Meet The Kinesis Monetary System: The evolution of the gold standard

"The London Bullion Market Association LBMA is gathering ideas to optimize the current procedures of buying and selling gold"

- Next year, the gold market could use Blockchain technology to, for example, track a supply chain valued at almost $ 200 billion.

- The LBMA has closed a round of consultations to establish a new system capable of tracking gold, from its extraction in the mines, to the final sale to the consumer.

- Although the LBMA did not stipulate what form the system would eventually adopt, most of the 25 proposals presented have incorporated the Blockchain technology as the optimal solution.

- The LBMA has indicated to Bloomberg that "the result will involve the use of better technology to help the market mitigate the dangers that threaten the integrity of the global precious metals market"

- For the executive president of LBMA, Ruth Crowell, this is a step in the direction taken some time ago, "it's about doing things well, doing something efficient, practical and credible" that benefits the industry.

The possibility of using Blockchain technology in the gold market and in other commodity markets, such as oil, diamonds or even tomatoes is a reality.

This interest is due to the fact that the technology that supports cryptocurrencies can be applied to track the ownership of the raw material. The tracking of the origin of an asset such as gold is key to avoid smuggling it. The idea is that with Blockchain, these bad practices can be eradicated, making it easier for all the gold that enters the markets to be identified from its origin to the final consumer.

Gold is one of the assets that despite its frequent fluctuations always ends up, becoming an extremely attractive investment in the long term for people of any economic level.

The difficulty lies in where to buy it at the right price and safely.

Is it possible in the short term to buy gold and other precious metals taking advantage of the transaction security provided by the blockchain?

People currently invest in cryptocurrencies to treasure them, as they give more value to them than to fiduciary money. But cryptocurrencies are an asset with high volatility, so that just as you can accumulate wealth, you can lose it. For that same reason, cryptocurrencies are practically not fungible currencies.

The secret to dispose of a fungible cryptocurrency is the stability of its price, that is, the low volatility of it.

For that and much more, KINESIS was created

What is Kinesis?

Kinesis is a system that through participation, improves money as a reserve of value and as a means of exchange, for the benefit of all. Stimulating the movement of capital by acting as a system that promotes trade and economic activity.

Kinesis has created a monetary system that can be universally adopted, decentralized and backed by assets. An efficient, safe and fair monetary system that encourages commercial exchange.

The Kinesis Monetary System

The monetary system of Kinesis consists of different tokens which we will see briefly below

Gold coin (KAU)

"Description: 1 contract and tab of fine gold of one gram, consisting of bars of cast gold of minimum fineness of 995, and bearing a serial number and identification stamp according to the ABX Quality Assurance Framework, table of the List of Approved Refineries. "

Silver coin (KAG)

"Description: contract and record of 10 grams of silver, consisting of silver bars with a minimum fineness of 999, and with a seal of identification of a refiner according to the ABX Quality Assurance Framework, table of the List of Approved Refineries "

Wholesale gold coin (KWG)

"Description: 1 contract and gold file of fine kilograms, consisting of gold smelting bars of minimum fineness of 9999 and with a serial number and identification stamp of a refiner according to the ABX Quality Assurance Framework, table from the list of authorized refineries. "

Wholesale silver contract (KWS)

"Description: 1,000 troy ounces of contract and silver token, consisting of sterling silver bars of minimum fineness of 999, and stamp identification of a refiner according to the ABX Quality Assurance Framework, table of the List of Approved Refineries "

Kinesis seeks to create a fungible currency, that is, a daily currency, a currency that promotes the mobility of capital and that thanks to this mobility the holders of the same generate new income.

Kinesis wants to get out of the capital scheme stuck in a cryptocurrency, in which the only way to earn money is if it increases its value against FIAT money or another crypto currency.

For that he has created a powerful idea of earnings based on speed performance, where the speed of money and economic activity is stimulated through a multifaceted system of incentivizing performance.

Here are their different phases or spheres of performance

1- Minter Yield: "This system rewards the participants who create the coin (" Mint ") in the primary market and then use it in the secondary blockchain market. The Minters receive a proportional part of the transaction fees as a performance forever in the Kinesis currencies they create. The more Kinesis coins are created, processed, or the higher the speed, the higher the yield "

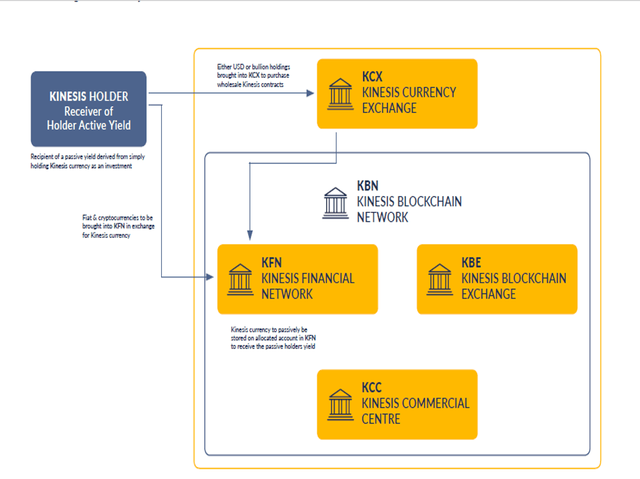

2- Holder Yield: "This yield is purely passive and is designed to compete with bank deposits, dividend yields and rental property yields."

