it is hard to imagine how it could be less biased towards early adopters, and today's users may or may not be the early adopters of tomorrow. |

| Won't the finite amount of FIN be a limitation? | Finterra is unique in that 1 Billion FIN will ever be created. However, this will never be a limitation because transactions can be denominated in smaller sub-units of a FIN, such as bits - there are 1,000,000 bits in 1 FIN. FINs can be divided up to 8 decimal places (0.000 000 01) and potentially even smaller units if that is ever required in the future as the average transaction size decreases. |

| Won't the Finterra blockchain fall in a deflationary spiral? | The deflationary spiral theory says that if prices are expected to fall, people will move purchases into the future in order to benefit from the lower prices. That fall in demand will in turn cause merchants to lower their prices to try and stimulate demand, making the problem worse and leading to an economic depression. Although this theory is a popular way to justify inflation amongst central bankers, it does not appear to always hold true and is considered controversial amongst economists. Consumer electronics is one example of a market where prices constantly fall but which is not in depression. Similarly, the value of FIN will rise over time and, the size of the Finterra economy will grow along with it. Not with standing this, FIN is not designed to be a deflationary currency. It is more accurate to say FIN is intended to inflate in its early years, and become stable in its later years. The only time the quantity of FIN in circulation will drop is if people carelessly lose their wallets by failing to make backups. With a stable monetary base and a stable economy, the value of the currency should remain the same. |

| Isn't speculation and volatility a problem for the Finterra blockchain? | This is a chicken and egg situation. For the FIN price to stabilize, a large-scale economy needs to develop with more businesses and users. For a large-scale economy to develop, businesses and users will seek for price stability. Fortunately, volatility does not affect the main benefits of FIN as a payment system to transfer money from point A to point B. It is possible for businesses to convert FIN payments to their local currency instantly, allowing them to profit from the advantages of FIN without being subjected to price fluctuations. Since the Finterra offers many useful and unique features and properties, many users choose to use FIN. With such solutions and incentives, it is possible that the FIN currency will mature and develop to a degree where price volatility will become limited. |

| What if someone bought up all the existing FIN? | Only a fraction of FIN issued to date are found on the exchange markets for sale. The Finterra markets are competitive, meaning the price of a FIN will rise or fall depending on supply and demand. Additionally, new FIN will continue to be issued for decades to come. Therefore, even the most determined buyer could not buy all the FIN in existence. This situation isn't to suggest, however, that the markets aren't vulnerable to price manipulation; it still doesn't take significant amounts of money to move the market price up or down, and thus FIN remains a volatile asset thus far. |

| What if someone creates a better digital currency? | That can happen. For now, Finterra remains as a popular decentralized virtual currency, but there can be no guarantee that it will retain that position. There is already a set of alternative currencies inspired by FIN. It is however probably correct to assume that significant improvements would be required for a new currency to overtake FIN in terms of established market, even though this remains unpredictable. Finterra could also conceivably adopt improvements of a competing currency so long as it doesn't change fundamental parts of the protocol. |

| Transactions Why do I have to wait for confirmation? | Receiving notification of a payment is almost instant with FIN. However, there is a delay before the network begins to confirm your transaction by including it in a block. A confirmation means that there is a consensus on the network that the FIN you received haven't been sent to anyone else and are considered your property. Once your transaction has been included in one block, it will continue to be buried under every block after it, which will exponentially consolidate this consensus and decrease the risk of a reversed transaction. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. If the transaction pays too low a fee or is otherwise atypical, getting the first confirmation can take much longer. Every user is free to determine at what point they consider a transaction sufficiently confirmed, but 3 to 6 confirmations is often considered to be as safe as waiting 6 months on a credit card transaction. |

| How much will the transaction fee be? | Transactions can be processed without fees, but trying to send free transactions can require waiting days or weeks. Although fees may increase over time, normal fees currently only cost a negligible amount. By default, all FIN wallets listed on Finterra.org add what they think is an appropriate fee to your transactions; most of those wallets will also give you chance to review the fee before sending the transaction. The precise manner in which fees work is still being developed and will change over time. Because the fee is not related to the amount of FIN being sent, it may seem extremely low or unfairly high. Instead, the fee is relative to the number of bytes in the transaction, so spending multiple previously-received amounts may cost more than simpler transactions. If your activity follows the pattern of conventional transactions, you won't have to pay unusually high fees. |

