Post-ICO Projects

Hello!

My name is Angelika Erhan. Being the head of the design department means not just creating cool pics. It is all about being a part of the unique and progressive Platinum company, which is a wolf of STO street, creating one-stop solutions for Security Token Offerings. Want to know more? Visit our site:

I am also a part of the University of Blockchain and Investing, where you can get the profession of a future, learn all about blockchain, ICO, STO and everything you already need to know but still don’t. 🙃 Still doubting whether it is as cool as I describe? Just start reading about Post-ICO Projects. I’m sure you’ll get addictive:

We are going to see what a post-ICO company does. The typical actions it would take. Frameworks it would establish. Behavior we might see in a successful project contrasted with what we might see in other less successful ones. We will cover the process of listing on an exchange, and how those procedures can vary among different exchanges. And the nature of the relationship between the ICO company and the exchange. We conclude with an evaluation of the advantages and disadvantages of not being post-ICO.

Lesson Objectives:

By the end of this lesson you will have learned the following:

Real world examples of both successful and unsuccessful post-ICO companies, and the actions that got them there.

A comprehensive understanding of the nature of the relationship ICOs, specifically post-ICO companies, have with the exchanges. The process of listing. And the relationships between the different exchanges.

The advantages and disadvantages of companies being post-ICO.

Terminology:

Hardcap: The hardcap represents the absolute maximum a team will take from prospective investors in the fund raising effort.

Softcap: The softcap represents the point past which fundraising efforts are deemed a success; the lower limit of the total that the team will aim for.

Over the Counter (OTC): Over the counter is a transaction wherein one party is purchasing assets directly from another party without going through the usual intermediary public exchange. Over the counter, means off the exchange.

DAICO: The DAICO, Decentralized Autonomous Organization Initial Coin Offering, is a means to integrate a more specific, rigorous and regimented smart contract schedule into the ICO process.1.

ICO Company actions post-ICO

1.1 Introduction

There is a usual series of steps a project takes in its development from nascent vision to fledgling Blockchain based business.

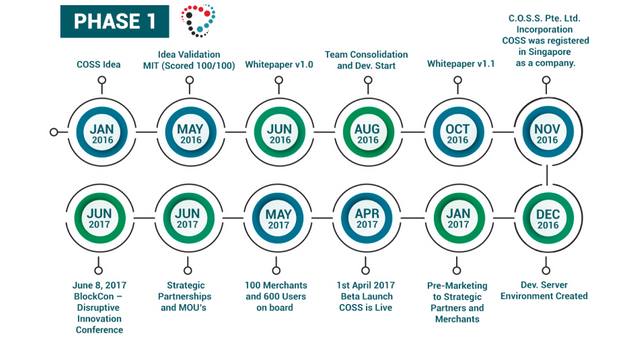

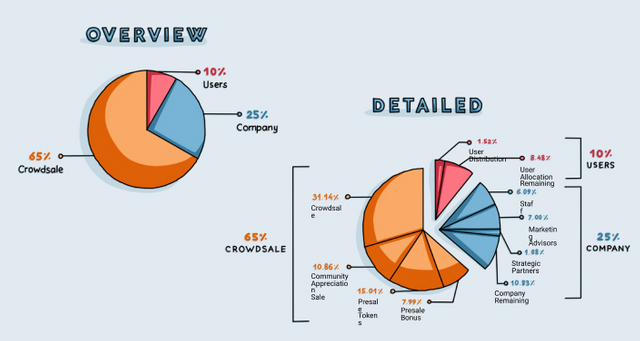

The team will outline its intended progression on their road map; then usually follow a fairly uniform pattern of token distribution and initial funds allocation. That will be followed by an exchange listing. Then product development. And eventually implementation. Distribution of funds raised will have been planned during the pre-ICO phase and will be incrementally implemented throughout all the post-ICO stages as outlined above.