3- Affiliate Yield: reward entities, people or corporations that attract new users to the Kinesis platform. And it is designed to encourage the attraction and capture of more participants to the ecosystem

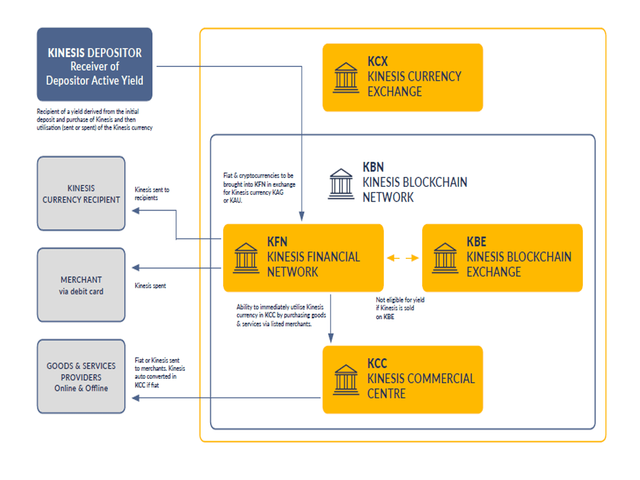

4- Depositors Yield: It is designed to encourage the idea of

starting with a large initial deposit and then give more use to the coins. Depositors receive part of the transaction fees forever in the Kinesis currencies that they bought and then used.

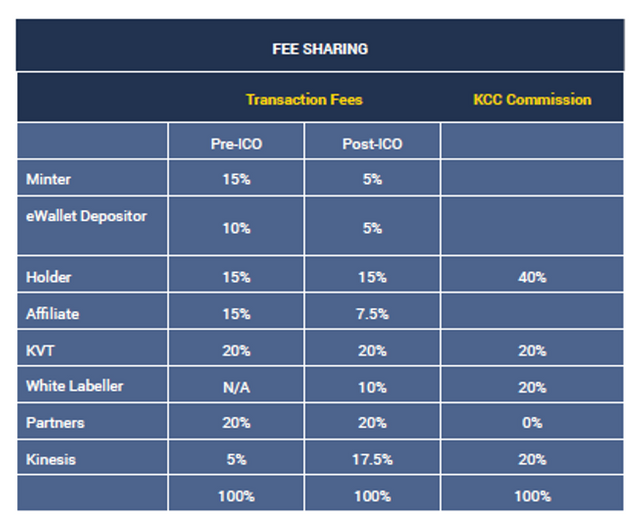

5- Fee Sharing: higher commissions will be received by those who acquire the Kinesis currency packages in the Pre-ICO. This phase includes from November 12, 2018 to February 28, 2019.

Kinesis Economy

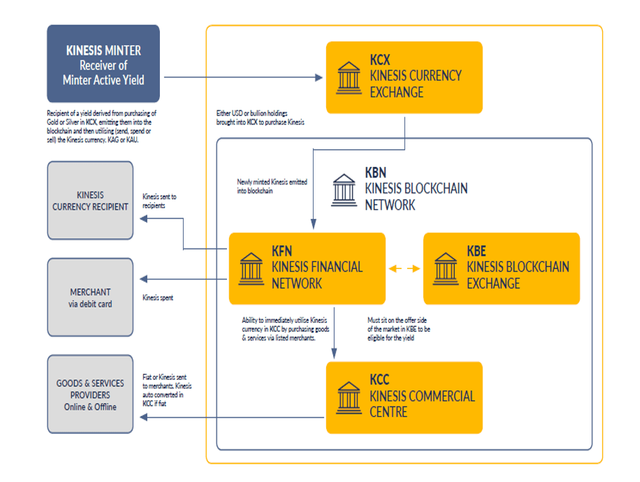

1- Kinesis Minters: Kinesis Minters will receive profits for its participation when buying the Kinesis currency in the wholesale market KCX and then spend it or sell it in Kinesis Blockchain Network (KBN). This system provides people with perpetual recurring income that continues to increase over time as currencies are used. Receive profits simply for having created the Kinesis currency and use it in the ecosystem. The more currency the Minter coins and sends to the system, the more volume of coins will move through the system and the greater the recurring financial reward.