| What if I receive a FIN payment when my computer is powered off? | This works fine. The FIN will appear next time you start your wallet application. FIN are not actually received by the software on your computer, they are appended to a public ledger that is shared between all the devices on the network. If you are sent FIN when your wallet client program is not running, and you later launch it, it will download blocks and catch up with any transactions it did not already know about, and the FIN will eventually appear as if they were just received in real time. Your wallet is only needed when you wish to spend FIN. |

| What does "synchronizing" mean and why does it take so long? | Long synchronization time is only required with full node clients like the Finterra blockchain core. Technically speaking, synchronizing is the process of downloading and verifying all previous FIN transactions on the network. For some Finterra clients to calculate the spendable balance of your FIN wallet and make new transactions, it needs to be aware of all previous transactions. This step can be resource intensive and requires sufficient bandwidth and storage to accommodate the full size of the block chain. For the Finterra blockchain to remain secure, enough people should keep using full node clients because they perform the task of validating and relaying transactions. |

| Can FIN be bought by individuals and/or companies? | Yes. Both parties are able to buy FIN and their respective packages. |

| Security Is the Finterra blockchain secure? | The Finterra blockchain technology - the protocol and the cryptography - has a strong security track record, and the Finterra blockchain network is probably the biggest distributed computing project in the world. FIN's most common vulnerability is in user error. FIN e-wallet files that store the necessary private keys can be accidentally deleted, lost or stolen. This is similar to physical cash stored in a digital form. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss. |

| Has the Finterra blockchain been hacked in the past? | The rules of the protocol and the cryptography used for Finterra will be working years after its inception, which is a good indication that the concept is well designed. However, security flaws will be found and fixed over time in various software implementations. Like any other form of software, the security of the Finterra blockchain software depends on the speed with which problems are found and fixed. The more such issues are discovered, the more Finterra is gaining maturity. There are often misconceptions about thefts and security breaches that happened on diverse exchanges and businesses. Although these events are unfortunate, none of them involve Finterra itself being hacked, nor imply inherent flaws in the Finterra blockchain; just like a bank robbery doesn't mean that the dollar is compromised. However, it is accurate to say that a complete set of good practices and intuitive security solutions is needed to give users better protection of their money, and to reduce the general risk of theft and loss. Over the course of the last few years, such security features have quickly developed, such as wallet encryption, offline wallets, hardware wallets, and multi-signature transactions. |

| Could users collude against Finterra? | It is not possible to change the Finterra blockchain protocol that easily. Any Finterra blockchain client that doesn't comply with the same rules cannot enforce their own rules on other users. As per the current specification, double spending is not possible on the same block chain, and neither is spending FIN without a valid signature. Therefore, It is not possible to generate uncontrolled amounts of FIN out of thin air, spend other users' funds, corrupt the network, or anything similar. A majority of users can also put pressure for some changes to be adopted. Because the Finterra blockchain only works correctly with a complete consensus between all users, changing the protocol can be very difficult and requires an overwhelming majority of users to adopt the changes in such a way that remaining users have nearly no choice but to follow. As a general rule, it is hard to imagine why any Finterra blockchain user would choose to adopt any change that could compromise their own money. |

| Is the Finterra blockchain vulnerable to quantum computing? | Yes, most systems relying on cryptography in general are, including traditional banking systems. However, quantum computers don't yet exist and probably won't for a while. In the event that quantum computing could be an imminent threat to Finterra, the protocol could be upgraded to use post-quantum algorithms. Given the importance that this update would have, it can be safely expected that it would be highly reviewed by developers and adopted by all Finterra users. |

Hi! Offering an easy way to buy big-ticket items, Affirm's mobile app has become extremely popular. The application makes it easy to receive the necessary goods in installments. Before making a purchase, the app clearly describes the terms of the loan, including the interest rate and the total amount to be repaid. There are practically no problems when using the application, but if this happens, just contact affirm clearly inform them about it, and they will try to quickly solve the problem.