ubai.co

platinum.fund

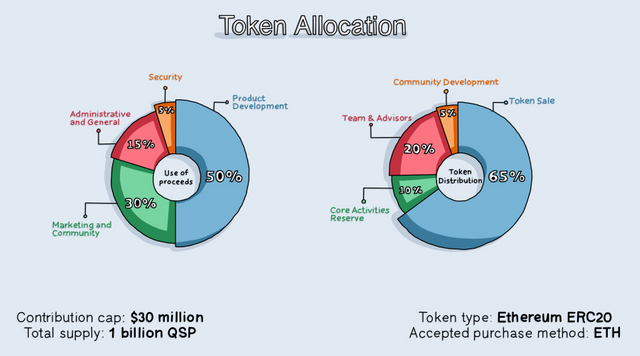

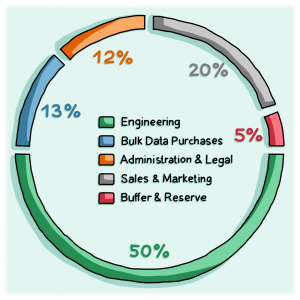

Cryptocurrency startups will have to decide how to divide up the funds raised in the token sale for use in the following categories:

Operational Expenses (Exchange listing, travel fees, etc.).

Software Development.

Research.

Marketing.

Business development.

Legal costs.

Bounty & Advisor Fees.

Image of ICO roadmap

1.2 Hardcap/Softcap vs Uncapped

The amount of funds raised in a contemporary Initial Coin Offering (ICO) are usually capped. The hardcap represents the absolute maximum a team will take from prospective investors in the fundraising effort. If the ICO is a massive success and the hardcap is reached very quickly, excess funds will be returned to investors as soon as the team can process the transactions.

The softcap represents the point past which fundraising efforts are deemed a success; the lower limit of the total that the team will aim for. Having an uncapped ICO such as that of Tezos, means that more investors can buy and obtain tokens, and the team will have more capital to work with, but each token will be worth less. The project’s valuation could be significantly less than the total amount all the investors pay in for tokens.

Immediately following the conclusion of the ICO stage of project development, tokens will be distributed to investors.

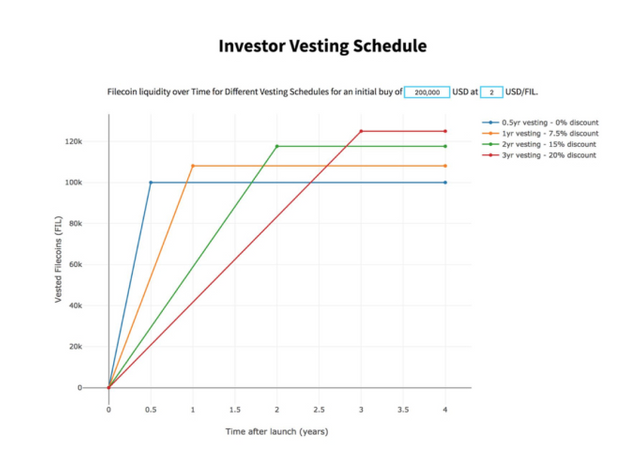

In reputable ICOs, the team tokens will be set aside and “locked” as will those of private sale and angel round investors. The period of token locking will vary depending how close to the core team you are. Generally speaking, the founders would be locked for a period of several years. Angel round and private investors locked for a year or more. Pre-sale investors locked for a couple of months.

1.2 Hardcap/Softcap vs Uncapped

Although these are estimations and lock up times can differ from project to project, the length of time the team’s tokens are locked can be taken as an indicator of their faith and belief in the project.

After the token allocation, first, part of the funds collected will be liquidated into fiat currency to cover operating costs, and then funds will be allocated to different sectors of the business plan outlined in the first slide. Which sector of the operation receives the largest share of capital to use, depends entirely on the type of project and their stage of development.

A project with a working product such as The Key (TKY) will obviously spend far less on software development and will focus more on pilots with prospective clients or listing on different exchanges.

1.3 Short Post-ICO Checklist

1.3 Short Post-ICO Checklist

For a post-ICO Company:

Once your Token Generation Event (TGE) is complete, convert enough of your crypto holdings into fiat currency to ensure you have a two-year runway.

Don’t sell all your crypto; stay long on your own newly minted currency and the ecosystem currency on which it is based.

Make a plan to manage the money and provide transparency to your token holders; deliver regular reports on your progress.

Replace your advisors: If you brought on advisors to market the token sale, now you should recruit new ones who can help achieve specific product-market fit and win customers.

1.4 Exchange Listings

There may be a period of weeks, or even months, between the tokens being distributed and the exchange listing.

Did you know?

If the project is built on the Ethereum platform they will be tradable on IDEX or

EtherDelta.

There have been rumors of listing fees of more than $5 million to list on a major exchange like Binance.