2- Kinesis Depositors: Kinesis Depositors will receive a return on their initial deposit and the purchase of Kinesis from their Kinesis Wallet at KFN once they are sent or spent. A proportional part of the transaction fees will be perpetually shared with the Depositor during the term of the currency. This performance is also designed to maximize the initial deposits in the Kinesis Blockchain network by strongly rewarding the initial deposit.

3- Kinesis Holders: Kinesis Holders will receive a performance for their passive participation in the Kinesis currency that is in their Kinesis Wallet. This performance is calculated daily and deposited in your Kinesis Wallet accounts monthly. Based on conservative figures of speed, it is estimated that the yield will far exceed the interest rates of global bank deposits with the assigned property and less risk.

4- Kinesis Affiliates: Kinesis Affiliates will receive in perpetuity a percentage of each transaction made by all the participants that have been recruited. This provides a very powerful source of residual additional income.

Conclusion

One of the problems that Kinesis solves is the fact that the crypto-investor does not mobilize its cryptocurrencies in the economic system, considering them to be more valuable than fiduciary money.

Another problem is the high price volatility of cryptocurrencies, which is why the investor does not move them because they believe that they will increase in a short time of value and in that case he would stop making money, or believing that he is very He loses money and if he sells it, he loses money, which is why he keeps them waiting for them to recover.

Both cases strongly affect the growth of the blockchain ecosystem of cryptocurrencies. This excessive volatility creates distrust in most of the public that for this reason refuses to invest in them. Price stability would attract more new audiences to the world of cryptocurrencies and to show a "Tether" button (a token backed by the US dollar, which has the highest constant speed in the cryptocurrency market) Between December 1, 2017 and on January 17, 2018, its speed rate averaged 199% per day. (Page # 11 of the Whitepaper)

Normally, assets such as gold and silver do not have an associated average yield, so they were not as attractive as medium-term investment. The Kinesis Monetary System solves this by matching these precious metals to multiple types of returns, depending on the degree of passive or active participation.

The main final problem with asset-backed currencies revolves around security. Frequently cases of fraud related to the use of precious metals and other assets are presented as a means of payment. The investor must therefore be very careful with whom he invests to avoid the risk of fraud and theft.

"Kinesis uses the third-party multilayer audit and verification system of the ABX quality assurance framework. ABX is a global wholesale bullion exchanger that has been operating flawlessly since 2013 and has major physical intermediaries and merchants around the world who rely on their systems. "

Kinesis through its institutional integration with ABX and its operationally segregated wholesale contracts, which offer a serial number and distinctive bar seal, also provides an ideal solution for bilateral wholesale trade through the blockchain.

ROADMAP

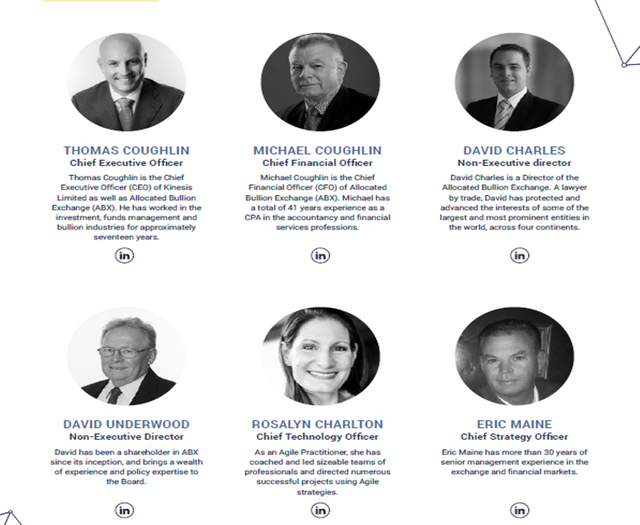

THE TEAM

More Information & Resources:

- Kinesis.Money Website

- Kinesis.Money WhitePaper

- Kinesis.Money OnePager

- Kinesis.Money YouTube

- Kinesis.Money Telegram

- Kinesis.Money Linkedin

- Kinesis.Money Github

- Kinesis.Money Steemit

- Kinesis.Money Bitcointalk

- Kinesis.Money Medium

- Kinesis.Money Twitter

contest sponsored by @originalworks

I hope you enjoyed this publication!

Thank you for your support Comments, Resteem and Votes

With appreciation from STEEMIT, Carlos

kinesistwitter

https://twitter.com/CarlosJMontill3/status/1036773724018679808

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by trituratusmiedos from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!