Only the biggest and most high profile projects can afford an immediate listing on one of the large trading platforms. Immediate listing is generally desirable as post-ICO hype, and a great boost to your business profile. Some projects, however, may decide to delay listing for a while, and wait for more advantageous market conditions. In the case of WANchain, this strategy worked fabulously well. They got a rise of approximately 26 times the ICO price in the project’s post-Binance listing pump. They made a risky decision based on market conditions, and what they know about their own project; and it proved correct.

After exchange listing, the project leaders will be busy overseeing business development, planning for future implementation, and seeking partnerships with real-world organizations in their field. The team must also organize marketing events to maintain visibility and obtain new exchange listings, as much as their budget permits.

1.4 Exchange Listings

Another key factor in the success of a project is maintenance of a healthy grass roots community, keeping up active channels of communication with Telegram groups and Reddit subs. Crypto investors are a fickle bunch. It is easy to lose your community support. There are always so many other projects taking off as yours begins to stagnate. The Fear of Missing Out is always somewhere in the back of everyone’s mind, pushing and pulling them in another direction.

ubai.co

platinum.fund

Investors have only limited available capital. If a post-ICO company does not engage with its investor base, those investors will allocate their limited capital to other potentially more profitable ventures.

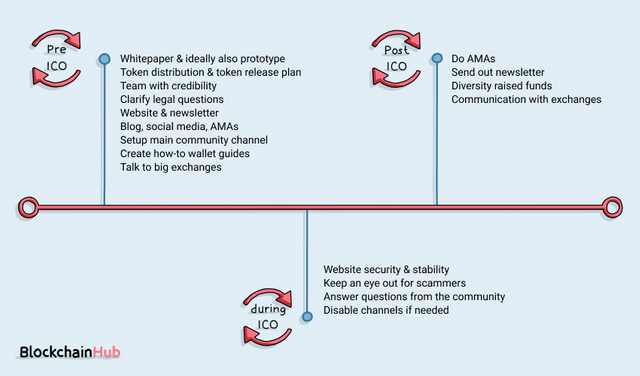

Good post-ICO practice is characterized by stringent security, well thought-out legal strategy and clear communication. Many projects have paid the price in damage to their reputation for failing to adequately guard customer information, leaving themselves open to phishing attacks by fraudsters.

Investors in the Enigma project had half a million dollars stolen from them; and a whopping $8.4 million was defrauded from investors in Veritaseum via phishing attacks.

After a successful token distribution, the team’s main focus is initially on switching the enterprise from one primarily focused on fundraising, to superficially at least, a fully-fledged, functioning business.

This involves removing most of the token sale-related content from their main webpage, sending newsletters to all successful ICO participants, and sending refunds to those who may have missed the deadline or the hardcap.

Then, with the stressful and complicated fundraising stage finally concluded, a portion of the funds raised can be assigned to fuel the growth of the project community. This can involve hiring community managers, forum admins, and social media managers to outsource the job of keeping investors in the loop. The founders can focus on growth strategy and product development.

The cultivation of a thriving and energetic community is extremely important. The community will give you free marketing for your product and your business. Community members who believe in the project, and are engaged by professional moderators, can give you very effective promotion to other prospective investors. Communication with community members is a great way to test ideas and gauge sentiment related to various aspects of your project.

ubai.co

platinum.fund

The project leads must also set aside adequate funds for lawyers. The project will need to address potential future or imminent problems with regulators, at the very least.

The transition from fundraising project to full-fledged business can be incredibly challenging, and even more stressful than the ICO itself. The main thing to remember is that your pre-sale and ICO investors are not just silent investors waiting for a return.

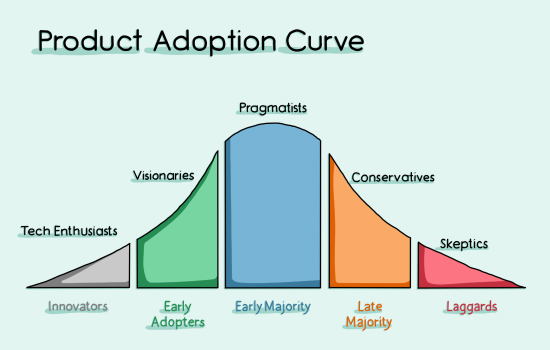

They are the early adopters of your solution, of your product; they are the community and promoters of your project; and they are the individuals with a vested interest in the financial success of your venture.

1.5 Actions after a Successful ICO

The ICO environment is not as heavily regulated, so quarterly and/or semi-annual reporting is not required the way it is in the traditional world. That means your own style of effective communication about the progress and key developments on your project matters even more. In the ICO world, you communicate with your press releases, social media, and Medium posts. You also communicate by the very nature of your relations with your exchange, and relationships with your cornerstone investors. Effective communication and good business relationships can play a prominent role in the success or failure of your venture (by token liquidity and valuation).

If your investors start to lose interest, and stop trading your token on the exchange, liquidity will dry up and cause increasingly volatile price swings. You need to keep certain things in mind, and follow effective practices to maintain a happy and motivated community.

Social Media & Medium

In addition to your website, your social media & Medium blog most likely formed a significant part of your ICO preparations. Your purpose pivots after the ICO from one of promotion to one of communication. Consistent, informative and material Medium blogs, also Facebook and Twitter updates, ensure that investors remain engaged and well-informed of what the company is up to.

1.5 Actions after a Successful ICO

Frequent activity in this space makes investors feel much more comfortable. You can foster a kind of organic community expansion that is consistently advertising your project to potential new members.

Cornerstone Investors & Exchanges

As we mentioned, your relationship with investors in the ICO world is different from that of the traditional silent IPO minority equity partners. Consistent, Transparent & Honest communication is incredibly important here. Even if an ICO is struggling to overcome a problem or whatever issues are occurring, honest communication from the team is key to business survival.

1.5 Actions after a Successful ICO

You should think of and treat your exchange like a business partner too, a very important one at that. Exchanges provide liquidity for you and your investors. That liquidity is like the blood for your business.

Many top exchanges demand nothing less than absolute honesty and integrity, it is imperative to maintain strong and comfortable relationships with exchanges.

Forums & Telegram Channels

1.5 Actions after a Successful ICO

Everything we have said so far, also applies to your Telegram channel and forums too. These give you another great opportunity to build a thriving community. Team members and investors can enjoy lively debates in their Telegram channels. This can be constructive discussion, or critical commentary too. But it is always valuable as a direct link between the team and the community. It is always good to know how people are feeling and what they expect from you and your project.

You are able to use your Telegram channel and forums to consistently adapt your marketing and communication strategy. Keep your investors as happy and comfortable as possible, and you will be more likely to attract new investors and allocations.

Other forums around the internet operate more or less in the same manner as Telegram.

1.5 Actions after a Successful ICO

After a successful funding round with the hardcap reached and time to spare, legal counsel has been secured, and the community is flourishing, the team will prepare for their first listing by paying the exchange fee and waiting for the announcement by the exchange.

Unless they are willing to pay exorbitant fees for an immediate listing on Binance for example, teams will usually settle for an initial listing on a second-tier exchange. The fee charged by an exchange depends on many different factors that we will cover in more detail in the next section.

1.6 ICO Company actions after a Successful ICO Real World Case Study

1.6 ICO Company actions after a Successful ICO Real World Case Study

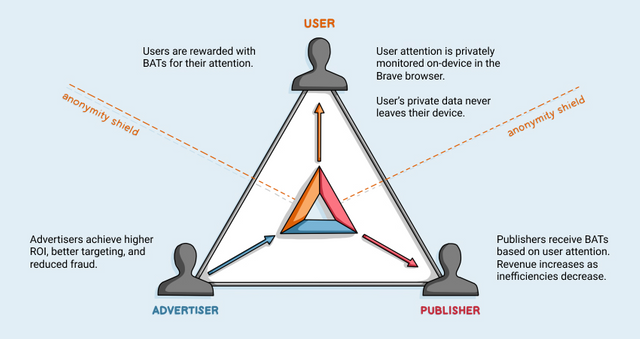

The Basic Attention Token (BAT) project, when used in conjunction with the Brave Browser, allows users to pay micro-fees in BAT to their most-used sites. The idea was conceived by Brendan Eich, the inventor of Javascipt and former CEO of Mozilla Firefox.

Investors absolutely pounced on it at ICO and the project raised an amazing $35million in under 30 seconds.

The BAT/Brave project has delivered on time on nearly all of its targets, helped in no small part by having a working product, the Brave Browser, for over a year before the token launch. The project secured a listing on the premier exchange, Binance, in November 2017.

A project can suffer through a disappointing funding phase and, for example, fail to reach 75% of its hardcap. The team will be only partially funded. Though they may be able to initiate the project, the value proposition of the token has been compromised, potentially forever. The market has spoken. There is limited faith in the team’s ability to complete or carry out their project.

Failure to reach a hardcap is a serious obstacle on the project road map. This will mean massive revisions to the timescales for development and listing. Such a project may have to be content listing on decentralized exchanges for a period of time and they will lose any post-ICO hype that could have helped the project price to “moon” early on.

There is less money to be allocated. Each section of the business will be underfunded compared to the original plan. There can be delays in code development, exchange listing, marketing and community development as well.

1.7 Actions after a Successful ICO

Calling the Tezos ICO a disappointment might seem strange considering they raised over $232million. But this open-source, smart contracts fintech platform became a victim of its own success post-ICO by devolving into multiple class-action lawsuits between the founders and its foundation chairman. They suffered from a distinct lack of clearly defined roles and expectations on key positions. There was infighting at the boardroom level. This all caused an as yet unresolved delay in listing and development.

This is also one example why a capped ICO can be more desirable for investors than an uncapped ICO. If the team have a set amount of capital to work with, an amount that isn’t absolutely ridiculous, like in the case of Tezos, perhaps the resultant greed and discord is less likely.

ubai.co

platinum.fund

Although it may not be so easy for speculative investors to make a profit from an uncapped ICO with such a massive initial market cap, it is a very impressive feat of fundraising nonetheless.

Tezos’s post ICO market cap of $232million is already 64th of all projects, and would have to perform brilliantly on listing to maintain this position.

1.7 Actions after a Successful ICO

NapoleonX was the victim of cruel market conditions at the beginning of its ICO and ended up just passing its softcap of 10million Euros, falling well short of the 15 million Euro hardcap.

1.7 Actions after a Successful ICO

ubai.co

platinum.fund

The quantitative and algorithmic trading project aims to produce Decentralized Autonomous Funds operating in traditional markets such as equities, oil futures, and other commodities etc. The final 5 million of the ICO hardcap amount was to be used to fund the first DAF. So with only a few hundred thousand available for use by the first fund, profit projections and future token price potential for investors were cut severely.

The massive drop in ETH price from the start of the ICO to the end, meant that the project had just barely enough funds to cover operating costs and exchange listing. Then the listing on HitBTC was delayed due to lack of clarity in the terms offered, and the team was still wrangling over the need for a cast iron assurance against the threat of delisting. Up to a month after the ICO, investors NPX tokens were languishing and depreciating on IDEX, though finally in the middle of 2018, NPX did achieve listing.

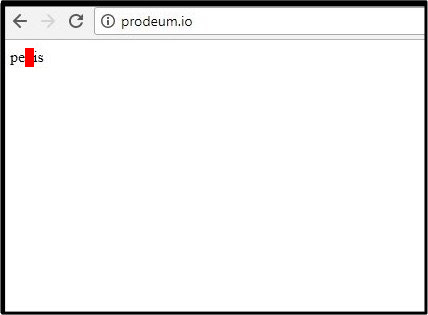

Failed ICOs can mean either fundraising initiatives that have failed to reach the softcap and will therefore not be economically viable, or fraudulent projects whose sole intention was to steal from investors and do an exit scam.

1.8 Company actions after a Failed ICO

We’ve already covered scams and fraud projects in detail, but what happens when an ICO just fails to raise the requisite funds?

Projects that are legitimate, with honest founders and developers, refund the ETH or BTC deposited by investors as quickly as possible if the softcap is not reached. The same process that is followed by ICOs that are oversubscribed is employed by those that have failed to raise enough capital. The process of returning funds back to the sender ideally should take a period of days, but more likely will take a few weeks.

The Sappy Network, advised by Dan Tapscott, failed to come anywhere near to their funding goals. They are currently in the process of sending all investor funds back to the wallets from which they came.

The statement from the founders read as a textbook example of how you should react to failure with the founder stating

“In the spirit of transparency and honesty, we are sharing with the community that we did not reach the soft cap, and thus we will be honoring our terms and conditions and returning the Ethers to all contributors”

1.8 Company actions after a Failed ICO

With an Honest Team:

Image of what you will be faced by when you have invested in a failed ICO with an honest team (Swappy Network)

With a Dishonest Team:

Image of what you will be faced by if you have invested in a failed ICO with a dishonest team (Prodeum)

🙃 Still doubting whether it is as cool as I describe? Just start reading about Post-ICO Projects. I’m sure you’ll get addictive:

Any questions left? No problem, you can always find and reach me via:

✅ Enjoy the vote! For more amazing content, please follow @themadcurator for a chance to receive more free votes!

Congratulations @ubai! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOP